Every few generations, the world forgets how wealth is created. Then, almost overnight, it remembers.

As gold rises, currencies wobble, and Bitcoin finds new believers, it may be worth asking how value itself is born. Markets rarely warn before they rewrite the rules. When they do, history calls it a reset.

On January 30, 1934, President Franklin D. Roosevelt signed the Gold Reserve Act of 1934, transferring ownership of all monetary gold in the United States to the U.S. Treasury. The law required individuals, banks, and even the Federal Reserve to surrender their gold coins and bullion in exchange for paper currency valued at $35 an ounce. That rate replaced the long-standing $20.67 price set by the Gold Act of 1900 and instantly reduced the gold value of the dollar to 59 percent of its earlier worth.

No new gold was mined. No ships crossed the seas. Yet the value of every ounce of gold in America, and across the world, changed overnight.

Fortunes were made and lost in a matter of hours. Not because money moved, but because meaning shifted. One presidential order altered how the world understood a dollar and reset the value of everything priced with it.

How can value change so dramatically when nothing physical moves? That question, the mystery of how perception alone can create or erase trillions, lies at the heart of how markets work.

Now consider Bitcoin. Only twenty-one million coins will ever exist. Approximately one and a half million remain to be mined, and the last will not be produced until 2140. Today it trades near $108,000. With a market value hovering around $2.25 trillion, Bitcoin now stands among the world’s most valued financial assets. Gold’s total market capitalization is estimated at roughly $28.5 trillion, a ratio of about ten to one, and many believe Bitcoin will one day reach parity.

Now, imagine you hold five coins in cold storage, worth about half a million dollars. Then the headlines hit. A major nation decides to build a Bitcoin reserve. Washington eases crypto regulation. Ecuador adds to its holdings. The Saudi kingdom launches a sovereign Bitcoin fund.

The market senses scarcity. Demand rises while supply stays fixed. Within weeks, Bitcoin trades at $1 million per coin. Your five coins are now worth five million.

No new money entered your wallet. The world simply changed its mind about what your coins were worth. That is the essence of a repricing.

At the Bitcoin Asia 2025 conference in Hong Kong, Eric Trump said, “I really believe in the next several years, Bitcoin hits a million dollars. There’s no question,” adding that 90% of his time is now spent with the crypto community. His remark was not naïve optimism. It captured the psychology of markets: belief running ahead of reality.

We do not dismiss his expectations as Pollyanna. History is full of moments when the world repriced itself overnight. In 2007, Steve Jobs unveiled the first iPhone. Within months, Apple’s market value soared by hundreds of billions. Investors simply changed their minds about what Apple was. A hardware maker became a gateway to the future.

In 2020, when Tesla joined the S&P 500, its worth briefly topped that of the following nine automakers combined. No flood of new cash entered the stock. The market decided Tesla was not a car company, but a revolution on wheels.

When a small town announces the establishment of a new university or factory. Overnight, property prices jump. The same bricks and beams become twice as valuable because expectations have changed.

In 1934, Roosevelt raised the price of gold. In 1971, Nixon closed the gold window and ended the convertibility of the dollar to gold. Each act reshaped global wealth, not through trade or labor but through policy.

From gold to gadgets, from policy to perception, every age has its repricing. The assets change; the mechanism does not. Value is a story the world tells itself until it decides to tell a new one.

Every market lives inside a shared story. Prices are not formed by money moving but by minds meeting. Billions of private judgments merge into a public truth.

When those judgments shift, so does value. A company’s worth, a currency’s strength, and a house’s price all rest on what people believe others will believe tomorrow. Economists call it expectations. Historians call it sentiment. Psychologists call it trust.

Markets turn these invisible forces into numbers. A rumor, a law, or a discovery can rewrite the story in an instant. Nothing physical changes. The same gold lies in vaults. The same cars roll off assembly lines. The same five bitcoins sit in your wallet. Yet value multiplies or vanishes because perception has been repriced.

We call it volatility, or momentum, or a rally. But beneath those words lies something simpler. Belief.

Some say President Trump could be the one to set the next great repricing in motion, while others believe that it has already begun.

The next great repricing may not begin with a war or an invention, but with a consensus, as the world changes its mind again. It might start with a policy speech, a court ruling, a discovery, or an order from the president’s desk.

Understanding this truth is both humbling and freeing. Markets are not machines that obey formulas. They are mirrors of the human mind. Wealth is not transferred so much as imagined, debated, and agreed upon.

Many people still struggle with this idea. They believe wealth transfers involve finding the ten trillion dollars and wiring it from one account to another. They wait for the money to move. It never does. What moves is understanding.

Those who grasp this simple truth are better prepared for what lies ahead. They do not chase the flow. They study the change in meaning. They learn to see when the world is about to rewrite its story.

The Great Repricing is not a future event. It is how the world works. It always has been.

TIPP Curated

Handpicked articles from TIPP Insights & beyond

1. Trump Evaluates Chances Of Defeating Socialist Mamdani If GOP Candidate Quits NYC Mayoral Race—Elizabeth Troutman Mitchell, The Daily Signal

2. Democrats Gave New Yorkers The Choice To Vote For A Socialist… Who Pals Around With Islamists—Jarrett Stepman, The Daily Signal

3. Spanberger Voted To Protect Radical DC Crime Bill Even Biden Opposed—Tyler O'Neil, The Daily Signal

4. Obama’s Last-Minute Rally For Virginia Democrat Abigail Spanberger As Earle-Sears Closes Gap—Virginia Grace McKinnon, The Daily Signal

5. Russia Pounds Ukraine In Overnight Missile Barrage, 6 Dead—TIPP Staff, TIPP Insights

6. Bessent Defends $20 Billion Argentina Aid Amid U.S. Shutdown—TIPP Staff, TIPP Insights

7. Saudi Prince MBS To Meet Trump To Discuss Defense Pact, Trade Deals—TIPP Staff, TIPP Insights

8. Hegseth Tightens Pentagon Control Over Congressional Communications—TIPP Staff, TIPP Insights

9. Meta Cuts 600 AI Jobs, Shifts Focus To New Superintelligence Lab—TIPP Staff, TIPP Insights

10. AI Experts Demand Global Pause On Superintelligence Development—TIPP Staff, TIPP Insights

11. Vance: U.S. Not In Israel To “Babysit” Gaza Ceasefire—TIPP Staff, TIPP Insights

12. GM’s 2028 Plan: Auto Giant Unveils Vision For AI-Powered, Self-Driving Future—TIPP Staff, TIPP Insights

13. UN Warns Welfare Cuts Fuel Global Far-Right Surge—TIPP Staff, TIPP Insights

14. Congressional Republicans Slam Jeffries For Not Backing Military Pay Bill—Jacob Adams, The Daily Signal

15. Obama Targets Hungary, Poland With ‘Organizing’ Campaign—Mike Gonzalez, The Daily Signal

16, Chicago Sues Trump, Refusing To Drop DEI As Condition For Federal Money—Fred Lucas, The Daily Signal

17. Freed Terrorists Paid $70 Million As Part Of Palestine’s ‘Pay For Slay’ Program—Virginia Allen, The Daily Signal

18. Homes With Trump Signs Were Passed Over For Federal Disaster Aid—Now The DOJ May Step In—Fred Lucas, The Daily Signal

19. Why Senate Republicans ‘Cheered’ At Trump’s New Shutdown Advice—Elizabeth Troutman Mitchell, The Daily Signal

20. Trump Admin Reveals Devastating Impact Of Shutdown On Small Businesses—Elizabeth Troutman Mitchell, The Daily Signal

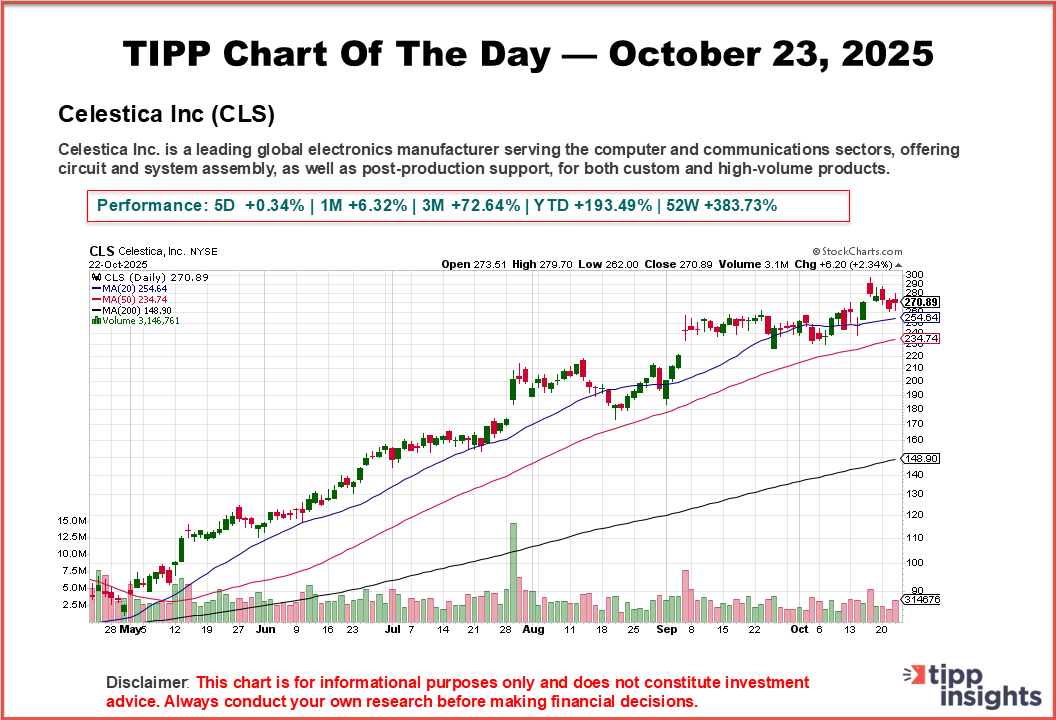

📊 Market Mood — Thursday, October 23, 2025

🟡 Futures Mixed as Earnings and Trade Tensions Collide

U.S. stock futures traded mixed as investors weighed strong corporate results against renewed U.S.-China trade frictions. While the S&P 500 and Nasdaq inched higher, the Dow slipped as traders digested disappointing earnings from key tech and consumer names.

🔴 Tesla Drops After Soft Margins and Higher Costs

Tesla shares slid after quarterly results missed expectations. Record revenue was overshadowed by a 37% drop in net income as rising R&D spending and tariff-related costs squeezed profitability. The company now faces slowing U.S. demand following the expiration of an EV tax credit.

🟡 Tech Earnings Disappoint: Netflix, Texas Instruments, IBM

Markets were pressured by weak results from Netflix and Texas Instruments, while IBM’s software growth came up short despite upbeat guidance. Eyes now turn to Intel, set to report after the bell, with analysts expecting flat results and softer AI division sales.

🔴 Trade Tensions Flare Ahead of Trump–Xi Meeting

Sentiment took a hit after reports that Washington may restrict exports to China of goods made with U.S. software, escalating trade tensions. The move follows Beijing’s rare earth export curbs and threatens to disrupt sectors from semiconductors to aerospace.

🟢 Oil Prices Surge After Russian Sanctions

Oil jumped more than 5% as the U.S. imposed sanctions on Russian energy giants Lukoil and Rosneft, marking a sharp policy shift and raising concerns over tighter global supply. Brent climbed above $65 a barrel, with WTI topping $61.

Market round-up in 5 minutes. We bring you up to speed. Subscribe to TIPP Insights for $99/year.

📅 Key Events Today

🟠 08:30 ET – Initial Jobless Claims

Weekly snapshot of labor market trends and unemployment filings.

🟣 10:00 ET – Existing Home Sales (September)

Monthly report tracking U.S. housing market activity and consumer demand for pre-owned homes.

Access our Featured Stocks and TIPP Top-20 archives — exclusive to paid subscribers. Subscribe now → $99/year.