President Biden delivered an economic policy speech in Chicago in late June in what was supposed to be his vision for the 2024 campaign. Usurping the term "Bidenomics" first used by the media, he took full credit for it.

"And guess what? Bidenomics is working. When I took office, the pandemic was raging, and our economy was reeling, supply chains were broken, millions of people unemployed, hundreds of thousands of small businesses on the verge of closing after so many had already closed — literally, hundreds of thousands on the verge of closing.

Today, the U.S. has had the highest economic growth rate, leading the world economies since the pandemic. The highest in the world. (Applause.)"

What the President did not say was how his economic stewardship has been a disaster. Inflation, measured since President Biden took office, has been stubborn at 45-year highs, climbing to 15.6% in June as high prices persisted. TIPP CPI data shows that energy prices have increased by 31.2% since Feb 2021, the first full month of Biden's term. Gasoline prices have increased by 41.7%, used car prices by 32.9%, and air tickets by 51.4%. If this is what Bidenomics is, Americans want nothing to do with it.

The Fed's dual mandate. The President also did not address how the Fed's dual mandate is taking the wind out of his economic sail and forcing a slowdown of economies worldwide. Many Americans are unaware that while the Fed's primary function is to maintain the dollar's value, it has an equally crucial mandate to keep U.S. unemployment low.

[Under President Carter, Congress, in 1977, reformed the original charter of the Fed by explicitly directing the Federal Reserve to "maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote the goals of maximum employment, stable prices, and moderate long-term interest rates."]

To bring the raging inflation down, the Fed has regularly increased the Funds rate, which now stands at 5.25%. Chairman Powell has refused to rule out additional hikes. Speaking in Madrid last week, he said: "As noted in the FOMC's Summary of Economic Projections, a strong majority of Committee participants expect that it will be appropriate to raise interest rates two or more times by the end of the year."

But each time the rate goes up, it becomes more expensive for companies to borrow, invest, or retain staff - meaning the unemployment rate will rise sooner or later, potentially tipping the U.S. into a recession. Reuters reported that Pacific Investment Management Co (PIMCO), the giant U.S. bond fund manager, is preparing for a "harder landing," while top central bank chiefs prepare to continue their campaign of interest rate rises, Daniel Ivascyn, chief investment officer, told the Financial Times in an interview published on Sunday. President Biden never mentioned the R-word in his Chicago speech.

Unemployment in America in May was recorded to be a robust 3.7%, a fact that President Biden boasted in his Chicago speech.

"When I took office, unemployment was over 6 percent. With the American Rescue Plan, we've provided relief and support directly to working-class families. Our economy came roaring back. Unemployment dipped below 4 percent by the end of my first year in office. Now it's been below 4 percent for the longest stretch in 50 years in American history. (Applause.)"

But Biden did not talk about the labor force participation rate, which is too low for a vibrant economy. At only 62.6 percent in May, it is almost an entire percentage point lower than in January 2020 when the American economy was firing on all cylinders under former President Trump and before Covid. When fewer able-bodied people are looking for work or have retired from the workforce altogether, unemployment rates tend to look attractive. [Twenty years ago, after the Bush tax cuts and an economy roaring after 9/11, the labor force participation rate was almost four percentage points higher, at 66.5%].

The headaches of an uber-strong dollar.

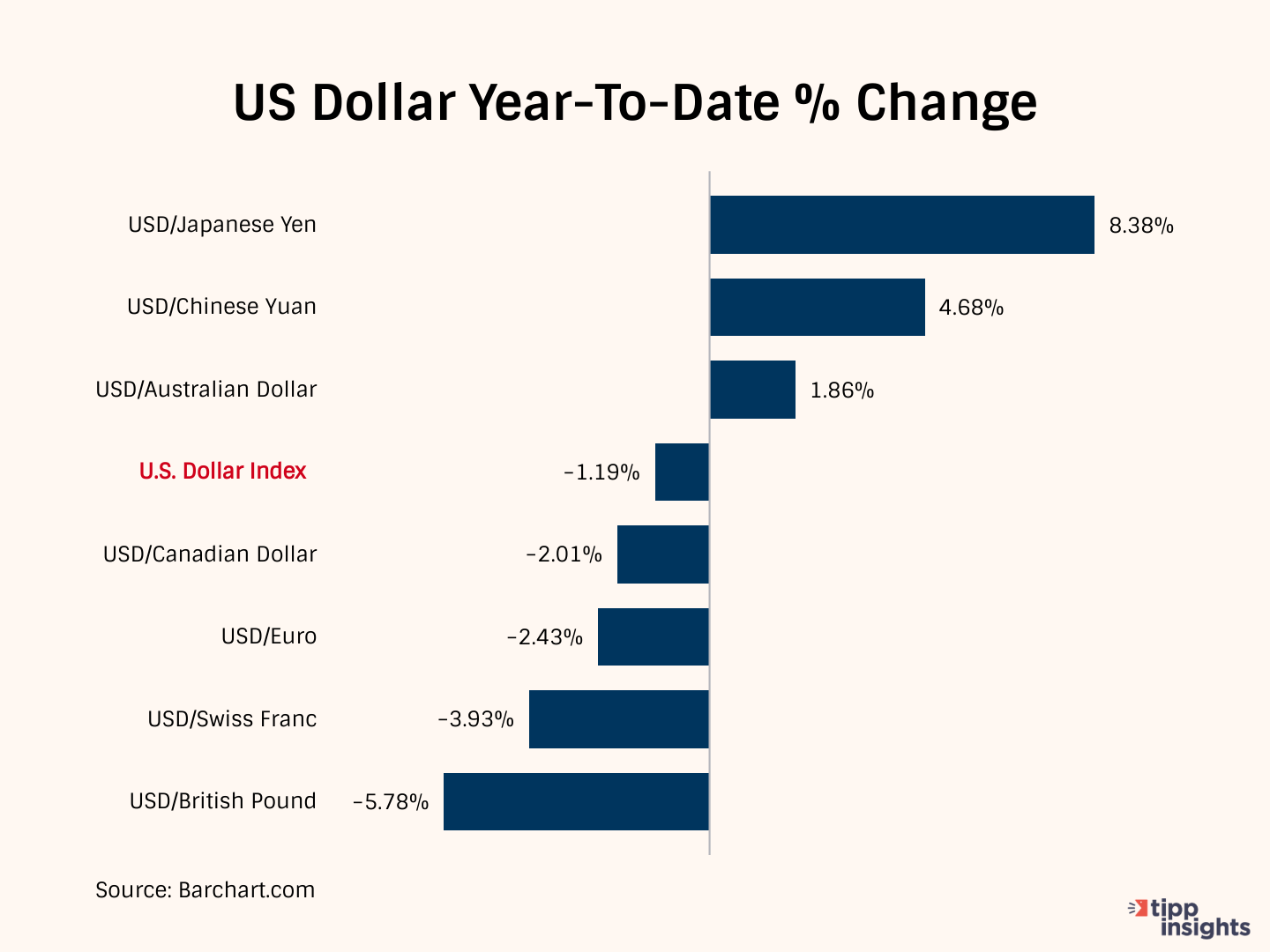

There's another issue that many media outlets have not chosen to cover. Investors tend to buy up the dollar when the Fed increases rates - and investors see political instability in other parts of the world, such as in France now and during the Wagner run in Russia last week.

The Chinese Yuan has weakened 4.68 percent against the dollar since Jan 2, 2023, and is now trading at 7.2212 to the dollar compared to 6.8982. The Japanese Yen fell to near-historic lows when it traded at just 144.30 to the dollar on July 1. The Yen opened at 131.102 0n January 2 and closed on Friday at 142.107, meaning it has sunk nearly 8.38%.

A strong dollar means that American exports will become dearer for foreign customers. This isn't good for American companies that rely on exports, forcing them to lay off workers as global sales go down.

While foreign goods consumed in America will become relatively cheaper, helping to bring inflation down, the flip side is that trade deficits with foreign nations, already high, will become higher, weakening American competitiveness.

President Biden's economic policies have resulted in high inflation, potential future recessions due to the Federal Reserve's actions, and a concerning labor force participation rate. Further, the impact of an overly strong dollar on American exports and trade deficits poses further challenges for the economy.

Like our insights? Show your support by becoming a paid subscriber!