There's always a lot riding on a showdown between a president and Congress over raising the federal debt ceiling to avoid a government shutdown. But this year, as the 2024 election year looms, the stakes are particularly high. That could be bad news for President Joe Biden, the latest I&I/TIPP Poll shows, since his positions on debt, taxes and spending lack majority support even from Democratic voters.

For our May online I&I/TIPP Poll, taken May 3-5 with a margin of error of +/-2.6 percentage points, we asked 1,480 adults across the country the following question:

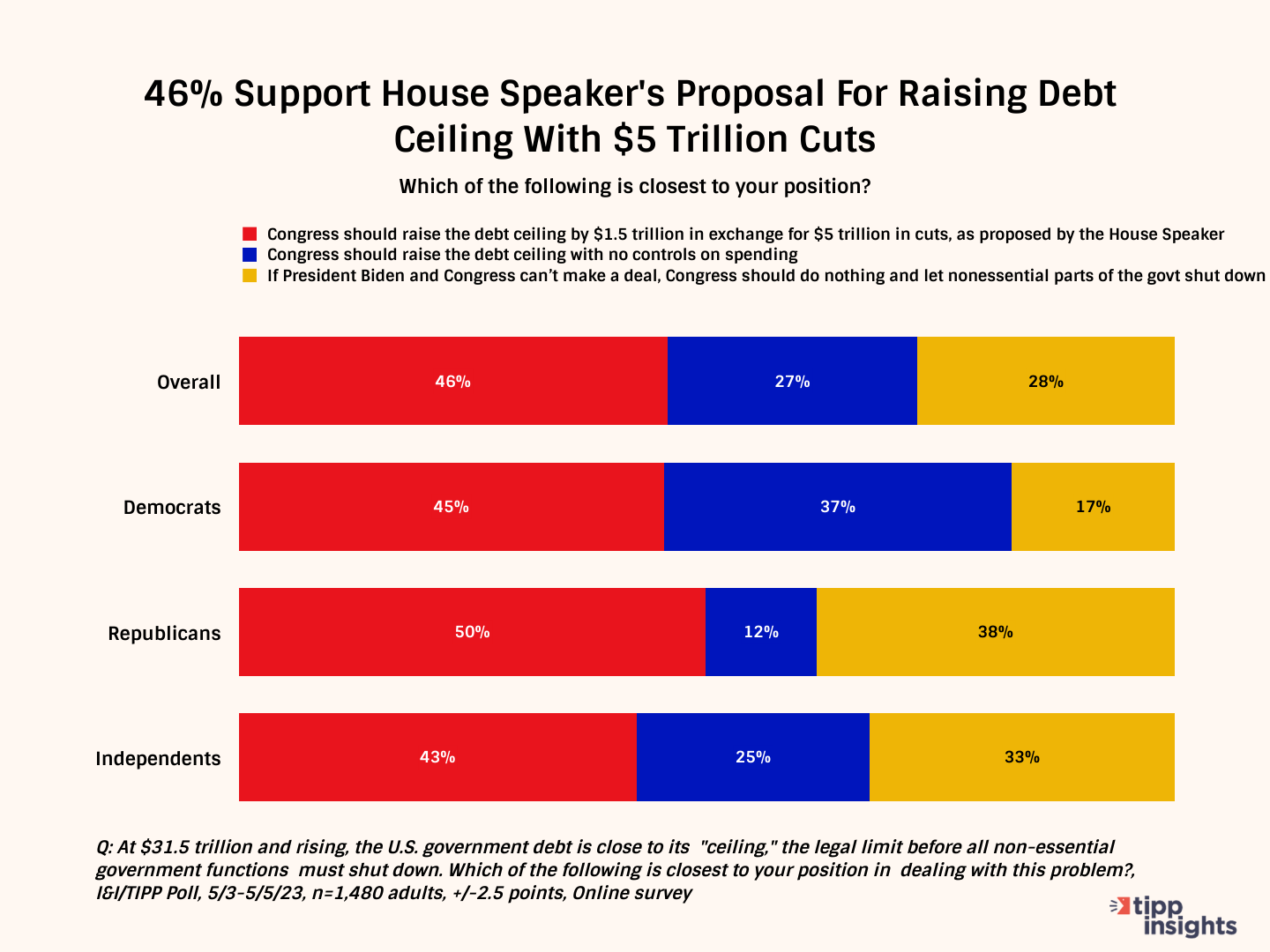

"At $31.5 trillion and rising, the U.S. government debt is close to its 'ceiling,' the legal limit before all non-essential government functions must shut down. Which of the following is closest to your position in dealing with this problem?"

Respondents were given three possible answers.

The first represents the president's basic negotiating position, as of late April: "Congress should raise the debt ceiling with no controls on spending."

The second response represents the negotiating position of House Speaker Kevin McCarthy and Republican lawmakers: "Congress should raise the debt ceiling by $1.5 trillion in exchange for $5 trillion in cuts over the next decade, as proposed by the House Speaker."

The third response: "If President Biden and Congress can’t make a deal, Congress should do nothing and let nonessential parts of the government shut down."

The breakdown of the answers showed a clear preference (46%) for the congressional proposal over Biden's take-it-or-leave-it plan (27%).

And 28% said if the two sides can't agree, Congress should just let the nonessential parts of the government close until a deal is struck.

The breakdown of responses by political affiliation also shows that Biden doesn't even have the support of his own party's voters. Among Democrats, 45% supported the House Republican plan, versus just 37% supporting Biden's proposal. For Republicans, the support was 50% to 12%; for independents, 43% to 25%. In short, no party's voters back Biden.

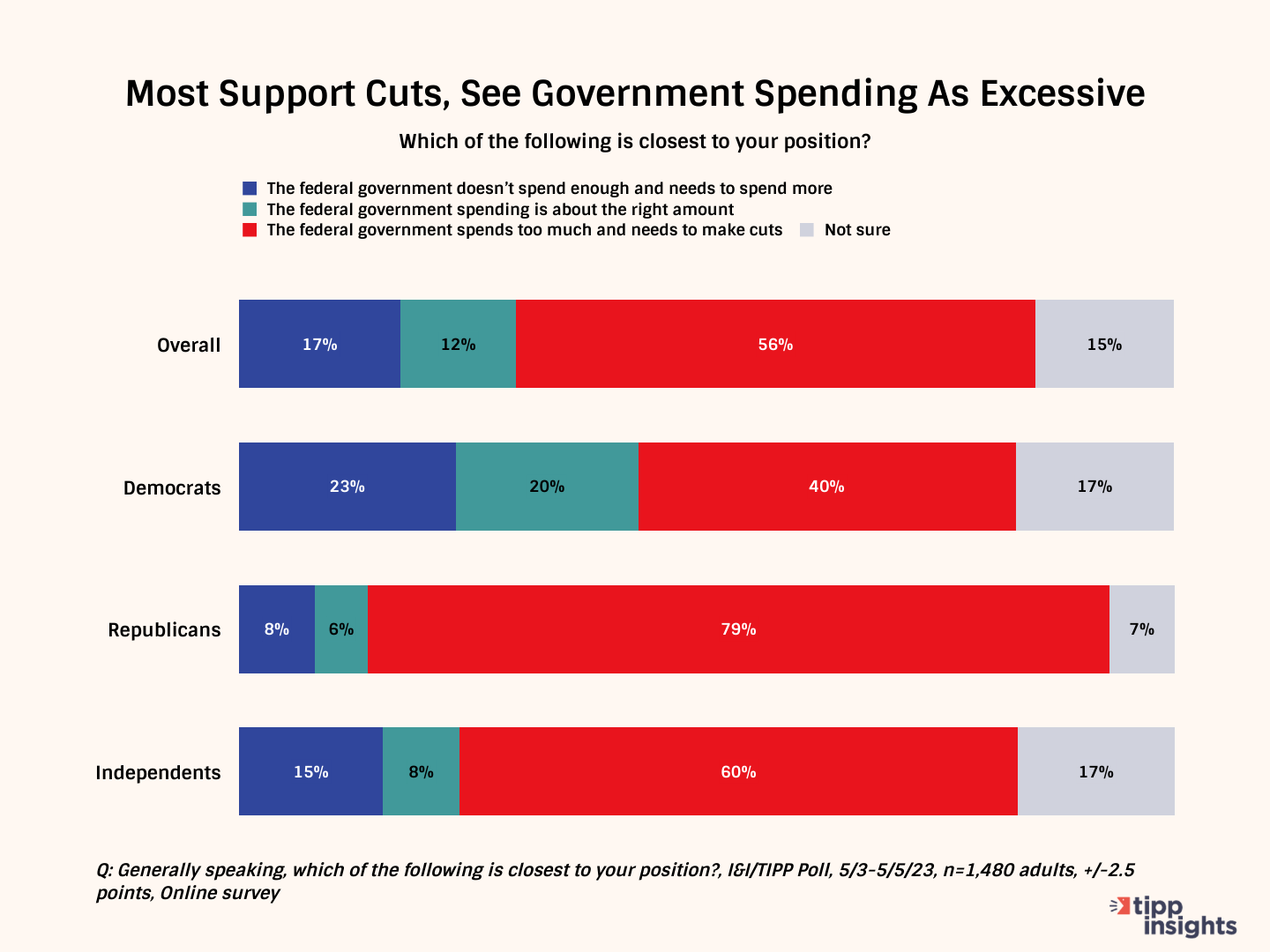

What could possibly be behind this? To get at voters' own beliefs about spending, taxes and debt, we asked them which of the following three statements most matched their own ideas:

1. "The federal government spends too much and needs to make cuts."

2. "The federal government doesn’t spend enough and needs to spend more."

3. "The federal government spending is about the right amount."

The overwhelming winner here was No. 1, with 56% support, compared to just 17% for No. 2, and 12% for No. 3; 15% said "not sure."

In short, Americans by a clear majority think the government spends to much and wants to see spending cut.

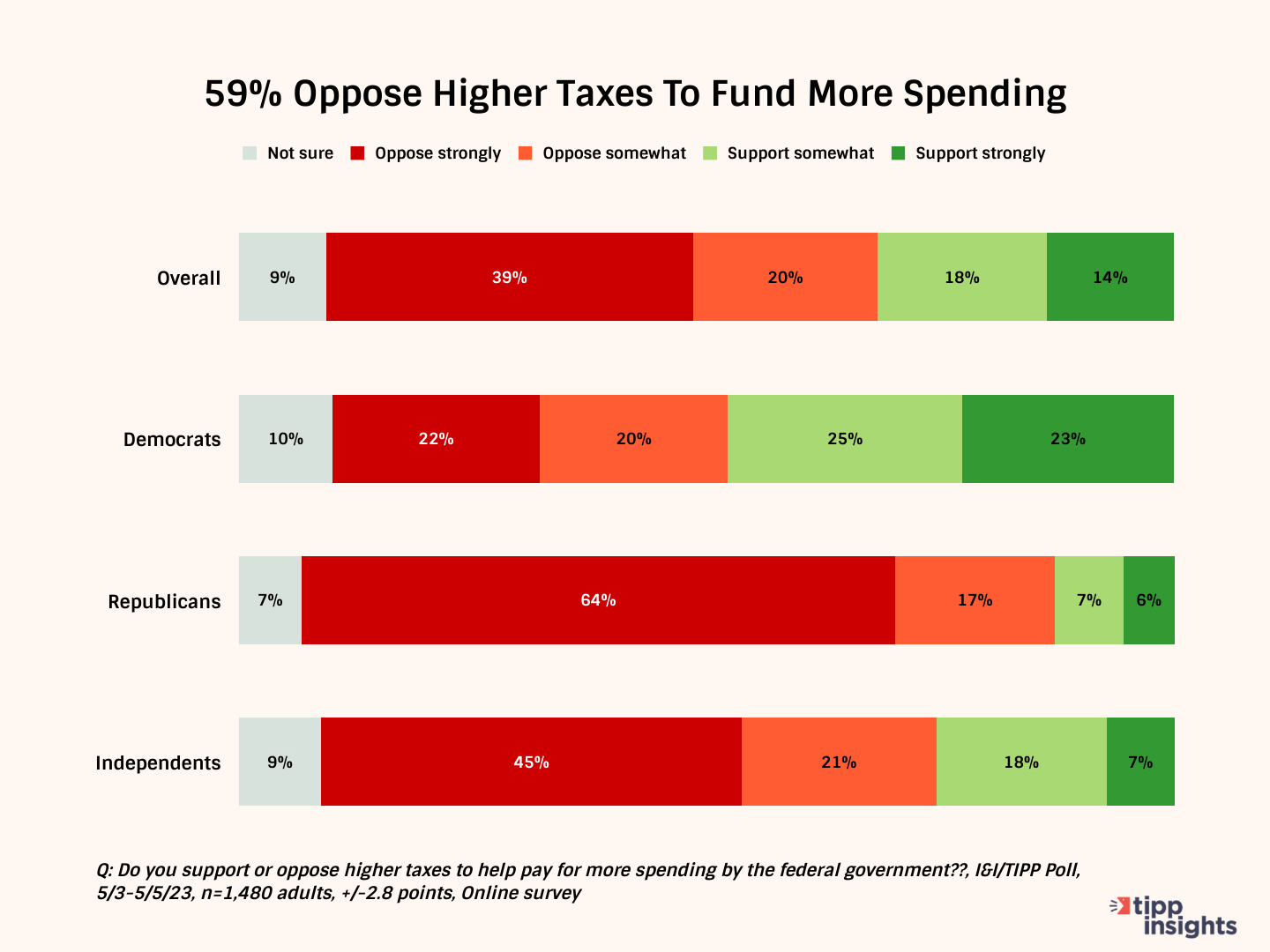

Finally, we also asked a final question, this one about taxes. Specifically, we asked: "Do you support or oppose higher taxes to help pay for more spending by the federal government?"

Once again, Americans showed their fiscally conservative side: 59% oppose higher taxes, with 20% saying they opposed them "somewhat" and 39% saying they opposed them "strongly."

Just 32% said they would support higher taxes, but the breakdown showed 14% said their support was strong while a larger portion, 18%, said they support tax hikes only "somewhat" strongly.

And support is bipartisan, though it's stronger among Republicans (79%) than among Democrats (40%) and independents (60%). Neither option No. 2 nor option No. 3 get even a quarter of any party's support.

Will this make a big difference for Biden's fiscal policy going forward?

On Friday of last week, Biden sounded anything but conciliatory.

"The last thing this country needs after all we've been through is a manufactured crisis," the president said. "And that's what it is from beginning to end, it's a manufactured crisis driven by the MAGA Republicans in Congress."

And, while calling McCarthy an "honest man," he repeated an earlier claim:

"In a speech to Wall Street, the speaker failed to guarantee he would be the first speaker not to default on our debt,” Biden said on April 29. “Let's be clear. If he fails, the American people will be devastated.”

But as has been noted, in fact McCarthy would not be the "first speaker" to default on our debt. The U.S. has reneged on debts at least four times in the past: once in 1862, during the Civil War; again in 1931, as the Depression began; in the late 1960s as the Vietnam War strained the public purse; and again in 1973, when President Richard Nixon took us off the gold standard.

Biden's claims aside, the massive increase in COVID-related welfare spending over the last three years, coupled with a steep decline in tax revenues due to the shutdowns, have caused our debt to soar so rapidly.

That's why the idea of cutting spending rather than raising taxes has such appeal. The government has never been larger nor spent as much in peacetime as it does today. Those were results of conscious policy choices, not accidents.

And it's getting worse. In the first half of the 2023 fiscal year, the deficit hit $1.1 trillion — an unheard of amount of red ink. It may reach $3 trillion before the year ends.

"In February, the Congressional Budget Office (CBO) projected that annual net interest costs would total $640 billion in 2023 and double over the upcoming decade, soaring from $739 billion in 2024 to $1.4 trillion in 2033 and summing to $10.5 trillion over that period," noted the centrist Peter G. Peterson Foundation, in a report released last week. "However, if inflation is higher than CBO’s projections and if the Fed raises interest rates by larger amounts than the agency projected, such costs may rise even faster than anticipated."

Biden's initial position with the GOP-led House was "show me your plan." On April 26, the House did just that, passing a bill that would slash spending while also lifting the debt ceiling and avoiding a default.

Biden now knows where House Republicans stand. As the I&I/TIPP Poll suggests, he now also knows where average voters stand on the key issues of spending, taxes and debt. And it's not with him.

Meanwhile, the Thelma-and-Louise-like posturing of the two parties on the debt ceiling will soon come to an end. It's not likely that anyone on either side is eager to call attention to our government's lack of fiscal control during an election year.

I&I/TIPP publishes timely, unique, and informative data each month on topics of public interest. TIPP’s reputation for polling excellence comes from being the most accurate pollster for the past five presidential elections.

Terry Jones is an editor of Issues & Insights. His four decades of journalism experience include serving as national issues editor, economics editor, and editorial page editor for Investor’s Business Daily.

Want to dig deeper? Download data from our store and pay what you can afford!

Like our insights? Show your support by becoming a paid subscriber!