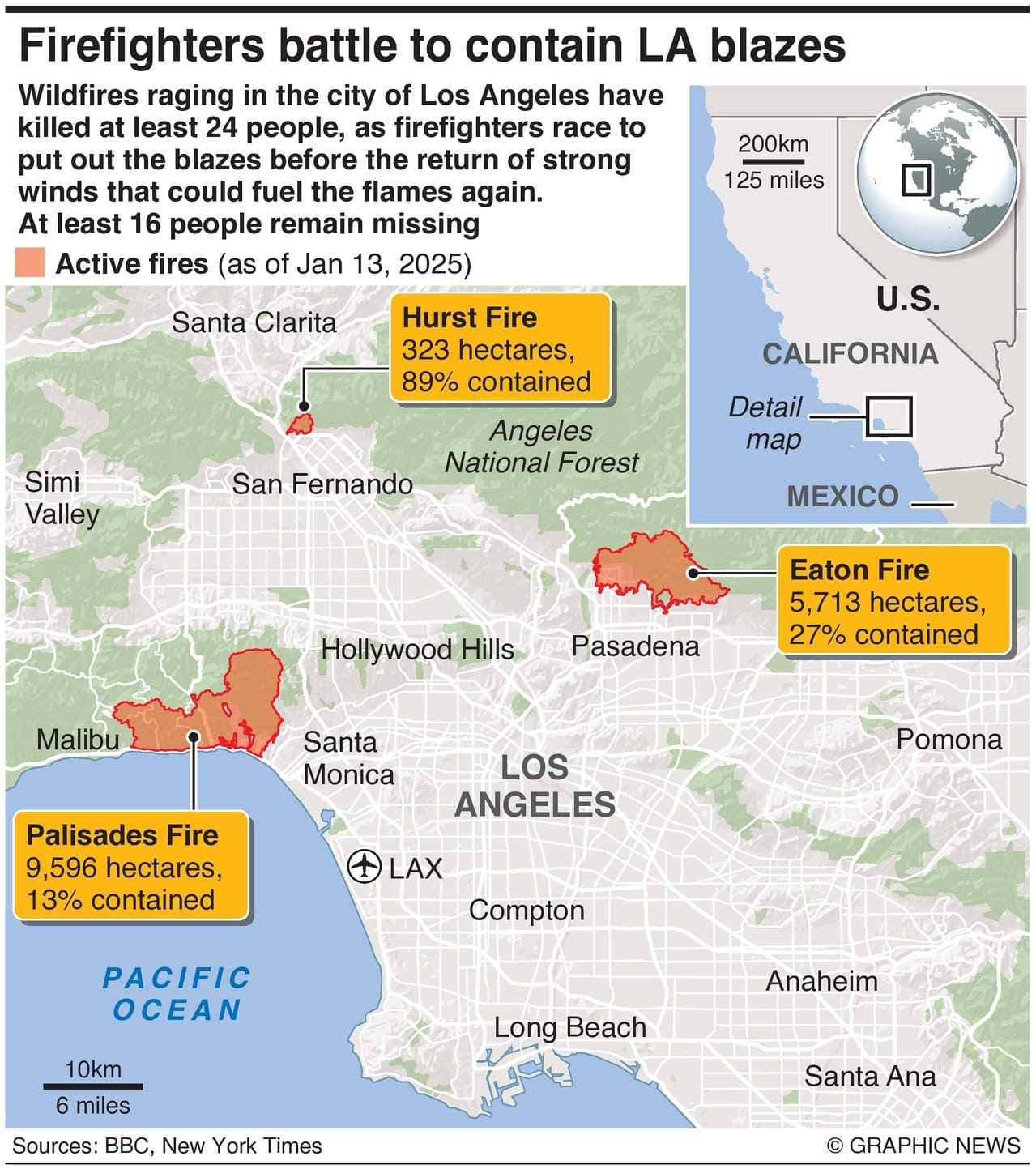

As fires continue to rage in Los Angeles, devouring homes, businesses, and entire neighborhoods, the authorities are rightly focused on saving lives by issuing evacuation orders. The time will come to assess what caused the devastation and what could have been done to prevent it. Then, the painful process of rebuilding will start.

Based on precedent, the American taxpayer will be hit with a hefty bill. Over the years, there has been an expectation that the Federal Emergency Management Agency (FEMA) will step in to help pay for natural disasters. However, the costs to the taxpayer, will not be felt immediately as Washington will borrow the funds and add to the deficit.

A far more crucial concern is what the insurance industry will do. To the extent that they are legally liable, insurers will pitch in and simultaneously begin a nationwide campaign to convince state insurance commissioners to raise rates next year. A family living in flyover country in Kansas and Illinois, far removed from Los Angeles, will be likely hit as the cost of insuring their home goes up.

Unlike automobile or life insurance, the home insurance market in America is regulated at the state level, which means each state has its own set of rules and regulations that dictate how these companies can operate and price their policies. Each state has an insurance department or commission that oversees the insurance industry. These bodies are responsible for ensuring that insurance companies operate fairly and adhere to state laws. They approve policy forms and rates and can investigate complaints against insurers.

In most states, insurance companies must submit proposed rates to the state insurance department for approval before implementing them. This ensures that the rates are not excessively high or unfairly low, which could lead to insolvency. For example, California mandates through Proposition 103 that insurers get rate changes approved by the California Department of Insurance (CDI).

Insurers price their policies based on the perceived risk of insuring a property. They assess the likelihood of claims due to factors like natural disasters, crime rates, and the condition of the home (age, construction materials, etc.). Homes in areas prone to wildfires or hurricanes have higher premiums. Social media posts on X revealed that several Los Angeles-area homeowners lacked insurance protection. The insurers had asked for price increases that CDI did not approve, and when the policies expired, insurers did not offer policy renewals to homeowners. CDI maintains an emergency fund to pay out these claims, but given the extent of the damage, it will likely quickly run out.

The top five home insurance companies in America—State Farm, Allstate, Liberty Mutual, USAA, and Farmers—control nearly 50% of the market and operate in almost every state. These companies have already paid out billions of dollars in claims to cover hurricanes in Texas, Florida, Georgia, and North Carolina last fall. The Los Angeles fires will rack up their claim costs even more. To remedy the health of their books, the companies will request their state overseers for a price increase nationwide, a request that will ultimately be approved. Otherwise, the companies will state that one or more of them could declare bankruptcy.

Over the last 10 years, from 2014 to 2024, the average cost of homeowners insurance in the U.S. has seen a significant rise, from approximately $1,100 in 2014 to an average of about $2,728 per year by 2024 - an increase of roughly 148% over the decade. While every homeowner nationwide pays higher premiums, the Insurance Information Institute says that only about 6% of homeowners actually file a claim. The system effectively redistributes costs, with 94% of homeowners contributing to the coverage needed for the 6% who file claims, often due to living in high-risk areas. This dynamic underscores the broader challenges of balancing equity and risk within the insurance market.

Add the burden of finding a home in a limited-supply environment, higher property taxes as localities reassess property values, and higher maintenance costs as the price of materials and labor goes up, and it is little wonder that new home buyers are scared even to consider entering the market. The lack of supply and higher mortgage costs are severe issues for which there is no quick solution.

Lack of adequate supply: President Biden's reckless spending during the first three years of his administration drove inflation to record levels. The Federal Reserve Bank raised interest rates from near zero in 2022 to 5.33% in December 2023. Home building and home improvement projects became tremendously expensive as the price of new homes steadily rose, and with few takers, the inventory of new homes fell relative to demand.

An unintended consequence of Bidenflation was that existing homeowners sat tight on their cheap mortgages from years before and refused to list their homes for sale, adding to the housing shortage. Home mortgage rates follow the 10-year Treasury yield and not the Fed Funds rate, which impacts short-term borrowing, such as credit card and auto insurance rates.

At its peak in 2023, a 30-year home loan almost went up to 8%, completely shutting new home buyers out. Existing homeowners enjoying a 30-year loan at 3.5%—locked in during the easy money environment that prevailed much of the decade—would be hard-pressed to sell. Why would a homeowner trade up to pay more each month?

Mortgages are unaffordable for many. Even if a first-time home buyer finds a home to buy, many will find the mortgage payments unaffordable.

The median home in the United States sells for about $430,000. Just a few years ago, a homeowner with a 20% down payment and a 30-year mortgage at a 3.5% interest rate would have paid about $1,450 a month before property taxes, maintenance, and insurance. Today, the 30-year rate is nearly 7%, and the same monthly mortgage payment would be approximately $2,111, a whopping $661 increase.

President-elect Trump understands the real estate business like no other president before him. He should prioritize addressing the housing affordability crisis as part of his MAGA agenda.