In our Tuesday editorial, 'Why There Is No Hope In Sight To Tame Inflation,' we underscored the role of President Biden’s loose fiscal policy and ballooning national debt in neutralizing the Federal Reserve's rate hikes, leading to persistent inflation. This insight is a stark reminder that monetary policy alone is insufficient to curb inflation without fiscal austerity. With Biden's continued adherence to a slack fiscal policy, the threat of prolonged inflation looms large, potentially impacting our economy for years.

Within 24 hours of our editorial, the Biden-Harris administration announced canceling an additional $7.7 billion in student loans. We should not take this decision lightly, as it brings the total canceled amount to a staggering $167 billion for nearly 5 million Americans. Its implications for the economy and the November election are profound.

In his desperation to win a second term, President Biden is taking actions ranging from releasing oil from the nation’s strategic petroleum reserve to canceling student debt by fiat and using lawfare against his opponent.

Election Interference Concerns

What is the underlying motivation behind Biden’s generous actions with public money? Biden is not losing sleep over student loan borrowers. The President strategically aims to attract specific voter segments, which could significantly influence the upcoming election's outcome. This is not just a matter of policy but a potential case of election interference that demands attention and scrutiny.

As CNN puts it, it is now a monthly feature:

As the November election looms, the administration has been eager to highlight progress in its debt cancellation programs, making announcements such as this one nearly once a month.

The strategy aims to draw in young voters, a group the President can no longer rely on for reelection in November. Young voters struggling with various issues, from minimal wage increases to their inability to afford their first homes, are increasingly disillusioned with his leadership. This disenchantment is more than just a statistic; it reflects their real-life struggles and concerns, as seen in their pessimism on the TIPP Presidential Leadership Index's monthly tracking. In the chart below, his leadership readings are in pessimistic territory, below 50. For those in the 18 to 24 bracket, his May reading is only 44.7, and for the 25 to 44 group, it is 40.5.

We define momentum as the difference between the 3-month and 6-month exponential moving averages. Our momentum analysis further shows the underlying weakness in Biden’s approval among young people.

Biden has a history of using student loans for election purposes. In one of his gaffes after the 2022 midterms, President Biden let slip that his actions to reach out to younger voters had paid dividends for his party at the polls. Biden said, according to Politico:

I especially want to thank the young people of this nation, they voted in historic numbers. Those young voters voted to continue addressing the climate crisis, gun violence, their personal rights and freedoms, and the student debt relief.

The GOP House should investigate the inherent dishonesty of Biden's monthly student loan cancellation agenda.

Fairness Concerns

Biden’s policy reeks of unfairness on many fronts.

The forgiven debt of $167 billion equates to $500 per American citizen. When Biden cancels $167 billion in student loans by fiat, the burden falls on all taxpayers, which is inherently unfair, especially to those who did not attend college or have already repaid their loans. In the current inflationary environment, many Americans struggle to make ends meet and pay taxes. The $500 additional burden is simply insensitive and harsh.

Furthermore, many of Biden's waivers benefit those with an old graduate degree who are among the top 5% earners. So, with his plan, Biden is taking money from middle-income families and helping benefit higher-income borrowers.

It is also unfair that many borrowers who refinanced their original federal loans with private entities will not benefit because they are no longer in the federal loan system.

Legal Concerns

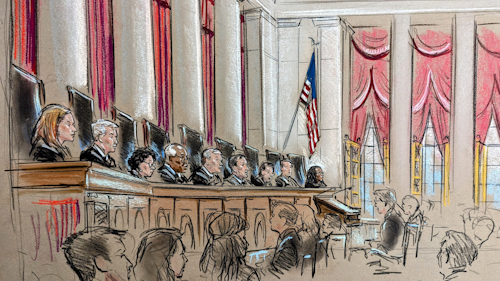

Biden’s plan is an overreach of executive authority, particularly given that the Supreme Court recently blocked a previous student loan forgiveness plan to erase up to $20,000 in student debt for about 43 million borrowers, ruling that such actions required Congressional authorization.

Inflation Concerns

The dark reality of Bidenomics is 19.2% inflation under the President’s watch, which is 5.9% annually.

The President’s action will boost the M2 money supply and counteract the Fed’s tightening. The M2 money supply measures the amount of money readily available in the economy, which reflects overall liquidity. It includes cash, checking deposits, savings accounts, money market accounts, and small certificates of deposit. The "net effect" will be inflation exceeding 3.0% in the foreseeable future. It can also increase the nation’s debt, already $35 trillion.

Like skyrocketing mortgage rates, many student loan borrowers' interest rates have increased primarily due to Bidenomics. Biden is both the arsonist and the firefighter. What an irony!

Bad Precedent

Biden’s forgiveness does not tackle the rising cost of education, which is the root cause of the problem.

Canceling student debt serves as an incentive for colleges to increase their costs. They can point to the likely forgiveness borrowers would receive from the government down the road and justify the higher cost of education to students.

Biden’s reelection comes with a hefty price: devolving the country into a banana republic through lawfare, implementing social engineering maneuvers like student debt cancellations, turning the strategic petroleum reserve into a strategic political reserve, and abandoning our loyal Middle East ally. Elections do have consequences.