The RealClearMarkets/TIPP Economic Optimism Index, a leading gauge of consumer sentiment, dropped 0.7% in April to 43.2. Since September 2021, the index has stayed in negative territory for 32 consecutive months.

Reflecting the recent stock market gains, optimism among investors gained 8.3% from 50.7 in March to 54.9 in April, while it dropped by 8.7% among non-investors, from 40.1 in March to 36.6 in April.

The RCM/TIPP Economic Optimism Index is the first monthly measure of consumer confidence. It has established a strong track record of foreshadowing the confidence indicators issued later each month by the University of Michigan and The Conference Board. From February 2001 to October 2023, TIPP released this index monthly in collaboration with its former sponsor and media partner, Investor's Business Daily.

RCM/TIPP surveyed 1,432 adults from April 3 to April 5 for the March index. The online survey utilized TIPP's network of panels to obtain the sample. A more detailed methodology is available here.

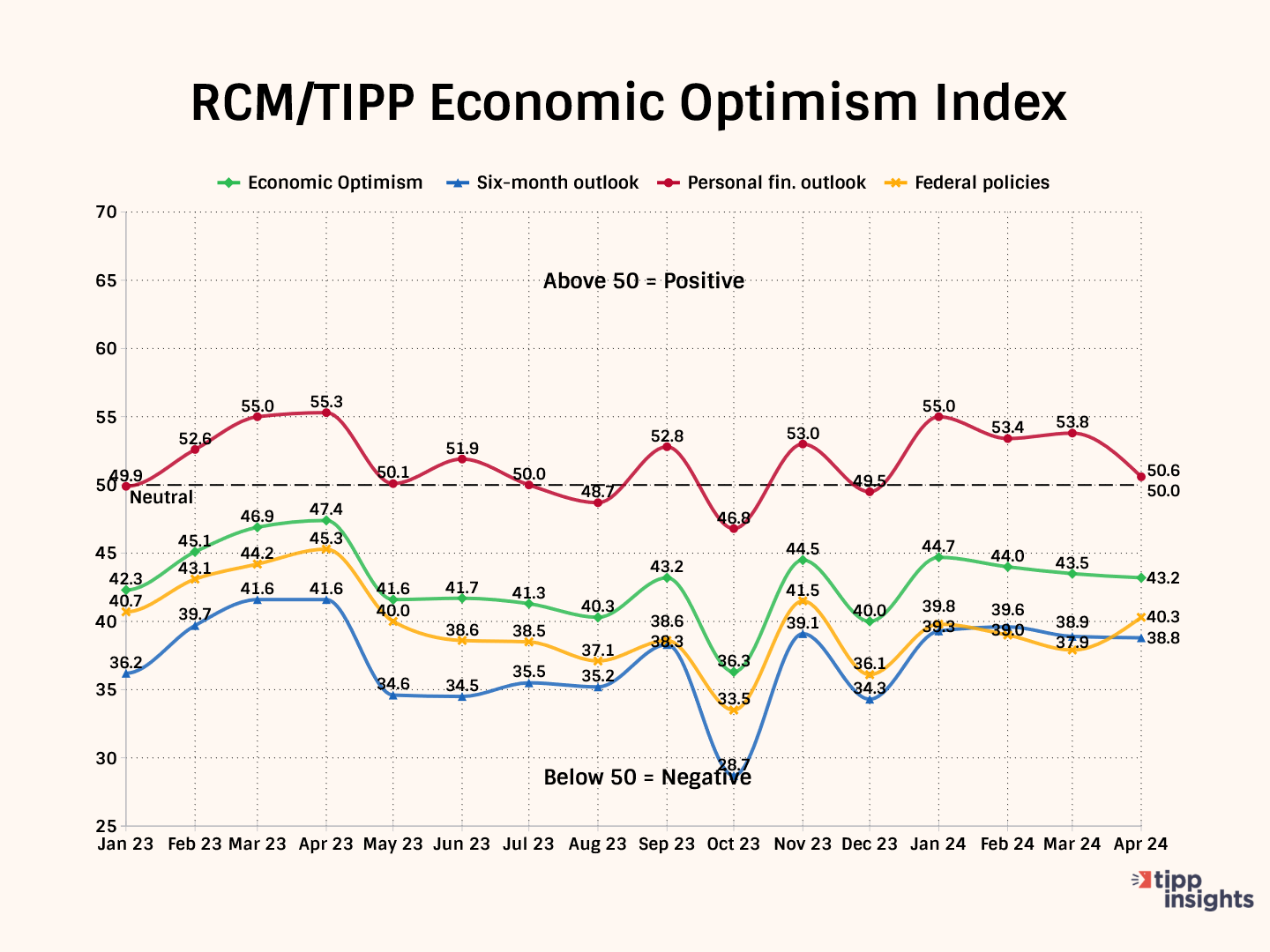

RCM/TIPP Economic Optimism Index

The RCM/TIPP Economic Optimism Index has three key components. In April, two of these components declined, while one showed improvement. The index and its components range from 0 to 100. A reading above 50.0 signals optimism, anda reading below 50.0 indicates pessimism. 50 is neutral.

- The Six-Month Economic Outlook, which measures how consumers perceive the economy's prospects in the next six months, dropped slightly from 38.9 in March to 38.8 in April, marking a 0.3% decrease. In October 2023, this component posted 28.7, its lowest reading since the index debuted in February 2001.

- The Personal Financial Outlook, a measure of how Americans feel about their own finances in the next six months, declined sharply by 5.9% from its previous reading of 53.8 in March to 50.6 this month. In January, the component exceeded the neutral reading of 50.0 and has since remained in positive territory for the fourth month.

- Confidence in Federal Economic Policies, a proprietary RCM/TIPP measure of views on the effectiveness of government economic policies, improved from 37.9 in March to 40.3 this month, reflecting a 6.3% gain.

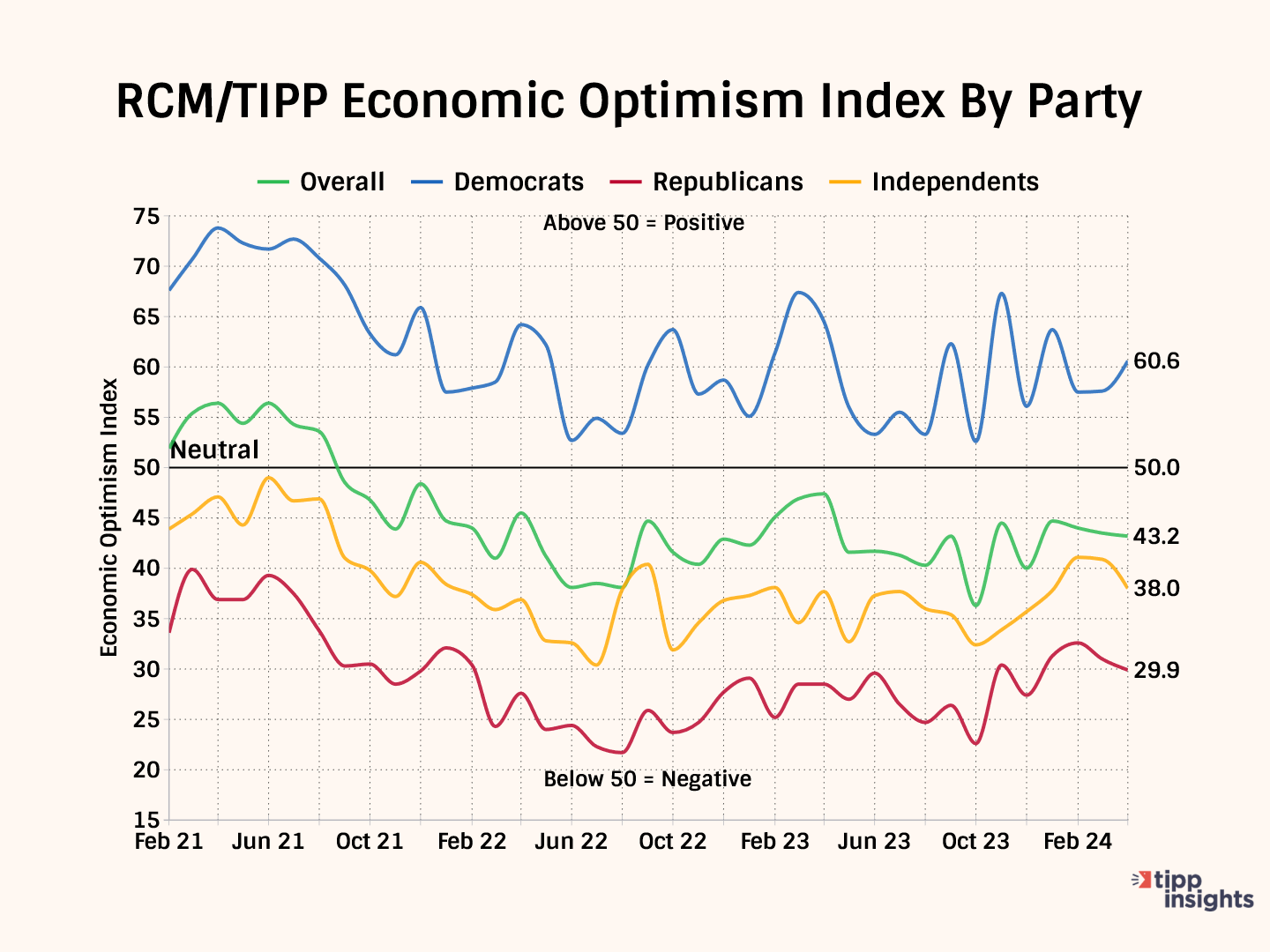

Party Dynamics

Democrats posted the highest confidence levels in April, at 60.6, increasing sharply from 57.6 in March, a 5.2% gain.

Meanwhile, Republicans' confidence declined 1.1 points to 29.9 this month, a drop of 3.5%. It has stayed in the pessimistic zone for 41 consecutive months since December 2020, after the last presidential election.

Independents’ confidence has been in pessimistic territory for 49 months since April 2020, the month after the onset of the pandemic. In April, independents dropped 2.9 points, or 7.1%, and posted 38.0 on the index.

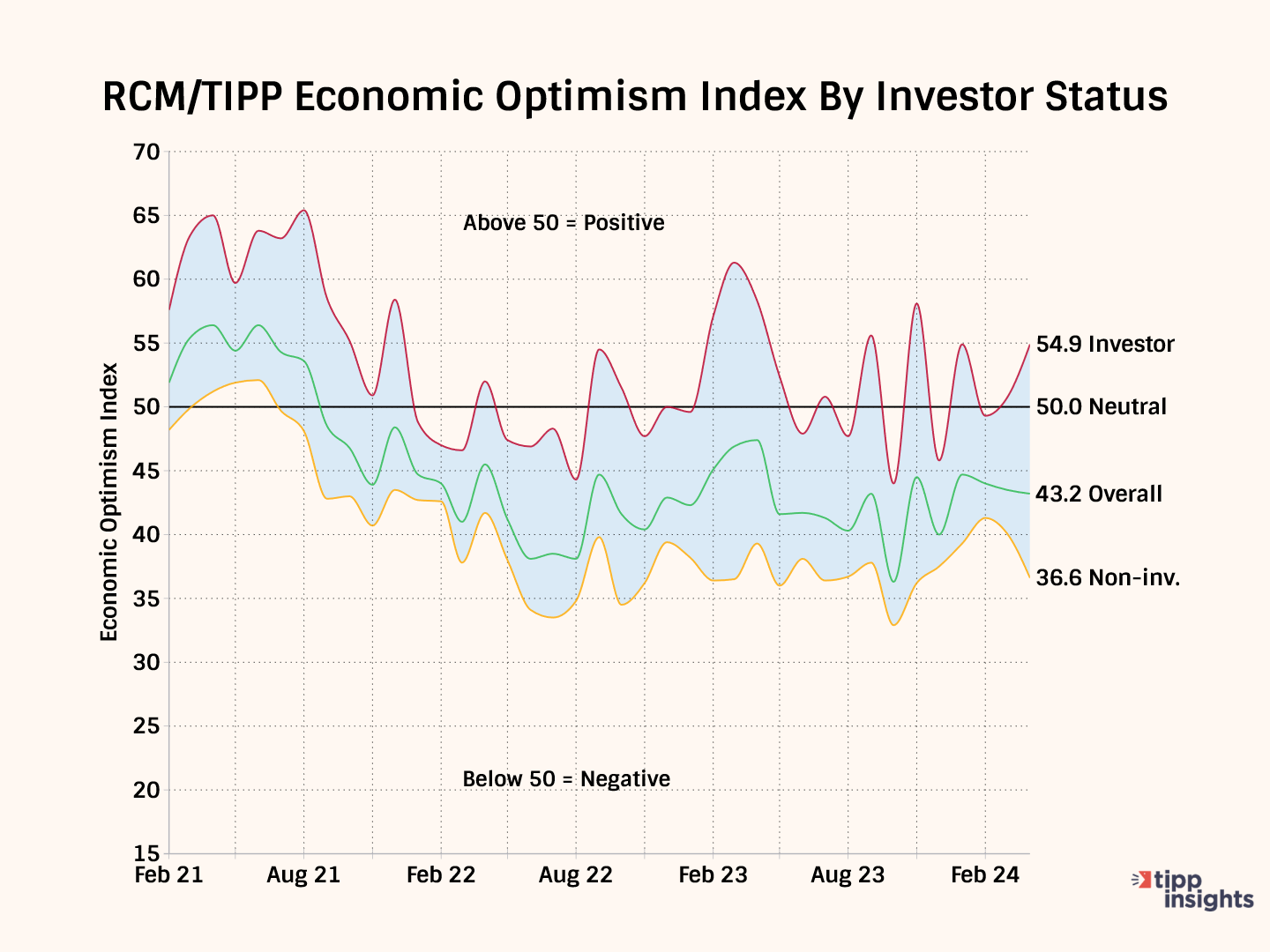

Investor Confidence

Respondents are considered "investors" if they currently have at least $10,000 invested in the stock market, either personally or jointly with a spouse, either directly or through a retirement plan. We classified 32.5% of respondents who met this criterion as investors and 61% as non-investors. We could not ascertain the status of 6% of respondents.

Reflecting the recent stock market gains, optimism among investors gained 4.2 points or 8.3%, from 50.7 in March to 54.9 in April, while it dropped by 3.5 points or 8.7% among non-investors, from 40.1 in March to 36.6 in April.

The economic optimism gap between investors and non-investors widened again to 18.3 in April from 10.6 in March and 8.0 in February.

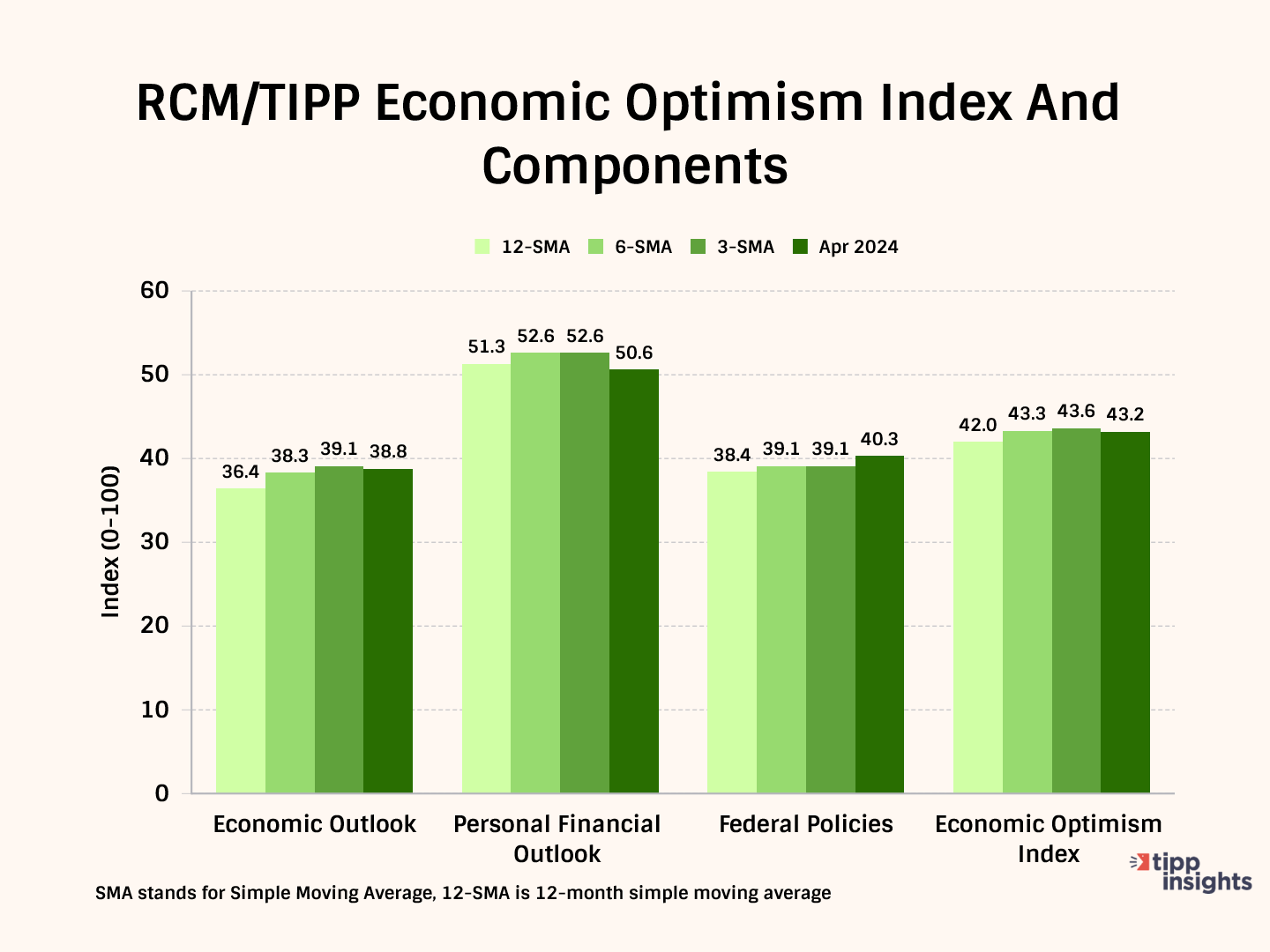

Momentum

Comparing a measure's short-term average to its long-term average is one way to detect its underlying momentum. For example, if the 3-month average is higher than the 6-month average, the indicator is bullish. If the 6-month average exceeds the 12-month average, the same holds true.

In April, the Economic Outlook and Personal Financial Outlook components and the Economic Optimism Index are lower than their respective three-month moving averages. However, the Federal Policies component bucks this trend, registering a higher reading of 40.3 compared to its three-month moving average of 39.1.

Also, the three-month moving averages for all the components and the Optimism Index are equal to or higher than the six-month moving average. As a result, the data shows a mixed picture.

Demographic Analysis

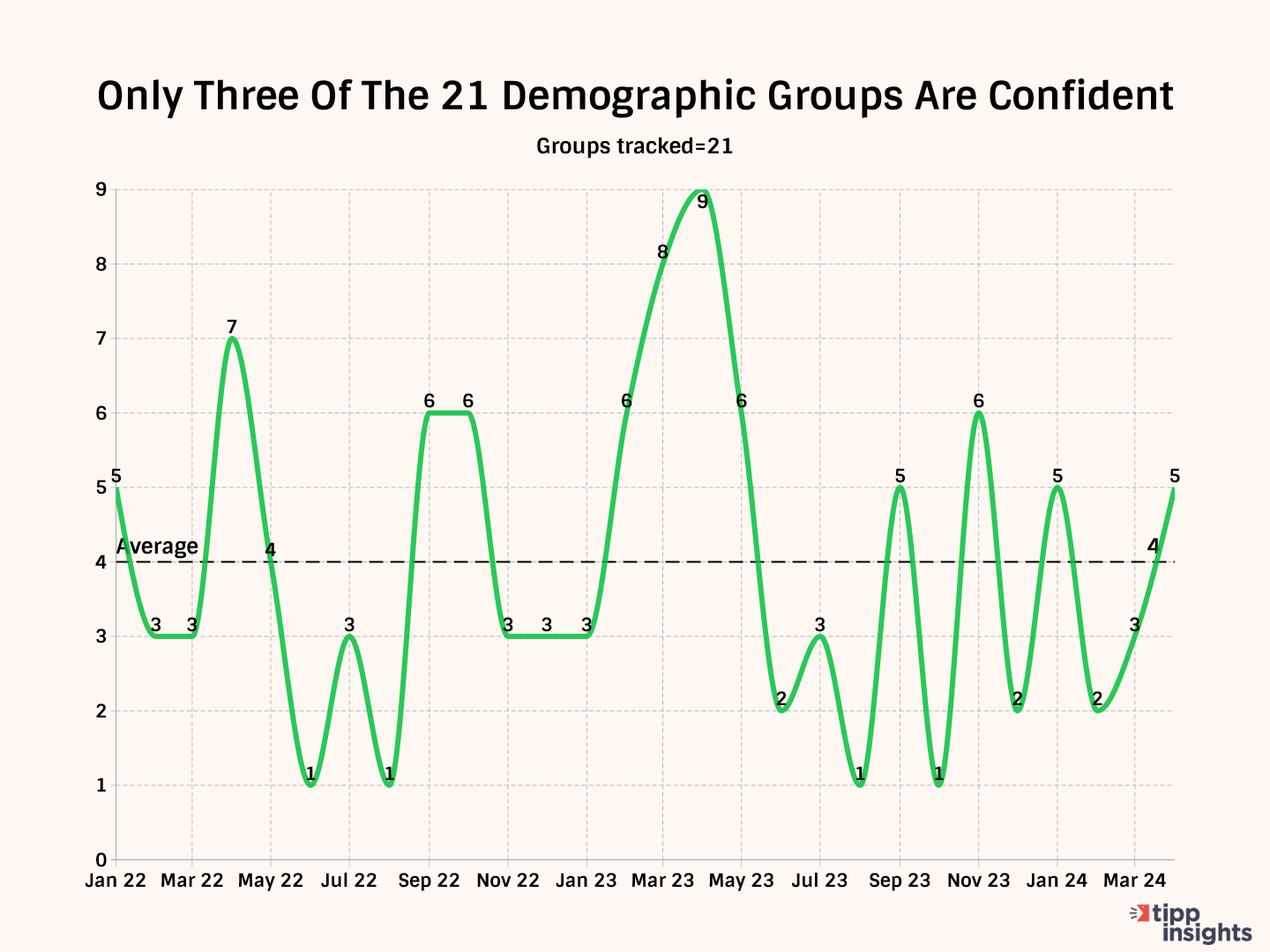

The number of groups in the positive zone indicates the breadth of optimism in American society. This month, three of the 21 demographic groups we track—such as age, income, education, race, etc.—are above 50.0, indicating optimism on the Economic Optimism Index. Starting with three groups in January 2023, we saw steady improvement, peaking at nine groups in April and then declining to one group in August. Since August, it has been in the range of one to six. In April, only five groups are in the positive zone.

Six of the 21 groups improved on the index, compared to 10 in March, 10 in February, and 19 in January.

Inflation

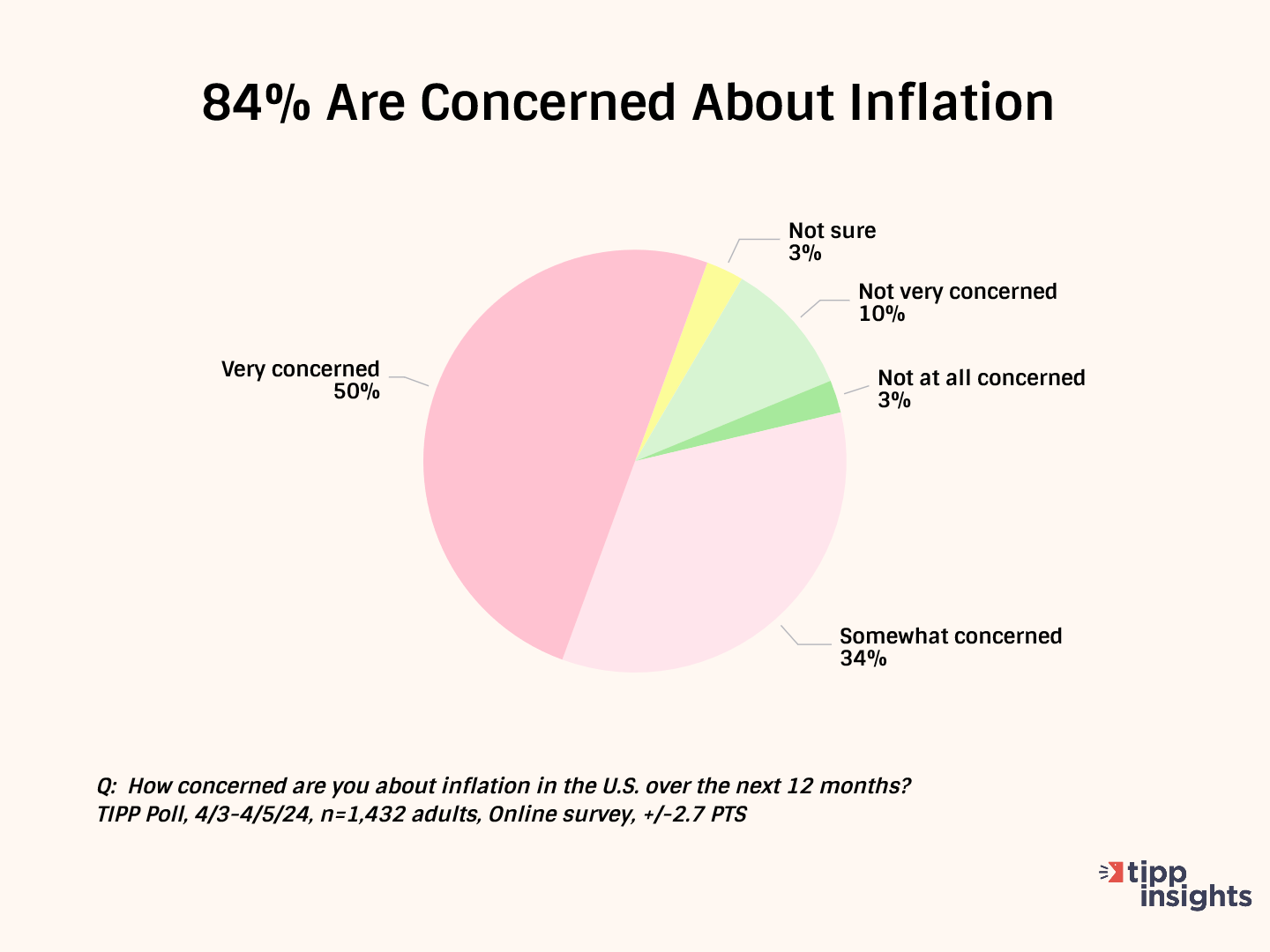

The survey showed that 84% are worried about inflation. One-half (50%) are very concerned, and another 34% are somewhat concerned.

Americans continue to suffer because real wages have not increased, despite the CPI rate falling from a 40-year high of 9.1% in June 2022 to 3.5% in March 2024.

The Federal Reserve believes that long-run inflation of 2%, measured by the annual change in the price index for personal consumption expenditures, is most consistent with its maximum employment and price stability mandate.

On Saturday, we will cover inflation in greater detail.

Recession

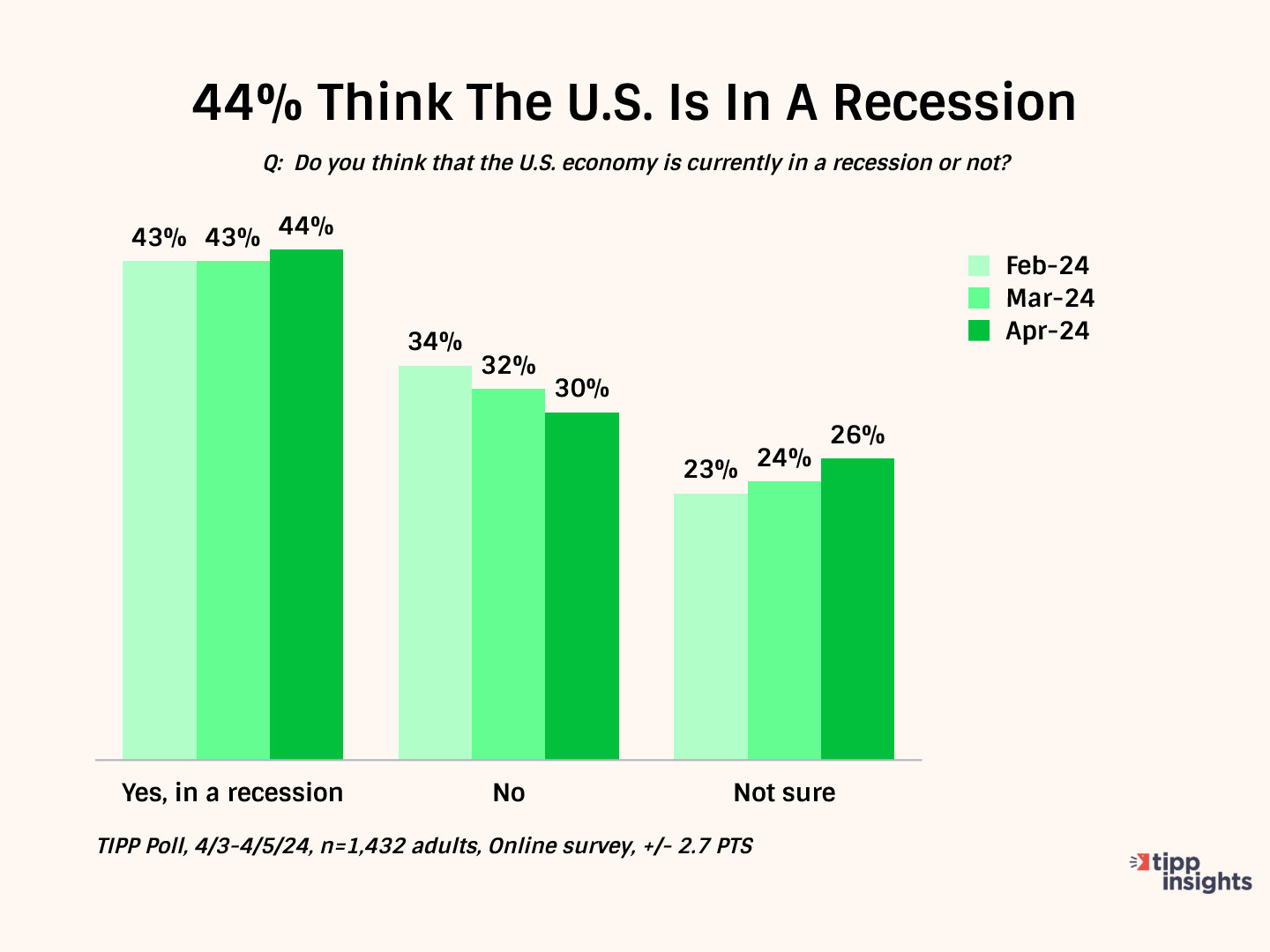

Four in ten (44%) Americans believe we are in a recession, while 26% are unsure. 30% believe we are not in a recession.

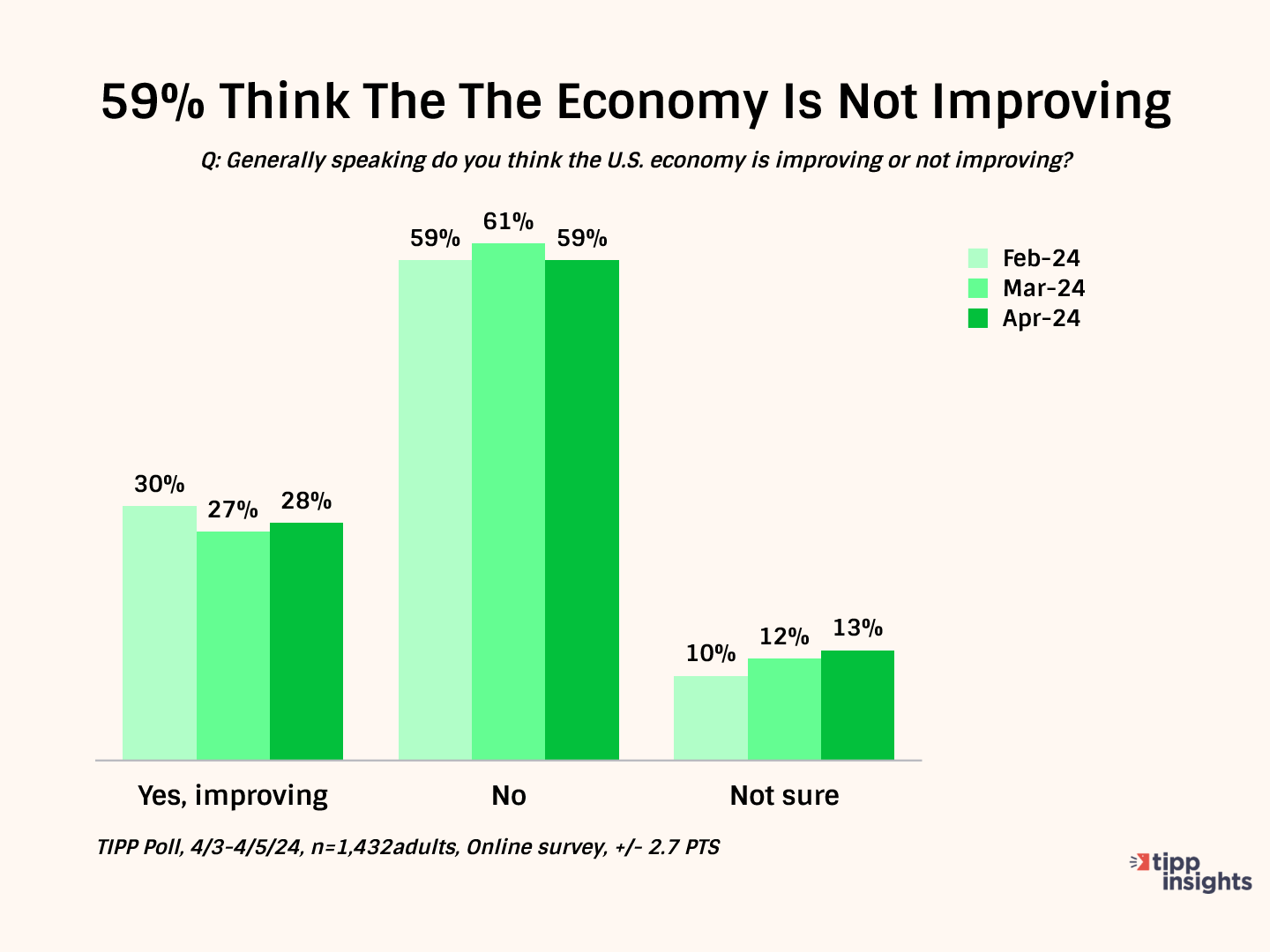

Further, over one-half (59%) think the U.S. economy is not improving, while 28% believe it is improving.

Fiscal Profligacy

Government spending has spiraled out of control, resulting in a national debt exceeding $34 trillion. The debt increases by $1 trillion every 100 days.

Most Americans are concerned about the sustainability of this trajectory. The high interest rates are also hurting Americans and sapping their confidence.

We anticipate a stagflationary economy in 2024. The risks on the downside outweigh those on the upside. Watch the real estate, stock, and job markets, and see if Washington can cut spending.

ICYMI - Recent TIPP Poll Stories

America's Heart Wants To Help Ukraine, But The Mind Wants The War To End: TIPP Poll