The United States government is in deep, in fact, very deep, financial trouble.

In just one year, the federal deficit - the difference between what the government takes in as revenues and what it spends - has doubled from $1 trillion to $2 trillion.

Yet President Biden and his Uniparty friends want to spend $74 billion more to address "national emergencies," the kind that occur 5,000 miles away.

Meanwhile, the national debt is steadily climbing to $34 trillion. So significant is this amount that the government is expected to pay nearly $750 billion this year to service the debt. This outlay is about the same as the entire Pentagon budget, which is more than the military budgets of the next ten countries after the U.S.

Government forecasters are so wrong in their estimates that one may be better off just picking numbers from the sky. In February, the Congressional Budget Office forecasted an amount that would need to be allocated to pay interest this year. That estimate is off by a whopping $70 billion today just seven months later. For calibration, $70 billion is more than six times the annual budget for the Centers for Disease Control.

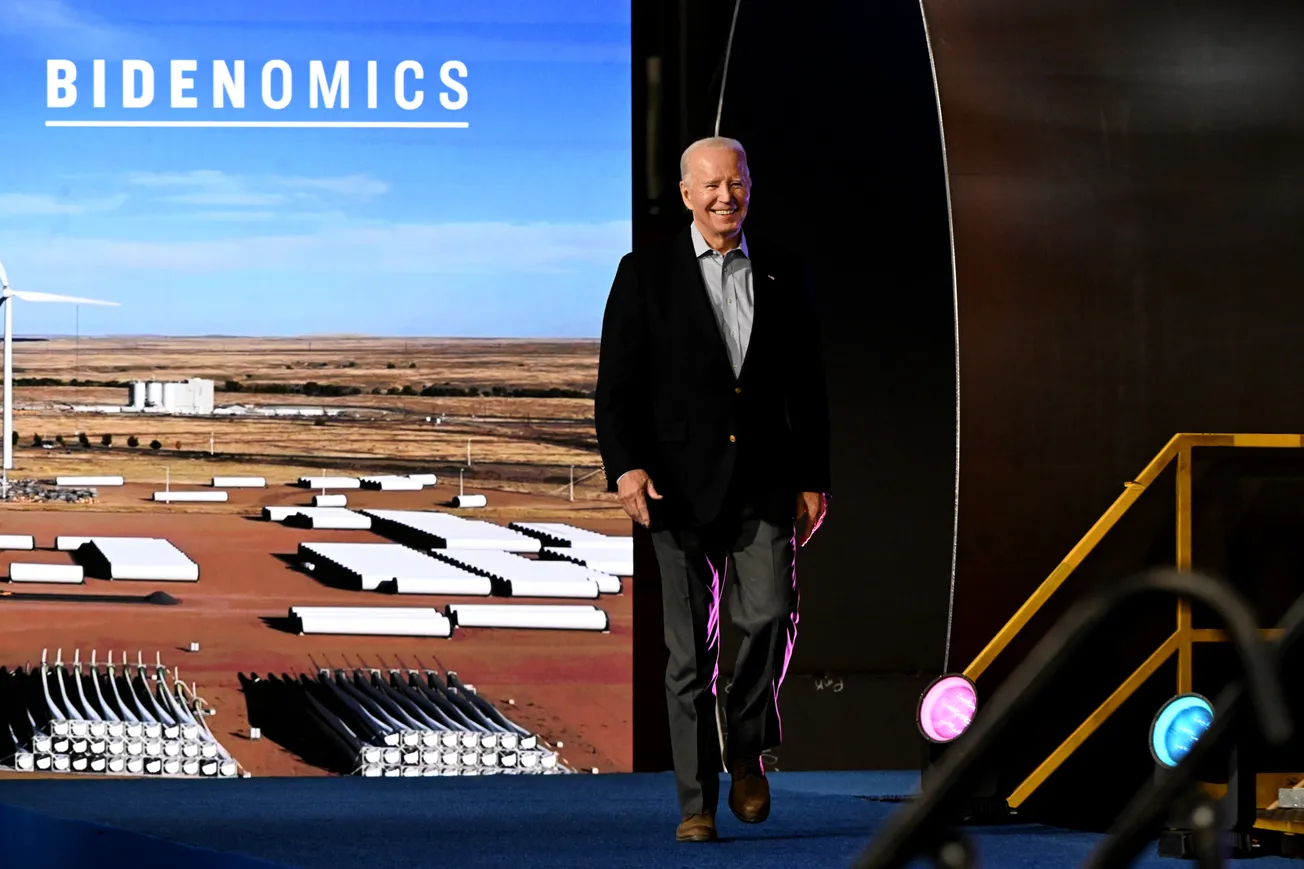

For all the gloating that the White House engages in about the strength of the Biden economy - daily briefings from Press Secretary Karine Jean-Pierre are a trip to fantasyland - federal tax receipts actually fell this year. Please explain this to us, KJP: the administration has raised taxes, the economy is growing, and unemployment is at an all-time low, so how can tax collections go down?

Over on the monetary policy side, the Federal Reserve Chairman is unmoved. Jerome Powell says that inflation is too high and the interest rates are not high enough, arguing that the only way to bring both down to acceptable levels is to slow the economy.

But wouldn't a slower economy add to deficit spending and increase inflation right back up as the Left rushes to shore up federal assistance to Americans? Remember the $4 trillion in cash injection during COVID-19 and the years after, which put us in this inflationary mess in the first place? Also, wouldn't a slower economy increase unemployment, leading to even lower tax collections?

The conundrum we describe above has a name in Economics: Stagflation. According to Investopedia, stagflation is an economic cycle characterized by slow growth and a high unemployment rate accompanied by inflation. Economic policymakers find this combination particularly difficult to handle, as attempting to correct one of the factors can exacerbate another: the Whack-a-Mole effect.

The Biden administration does not want to admit that we are already in a stagflationary period. That is, KJP keeps insisting every day that the unemployment rate is low, not high; and why the economy is growing, not slowing. But if we were to believe KJP (we rarely do), why is America in such a fiscal and monetary mess?

And then, there's Wall Street. Because the dollar is the world's reserve currency and the default currency for over 90% of international settlements, even when an American entity is not a party to the trade, the dollar's value is rising steadily with the Fed funds rate so high. On Friday, the 10-year Treasury yield crossed 5% for the first time since 2007. As investors move money to safe Treasurys, stock market indices will fall. The Japanese yen may breach the historically and emotionally significant 150 level and stay there. The last time the yen was this weak was in 1990.

A super-strong dollar is bad for America when the underlying American economy is struggling. Exports are a significant engine of American economic activity, but American companies will lose out to German, Japanese, and Chinese competitors because when priced in dollars, American products become too expensive.

Oil, traded in dollars, becomes prohibitively expensive for many countries that may otherwise have bought American products. These countries must now save their valuable foreign exchange to purchase energy products to keep their economies alive, benefiting OPEC+ oil producers. As Israel prepares to launch a ground offensive, oil prices could breach the $100 mark and stay there, creating a double-whammy situation for the world. The base price of oil goes up because of lower supply in war-torn regions, to be paid for in dollars that are increasing in value.

The mighty military-industrial machine is the only safe American sector exempt from all the stagflationary pressures above. More war means more production of super-inflated products and services, not subject to competitive bidding. More production means well-paying jobs in diverse Congressional districts.

The cost is the long-term impact on America's health. But the average Uniparty politician quips, "Long-term? Who cares?"

We could use your help. Support our independent journalism with your paid subscription to keep our mission going.