Two millennia ago, the ancient Indian strategist Chanakya understood something modern governments often forget: taxation resembles ecology more than we often admit. A state must sustain itself, but it must also preserve the source of its prosperity.

Just as fruits are gathered from a garden as often as they become ripe, so revenue shall be collected as often as it becomes ripe. Collection of revenue or of fruits, when unripe, shall never be carried on, lest their source may be injured, causing immense trouble — Chanakya, Arthashastra

His principle is worth recalling as New York debates a proposed property tax increase of nearly 10% to help close a multibillion-dollar budget gap. Fiscal balance is not optional. Cities must fund schools, public safety, infrastructure, and social services. The question is not whether revenue is necessary. The question is whether higher rates, imposed in an already high-tax environment, will strengthen or weaken the base over time.

In public debate, tax proposals are often treated as static calculations. Raise the rate by 9.5%, multiply it by assessed value, and revenue does not ipso facto rise accordingly. They operate within an economy shaped by incentives, mobility, and long-run expectations.

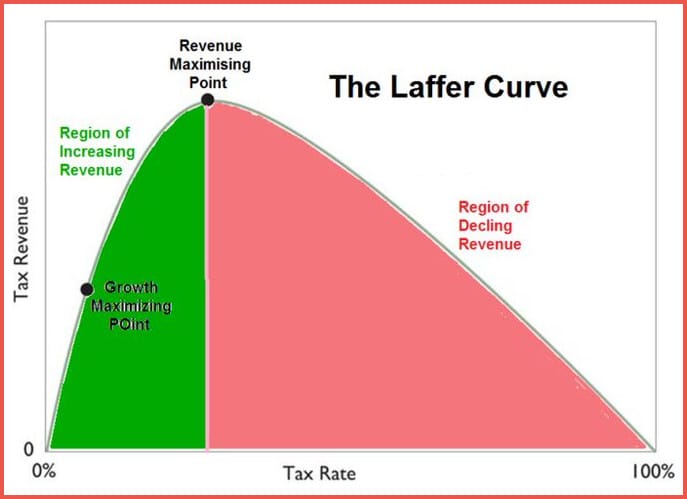

Economists refer to this behavioral response as elasticity. If taxpayers do not change their behavior when rates rise, revenue increases cleanly. If they do—by relocating, delaying investment, restructuring assets, or shifting activity elsewhere—the yield may fall short of projections. In extreme cases, higher rates can even shrink the base. The so-called “Laffer Curve” made this intuition politically controversial decades ago, but the underlying principle is older than modern supply-side debates. It is embedded in common sense: beyond a point, additional extraction or overextraction reduces the source.

New York’s fiscal structure heightens the stakes. Like many large states and cities, it relies heavily on a relatively narrow band of high earners and high-value properties for a disproportionate share of its revenue. When a small share of taxpayers contributes a large share of receipts, stability depends not only on rates but on their willingness to remain and invest.

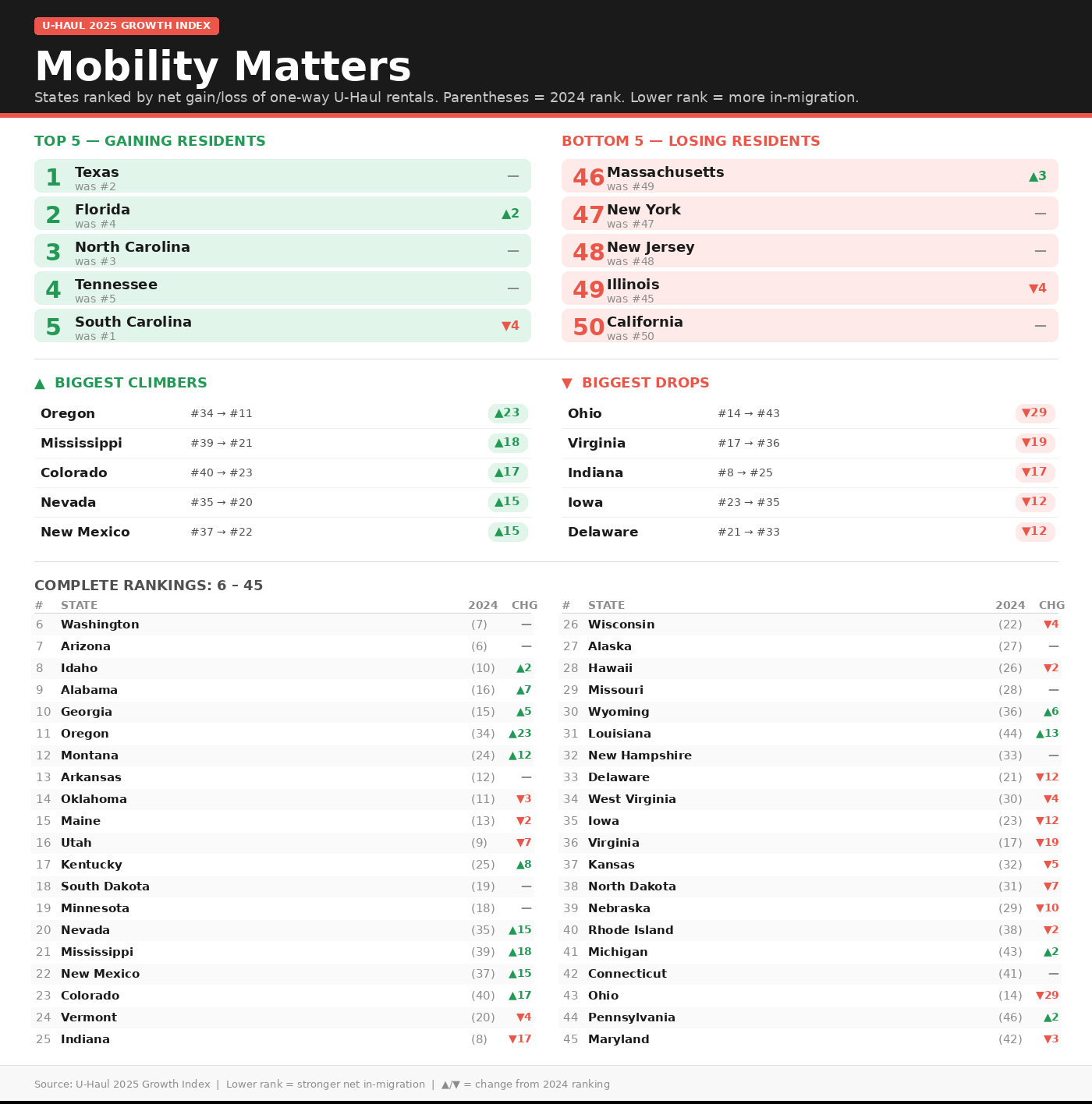

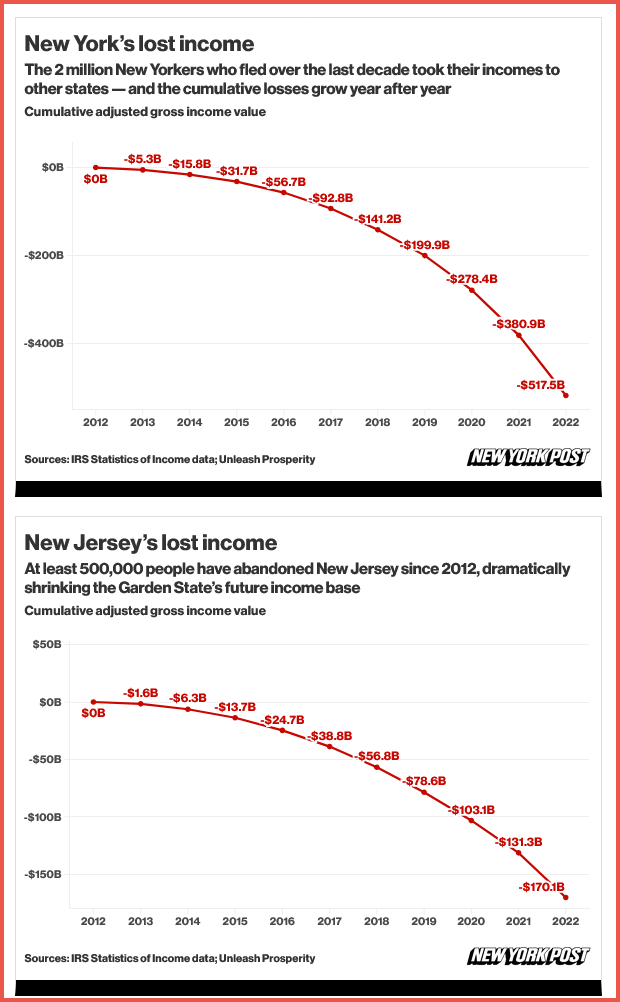

Over the past several years, IRS migration data and indicators such as U-Haul’s annual Growth Index have shown sustained net out-migration from high-tax states such as California, New York, and Illinois, while lower-tax states like Texas, Florida, and Tennessee dominate in-migration rankings. Life events drive many moves. But in an era of remote work and interstate mobility, fiscal climate increasingly matters at the margin.

California offers a cautionary illustration. The state has repeatedly adopted “temporary” tax measures on high earners to address budget pressures. Some have been extended beyond their original sunset provisions. Meanwhile, the state’s revenue has grown more volatile, reflecting its dependence on a concentrated/narrow high-income base. Prominent entrepreneurs relocating to lower-tax jurisdictions attract headlines, but the deeper issue is structural: when revenue depends heavily on a mobile minority, even modest departures can have outsized fiscal effects.

New York need not replicate California’s experience. But it should not assume immunity either. The city’s own history offers a reminder: projections for the “millionaire’s tax” surcharge have periodically fallen short of estimates as high earners adjusted their behavior or shifted residency.

Granted, property is less mobile than income. Buildings cannot relocate to Florida. Yet capital can. Investment decisions can shift. Developers can choose to build elsewhere. Buyers can delay purchases. Rental markets can tighten or soften depending on expectations of future burdens. Over time, these marginal decisions accumulate.

Supporters of a property tax increase argue that New York’s scale and desirability provide insulation. The city remains a global financial center, a cultural capital, a magnet for talent. That is true—and it is precisely why prudence matters. Competitive advantage is not a birthright; it is maintained through policy discipline.

A nearly 10% increase may well generate the projected revenue in the short term. The risk lies in the long term. If higher rates accelerate out-migration at the margin, discourage investment, or signal a willingness to rely repeatedly on rate hikes rather than structural reform, the tax base may erode quietly before the effects become visible in budget spreadsheets.

The broader debate should move beyond partisan frames of redistribution versus austerity. It should focus instead on sustainability, the sine qua non of long-term fiscal stability. Are there efficiencies to be found in city operations? Can the tax base be broadened rather than deepened? Can spending reform accompany any revenue increase? In a federal system where individuals and capital can move across state lines with increasing ease, policy must account for behavior, not simply balance sheets.

Chanakya’s metaphor endures because it captures this balance. The goal is continuity, not exhaustion. New York’s challenge is not to avoid taxation. It is to ensure that in securing the revenue it needs, it does not weaken the ecosystem that produces it.

A city that assumes it still has room to raise rates may discover too late that it has crossed the point of diminishing returns. And when the base narrows, restoring confidence will become far more difficult than raising rates.

In matters of taxation, as in gardening, restraint is often the wiser course.

👉 Show & Tell 🔥 The Signals

I. Texas Tops U-Haul Growth Index, California Last Again

U-Haul’s 2025 Growth Index ranks states by net one-way moves, a proxy for domestic migration. Texas leads, followed by Florida and the Carolinas, while California ranks last for the second straight year. The pattern underscores continued population shifts toward the South and Mountain West.

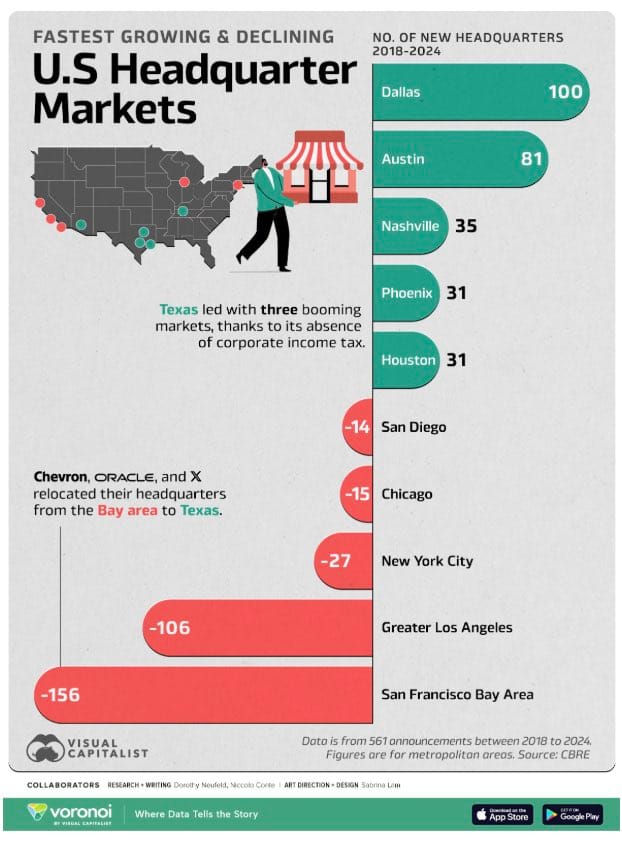

II. Dallas and Austin Lead In New Corporate Headquarters

From 2018 to 2024, Dallas and Austin attracted the most new corporate headquarters among major U.S. metro areas, while the San Francisco Bay Area and Greater Los Angeles posted the largest net losses. The data reflect ongoing geographic realignment in corporate America.

III. New York And New Jersey Lose Hundreds Of Billions In Income Migration

IRS migration data show that since 2012, New York has recorded more than $500 billion in cumulative adjusted gross income losses as residents moved to other states, while New Jersey’s losses approach $170 billion. The sustained outflow of both people and income underscores a long-term shift in population and tax base away from parts of the Northeast.

The TIPP Stack

Handpicked articles from TIPP Insights & beyond

1. How Many More Trans Shootings Before The FBI Acts?—Tyler O'Neil, The Daily Signal

2. Mamdani’s Homelessness Crisis: Urgent Course Correction Needed—Rachel Sheffield, The Daily Signal

3. Largest ‘Precinct’: Why Some Mail Ballots Travel Across State Lines Before Counting Begins—Fred Lucas, The Daily Signal

4. Hakeem Jeffries Pushes For Maryland Redistricting—George Caldwell, The Daily Signal

5. Minnesota Pastor Breaks Silence On Don Lemon—Tyler O'Neil, The Daily Signal

6. Employment Up and Inflation Down, New BLS Report Shows—Nicole Huyer, The Daily Signal

7. Investigators Look For DNA Match, Claim The Search For Nancy Guthrie Is ‘Not Cold’—Virginia Grace McKinnon, The Daily Signal

8. House Republicans Pressure Senate to Force Vote On SAVE America Act—George Caldwell, The Daily Signal

9. Texas AG Contest Includes Cruz-Backed Candidate Vs. Paxton-Endorsed Contender—Fred Lucas, The Daily Signal

10. White House Responds To Pope Declining Peace Board Invitation—Fred Lucas, The Daily Signal

📊 Market Mood — Friday, February 20, 2026

🟩 Futures Rise Ahead of Key Inflation, Growth Data

U.S. futures edge higher as investors brace for PCE inflation and GDP readings that could reset rate expectations.

🟧 Private Credit Jitters Rattle Markets

Concerns flare after a major private lender tightens redemption terms, raising questions about stress in the booming private credit space.

🟦 Oil Holds Near Highs on U.S.–Iran Tensions

Crude steadies near multi-month highs as escalating rhetoric keeps supply disruption fears alive.

🟨 PCE and GDP to Test Fed Path

Core PCE and fourth-quarter GDP data will shape expectations for when — or if — the Fed resumes rate cuts in 2026.

🗓️ Key Economic Events — Friday, February 20, 2026

🟩 8:30 AM — Core PCE Inflation & GDP (Q4)

Core PCE is the Fed’s preferred inflation gauge, while advance GDP shows how fast the economy grew in the fourth quarter.

🟧 9:45 AM — S&P Global Manufacturing & Services PMIs (February)

Early reads on business activity across factories and services, signaling momentum at the start of the year.

🟦 10:00 AM — New Home Sales (December)

Tracks demand in the housing market, offering insight into consumer confidence and mortgage-rate sensitivity.

editor-tippinsights@technometrica.com