Consumer sentiment brightened in February as the RealClearMarkets/TIPP Economic Optimism Index, the first monthly read on U.S. consumer confidence, rose from 47.2 in January to 48.8, a 1.6-point or 3.4 percent gain. The Index stayed below the neutral level for the sixth straight month, keeping the nation in what we classify as a pessimistic zone.

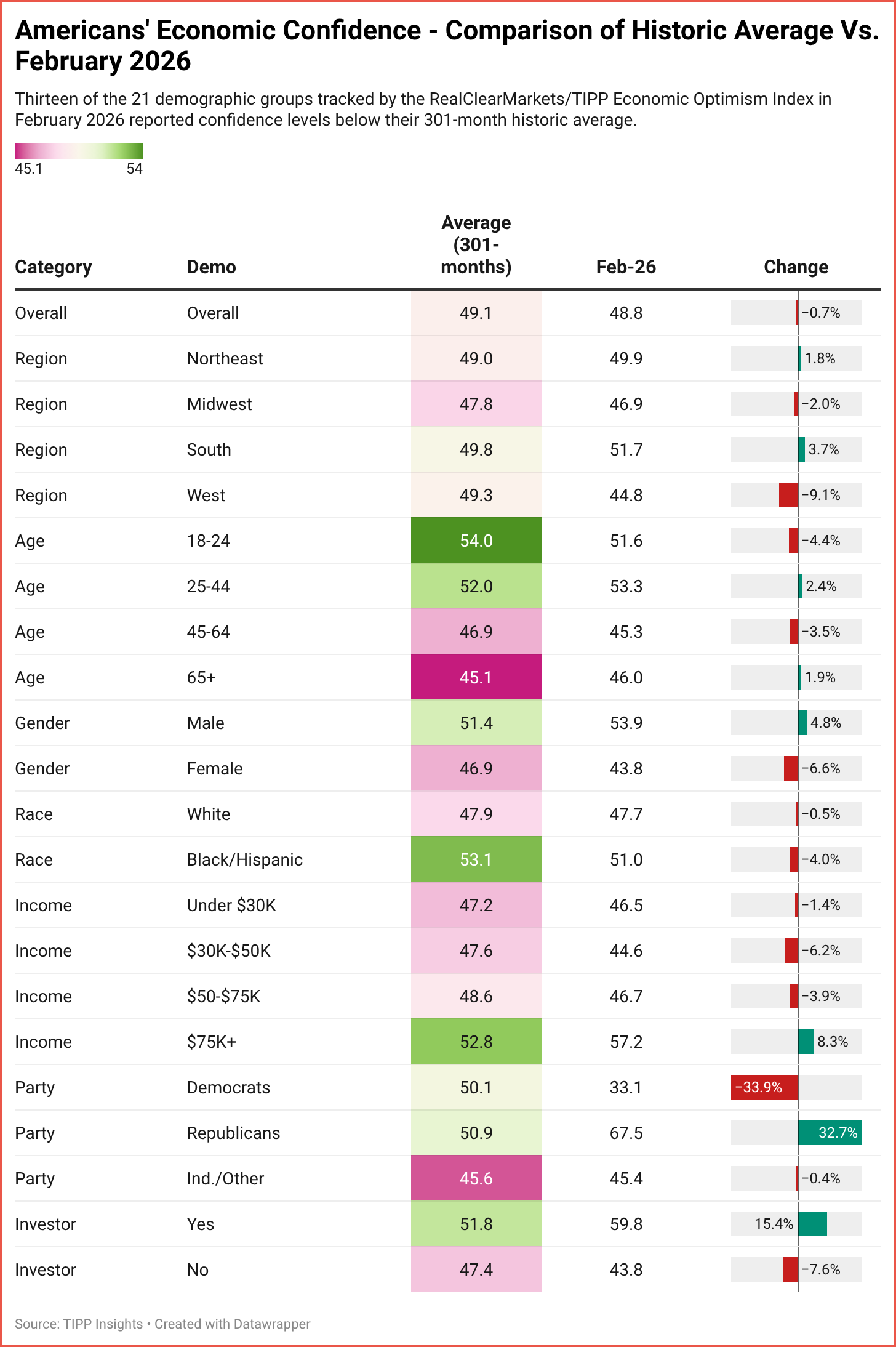

February’s reading of 48.8 is 0.66% below the 301-month historical average of 49.1, indicating that optimism remains slightly below the long-term average.

The RCM/TIPP Economic Optimism Index is the first monthly measure of consumer confidence. It has established a strong track record of foreshadowing the confidence indicators issued later each month by the University of Michigan and The Conference Board. (From February 2001 to October 2023, TIPP released this monthly Index in collaboration with its former sponsor and media partner, Investor's Business Daily.)

RCM/TIPP surveyed 1,384 adults from January 27 to 29 for the February Index, using TIPP’s panel network; results have a range of 0–100, with readings above 50 indicating optimism, below 50 signaling pessimism, and 50 considered neutral. A more detailed methodology is available here.

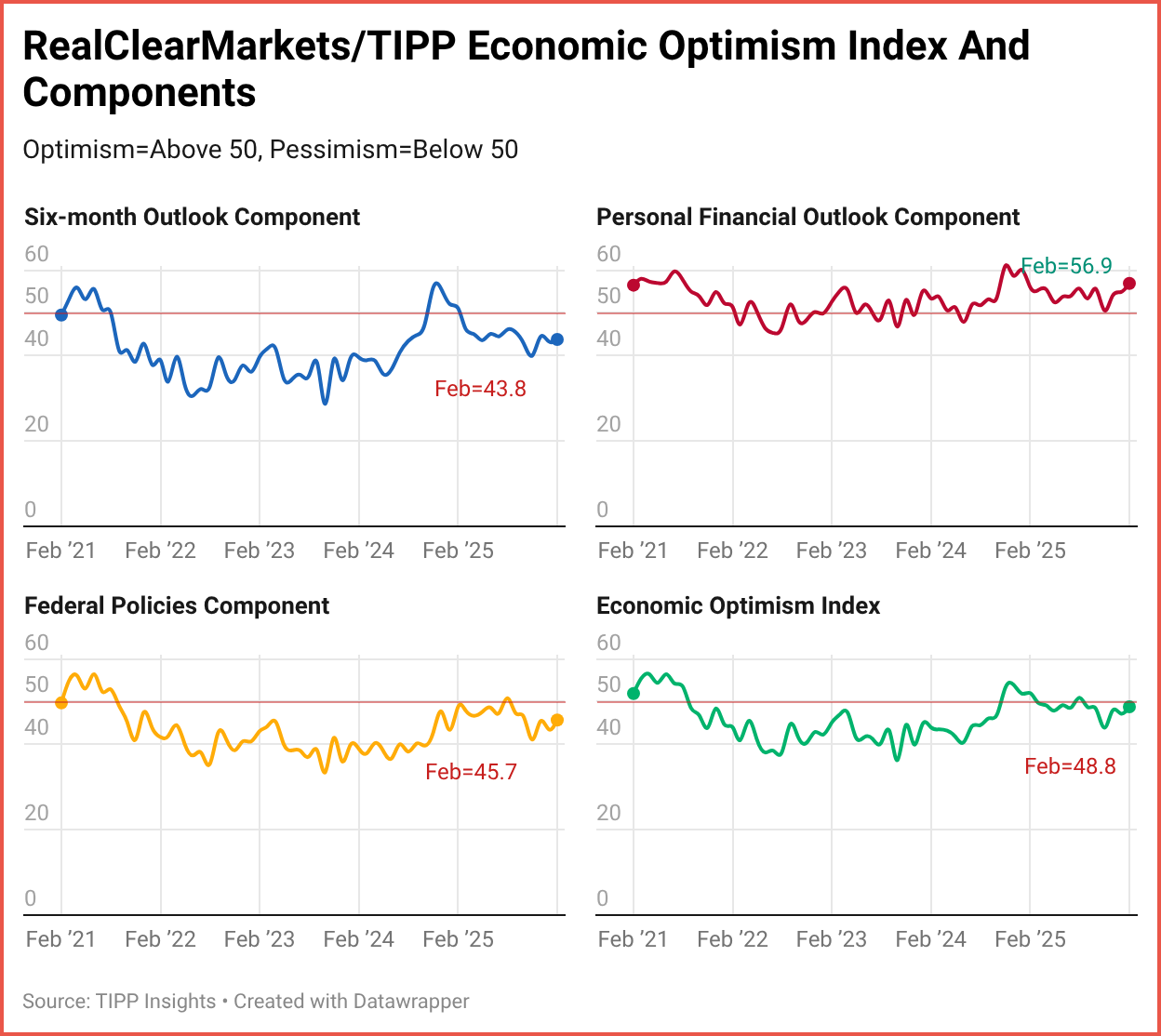

The RCM/TIPP Economic Optimism Index has three key components. In February, all three of them improved.

- The Six-Month Economic Outlook, which measures consumers’ perception of the economy's prospects over the next six months, gained 1.2%, from 43.3 in January to 43.8 in February.

- The Personal Financial Outlook, a measure of how Americans feel about their own finances over the next six months, rose 3.6% from its previous reading of 54.9 in January to 56.9 this month.

- Confidence in Federal Economic Policies, a proprietary RCM/TIPP measure of views on the effectiveness of government economic policies, improved to 45.7 in February from 43.5 in January, a 5.1% gain.

Explore the data in real time: Track the RCM/TIPP Economic Optimism Index on RealClearMarkets. View monthly trends, compare components, and analyze shifts across demographics.

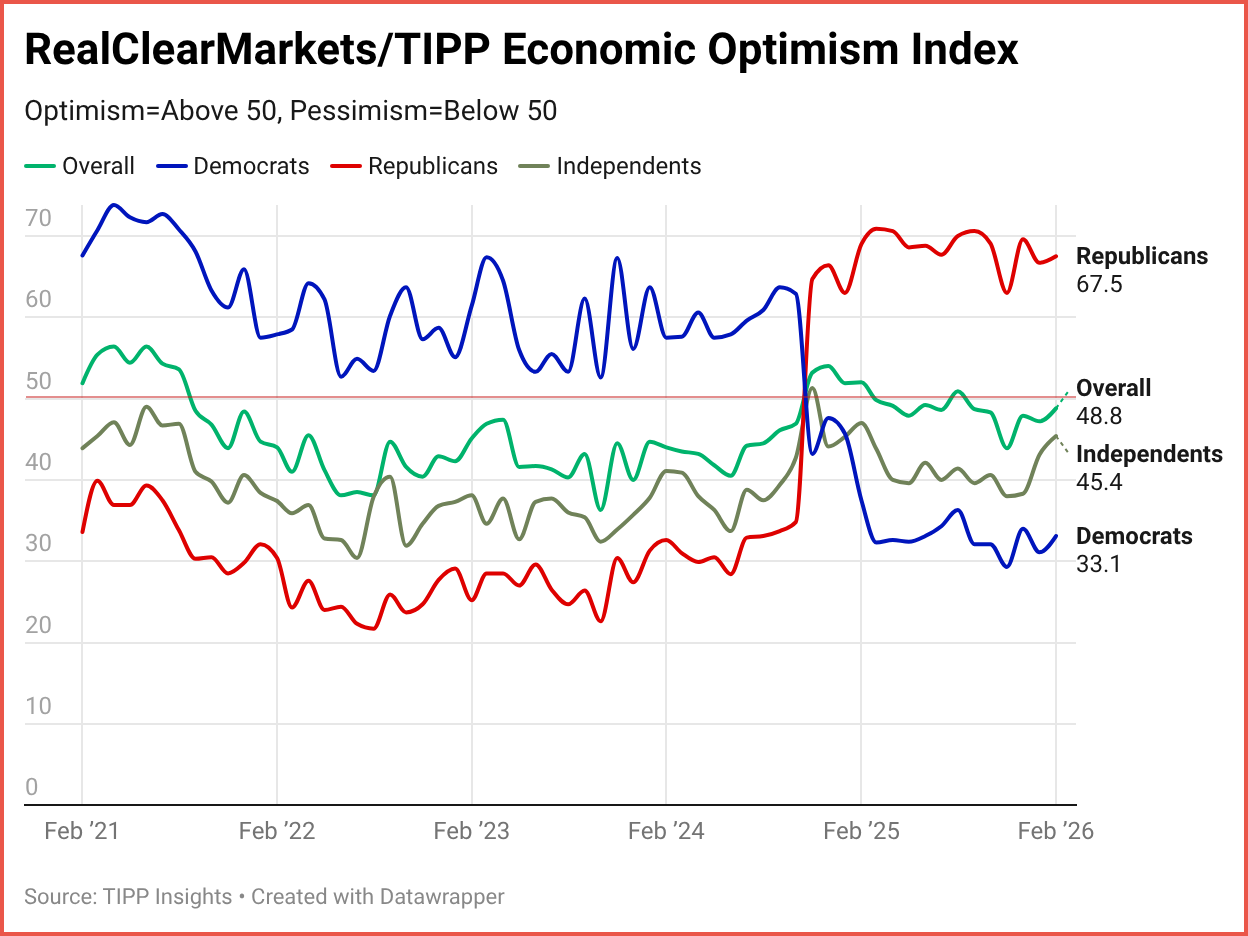

Party Dynamics

Under President Trump, Democrats’ confidence has plunged to 33.1, Republicans’ confidence has soared to 67.5, and independents, after briefly turning optimistic for the first time in nearly five years, have slipped back to 45.4.

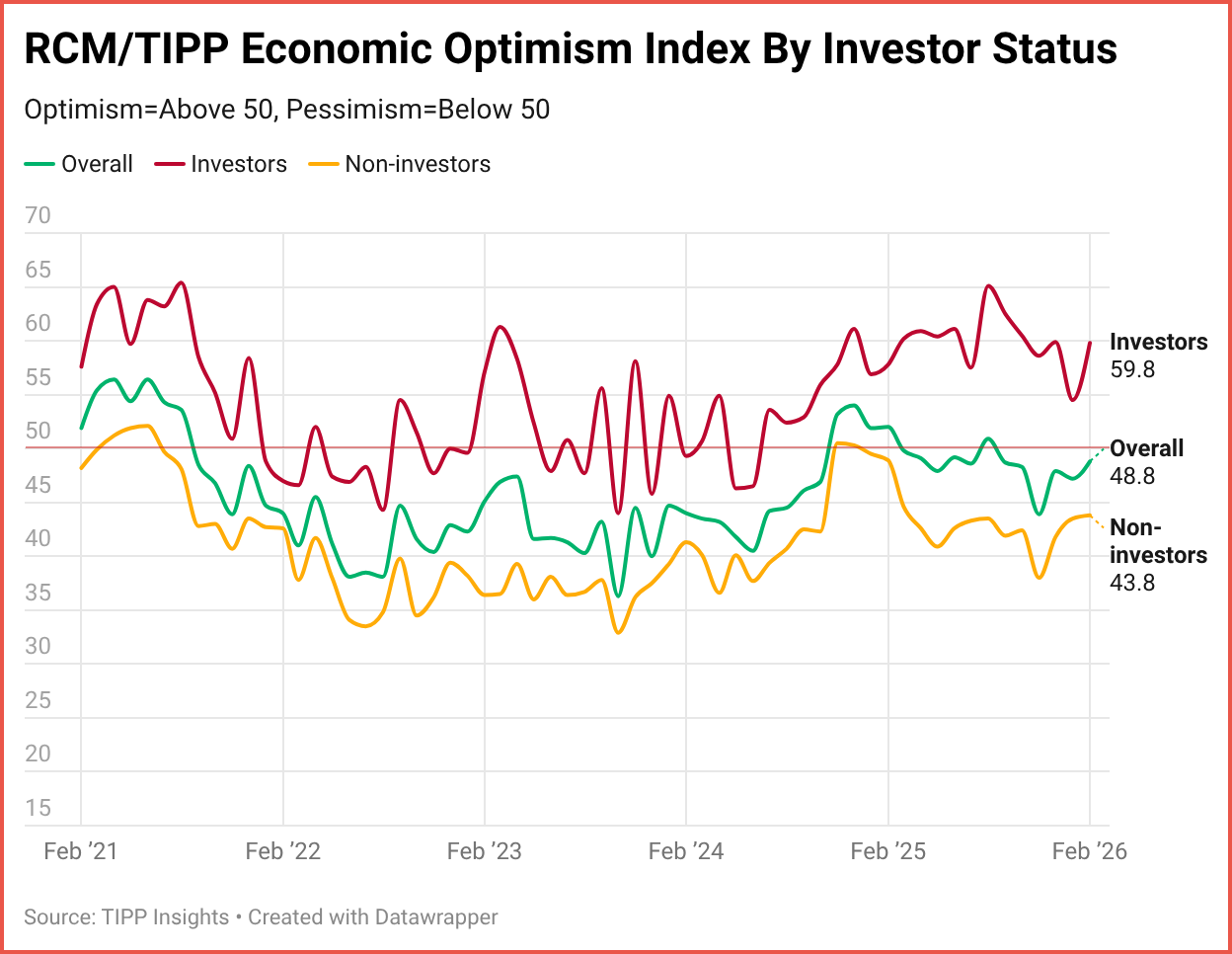

Investor Confidence

Respondents are considered "investors" if they currently have at least $10,000 invested in the stock market, either personally or jointly with a spouse, directly or through a retirement plan. One-third (27%) of respondents met this criterion, and 67% were classified as non-investors. We were unable to determine the status of six percent of respondents.

Investor confidence improved 9.7% (5.3 points) to 59.8 in February, while non-investor confidence gained 0.7% (0.3 points) to 43.8. The confidence gap between investors and non-investors widened from 11.0 to 16.0 points.

Momentum

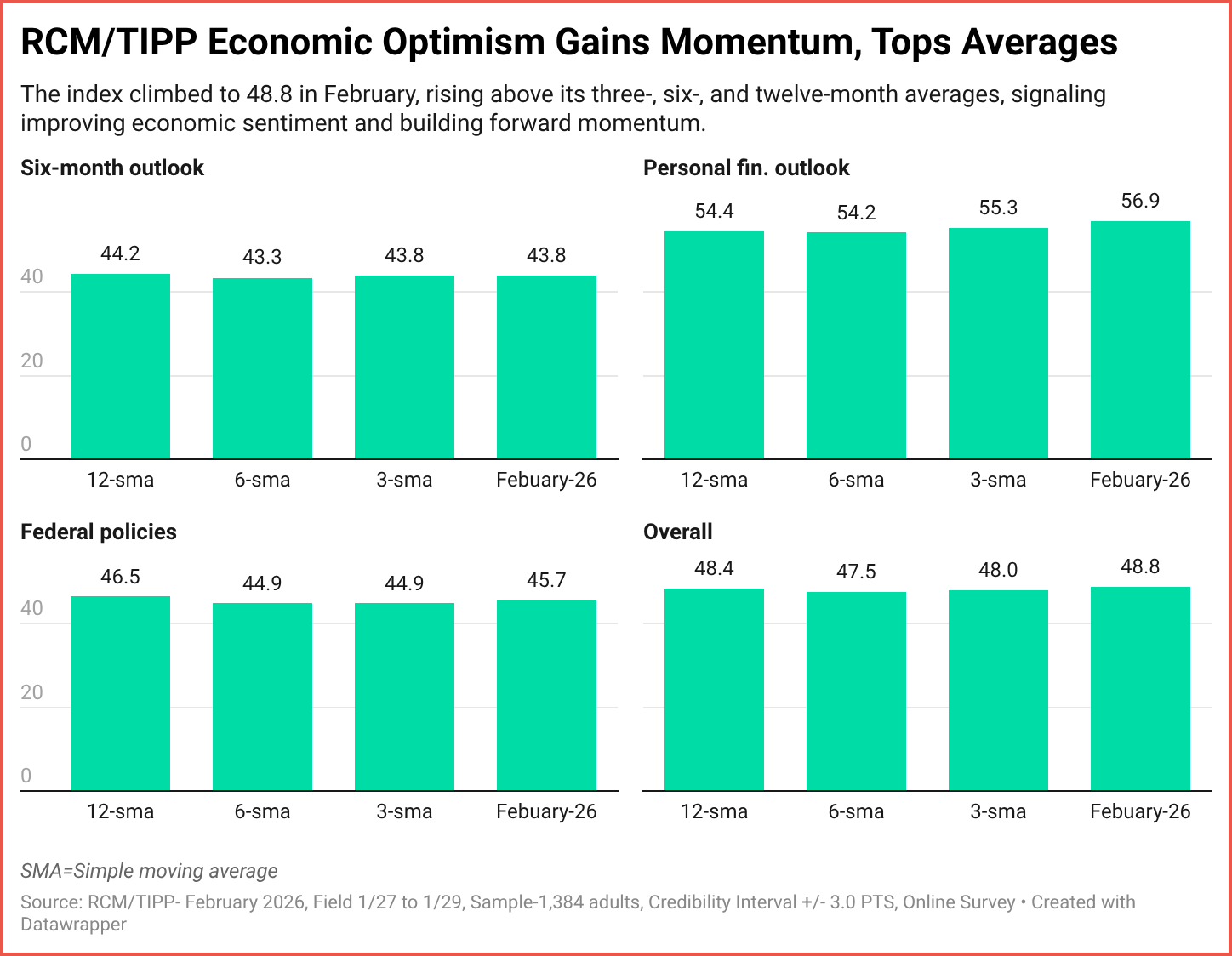

The RCM/TIPP Economic Optimism Index rose to 48.8 in February, moving above its three-month (48.0), six-month (47.5), and twelve-month (48.4) averages, indicating sentiment is gaining momentum rather than merely stabilizing. While still below the 50 threshold, the Index’s steady climb suggests improving confidence relative to recent trends.

The Six-Month Outlook ticked up to 43.8, roughly in line with its three-month average and above its six-month average, though still below its twelve-month trend, indicating cautious but gradually improving expectations for the broader economy.

Personal Financial Outlook strengthened further to 56.9, now comfortably above all short- and medium-term benchmarks, signaling growing confidence in household finances. Meanwhile, confidence in federal economic policies improved modestly to 45.7 but remains below its longer-term average, underscoring that rising personal optimism has yet to translate into confidence in economic policymaking.

Get sharp, original analysis on investor confidence and market trends. Full access → $99/year.

Demographic Analysis

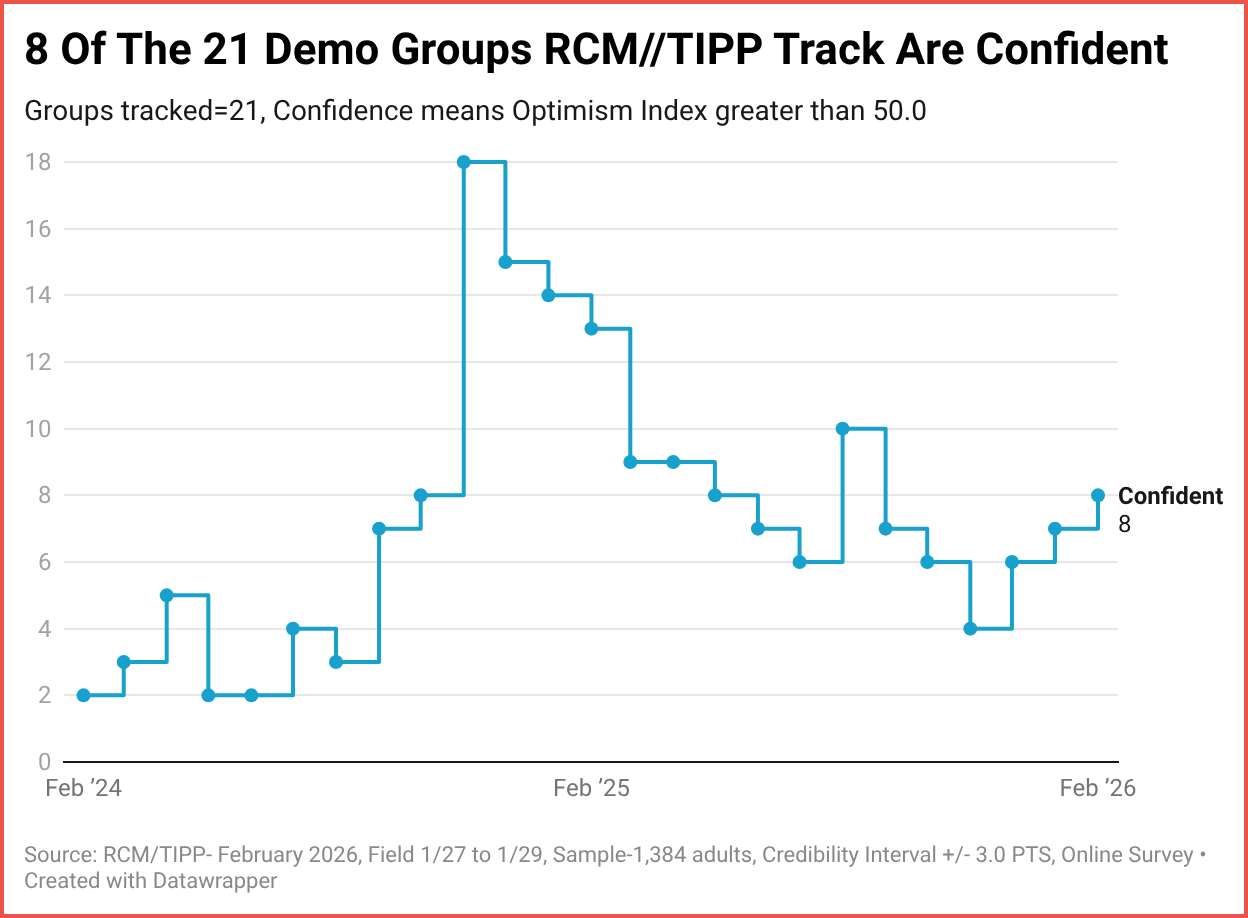

The number of groups in the positive zone indicates the breadth of optimism in American society.

This month, only eight of the 21 demographic groups we track are in positive territory, with scores above 50 on the Economic Optimism Index. For comparison, there were seven in January, six in December, and four in November.

In the immediate aftermath of the election, the number of groups in the optimistic zone had jumped from eight in October 2024 to 18 in November, indicating widespread optimism.

Eighteen groups improved on the index, compared to nine in January, 21 in December, and none in November.

Economic optimism levels for 13 of the 21 demographic groups are lower in February 2026 than the historical average since we began tracking in February 2001.

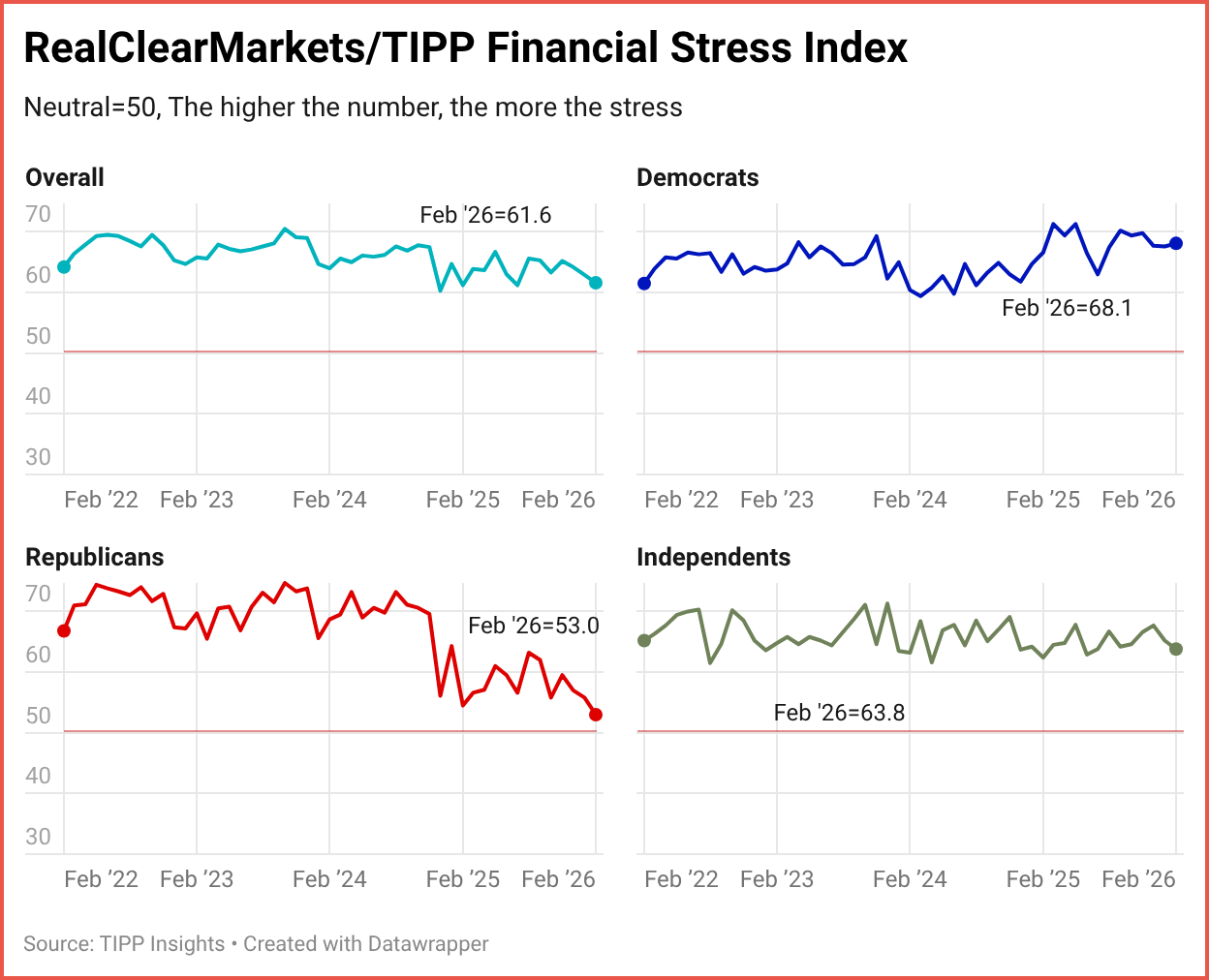

RCM/TIPP also releases our companion index, the RCM/TIPP Financial-Related Stress Index, the only metric that tracks Americans’ financial stress on a monthly basis.

The higher the number, the more the stress. Readings above 50 signal increased stress, while those below 50 indicate lower stress; 50 is considered neutral.

The RCM/TIPP Financial-Related Stress Index fell 1.3 points (2.1%) from 62.9 in January to 61.6 in February, indicating a decline in financial stress among Americans. This reading remains 1.9% above the long-term average of 60.5, underscoring elevated financial strain. The last time the Index posted below 50.0 was before the onset of the pandemic in February 2020, when it stood at 48.1.

RealClearMarkets website will release the next report at 10 a.m. EST on Tuesday, March 3.

👉 Show & Tell 🔥 The Signals

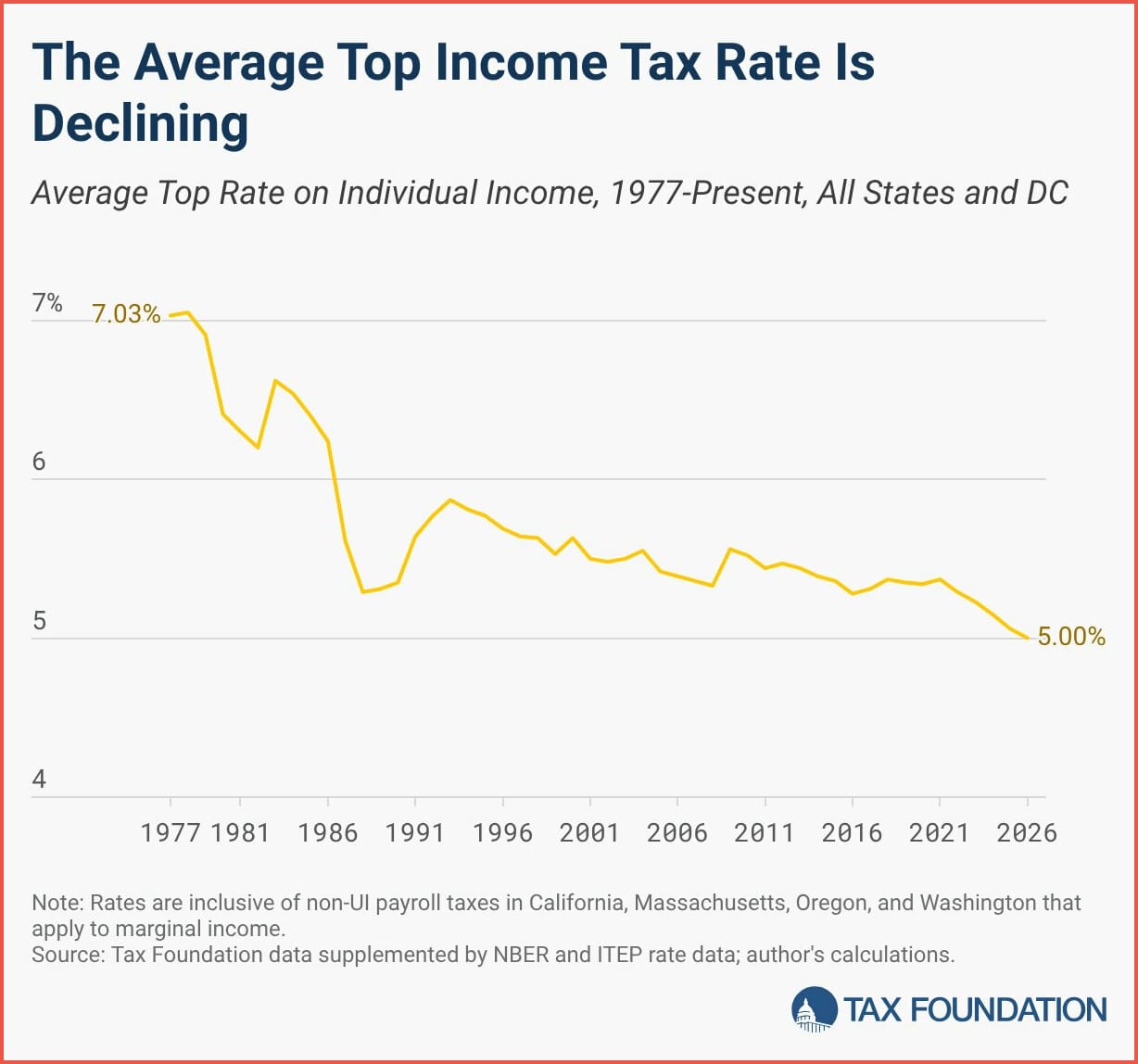

I. Top State Income Tax Rates Continue To Decline

The average top state income tax rate has steadily fallen over the past several decades, dropping from just over 7% in the late 1970s to about 5% today, as more states move toward lower and flatter tax structures.

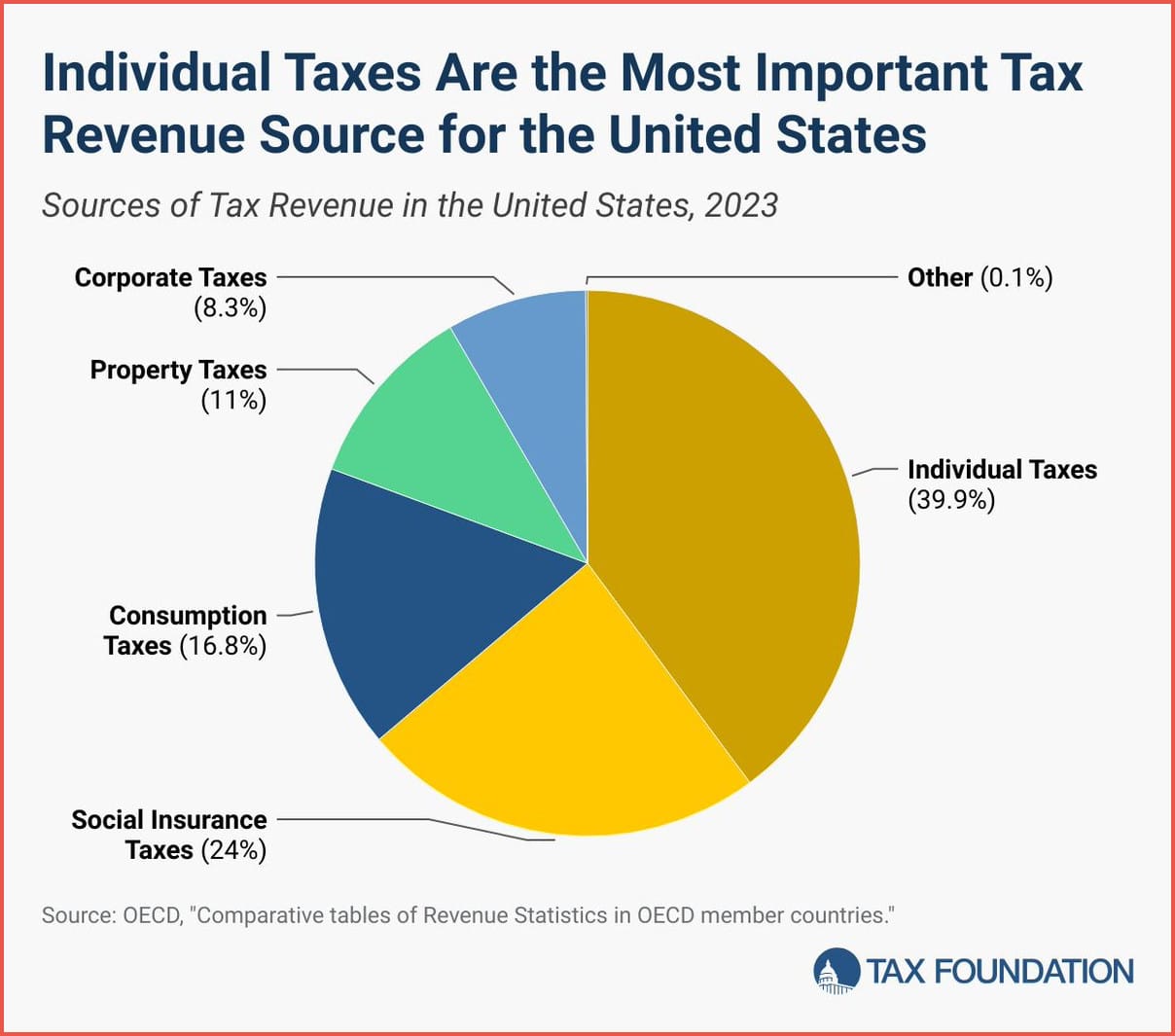

II. Income Taxes Are Government’s Biggest Revenue Source

Nearly 40% of U.S. government tax revenue comes from individual income taxes, making it the single largest source of federal funding. Social insurance taxes account for about 24%, while corporate taxes contribute less than 10%.

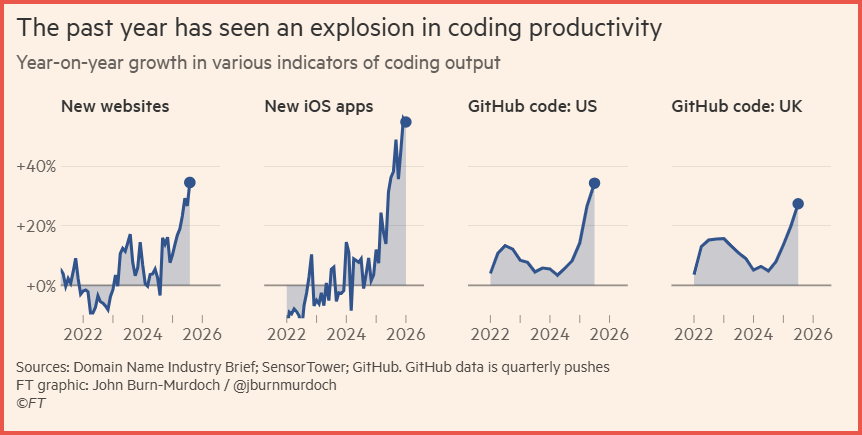

III. Coding Productivity Jumps As AI Tools Spread

Data show a sharp rise in coding output over the past year, with increases in new websites, iOS apps, and GitHub code activity in both the U.S. and U.K., suggesting software development productivity is accelerating.

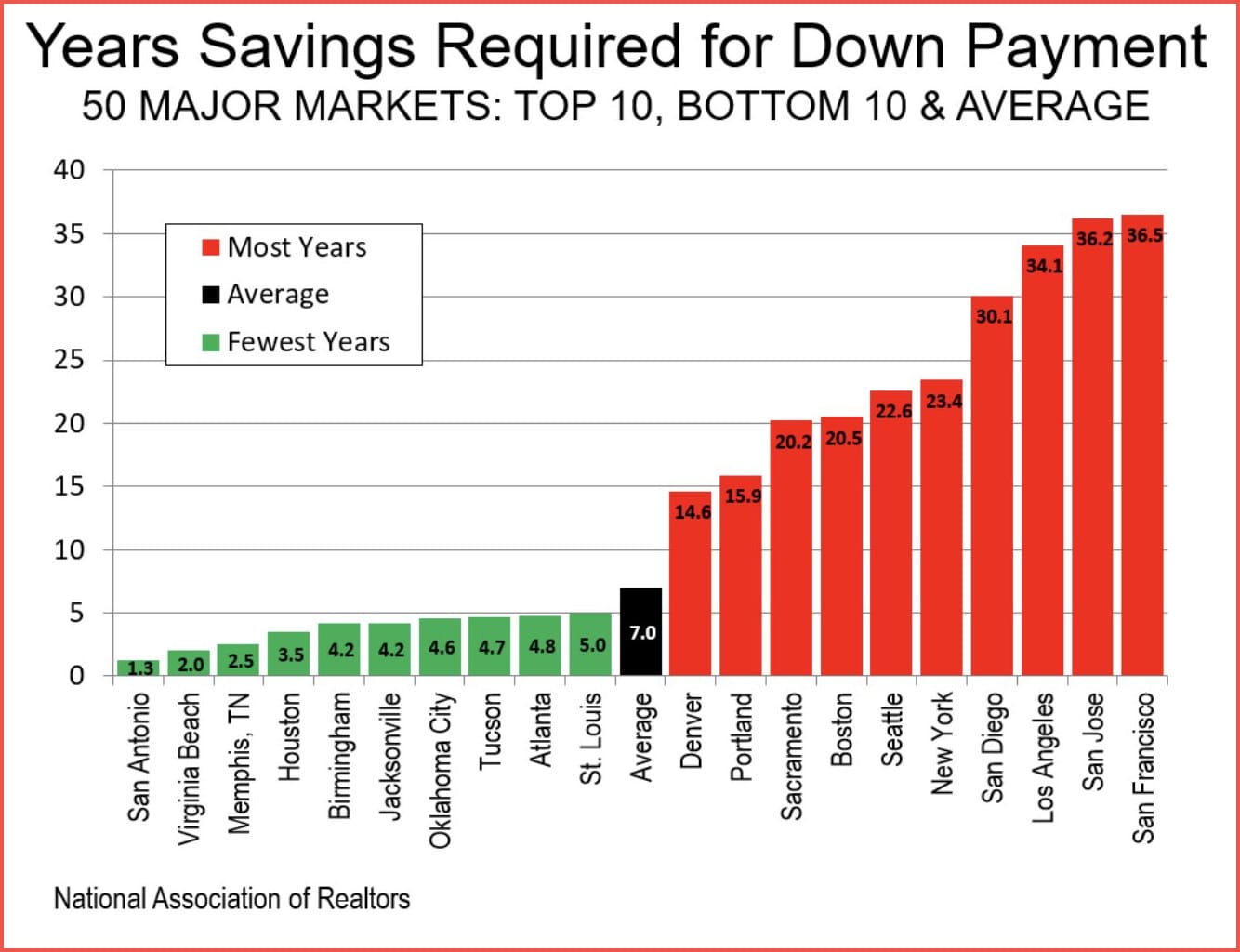

IV. Down Payments Now Take Decades To Save In Major Cities

In expensive housing markets like San Francisco and Los Angeles, a median-income household may need 20 to 36 years to save for a typical down payment, while buyers in lower-cost cities may need just a few years.

The TIPP Stack

Handpicked articles from TIPP Insights & beyond

1. FBI’s Fulton County Election Raid: Better 6 Years Late Than Never—Deroy Murdock, The Daily Signal

2. Trump Is Not All Wrong About Mexico—Guillermo Ortiz, Project Syndicate

3. Andy Barr Gains Momentum In Bid To Replace McConnell—Pedro Rodriguez, The Daily Signal

4. Trump Unveils Drug Savings Website ‘Trump Rx’—Elizabeth Troutman Mitchell, The Daily Signal

5. ‘Biology Is Not Bigotry’: Civil Rights Chief Urges Women To Challenge Trans Policies—Elizabeth Troutman Mitchell, The Daily Signal

From TIPP Insights News Editor

6. Russian General Shot In Moscow As Kremlin Blames Ukraine

7. Iran-U.S. Talks Resume In Oman As Nuclear Dispute Remains Unresolved

8. UK And China Strike Deal To Expand Yuan Trading In London

9. U.S. Ambassador Pushes Back After Polish Leader Criticizes Trump

10. Suspect In Deadly 2012 Benghazi Attack Now In U.S. Custody

11. Deadly Suicide Bombing Hits Mosque In Pakistan’s Capital

12. How The Louvre Plans To Restore Its Damaged CrownPresident Trump Faces Criticism Over 'Racist Meme' Targeting Obamas

13. Virginia Democrats Push New House Map To Flip Four Seats

14. Why Did The CIA End 'The World Factbook'

15. Epstein Files: LA Olympics Chief Faces Resignation Calls Over Maxwell Emails

16. Treasury Chief Flags Hong Kong As China’s Gateway To Digital Assets

17. What India’s $80 Billion Boeing Plan Signals About The U.S. Trade Deal

18. AI Investment Fears Wipe $1 Trillion From Big Tech Stocks

19. Big Tech Set To Spend Over $650 Billion On AI In 2026

20. U.S. Job Openings Fall To Lowest Level In Eight Years

editor-tippinsights@technometrica.com