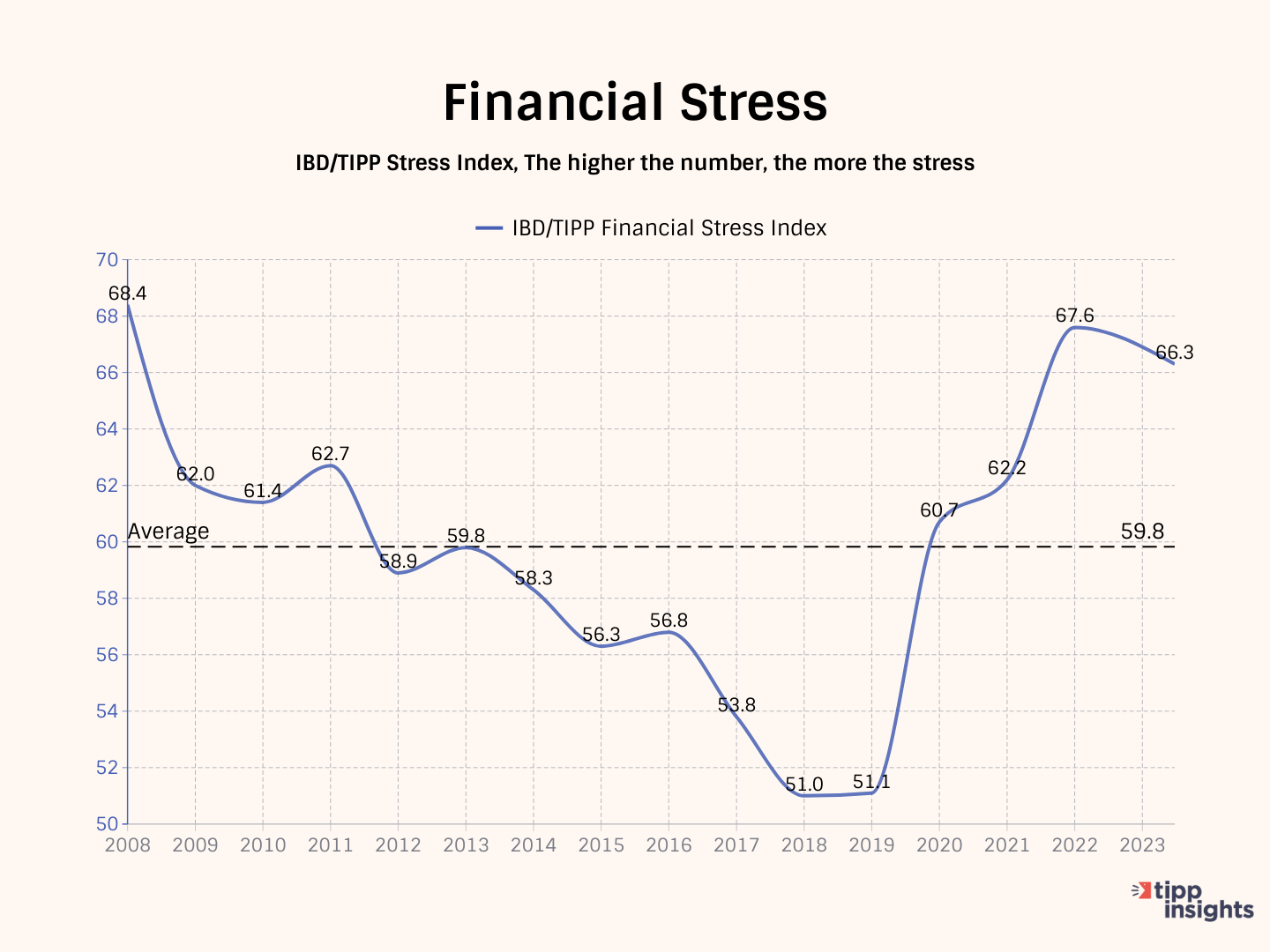

As we reach the midpoint of 2023, Americans' financial stress levels have slightly eased compared to the recent high point of 67.6 recorded in 2022. The financial stress index for the first half of 2023 averaged 66.3. In comparison, the average for 2022 was 67.6, while the highest recorded level was 68.4 in 2008. The chart below presents the average stress index for each year.

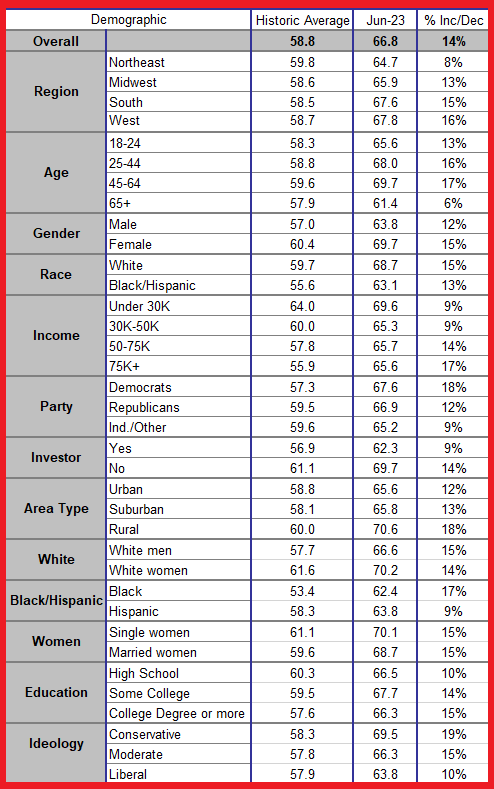

However, despite the slight improvement, out of the 36 demographic categories we track, 29 (81%) still experience elevated stress, 10% higher than their historical average. Furthermore, all 36 groups are in the "stress zone," leading us to label it an epidemic.

The IBD/TIPP Financial Stress Index is a one-of-a-kind financial stress metric. In December 2007, we began using it to track financial stress. The index accurately indicates Americans' financial concerns about paying bills and making ends meet. Consumer spending drives two-thirds of the economy. When people are stressed, they are hesitant to spend money.

There is another aspect too. Financial stress can lead to insomnia, weight gain (or loss), depression, anxiety, relationship difficulties, social withdrawal, and other physical ailments such as headaches, gastrointestinal problems, diabetes, high blood pressure, and heart disease.

We computed the stress index from responses to the questions: Thinking of your personal finances, compared to the past three months, do you feel more stressed these days, less stressed these days, or feel the same level of stress?

The index ranges from 0 to 100; the higher the number, the more stress. A reading of 50.0 is the neutral point.

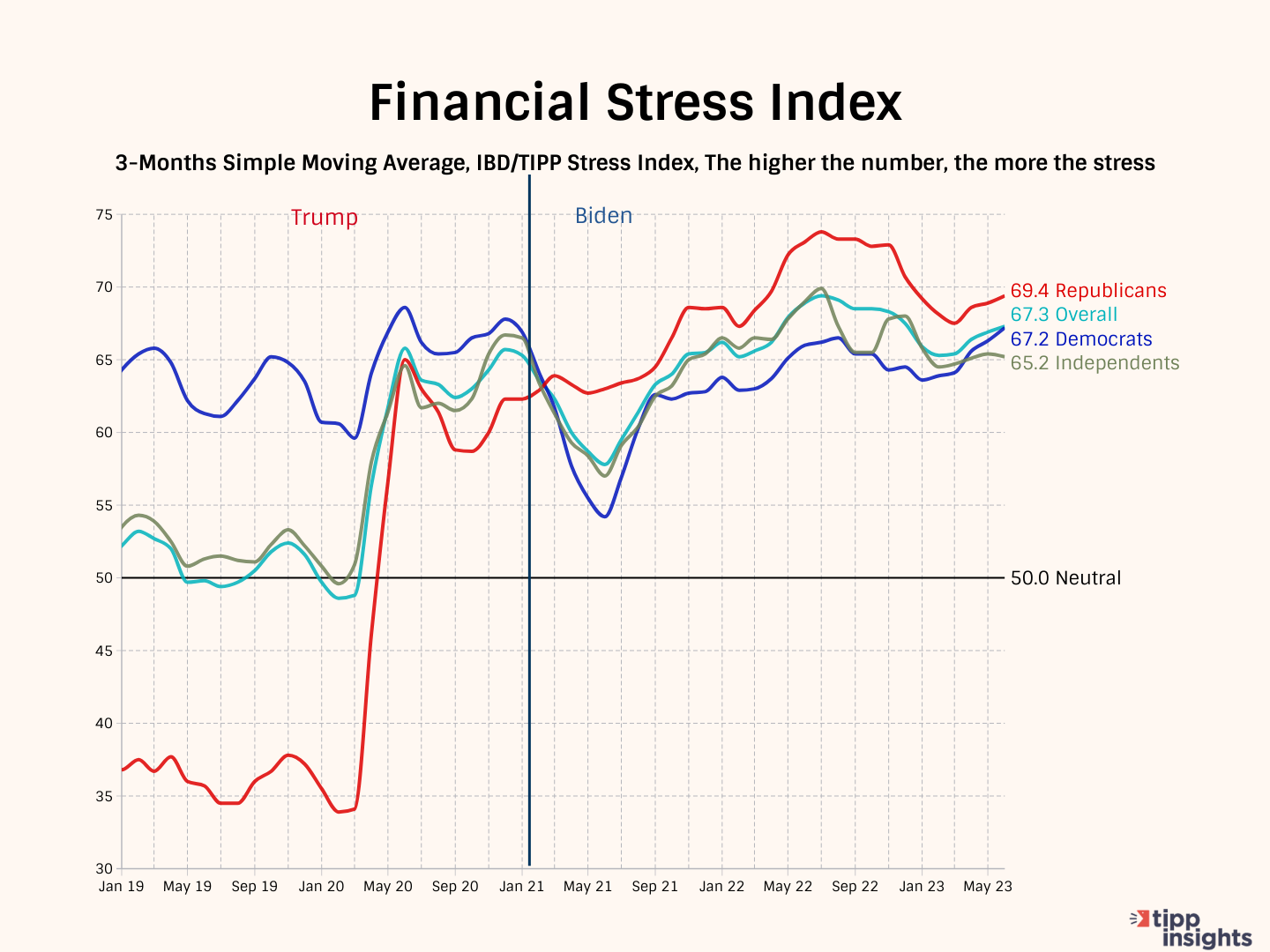

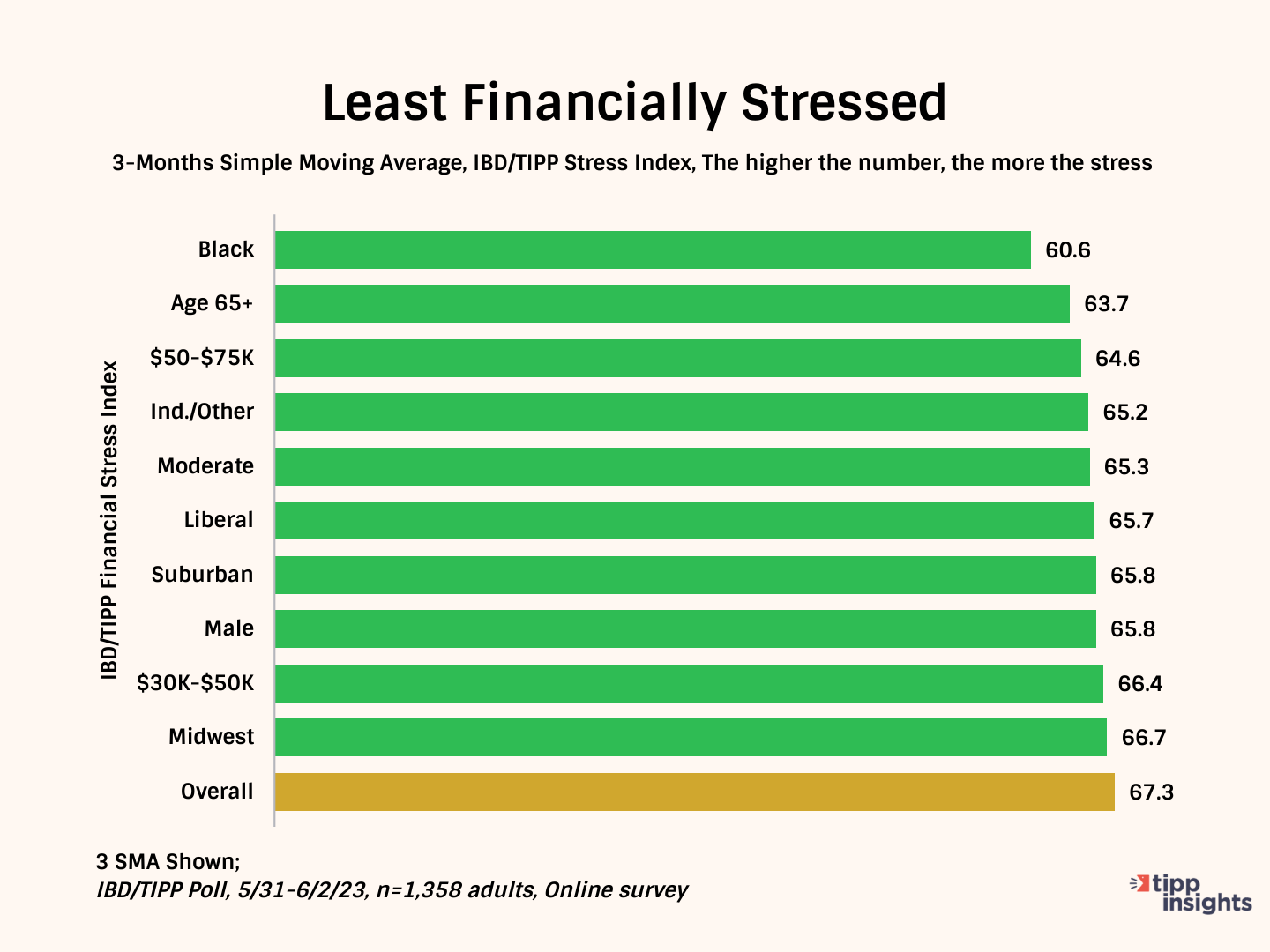

On a positive note, the June reading of the Investor's Business Daily/TIPP Financial Stress Index is 66.8, below the three-month moving average of 67.3, reflecting positive momentum.

Persistent Bidenflation, layoffs, and job insecurity exacerbate financial stress.

The chart below shows that financial stress impacts all Americans, irrespective of their party affiliation. Republicans (69.4) have the highest stress levels, while Democrats' stress level is 2.2 points lower (67.2), nearly close to the overall level of 67.3. Independents had the lowest stress at 65.2, 2.1 points lower than the overall 67.3.

By The Numbers

The table below shows the historical averages of the index, the June readings, and the differences across demographic groups. All 36 demographic groups exhibit stress, with readings above the neutral level of 50.0. Of the 36 demographic categories, 29 (81%) experience stress, 10% higher than their historical average.

Here are the ten demographic groups with the highest stress levels based on a three-month simple moving average. Conservatives are the most stressed group, followed by white women.

The chart below shows the ten demographic groups with the least stress. The least stressed groups are blacks, age 65+, $50K–$75K, independents, and moderates.

Biden’s Handling Of The Economy

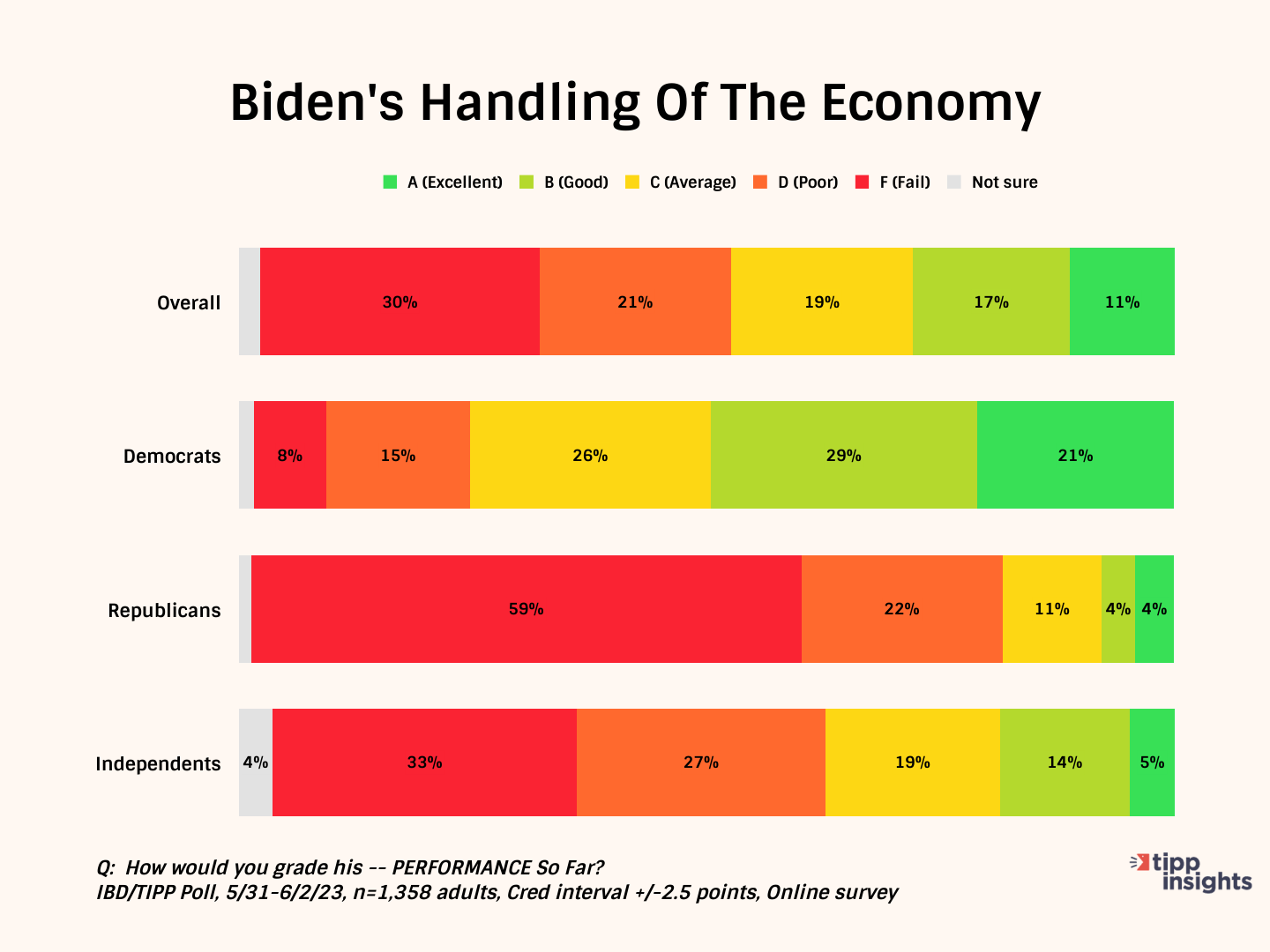

In our latest poll, most Americans (51%) give Biden a failing grade (D or F) regarding his handling of the economy. Only 28% give him an A or B.

Among Democrats, half (50%) give him positive grades, 24% believe he deserves failing grades, and another 26% rate his performance as average (C).

In contrast, Republicans are much more critical, with 81% expressing dissatisfaction with Biden's handling of the economy.

Furthermore, independents also express their disappointment, with 60% giving failing grades, 19% giving good grades, and 19% rating his performance as average.

Our data shows that the impact of the pandemic and inflation persists as the nation faces the stagflation monster. When discussing inflation, President Biden needs to consider Americans' financial stress and address it in a way that is sensitive to their feelings.

Like our insights? Show your support by becoming a paid subscriber!