By Jonathan Williams and Lee Schalk for Daily Caller News Foundation

As Americans continue to pay more for groceries and gas, most have little appetite for higher taxes. That didn’t stop President Joe Biden from recently pushing a $4.7 trillion federal tax increase in his new budget proposal, targeting American businesses, families, and energy producers.

The tone-deaf call for federal tax hikes comes amid record setting federal tax collections last year, totaling $4.9 trillion. Washington can’t quit its spending addiction either, as the national debt is approaches a previously unfathomable $32 trillion.

There is, however, hope to be had across the 50 states – the laboratories of democracy. This legislative session, a growing number of states are countering D.C.’s big government policies by implementing pro-growth and pro-worker policies at the state level. And that’s the smart approach. As the latest Census data reveals, millions of Americans are voting with their feet by moving to states with more freedom and more opportunity.

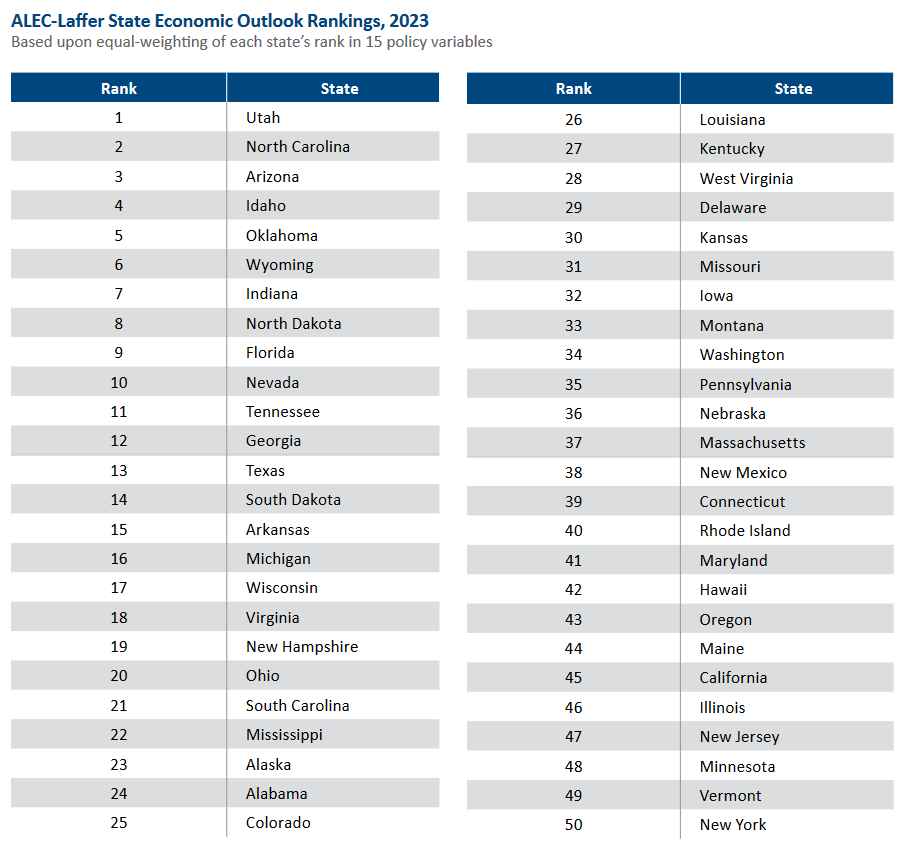

These states are highlighted in the newly released 16th edition of Rich States, Poor States: ALEC-Laffer State Economic Competitiveness Index. The 15 economic-policy variables used to rank the economic outlook of states have proven over time to be influential for state competitiveness and growth. Since 2007, our research has documented how cutting taxes, paying down debt, and maintaining free-market policies have significantly helped states attract new residents.

With that in mind, it’s no surprise the top five states in economic outlook for 2023 are Utah, North Carolina, Arizona, Idaho, and Oklahoma. The least competitive states may not come as a surprise either: Illinois, New Jersey, Minnesota, Vermont — with New York dead last.

For 16 years in a row, Utah has earned the top ranking, thanks to its pro-taxpayer policies. During these years, the Beehive State has created a flat personal income tax (and continued to chip away at its rate, which is now under 5 percent), reformed its public pension system to the benefit of both workers and taxpayers, and kept property taxes in check with its innovative Truth-in-Taxation law.

Down south, North Carolina is ranked second in the nation for economic outlook. Thanks to of historic tax reform in 2013, which significantly lowered and flattened income taxes, North Carolina improved from its ranking of 26th overall in 2011 and attracted more than 600,000 new residents in the past decade. Once North Carolina completes its phaseout of the state business income this decade, the sky is the limit for the Tarheel State.

Just up Interstate-95 from Raleigh, the Virginia Comeback story is underway in Richmond. Last year, Virginia received its lowest rank ever at 24th overall – the result of a long decline brought on by resting on its laurels. However, the 2022 legislative session was productive in creating tax cuts for Virginians. Thanks to the leadership of free market legislators and Governor Glenn Youngkin, Virginia reversed a nearly decade long losing streak and climbed an impressive six spotsto 18th in this year’s economic outlook rankings.

Kentucky was another bright spot this year, jumping an impressive seven spots to 27th overall. Over the last 15 years, Kentucky has moved up a total of 17 places, due to its creation of a flat personal income tax in 2019 and its continued progress cutting rates in recent years.

On the other hand, New York is once again ranked 50th for economic outlook due to its punishing tax burdens, overspending, and heavy-handed regulatory policies. The Empire State has also hemorrhaged more than 1.7 million residents in the past decade – and more than 300,000 in the past year alone.

Massachusetts fell four places in the rankings this year to 37th, after voters approved a teachers union-backed ballot measure in November that changed the personal income tax structure from a flat tax to a progressive tax. Massachusetts had been a 5% flat tax state, but now will add a 4% surcharge for those earning more than $1 million, creating a new top income tax rate of 9%. This marks the return of Taxachusetts, and the state will struggle in the competitive New England region, where neighboring New Hampshire boasts no sales tax and no personal income tax on wages.

While the tax-and-spend crowd in D.C. pushes bigger government, many states are leading the way by promoting economic growth through lower taxes, responsible budgeting and better policies that benefit the American people. Though some states like California and New York continue to teach what not to do, others like Utah and North Carolina are building stronger state economies and limiting the damage done to the national economy by Washington. As Rich States, Poor States reveals, Americans will continue to vote with their feet towards these freedom loving states.

Jonathan Williams is the executive vice president of policy and chief economist at the American Legislative Exchange Council (ALEC). Follow him on Twitter @TaxEconomist.

Lee Schalk is vice president of policy at ALEC.

Original article link

Related Data