By Angela Huyue Zhang, Project Syndicate | Jan 7, 2026

The global AI race will be won not by the power of models and chips, but by how effectively systems can be deployed and improved across the economy. China’s chronic excess capacity, long seen as its greatest weakness, has reduced costs and accelerated adoption, providing the country's AI sector with a decisive edge.

LOS ANGELES – While debates over the AI race between the United States and China tend to fixate on which country has the most powerful frontier models and the most advanced semiconductors, that framing is becoming outdated. As AI moves from our screens into the physical world, the question is no longer whose models hit technical benchmarks, but who can build and sustain an ecosystem that embeds AI into everyday products and services.

Such an ecosystem must rest on three pillars. First, it requires cheap, reliable, and widely deployed hardware capable of hosting AI systems across a range of applications, from cars and drones to industrial equipment. Second, it depends on software in the form of AI stacks that can be updated continuously as firms learn from real-world use. And lastly, it involves supporting infrastructure that allows these systems to operate safely, such as data centers, smart roads, charging stations, and power grids.

Viewed through this lens, China enjoys a distinct advantage that does not show up in standard measures of AI performance. Counterintuitively, China’s strength stems from what economists have long treated as one of its deepest structural weaknesses: overcapacity.

Excess capacity is built into China’s growth model. For decades, local officials have been rewarded for meeting investment and output targets rather than generating high returns on capital. State banks and local financing vehicles have kept credit flowing, while industrial policies have encouraged each province to cultivate its own “strategic” champions in steel, solar, and shipbuilding. More recently, this approach has expanded into emerging sectors like batteries, electric vehicles (EVs), and clean energy.

From a macroeconomic perspective, China’s growth model creates severe distortions, including duplicated investment, intense competition, thin margins, and trade friction as surplus output spills into overseas markets. When it comes to AI development, however, the same dynamic can turn into a competitive advantage.

AI is reshaping everything. Are you keeping up?

Our AI collection goes beyond headlines to explain the forces actually driving the technology. Join TIPP Insights today for $99 per year.

The EV sector offers the clearest example. Developing autonomous-driving capability requires a large installed base of modern vehicles that can run advanced driver-assistance systems. China has built such a base on a scale no other country can match, largely because of its overcapacity. More than 60% of the EVs sold in China now come equipped with driver-assistance features that support partial automation, often at no additional cost for consumers.

Each of these vehicles functions as a rolling sensor platform. Every assisted mile generates data on what sensors see, how human drivers react, and where systems may fail. By driving down EV prices and accelerating adoption, China’s overcapacity is effectively subsidizing the continuous collection of real-world data.

At the same time, China is rapidly building the infrastructure to support the shift toward autonomous driving, even ahead of private demand. Its “vehicle-road-cloud” strategy, for example, aims to turn cars into nodes in a broader digital network through dense 5G coverage, smart roads equipped with cameras and roadside units, high-definition maps, traffic-coordinating cloud platforms, and pilot zones where regulations are loosened to facilitate testing and deployment.

A similar dynamic is playing out in what Chinese policymakers call the “low-altitude economy”: airspace below roughly one kilometer (0.62 miles), which they seek to turn into a new growth engine via drones and flying taxis. Here, too, local governments are repeating the EV playbook, with at least 45 localities announcing drone industrial parks and competing to attract firms with tax breaks, subsidies, cheap office space, and procurement contracts.

As in the EV sector, this investment frenzy is putting downward pressure on prices. DJI, China’s largest civilian drone manufacturer, with a global market share of 70-80%, has recently cut prices by more than 20% across its domestic online stores.

If you care about China and AI, subscribe today — $99 per year.

We don’t just track the race. We explain what actually moves it, so you stay ahead of markets, policy, and technology.

Five recent reads to whet your appetite:

Energy Will Decide The AI Race—Vittorio Quaglione

Why China Can’t Win the AI-Led Industrial Revolution—Di Guo, Chenggang Xu

The Future of China’s “Electro-State”—Ludovic Subran

Let a Thousand AI Regimes Bloom—Angela Huyue Zhang

The AI Bubble’s Shaky Math—Carl Benedikt Frey

👉Subscribe now and stay on top of the forces shaping the next decade.

Lower prices and subsidies, in turn, are accelerating adoption. Meituan, China’s leading food-delivery platform, has completed more than 600,000 orders across dozens of drone routes in major cities. And DJI says its agricultural drones now spray roughly one-third of all Chinese farmland.

The same logic applies to robotics. Buoyed by generous local subsidies and national industrial policy, robot manufacturing in China has expanded rapidly in recent years. Chinese factories now install around 280,000 industrial robots annually – roughly half of the global total – with nearly 60% of those units supplied by domestic manufacturers offering cheaper machines. This mass deployment, in turn, accelerates the learning and improvement of China’s robotics AI.

To be sure, China still trails the US in cutting-edge model development. But thanks to its tendency to scale aggressively, even to the point of overproduction, it is steadily assembling the hardware base and infrastructure on which the next phase of AI will depend, from EVs and robots to drones and flying taxis.

American policymakers ignore this shift at their peril. By narrowly focusing on winning the race for better models and chips, the US risks losing the more consequential contest to embed AI into the infrastructure, machines, and daily routines that will ultimately shape the global economy.

Angela Huyue Zhang, Professor of Law at the University of Southern California, is the author of High Wire: How China Regulates Big Tech and Governs Its Economy (Oxford University Press, 2024) and Chinese Antitrust Exceptionalism: How the Rise of China Challenges Global Regulation (Oxford University Press, 2021).

Copyright Project Syndicate

Catch up on today’s highlights, handpicked by our News Editor at TIPP Insights.

1. Russia Says Any Foreign Forces In Ukraine Face Military Strikes

2. Senate Moves To Curb Trump’s Venezuela Strikes With New War Powers Vote

3. Greenland Move Seen As Trump Effort To Block China’s Arctic Reach

4. Why Trump Withdrew U.S. From Dozens Of International Groups

5. Trump, Colombian Leader Hold Call As Tensions Ease

6. Japan Tourism Forecast Weakens Amid China Tensions

7. Lawmakers Press Ahead On Spending Bills To Avert Shutdown

8. Internal DHS Concerns Emerge After Minneapolis ICE Shooting

9. Fatal ICE Shooting Sparks Protests And Political Clash In Minneapolis

10. Paramount Stands Firm On Takeover Offer Amid WBD-Netflix Clash

11. Senate Votes To Rein In Trump’s War Powers

12. Americans Grow Pessimistic On Jobs, NY Fed Survey Finds

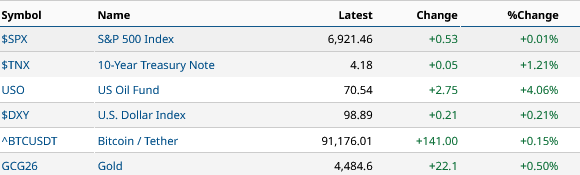

Market Pulse

editor-tippinsights@technometrica.com