Vice President Kamala Harris first spoke about her new mantra, "Opportunity Economy," in Chicago at her nomination. Since then, she has woven these words into every public utterance—at her highly structured campaign appearances, in the CNN interview with Dana Bash, and at the ABC presidential debate with opponent Trump.

Most recently, in a scripted/edited sit-down with Brian Tuff, an anchor at a local ABC affiliate in Philadelphia, Tuff asked Harris about what one or two specific things Harris would do to bring down prices and make life affordable.

In typical Harris style, she ignored the question altogether and repeated her memorized lines to perfection:

Well, I'll start with this. I grew up as a middle-class kid. My mother raised my sister and me. She worked very hard. We, as Americans, have beautiful character. We have ambitions and aspirations and dreams. But not everyone necessarily has access to the resources that can help them fuel those dreams and ambitions.

When I talk about building an opportunity economy, it is very much with the mind of investing in the ambitions and aspirations and the incredible work ethic of the American people and creating opportunity for people, for example, to start a small business.

Opportunity economy means, look, we don't have enough housing in America. We have a housing supply shortage, and what that means, in particular, for so many younger Americans, the American Dream is elusive; it's just actually not attainable. To help people who just want to get their foot in the door, literally, and so giving first-time homebuyers a $25,000 down payment assistance.

It was all a gigantic word salad with a few numbers thrown in here and there to make her proposals look like serious policy.

First, the concept of an Opportunity Economy is inherently disingenuous in a country known as the Land of Opportunity. Hundreds of millions of immigrants have flocked to America since the Great Depression precisely because the country is, at its foundation, a bastion of law and order. Financial markets are free but well-regulated, intellectual property is well-protected, bankruptcy laws are sophisticated, and civil/criminal penalties can be extreme for those who violate America's laws. Risk-taking is promoted in the very genes of America, which is one reason why the U.S. continues to have the world's largest GDP, with only about 4% of the global population.

Harris doesn't specify that she has to spend $1.7 trillion in borrowed funds on those sections of the economy that have "ambitions and aspirations and dreams" but do not have access to resources. It is proxy-speak for a large-scale wealth redistribution plan where social outcomes are paramount.

For a country of America's size in land area and productive output, the United States is already an extremely progressive economy. More than half of America's households pay very little in income taxes, if they pay anything at all, so aren't we already in an opportunity economy getting loads of government services for free?

As of 2024, the median household income in the United States is approximately $78,000. This figure represents the midpoint of household incomes, meaning that half of households earn less than this amount and half earn more.

A family of four (parents with two children) earning $80,000 is so coddled by government programs that the family gets to keep most of what it makes.

Now, suppose the family puts away 10%—$8,000—in a retirement savings account. The $8,000 is fully tax-deferred, so the family pays no tax on it.

The parents get to deduct $29,200 for filing jointly, bringing the family income to $42,800.

Applying the latest IRS schedules, this family is required to pay $4,456 in federal income taxes. However, each of the two children gets $2,000 in child tax credit, practically wiping out the family's tax burden, leaving them with a whopping $456 tax bill. Numerous other credits exist, such as the Child and Dependent Care Credit, Education-Related Deductions and Credits, or Health Savings Account (HSA) Contribution deductions. Effectively, a family making $80,000 - more than half of U.S. households - pays no income tax at all.

Liberal advocates point out that this family pays nearly $6,120 in Social Security and Medicare taxes, so it is unfair to say that the family pays no taxes. That is true, but the Social Security trust fund guarantees generous benefits when income earners retire as early as 62. Something is not a tax when you directly benefit from paying it, although the benefit is received decades later. For more than half of American families, the only meaningful tax, therefore, is the state sales tax, which they pay on their purchases, and property taxes, which directly fund local services, such as police, firefighters, schools, and libraries.

The bottom line: More than half of Americans have an excellent bargain from all levels of government, receiving way more in government services for what they contribute in taxes. K-12 education is 100% free, and transportation to and from school is free.

In truth, people at the bottom rungs of the economic ladder get even more in services-for a family of four with just one earner making $15.75/hour, more than twice the federal minimum wage, the Earned Income Tax Credit kicks in, where the government "pays" a family back $6,727 in what is termed as a "negative" income tax. Plus, these families qualify for free school lunches or are highly subsidized. They also get free medical care through Medicaid and Children's Health Insurance.

These households can buy a home, start a small business, and raise children—as they have been doing for generations. So, what is the need for additional injections of Harris's Opportunity Economy money? How much more free stuff should the government give out? When will the government stop coddling? Have we lost faith in Americans' ability to look after themselves, grow, and thrive?

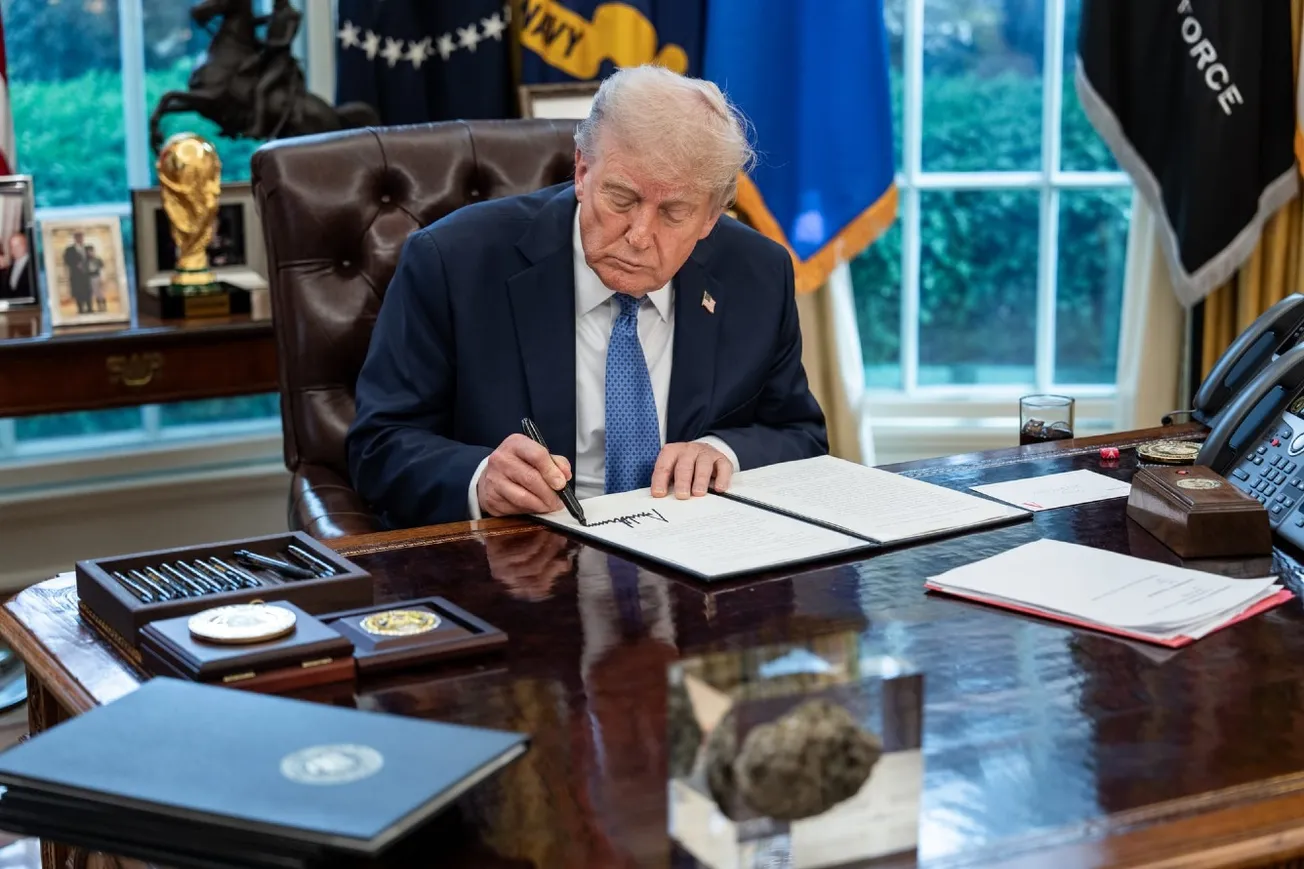

If Harris were so concerned about making new housing available, she should have stemmed the flow of over 21 million illegal immigrants as the border czar. America had no housing crisis under Trump.

Instead, Harris's solution is to "tax the wealthy" to pay for her $1.7 trillion proposal, with little regard for families making over $400,000 who are already paying the lion's share of all government expenditures. The federal debt has reached $35 trillion, and interest payments today, at over $1 trillion a year, exceed the Pentagon's annual budget. Spending even more money we don't have is not a solution.

Harris's Opportunity Economy is nothing more than a classic, liberal, tax-borrow-spend policy that socks the rich to redistribute funds and curry electoral favors for future cycles. From an economic standpoint, it will elevate home prices and increase inflation.

We invite TV journalists to challenge Harris using our analysis next time she sits down for an interview. Wait. That's not likely to happen.

ICYMI

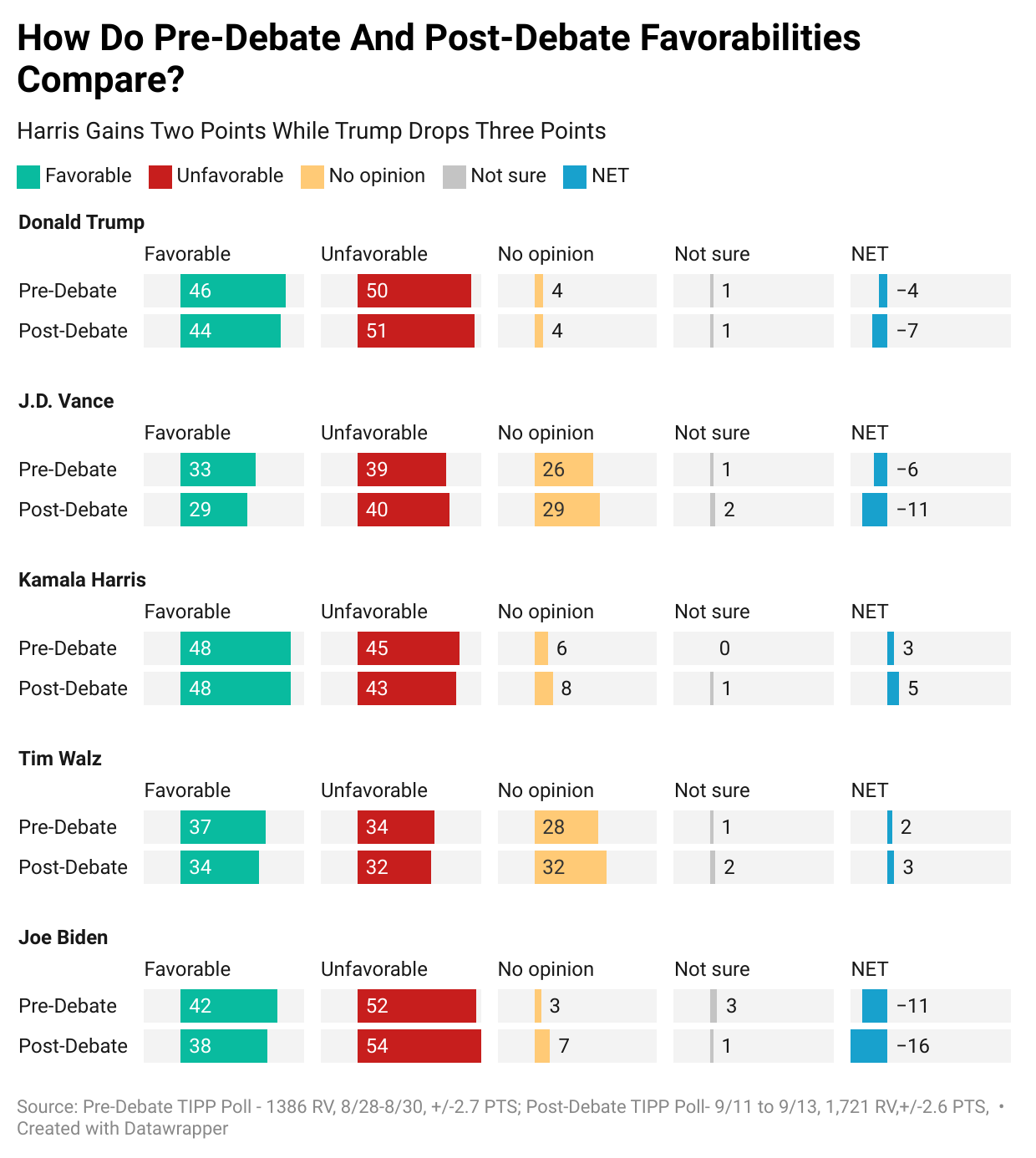

Editor’s Note: In response to feedback on our recent headline, Dead Cat Bounce or Lasting Shift?, we refer you to the following stories from the media. The term isn’t exclusively reserved for left-leaning outlets.

‘The Most Entertaining Dead-Cat Bounce in History'- The Atlantic

Opinion | Biden is Still a Political Albatross - Politico