By Angela Huyue Zhang, Project Syndicate | August 7, 2025

China’s dominance over the critical minerals used in electric vehicles, wind turbines, industrial robotics, and advanced defense systems was not built overnight, and it won’t be easily eroded. The sooner that US policymakers come to terms with this reality, the better.

BEIJING – China’s weaponization of rare earths has emerged as a major flash point in US-China trade negotiations. These critical materials, especially the high-performance magnets they make possible, are vital components in electric vehicles (EVs), wind turbines, industrial robotics, and advanced defense systems. In response to China’s strict rare-earths export controls, the United States has quietly lowered tariffs, relaxed export controls on AI chips, and even softened visa restrictions for Chinese students.

At the same time, the US is scrambling to secure alternative supplies. In July, the Department of Defense announced a landmark multi-billion-dollar investment package to boost MP Materials, the company behind America’s flagship rare-earths project. But what if, despite massive subsidies and years of effort, the US still can’t escape its dependence on Chinese rare earths?

Japan offers a cautionary tale. In 2010, following a maritime standoff over the Senkaku Islands, China abruptly cut off rare-earths exports to Japan. In response, the Japanese government pursued a series of strategic measures: investing in Lynas Rare Earths, an Australian producer; boosting domestic research and development in recycling and substitution; forging its own commercial partnerships with Chinese magnet manufacturers; and building strategic stockpiles to cushion future supply shocks. More than a decade later, Japan still sources over 70% of its rare-earths imports from China.

China’s rare-earths dominance wasn’t built overnight, and it won’t be easily eroded. Its strength does not lie in hoarding raw materials, but in the industrial capacity to refine, process, and produce at scale. Today, China controls between 85% and 90% of global rare-earths refining capacity, and produces roughly 90% of the world’s high-performance rare-earths magnets. It is the only country with a fully vertically integrated rare-earths supply chain – from mining to chemical separation to magnet fabrication.

China’s manufacturing edge has given it not only an industrial lead, but also a technological moat. Between 1950 and 2018, China filed more than 25,000 rare earths-related patents, more than twice the number filed in the US. Decades of hands-on experience in the complex chemistry and metallurgy of rare-earths processing have yielded a depth of expertise that Western firms cannot easily replicate. Moreover, in December 2023, China’s government moved to cement its lead, imposing sweeping export bans on the technologies behind rare-earths extraction, separation, and magnet production.

China’s lax environmental regulation has also given its firms a powerful advantage over their Western competitors. In 2002, the Mountain Pass Rare Earth Mine in California was forced to halt refining operations after a toxic waste spill. By contrast, China’s more permissive regulatory environment has allowed rare-earths production to expand rapidly, with fewer delays and far lower costs.

Importantly, rare-earths chokepoints are not fixed; they evolve with technology. China understood this, waiting patiently as Western dependence on rare-earths magnets increased exponentially with the global green transition, which created massive demand for EVs and wind turbines.

Even if the West succeeds in building a parallel supply chain for today’s rare-earths needs, tomorrow’s chokepoints may lie elsewhere. Quantum computing, for example, increasingly depends on rare isotopes like ytterbium-171, as well as on elements such as erbium and yttrium. These emerging applications could become the next pressure points, leaving the US and its allies once again racing to catch up.

Trusted takes on China, all in one place → $99/year.

The US therefore must confront an uncomfortable truth: China’s dominance in rare earths is likely to endure for the foreseeable future. Defensive strategies like supply-chain diversification may address some vulnerabilities, but true resilience demands an offensive strategy that enhances American leverage.

The US still holds many valuable cards. As long as it retains control over technologies or infrastructure that China cannot live without – be it advanced chips, frontier AI models, and access to the dollar-based financial system – China has a strong incentive to keep rare earths flowing. For years, though, the US has pursued the opposite course: gradually decoupling and restricting key technology flows to China.

Since the first Trump administration, the US playbook has been to blacklist leading Chinese tech firms and tighten export controls on cutting-edge chips. While these measures initially hobbled Chinese firms such as Huawei and ZTE, slowing the country’s AI development, they have proved difficult to enforce. Riddled with loopholes, they created opportunities for enforcement arbitrage. As outgoing US Commerce Secretary Gina Raimondo conceded in December 2024, “Trying to hold China back is a fool’s errand.”

At the same time, US export controls have galvanized efforts in China to build indigenous alternatives, effectively accelerating the rise of national champions like Huawei. Far from strengthening American leverage over China, US policy is steadily eroding it. If you are Nvidia, losing access to the Chinese market doesn’t just mean forfeiting billions in revenue. It means losing influence over the most important AI ecosystem for developers outside the US.

Recent policy shifts suggest that this realization is starting to take hold. The Trump administration’s decision to relax restrictions on sales of Nvidia’s H20 chips to China signals a move away from blanket bans and toward more calibrated engagement. Counterintuitively, such engagement may be a smarter form of de-risking. The more that China relies on American technology, the more deeply the two sides’ supply chains will become entangled, and the harder it will become for China to weaponize its own strategic assets, including rare earths.

Angela Huyue Zhang, Professor of Law at the University of Southern California, is the author of High Wire: How China Regulates Big Tech and Governs Its Economy (Oxford University Press, 2024) and Chinese Antitrust Exceptionalism: How the Rise of China Challenges Global Regulation (Oxford University Press, 2021).

Copyright Project Syndicate

TIPP Takes

Geopolitics, Geoeconomics, And More

1. Putin Rules Out Zelenskyy Meeting For Now - D.W.

Russian leader Vladimir Putin has said that a meeting with Ukrainian President Volodymyr Zelenskyy is still not on the table, despite growing international pressure for direct talks.

"I have nothing against it in general, it is possible," Putin told reporters in Moscow on Thursday. "But certain conditions must be created for this. Unfortunately, we are still far from creating such conditions." His comments came just hours after Zelenskyy again called for a face-to-face meeting to help end the war.

2. Kremlin Agrees To Putin-Trump Meeting In Coming Days - UPI

Yuri Ushakov, foreign affairs advisor to Putin, made the announcement to reporters, stating a venue has also been decided upon, in principle, for the Trump-Putin summit, but that it will be announced later, Russia's state-run TASS news agency reported.

The meeting will mark the first face-to-face conversation between the world leaders since they spoke on the sidelines of a G20 Summit in Osaka, Japan, in 2019. The pair also held a summit in Helsinki in 2018.

3. Russia’s Putin Says UAE Is One Of The Appropriate Places To Meet Trump - Reuters

Putin said that he was not “on the whole” against meeting Ukrainian President Volodymyr Zelenskyy, adding that “certain conditions should be created” for such a meeting. He stressed that the current situation was “far” from being ready for it.

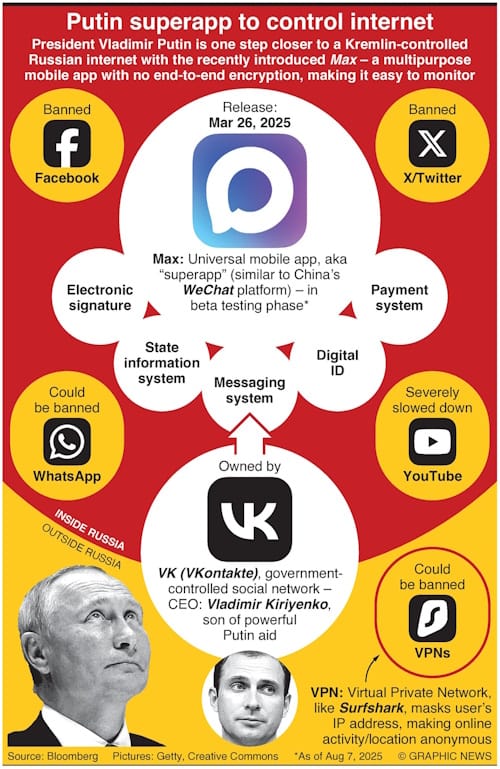

4. Russia’s New Superapp Will Control Internet Access - TIPP Insights

President Vladimir Putin is one step closer to a Kremlin-controlled Russian internet with the recently introduced Max, a multipurpose mobile app with no end-to-end encryption, making it easy to monitor.

5. Despite Sanctions, Russian Bomb Factory Bought Siemens Tech Via Middleman - Reuters

As Russia sought to ratchet up military production for the war, a state-owned explosives manufacturer circumvented Western sanctions by purchasing equipment made by Germany’s Siemens from a middleman that imports technology from China.

The acquisition of the equipment shows how Russian military firms have been able to easily avoid Western sanctions to boost their production. Reuters found no evidence that Siemens knew its equipment was sold to the Russian explosives maker.

6. China’s July Exports Top Expectations, Rising Over 7%; Imports Record Biggest Jump In A Year - CNBC

Exports climbed 7.2% in July in U.S. dollar terms from a year earlier, customs data showed, exceeding Reuters-polled economists’ estimates of a 5.4% rise.

Imports rose 4.1% last month from a year earlier, marking the biggest jump since July 2024, according to LSEG data. The data also indicated a recovery in import levels following June’s 1.1% rebound. Economists had forecast imports in July to fall 1.0%, according to a Reuters poll. However, Beijing’s exports to the U.S. fell for the fourth consecutive month on a year-over-year basis. Imports from the U.S. also dropped 18.9% year over year.

7. Netanyahu Says He Wants Israel To Take Control Of All Of Gaza - Reuters

“We intend to,” Israeli Prime Minister Benjamin Netanyahu said in an interview with Fox News when asked if Israel would take over the entire coastal territory.

“We don’t want to keep it. We want to have a security perimeter. We don’t want to govern it. We don’t want to be there as a governing body.” He said that Israel wanted to hand over the territory to Arab forces that would govern it.

8. Israel’s Leviathan Signs $35 Billion Natural Gas Supply Deal With Egypt - Reuters

Israel’s Leviathan natural gas field has signed the largest export agreement in the country’s history, worth up to $35 billion to supply gas to Egypt, NewMed, one of the partners in the field, said.

Leviathan, off Israel’s Mediterranean coast with reserves of some 600 billion cubic metres, will sell about 130 bcm of gas to Egypt through 2040, or until all of the contract quantities are fulfilled. During a 12-day war between Israel and Iran in June, exports from Leviathan were halted for security reasons.

9. Britain Begins Detaining 'Small Boat' Migrants To Send Back To France - UPI

A landmark Anglo-French "one-in, one-out" migrant agreement saw the first small boat arrivals on the British coast taken into custody in preparation for being returned to France, the government said.

The detentions got underway on Wednesday with migrants who had crossed the Channel "illegally" held in secure immigration centers pending their removal to France, which was expected to take place in a matter of weeks, according to a Home Office news release.

10. Ripple Acquires New Surprising Stablecoin Platform - TheStreet

Ripple has agreed to acquire Rail, a stablecoin platform for global payments, for $200 million, the crypto payments firm said.

The fintech firm is one of the leading players in the global stablecoin market that issues RLUSD, a stablecoin pegged 1:1 to the U.S. dollar. Expected to close in the fourth quarter of 2025, the deal would pave the way for Ripple to penetrate the stablecoin market further.

11. Standing Up More Times A Day Associated With Heart Health In Seniors - HealthDay Reporter

There's a simple way older women can protect their heart health, a new study argues. Just stand up.

Women who started standing up from a seated position more often during their day experienced notable improvement in blood pressure after three months, researchers reported recently in the journal Circulation. Taking these short-standing breaks appeared to boost heart health even though the women didn't increase their overall levels of intense exercise, researchers said.

12. Excessive Screen Time For Children Linked To Later Heart Health Risks - HealthDay Reporter

The time children and teens spend video gaming, scrolling through social media or watching TV could be putting their future heart health at risk, a new study says.

Each additional hour of screen time is associated with an increase in heart risk factors like blood pressure, cholesterol and blood sugar levels, researchers reported in the Journal of the American Heart Association. Both shorter sleep duration and hitting the sack later intensified the relationship between screen time and heart health risk, results show.