📊 Economic Pulse: September

- Optimism slips below 50

- Outlook dims ahead

- Wallet worries grow

- Confidence in Washington fades

👉 Takeaway: The rebound is over — Americans are cautious again.

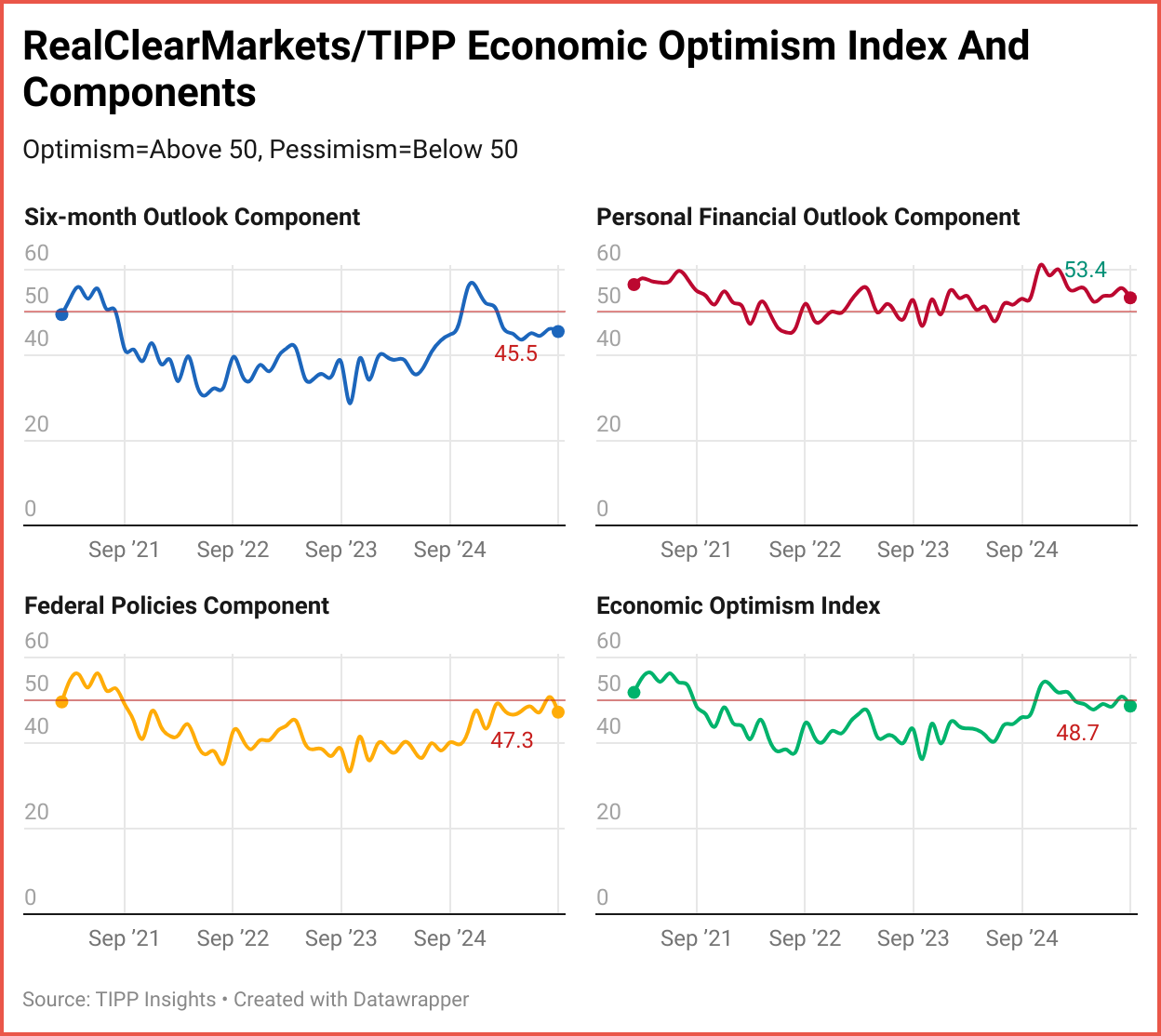

Consumer sentiment weakened in September as the RealClearMarkets/TIPP Economic Optimism Index, the first read on U.S. consumer confidence each month, fell from 50.9 in August to 48.7, a 2.2-point decline (-4.3%). After briefly breaking a five-month streak of pessimism in August by rising above the neutral 50.0 mark, the index slipped back into negative territory.

September’s Economic Optimism Index reading of 48.7 is 0.93% below its 296-month historical average of 49.2.

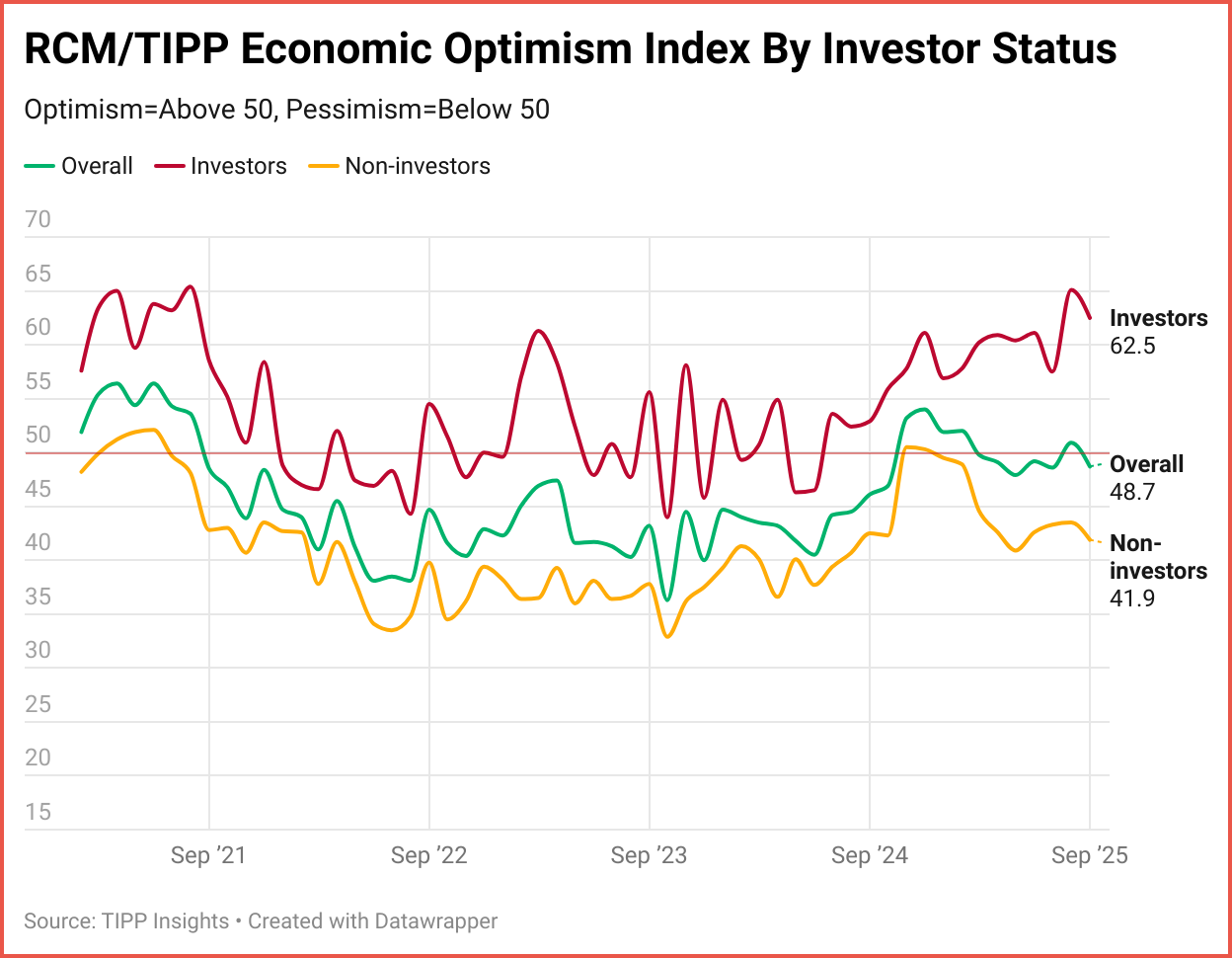

Investor confidence dropped 2.6 points (-4.0%) to 62.5 in September, while non-investor confidence declined 1.6 points (-3.7%) to 41.9. August’s investor reading had been the strongest since August 2021, and the gap between the two groups now stands at 20.6 points.

The RCM/TIPP Economic Optimism Index is the first monthly measure of consumer confidence. It has established a strong track record of foreshadowing the confidence indicators issued later each month by the University of Michigan and The Conference Board. (From February 2001 to October 2023, TIPP released this Index monthly in collaboration with its former sponsor and media partner, Investor's Business Daily.)

RCM/TIPP surveyed 1,362 adults from August 27 to 29 for the September index, using TIPP’s panel network; results have a range of 0–100, with readings above 50 indicating optimism, below 50 signaling pessimism, and 50 considered neutral. A more detailed methodology is available here.

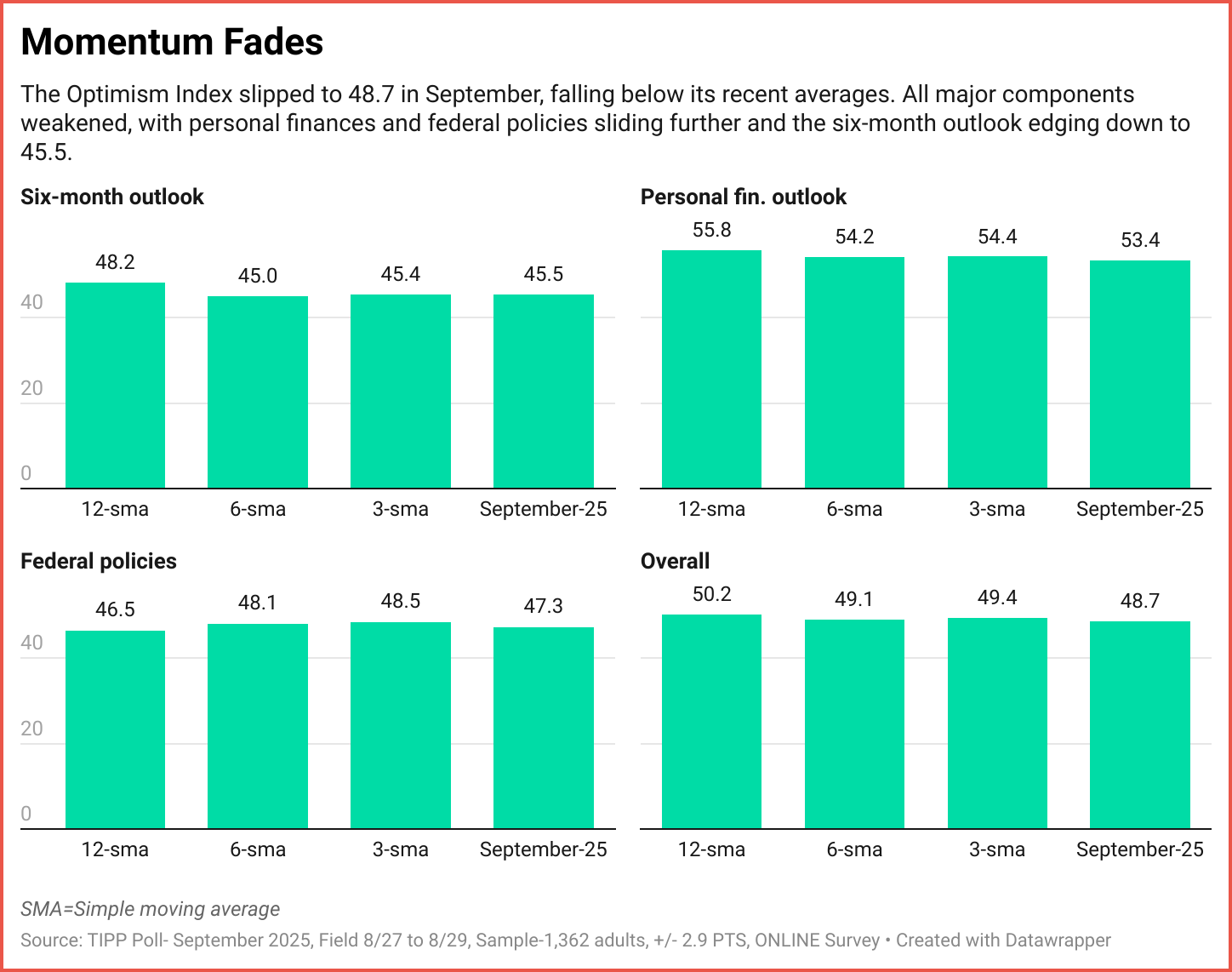

The RCM/TIPP Economic Optimism Index has three key components. In September, all of them declined.

- The Six-Month Economic Outlook, which measures how consumers perceive the economy's prospects in the next six months, dropped 1.3%, from 46.1 in August to 45.5 in September.

- The Personal Financial Outlook, a measure of how Americans feel about their own finances in the next six months, declined by 4.1% from its previous reading of 55.7 in August to 53.4 this month.

- Confidence in Federal Economic Policies, a proprietary RCM/TIPP measure of views on the effectiveness of government economic policies, weakened in September to 47.3 from 50.8 in August, reflecting a 6.9% decline. This component crossed above the neutral 50.0 mark for the first time in August, ending a 47-month streak in pessimistic territory that began in September 2021.

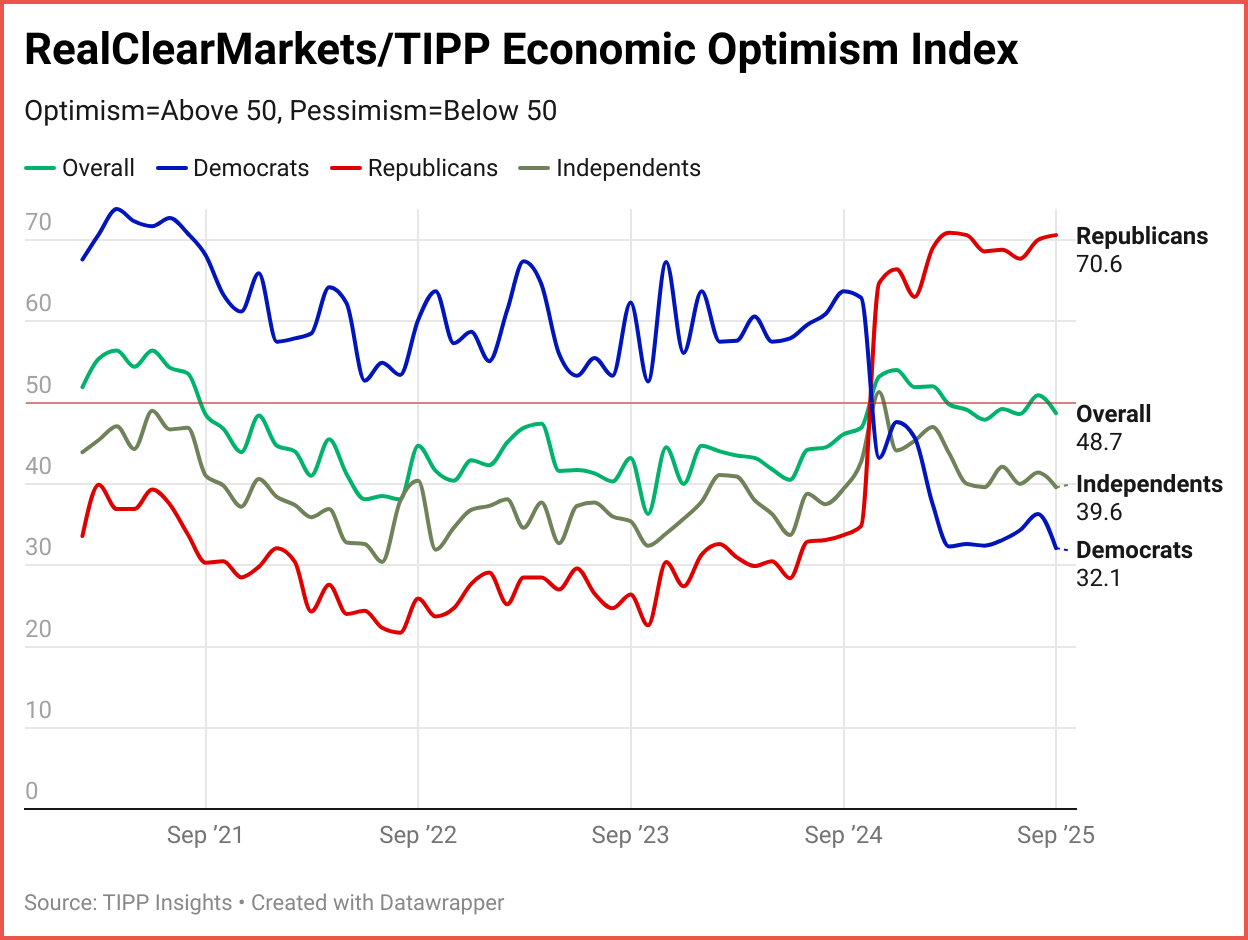

Party Dynamics

Since President Trump’s election as the 47th President, Democrats’ confidence has plunged to 32.1, Republicans’ confidence has soared to 70.6, and independents, after briefly turning optimistic for the first time in nearly five years, have slipped back to 39.6.

Investor Confidence

Respondents are considered "investors" if they currently have at least $10,000 invested in the stock market, either personally or jointly with a spouse, either directly or through a retirement plan. One-third (31%) of respondents met this criterion, and 63% were classified as non-investors. We were unable to determine the status of six percent of respondents.

Investor confidence fell 4.0% (2.6 points) to 62.5 in September, while non-investor confidence declined 3.7% (1.6 points) to 41.9. August’s reading for investors had marked a 48-month high, the strongest since August 2021. The confidence gap between investors and non-investors now stands at 20.6 points.

Momentum

The Optimism Index slipped to 48.7 in September, below its three-month average of 49.4. The Six-Month Outlook held at 45.5, a notch above its three- and six-month benchmarks but still short of its long-term trend. Personal finances eased to 53.4, under both its three- and six-month averages, while confidence in federal policies fell to 47.3, beneath its recent short-term marks though modestly above its 12-month average. Unlike August’s across-the-board rebound, September shows mixed signals, with only the outlook component holding steady while other measures softened.

Get sharp, original analysis on investor confidence and market trends. Full access → $99/year.

Demographic Analysis

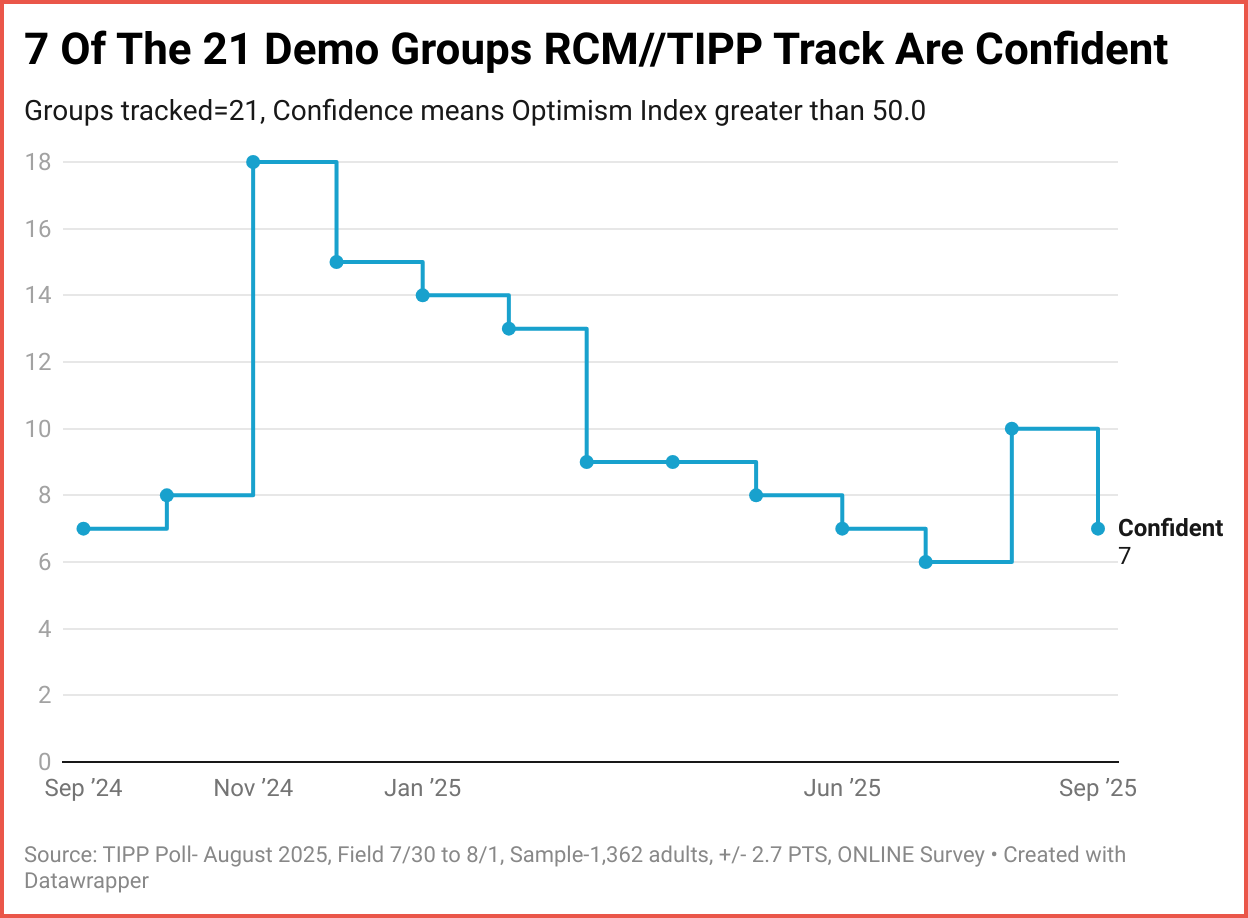

The number of groups in the positive zone indicates the breadth of optimism in American society.

This month, seven of the 21 demographic groups we track are in positive territory, with scores above 50 on the Economic Optimism Index. For comparison, there were 10 in August, six in July, and seven in June.

In the immediate aftermath of the election, the number of groups in the optimistic zone had jumped from eight in October 2024 to 18 in November, indicating widespread optimism.

Three groups improved on the index, compared to 20 in August, 10 in July, and 18 in June.

Economic optimism levels for 11 of 21 demographic groups are higher in September 2025 than the historical average of the 296 months, since we began tracking in February 2001.

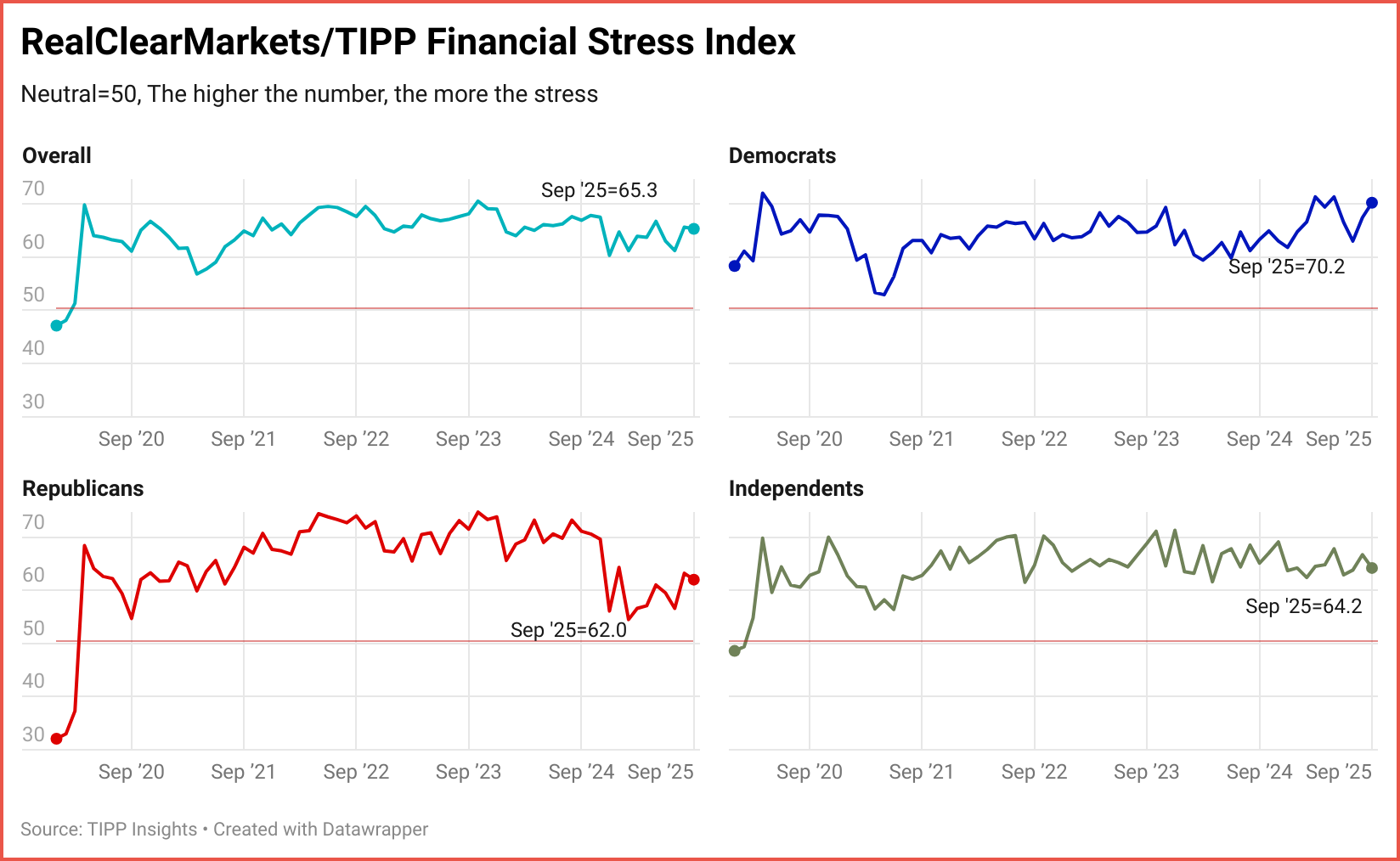

RCM/TIPP also releases our companion index, known as the RCM/TIPP Financial-Related Stress Index, the only metric to track the financial stress felt by Americans monthly.

The higher the number, the more stress. Readings above 50 signal increased stress, while those below 50 indicate lower stress, with 50 considered neutral.

The RCM/TIPP Financial-Related Stress Index dropped 0.3 points (0.5%) from 65.6 in August to 65.3 in September, echoing a slight easing of financial stress among Americans. This reading is still 8.1% above the long-term average of 60.4, underscoring elevated financial strain. The last time the index posted below 50.0 was before the onset of the pandemic in February 2020, when it stood at 48.1.

Release Schedule Of RCM/TIPP Indexes For The Rest Of 2025

The RealClearMarkets website releases the report at 10 a.m. EST on the release days.

- Tuesday, October 7

- Tuesday, November 4

- Tuesday, December 2

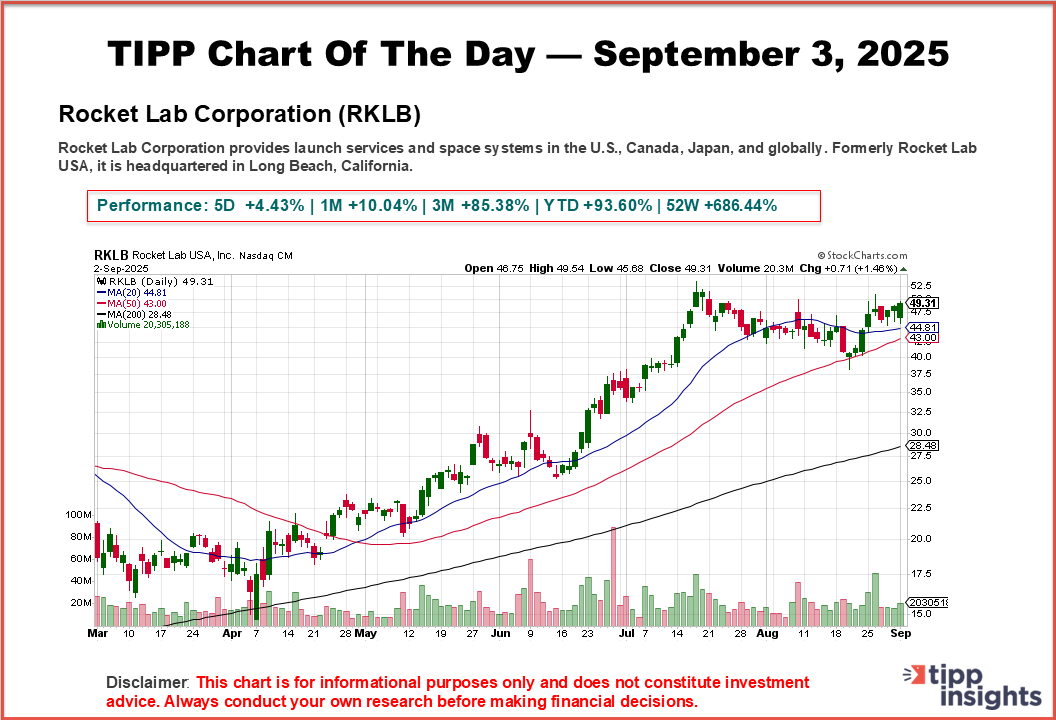

📈 Market Mood – Wednesday, September 3, 2025

🟡 Futures Mixed: Wall Street set for a choppy open after Tuesday’s selloff, with Dow futures lower while S&P 500 and Nasdaq futures edge up.

🟢 Google Relief Rally: Alphabet surges 5% after a U.S. judge spares it from divesting Chrome or Android in the DOJ’s antitrust case, easing fears of harsher remedies.

🟣 Beige Book Watch: Fed to release its Beige Book, offering one of the last economic snapshots before September’s policy meeting, with tariffs and hiring trends in focus.

🟠 Earnings on Deck: Salesforce reports after the bell, joined by Dollar Tree, HPE, Campbell’s, and Macy’s—key reads on AI software momentum and retail resilience.

🥇 Gold Hits Record: Bullion briefly touched $3,547/oz as tariff and fiscal worries fueled safe-haven demand, before easing on a dollar rebound.

Market round-up in 5 minutes. We bring you up to speed. Subscribe to TIPP Insights for $99/year.

📅 Key Events Today

🟩 Wednesday, September 3

10:00 – JOLTS Job Openings (Jul)

Labor demand indicator, number of unfilled positions.