- The Federal Reserve implemented 11 interest rate hikes to combat inflation

- The RCM/TIPP Economic Optimism Index reveals a significant decline in consumer confidence during the period coinciding with rate hikes

- Beyond economic impacts, the Federal Reserve's actions have also had psychological and health consequences for Americans

Speaking in a keynote speech at the Federal Reserve’s annual Jackson Hole Economic Symposium in August 2022, Federal Reserve chairman Jerome Powell forewarned Americans that the central bank’s mission to tame inflation would result in “some pain” for US households. Powell said:

While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses.

Dr. Fed's warning has proven to be accurate, as data now reveal the side effects of the rate hikes, ranging from record-low home affordability to skyrocketing auto loan payments, high credit card interest rates, and recent bank failures, as well as an imminent commercial real estate market crash. Because of high interest rates, the Fed’s operating losses are piling up, and the Fed’s portfolio now shows a $1.3 trillion loss on paper.

But the high interest rates are also taking a psychological toll, eroding Americans' economic confidence and increasing stress levels, which could potentially lead to mental and physical health consequences.

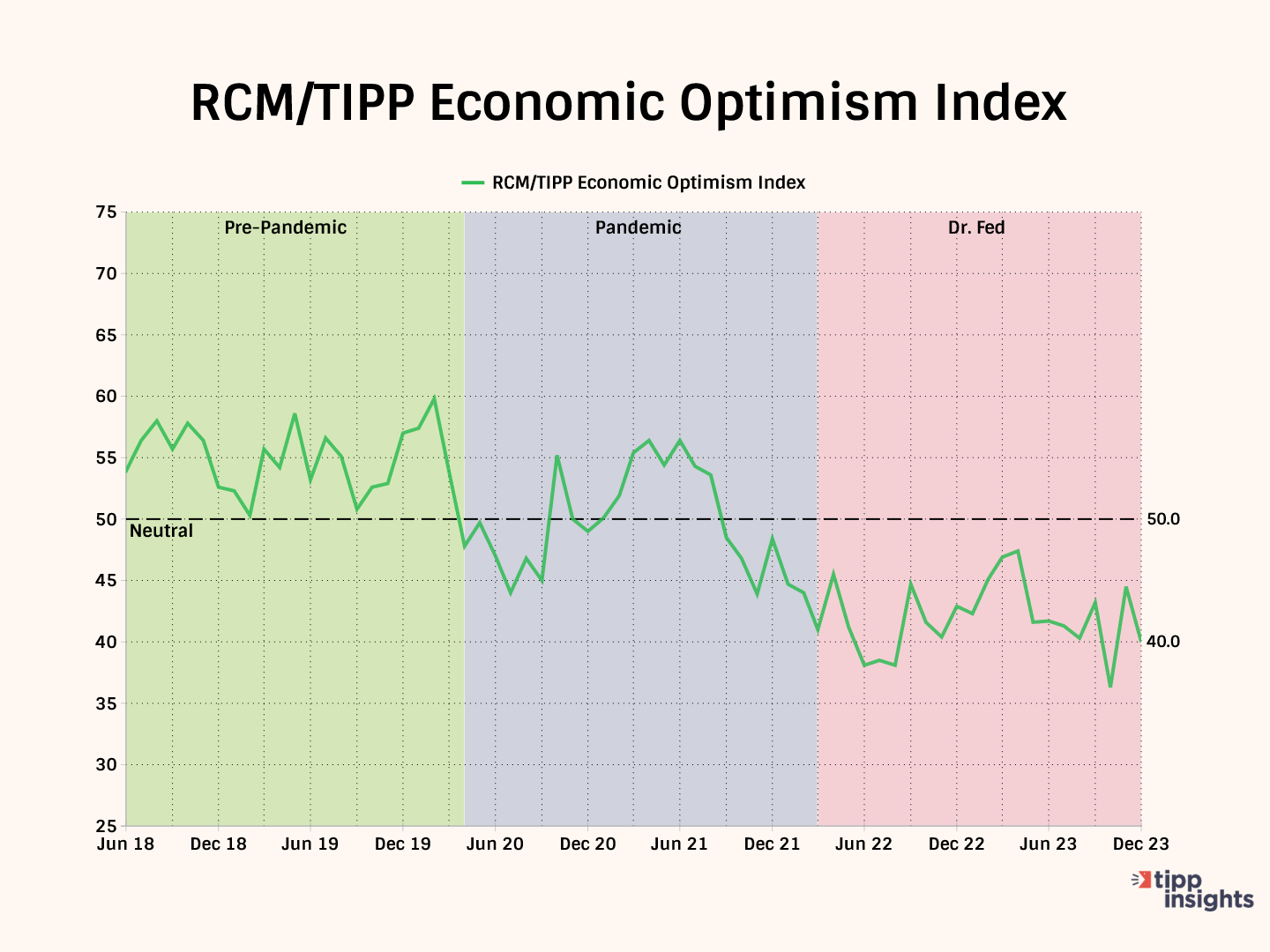

For this analysis, we consider the following three periods:

- Pre-Pandemic/Control: This period spans 22 months, from June 2018 to March 2020, and serves as the control for analysis, representing the time before the pandemic.

- Pandemic: Covering 23 months from April 2020 to February 2022, this period begins the month after the onset of the pandemic and concludes in February 2022, which is the month just before the Federal Reserve began to hike rates.

- Dr. Fed: Spanning 22 months from March 2022 to December 2023, this period began when the Fed initiated rate hikes in March 2022. Since then, the Fed has increased rates 11 times to 5.25 percent, a 22-year high.

We use the RealClearMarkets/TIPP Economic Optimism Index, a leading measure of consumer confidence, and the RealClearMarkets/TIPP Financial Stress Index to assess how they were impacted during the three periods. This analysis cannot establish causality, yet it is interesting to study their behavior in response to Dr. Fed's efforts to cure the inflationary economy.

RCM/TIPP Economic Optimism Index

RCM/TIPP index readings above 50.0 signal optimism, and readings below 50.0 indicate pessimism.

Notice the following in the chart below. During the pre-pandemic control period, shaded green, the index was convincingly above 50 in the optimistic zone.

During the pandemic period, shaded blue, the index was mixed. At the onset of the pandemic, the index turned pessimistic. From there, it recovered, only to return to pessimistic territory.

Beginning in March 2022, shaded red, when Dr. Fed injected his medicine of high interest rates, the confidence has convincingly stayed in pessimistic territory.

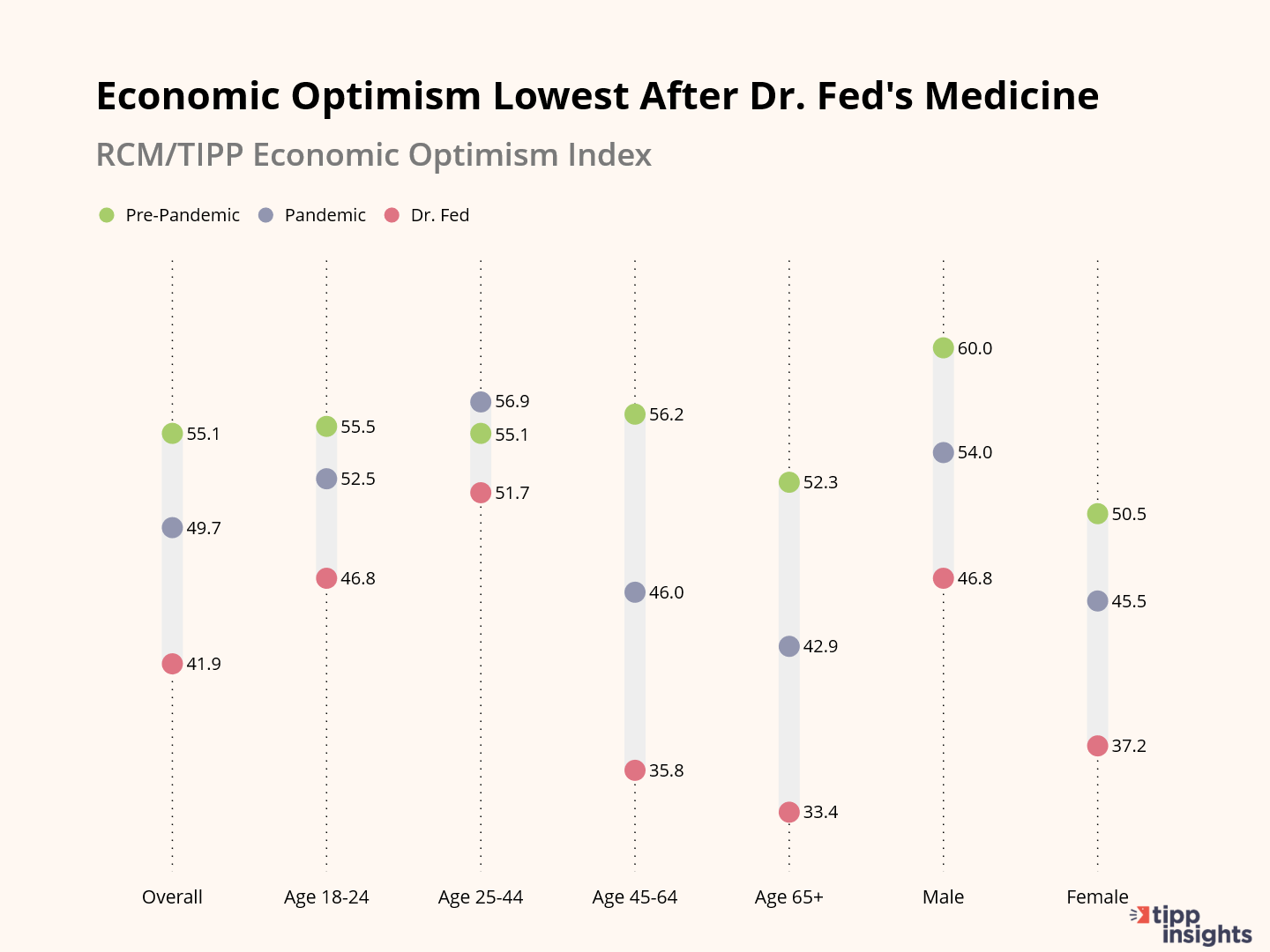

The chart below presents the averages of the RCM/TIPP Economic Optimism Index for the three periods. We present the data for overall, four age groups, and two genders.

For example, let’s look at the overall index for all Americans. The average during the pre-pandemic control period was the highest at 55.1. It dropped to 49.7 during the pandemic and sank to 41.9 after Dr. Fed’s medicine. Interestingly, except for the 25–44 age group, all other age groups and genders display the pattern.

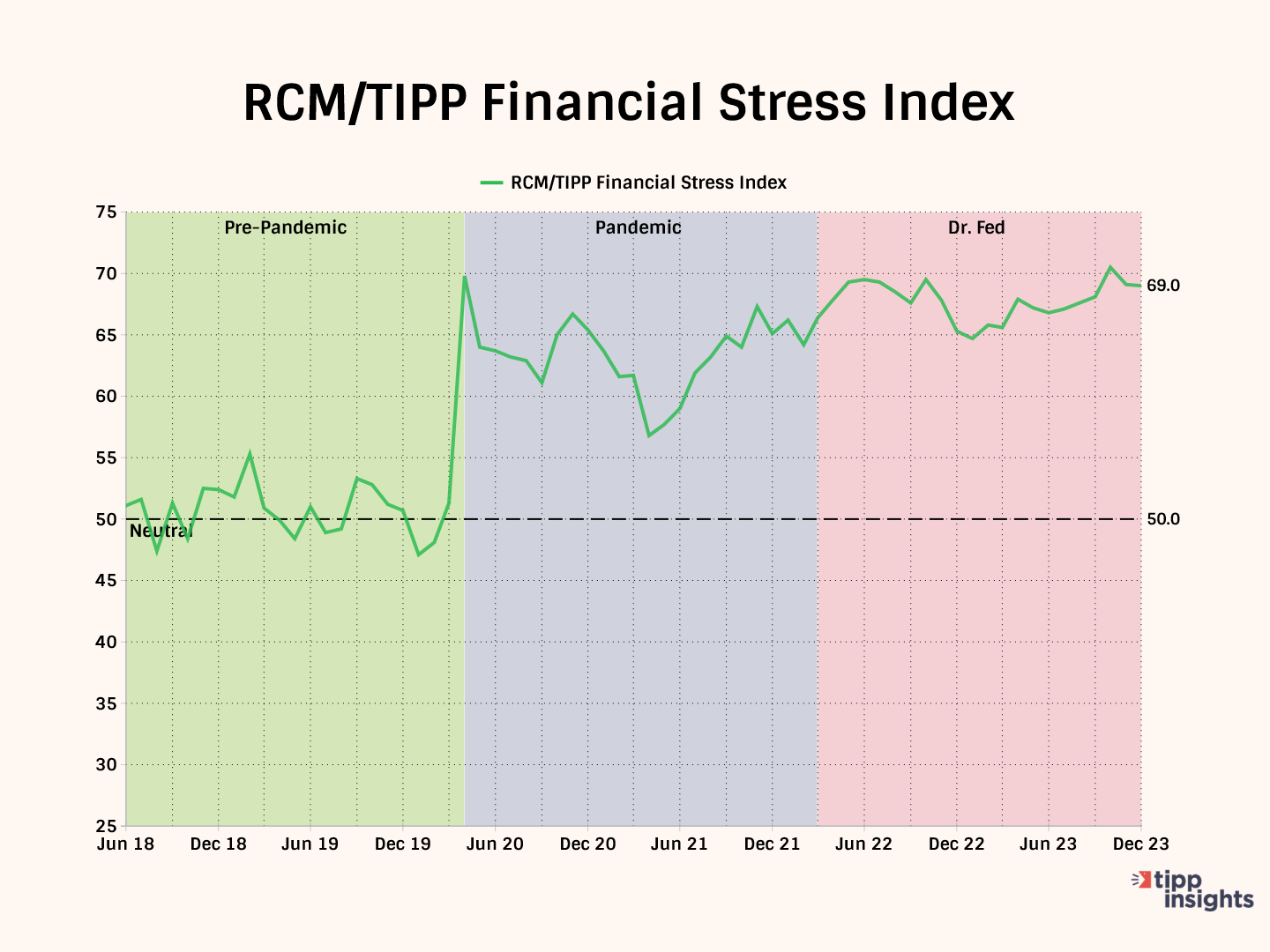

RCM/TIPP Financial Stress Index

The RCM/TIPP Financial Stress Index, formerly known as the IBD/TIPP Financial Stress Index, is a one-of-a-kind financial stress metric.

In December 2007, we began using it to track financial stress. The index accurately indicates Americans' financial concerns about paying bills and making ends meet.

Financial stress can lead to insomnia, weight gain (or loss), depression, anxiety, relationship difficulties, social withdrawal, and physical ailments such as headaches, gastrointestinal problems, diabetes, high blood pressure, and heart disease.

We computed the stress index from responses to the questions: Thinking of your personal finances, compared to the past three months, do you feel more stressed these days, less stressed these days, or feel the same level of stress?

The index ranges from 0 to 100; the higher the number, the more stress. A reading of 50.0 is the neutral point.

Notice the following in the chart below. During the pre-pandemic control period, shaded green, the index was convincingly hugging 50, mostly neutral.

At the onset of the pandemic, the index shot up above 50, reflecting high stress, and stayed mostly below 65.

Beginning in March 2022, shaded red, when Dr. Fed injected his medicine of high interest rates, the stress recorded has stayed in the 65 to 70 range. Incidentally, it recorded 70.5 in October 2023, the highest reading on this index since December 2008.

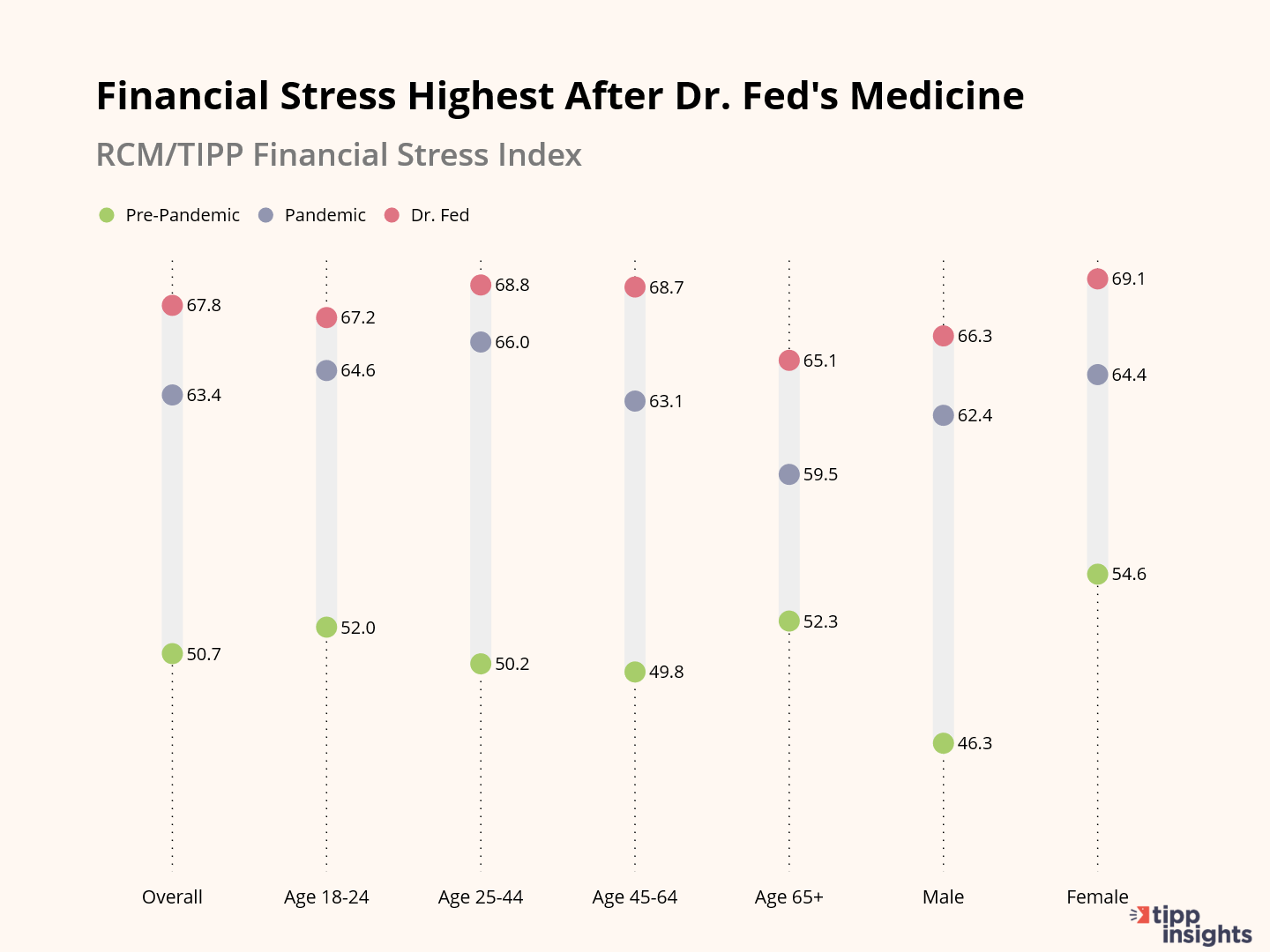

The chart below presents the averages of the RCM/TIPP Financial Stress Index for the three periods. We present the data for overall, four age groups, and two genders.

For example, let’s look at the overall index for all Americans. The average during the pre-pandemic control period was the lowest at 50.7. It increased to 63.4 during the pandemic, climbing to 67.8 after Dr. Fed’s medicine. Interestingly, the four age groups and two genders obey the pattern.

In summary, the high interest rates are a burden for American families. Our data show that they have not only destroyed the American dream of home ownership but also severely damaged people's psychological health.

We could use your help. Support our independent journalism with your paid subscription to keep our mission going.