Two words define America in 2025: impatience and fatigue. They describe our culture — short attention spans, constant scrolling, ongoing agitation.

They also describe our economy — families impatient for financial relief – and fatigued from years of broken promises.

Yet even in this jaded environment, bold gestures still cut through.

Americans will focus when they see a dramatic public commitment. Right now, Republicans must launch a policy and messaging campaign: the Golden Era for the economy. We must “renew vows” between American policymakers and the people, built on both immediate relief and a long-term economic reorientation.

Tariff Dividend Checks — Relief Today

Our consumer market is the most valuable in the world. If foreign companies want access, they need to pay for it. Just like the best seats at a theater or a stadium, premium pricing must guard access to the crown jewel consumer base. As such, these levies should be policies, and not merely bargaining chips.

For adversary nations, the levies may extend to far higher levels, of course. But even for allies, America should demand a “cover charge” to enter our market. Of course, any country or firm who wants to avoid such fees has a simple option: make your products here. Buy American equipment and hire American labor. Voila, no tariffs!

But what do we do with this revenue, with this windfall that already fills government coffers, right now?

Tariff revenues shouldn’t vanish into bureaucracy—they should come straight back to you as dividend checks.

Not welfare. Not redistribution. It’s your rightful share of the market you sustain. The world pays rent. You cash the check.

Certainly, it is sensible and prudent to use a large portion of the tariff revenues to pay down America’s stifling national debt. But given the profligacy of Washington, as shown in recent legislation, please spare the American people some lecture about fiscal discipline! The revenues should be used for both purposes: put earned cash into hurting citizens’ pockets AND make serious payments against our debt.

After years of enduring the inflation scourge of Bidenomics, Americans are understandably scarred concerning their finances. Huge supermajorities now report that they no longer believe the American Dream is attainable. My own recent polling shows that only about 1/5th of Americans believe that the Reconciliation package, the so-called “Big Beautiful Bill” will help them personally.

Even though President Trump inherited an awful economic handoff from feckless Biden, the current political reality is harsh: voters now blame this administration for prices they cannot afford, especially at the grocery store. As such, this is no time for groundless happy talk. Instead, it is time for action.

As President Trump rightly restructures global trade to benefit regular Americans, we need to show those workers the tangible, real-world benefits, and do it right now! Give American laborers something they have never had before, a seat at the table of global trade negotiations and real “skin in the game” when it comes to trade policies.

There is some very material good economic news, lately, to be sure. Most encouraging is the growth in real wages, meaning pay adjusted for inflation. That measure declined under Biden for a staggering 24 straight months, an economic disaster for working people. But even today, too many Americans feel trapped, and reflect the anxiety of working harder for a lower standard of living.

In time, rising real wages will return Americans to a place of confidence, the kind of broad success Trump compelled in his first term. But for now Americans are understandably shell-shocked from an economy that has been brutal for people who do not own substantial assets.

Unlike the Dems, who talk a big game about workers but then do every possible favor for globalist oligarchs, how about our movement delivers for the middle class? It is high time for quarterly checks providing cash dividends from tariff revenues.

Looking at electoral politics, this reform is an imperative. Incumbent parties typically struggle anyway in midterms, and given the present economic mood of the populace, things look dire for maintaining GOP control of the Congress.

Those of us on the populist right must recognize this severe threat…and take action. If we do not, undoubtedly Hakeem Jeffries as speaker would use the power of that gavel to impeach President Trump, no matter how ridiculous and scurrilous their accusations might be. Let’s avoid that entire saga.

Paying tariff dividends will build tremendous economic goodwill and political loyalty.

Our nation prepares to enter a hugely consequential year – the 250th semiquincentennial birthday celebration of our independence. As a “birthday” present to the American people, let’s deliver down payments on a new golden era of shared American success and prosperity.

Steve Cortes is president of the League of American Workers and senior political advisor to Catholic Vote. He is a former senior advisor to President Trump and JD Vance, plus a former commentator for Fox News and CNN. He delivers sharp political analysis, economic insights, and cultural commentary from a conservative perspective.

Original article link

TIPP Takes

Geopolitics, Geoeconomics, And More

1. Russia And Belarus War Games Fuel European Fears Over Ukraine Conflict - AFP

Russia and Belarus are set to stage a massive military exercise in mid-September and with the war in Ukraine still raging, the move has raised concern across Europe.

Germany has issued military warnings, while France is quietly preparing its hospitals for the possibility of a wider conflict.

Belarus insists the exercises are routine and preventative. But NATO countries are unconvinced.

With Russian and Belarusian troops training close to Poland and Lithuania – both NATO members – officials fear a miscalculation on Europe’s fault line.

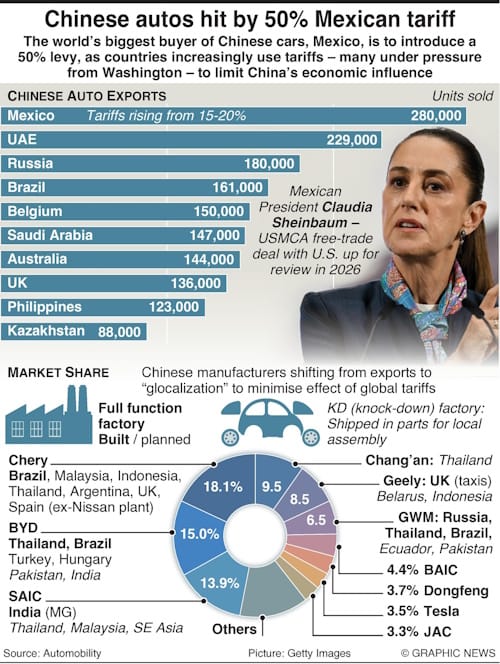

2. Mexico Slaps 50% Tariff On Chinese Cars - TIPP Insights

Mexico, the world’s biggest buyer of Chinese cars, is to introduce a 50% levy, as countries increasingly use tariffs – many under pressure from Washington – to limit China’s influence.

3. Brazil's Supreme Court Votes To Convict Ex-President Bolsonaro Of A Coup Plot - NPR

Brazil's Supreme Court has reached a majority vote to convict former President Jair Bolsonaro, with three of the five justices on the panel voting to find him guilty of attempting a coup to stay in power after losing the 2022 election.

The verdict is historic: It marks the first time a former Brazilian head of state went on trial for attempting to overthrow the government.

4. Belarus Frees Political Prisoners In Exchange For Easing Of US Sanctions - BBC

Dozens of political prisoners have been freed from Belarusian prisons as part of a deal between authoritarian leader Alexander Lukashenko and US President Donald Trump.

Fifty-two prisoners have been released, including trade union leaders, journalists and activists, but more than 1,000 political prisoners remain in jail.

In exchange, the US has said it will relieve some sanctions on Belarusian airline Belavia, allowing it to buy parts for its airlines.

5. Britain's U.S. Envoy Peter Mandelson Recalled Over Jeffrey Epstein Ties - UPI

British Prime Minister Keir Starmer on Thursday fired U.S. Ambassador Peter Mandelson amid revelations of a close friendship with convicted U.S. sex offender Jeffrey Epstein.

The Foreign Office said in a statement that the 71-year-old had been dismissed after communications emerged showing the "depth and extent" of his relationship with Epstein was "materially different from that known at the time of his appointment."

6. South Korea's Lee Says Immigration Raid May Deter U.S. Investment - UPI

South Korean President Lee Jae Myung said Thursday that last week's "perplexing" immigration raid at a Hyundai electric battery plant in Georgia, which led to the detention of more than 300 South Korean workers, could prevent firms from making future investments in the United States.

"Companies will have to worry about whether establishing a local factory in the United States will be subject to all sorts of disadvantages or difficulties," Lee said at a press conference in Seoul marking his 100th day in office.

Related Editorial: Hyundai’s Grand Flunk On Immigration

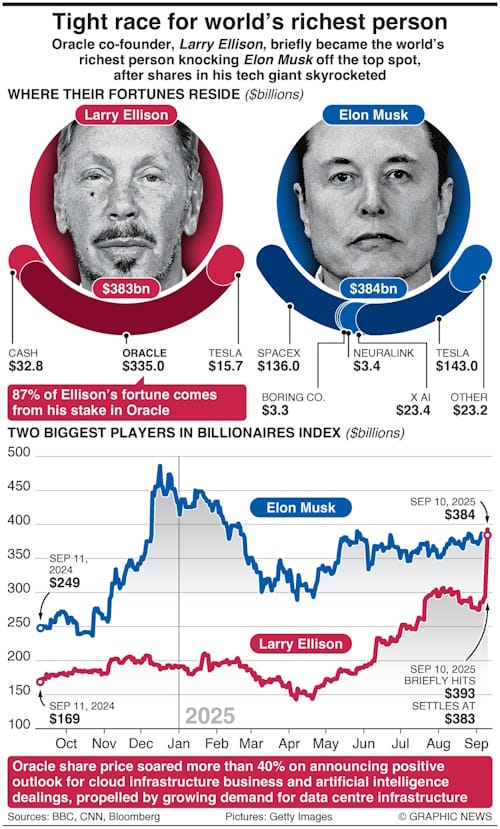

7. Ellison Gives Musk Run For His Money In Billionaires Index – TIPP Insights

Oracle co-founder, Larry Ellison, briefly became the world’s richest person, knocking Elon Musk off the top spot, after shares in his tech giant skyrocketed.

8. Study Links High THC Levels With Egg Quality And Fertility Issues – Health News

High levels of THC – the compound in marijuana that causes a "high" – may affect how eggs develop and could lead to fertility problems, miscarriages and chromosome issues in embryos, new research shows.

Researchers analyzed more than 1,000 samples of ovarian fluid from patients undergoing fertility treatment. They compared unfertilized eggs (oocytes) from 62 women who tested positive for THC with a control group who did not use cannabis.

The study found that women with detectable levels of THC had a higher egg maturation rate. But they also produced fewer embryos with the correct number of chromosomes.

📊 Market Pulse — September 11, 2025

📈 S&P 500 — 6,587.47 ▲ +0.85%

Stocks rallied strongly, with the S&P 500 breaking to fresh highs on heavy volume, extending its September rebound.

📉 10Y Treasury Yield — 4.011% ▼ -2.1 bp

Yields slid further as investors positioned for a Fed rate cut next week, deepening the bond market rally.

🛢️ Crude Oil — $62.32 ▼ -2.12%

Oil dropped for a second day, as demand concerns resurfaced despite recent geopolitical-driven gains.

₿ Bitcoin — $114,490 ▲ +2.0%

Bitcoin rebounded above $114K, bouncing off recent support amid risk-on sentiment in equities.

💵 US Dollar Index — 97.52 ▼ -0.26

The dollar drifted lower, extending its slide as rate cut expectations pressured yields.

🪙 Gold — $3,635.79 ▼ -0.13%

Gold held near record highs, consolidating as traders await Thursday’s CPI report for fresh rate clues.