Look, the U.S. economy just won’t quit surprising people in a good way. For months (okay, years), we kept hearing the same warnings: faster growth would stoke inflation again, tariffs would jack up prices across the board, and high interest rates would slam us into a recession. Well, it didn’t happen. Growth kept up, prices cooled off, and the crash everyone was waiting for never showed.

Take economic growth first. As we head deeper into 2026, the forecasts for how fast the whole economy is expanding are actually getting better, not worse. Goldman Sachs is forecasting about 2.5% growth this year, based on the end-of-year pace, which beats the typical forecast of around 2.1%. Some folks are even penciling in closer to 2.8% for the full year. Vanguard’s in the same boat, above 2%, and they’re pointing straight at businesses spending steadily on equipment, software, and new tech.

That flips the slowdown warning story on its head. Tariffs were supposed to choke everything, but they didn’t. Tax cuts were supposed to be a quick sugar rush that would fade—they’re still helping. Clearer signals out of Washington and a little less trade drama are letting companies plan and spend with more confidence. Policies and proposals that looked like roadblocks a year ago are quietly turning into tailwinds. Prices for the things families actually buy? They’re climbing way slower than Americans expected. Everyone braced for tariffs (those extra taxes on stuff coming from overseas) to send store prices through the roof. But, the big spike? It never really came.

The latest price reports keep coming in tame. Whatever little bump the tariffs caused is already washing out as companies shift suppliers and last year’s higher numbers fall off the yearly comparison.

The Federal Reserve’s favorite way of tracking underlying prices (skipping the wild swings in gas and groceries) is expected to land around 2.1%—maybe even a wee bit lower—by the end of the year. That’s basically the sweet spot they’ve been chasing forever. Bottom line for regular folks: your grocery run, rent check, and car repair bill aren’t shooting up month after month anymore. Families finally get a little breathing room instead of feeling like they’re running just to stay put in the same place.

Wages are still going up, but at a pace that doesn’t push everything else higher. At the same time, companies are squeezing more output from the same workers thanks to better tools and technology. That’s productivity in plain English: making more things (or giving more services) without needing extra people or extra hours. Smarter software, upgraded machines, and robots that handle the boring tasks are helping workers get more done without burning out. That mix—wage growth slowing just enough plus productivity picking up is the exact recipe everyone in Washington dreams about. A lot of people said it was impossible; turns out it’s happening.

The biggest story nobody’s applauding or reporting is what businesses are doing behind the scenes. They’re pouring real money into AI, automation, modern factories—stuff that makes them way more efficient. That investment spending is holding strong (some forecasts say 4% growth or better) even while hiring has eased off a touch. This isn’t credit-card-fueled shopping sprees. It’s companies buying the future: tools that let them produce more without jacking up prices, pay people better in real terms, and keep the whole expansion going longer than the old playbooks thought possible.

Tax breaks are still kicking in, too, with bigger refunds in pockets, faster write-offs for new equipment, and clearer rules so businesses aren’t second-guessing their every move. Borrowing isn’t dirt-cheap, but it’s not strangling anyone either. Earlier rate cuts are finally working their way through like they’re supposed to.

Put it all together, and you get an economy that keeps sidestepping every recession call. People are still spending. Trade gaps are shrinking. Jobs are holding steady, and unemployment should settle around 4.5%, nowhere near the spike lots of folks predicted. Every “this is the breaking point” moment has come and gone without breaking the American economy. Sure, nothing’s perfect. There are still risks—a softer job market in spots, policy surprises, you name it. But the good news is the gloom-and-doom take was way off.

Regular Americans have healthier savings than they’ve had in a while, businesses are betting big on tomorrow, and the economy keeps shrugging off punches better than expected. While the headlines kept screaming “cracks everywhere” and “collapse coming,” the economy quietly got its act together like a car that’s been tuned up and is now cruising past the people still yelling it’s about to stall. This isn’t some shaky rebound hanging on by a thread. It’s a real, momentum-building expansion that a whole lot of people missed because they were too busy bracing for the next prophesied disaster.

As 2026 keeps going, don’t be surprised if the good numbers just keep making the pessimists look wrong—again.

👉 Quick Reads

I. Russian War Machine Takes A Hit As Oil Income Tumbles

Oil and gas revenue – Russia’s leading source of income for its Ukraine war machine – fell by 24% in 2025, according to data from its own Finance Ministry.

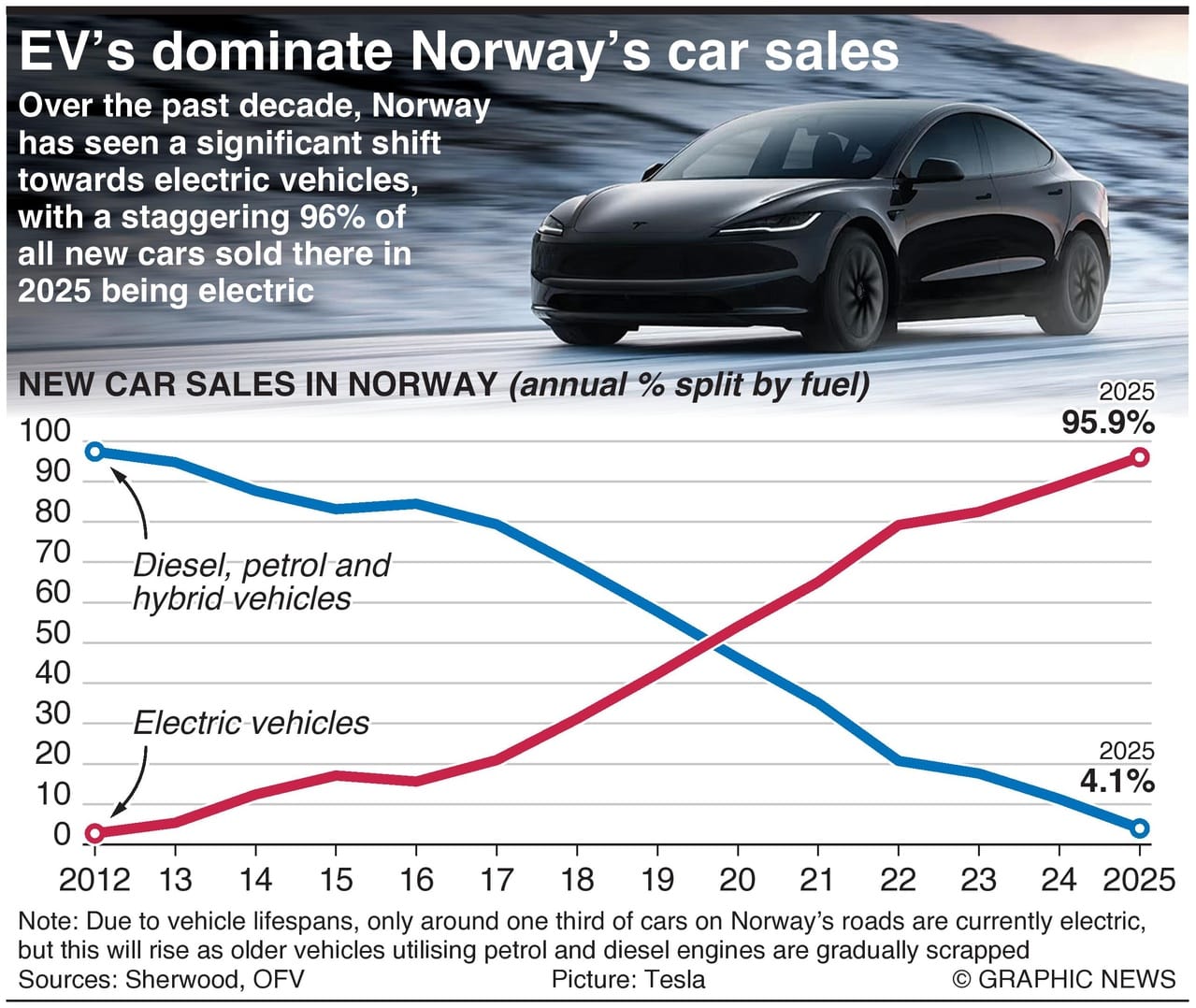

II. Nearly All New Cars Sold In Norway Are Now Electric

Over the past decade, Norway has seen a significant shift towards electric vehicles, with a staggering 96% of all new cars sold there in 2025 being electric.

editor-tippinsights@technometrica.com