Editor’s Note: The age of cheap trade with China is over. What began as economic interdependence is now a strategic chokehold. Beijing’s new weapon is not an army or a missile. It is the minerals without which modern life cannot function.

For decades, Western governments mollycoddled China. It was not naivety. It was a strategy. They believed that trade would tame ambition. They hoped prosperity would civilize power.

It was a comforting theory. It was also a catastrophic miscalculation.

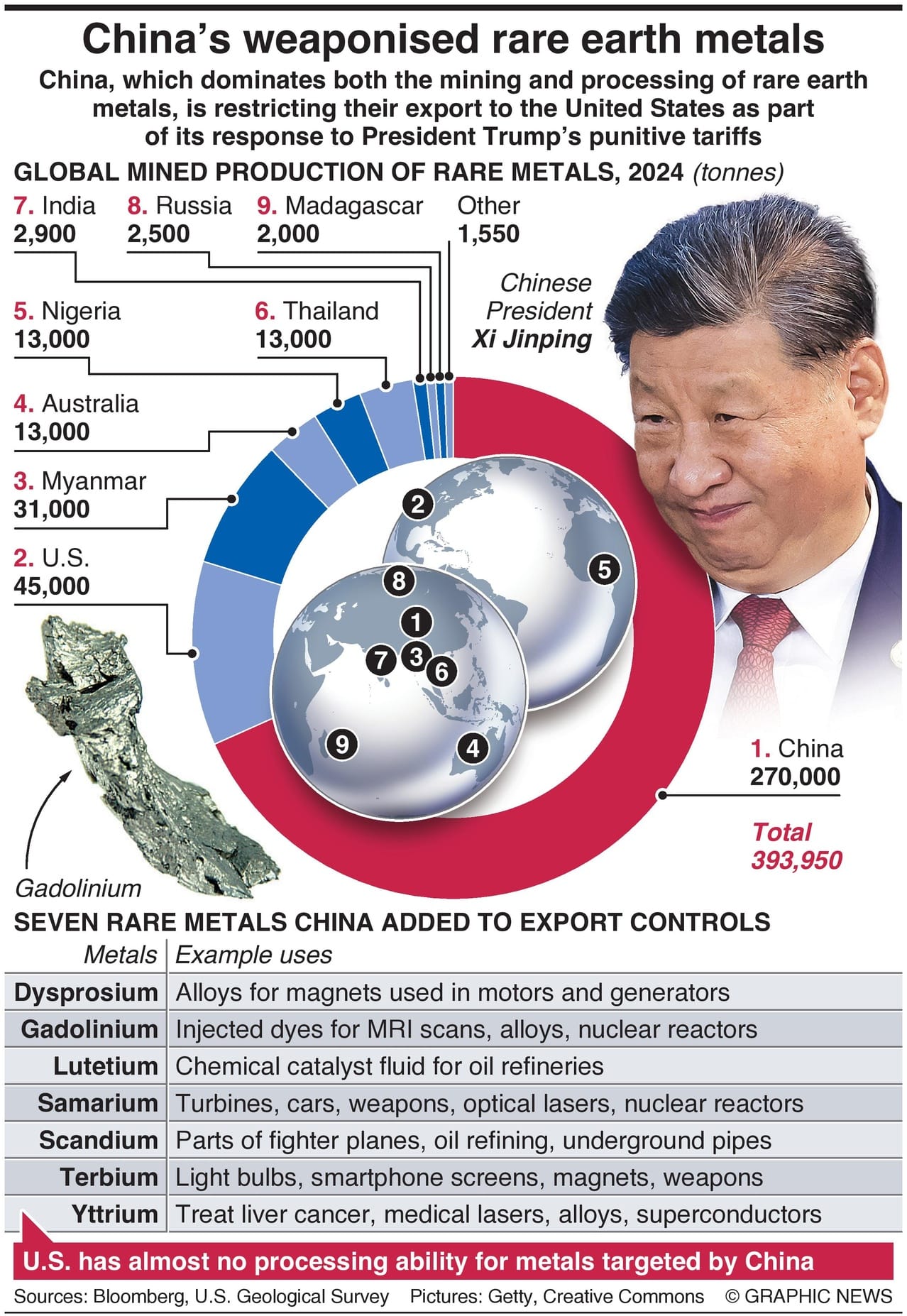

This week, Beijing unleashed the costly consequences of that mistake. It tightened its grip on rare earths, lithium-ion batteries, and other critical materials. It even extended that control beyond its borders. In short, China has turned its supply chains into a weapon.

The scope of these new restrictions is sweeping and deliberate. Their reach extends from pocket to battlefield.

Some of the newly restricted elements have direct military uses, including in laser targeting systems. Others, such as europium, are vital to everyday life, powering the screens of televisions and smartphones. Synthetic diamonds for industrial tools are now controlled, though those used in jewelry remain exempt.

Rare earths are at the heart of acoustic components, electric motors, and advanced batteries inside earphones, smartphones, and laptops. They are just as indispensable to missile guidance systems, sensors, and other defense technologies.

For China, the world’s dependence is no longer an accident; it is a weapon.

The scope of these restrictions is unprecedented. It no longer stops at China’s border. For example, a company in Düsseldorf that uses Chinese rare earths to make a magnet must now get Beijing’s permission before it can sell that product to the United States.

This is a new kind of control. China is not only deciding what it exports. It is deciding what others can trade, even when the final product is made elsewhere.

The timing is no accident. The Asia-Pacific Economic Cooperation (APEC) summit opens on October 31. Xi Jinping and Donald Trump are expected to meet on the sidelines. Exactly one month before that meeting, Beijing is raising the stakes. It is tightening its grip now, when leverage matters most.

The goal is obvious. It is to enter those talks from a position of strength. It is to extract concessions on tariffs, Taiwan, and other points of contention, before they sit down across the table. Beijing is also borrowing from Washington’s own playbook. For decades, the United States has used a mechanism known as the foreign direct product rule to extend export controls beyond its borders, restricting how foreign-made goods containing American technology are used. China is now doing the same. It is the first time Beijing has deployed a similar extraterritorial tool, turning a trade rule into a tool of coercion.

China has figured out that control is not only about armies or weapons. It is about resources, logistics, and influence. For more than two decades, Beijing has been securing access to the raw materials and infrastructure that give it substantial leverage.

It has leased cobalt and rare-earth mines in Africa and signed long-term deals for lithium and copper in South America. Beijing has poured billions into ports and railways from Sri Lanka to Kenya to Pakistan. These are not acts of charity. They are instruments of control.

The Belt and Road Initiative is the most obvious example. Under its banner, China built a port in Hambantota in Sri Lanka. When Colombo could not repay the loans, Beijing took control through a 99-year lease. It financed railways in Kenya that left the country heavily indebted. It built deep-water ports in Gwadar, Pakistan, and Djibouti on the Horn of Africa. Each project tightened China’s grip on global trade routes and resources.

This is the same strategy playing out in minerals and technology. Beijing knows that whoever controls the inputs controls the outcomes. And it is building a network that ensures the world’s most advanced economies cannot move without consent from China.

Its power rests not only on access to minerals but on its control of every stage of the supply chain, from mining to chemical separation to the fabrication of high-performance magnets. Decades of experience in rare-earth chemistry and metallurgy have given China a depth of industrial knowledge that rivals cannot quickly match, and its companies have filed tens of thousands of patents in the field, far more than those in the United States.

China’s looser environmental rules have also allowed its industry to grow without major interruptions, while projects in the United States and Europe have often stalled under stricter regulations. Operations at the Mountain Pass mine in California, for example, were halted after a toxic spill.

The chokehold is not static. As technology evolves, new dependencies will emerge. Quantum computing, for example, relies on rare isotopes like ytterbium-171 and on elements such as erbium and yttrium. These could become the next pressure points, leaving the West once again racing to catch up.

The uncomfortable truth is that the West is still deeply dependent on China. Years of rhetoric about decoupling have changed little on the ground. Most of the critical minerals that power American technology are mined, processed, or refined in China.

The United States has only one commercial-scale rare-earth magnet manufacturer, Noveon Magnetics. It still relies on China for raw materials. MP Materials, the only significant U.S. rare-earth miner, is trying to close that gap. It operates the Mountain Pass mine in California and plans to refine and manufacture magnets domestically. But that effort remains incomplete. The supply chain still depends on China at every critical step.

Even Apple’s $500 million partnership with MP Materials to recycle magnets in California could be hit. The new restrictions cover recycling technologies as well, tightening Beijing’s grip on what was supposed to be an escape route.

American companies and the Pentagon know the extent of the problem. Markets reacted swiftly. Chinese diamond producers surged, with shares of Henan Huanghe Whirlwind hitting their daily limit. Battery makers like CATL fell sharply, and lithium producers slid.

Western rare-earth companies rallied. Shares of Australia’s Lynas, the largest supplier outside China, have soared by more than 150 percent in six months. Beijing’s chokehold is reshaping investment and the global race for critical minerals.

Some suppliers have already walked away from projects rather than navigate Beijing’s new compliance rules. Others are warning of delays and shortages that will ripple through production lines. Even so, Western governments continue to act as if the problem can be managed with minor adjustments. It cannot.

A nation that does not control its supply chains does not control its destiny. And right now, the West is discovering what that means. Dependence is never neutral. It is weakness itself. It gives an adversary the power to dictate terms without firing a shot.

China is using its position to shape the balance of power in its favor. It is testing the will of the West before a single handshake in Seoul. It is showing that the future will not belong to those who build the best technology, but to those who control the materials that make the technology possible.

Governments are scrambling to respond. The Pentagon has taken a stake in MP Materials to secure a domestic magnet supply chain. Australia has funded new separation projects through companies like Iluka and Arafura. Japan and France are investing in refining capacity, and Belgium’s Solvay has built a rare-earth processing plant. These projects are still small compared with China’s dominance, but Beijing’s actions have made them necessary. Western investors now see rare earths not just as commodities, but as strategic assets.

Reducing exposure is essential, but so is building leverage. The more China depends on Western technology, finance, and advanced manufacturing tools, the harder it becomes for Beijing to weaponize its own resources. Mutual dependence can blunt the sharpest edge of the chokehold.

📘 TIPP’s Dragon Series

Explore China’s expanding reach and rising power through our exclusive editorial series:

- 🐉 The Dragon Learns To Fly

- 🐉 The Dragon’s Quest

- 🐉 Bear, Dragon, Eagle

- 🐉 Highway To The Danger Zone: The Dragon’s Gambit In The South China Sea

👉 Subscribe for $99/year to unlock the full Dragon Series and future deep-dive briefings from TIPP Insights.

The response must match the scale of the threat. Diversifying supply chains is no longer an industrial policy. It is a strategic imperative. Critical minerals must be treated with the same urgency as defense spending. Mining and refining capacity must be built at home and among trusted allies. Research must focus on substitutes and recycling technologies that reduce exposure to China’s control over critical materials.

Above all, Western leaders must stop pretending that time is on their side. It is not. Every year that passes without decisive action deepens the dependence and tightens Beijing’s grip.

Here lies the lesson of China 101. The Dragon’s chokehold is real. Breaking it will be difficult. But the alternative is far worse: a future where the free world must seek Beijing’s permission to power its economy, defend its territory, and secure its sovereignty.

🧠 TIPP Investing Weekly

Week Ending: October 10, 2025

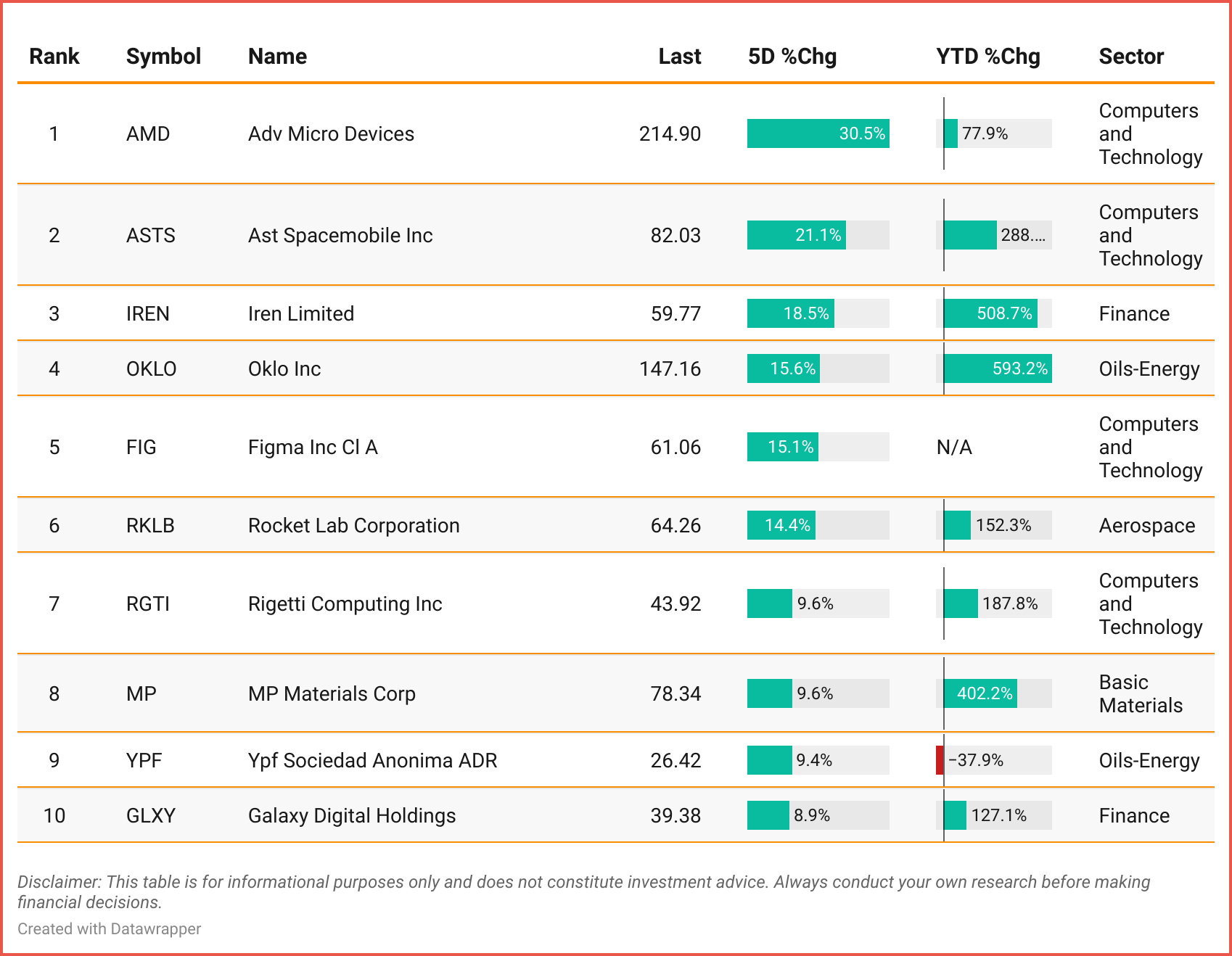

The Hot 10 Stocks 🔥

A data-driven look at the week’s 10 best-performing stocks — all trading above $20 with over 1M in volume.

Tickers: AMD| ASTS | IREN | OKLO | FIG | RKLB | RGTI| MP | YPF | GLXY

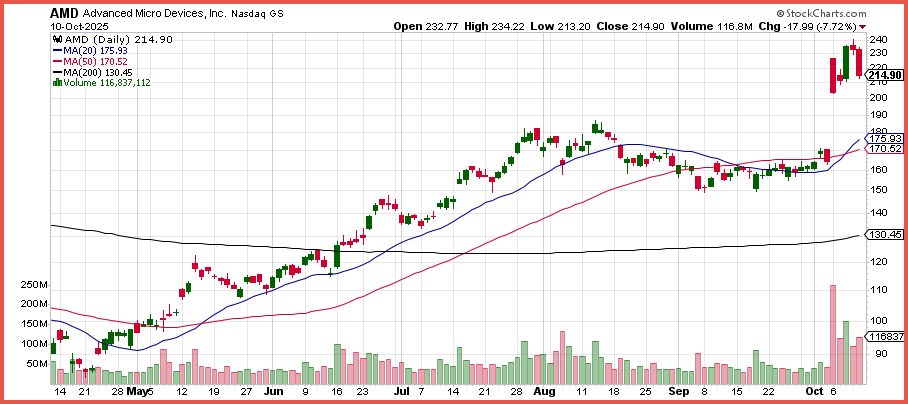

🔍 Stock to Watch: AMD

Advanced Micro Devices provides high-performance processors — CPUs, GPUs, FPGAs, and adaptive SoCs — powering computing from cloud to edge devices.

Access our Featured Stocks and TIPP Top-20 archives — exclusive to paid subscribers. Subscribe now → $99/year.

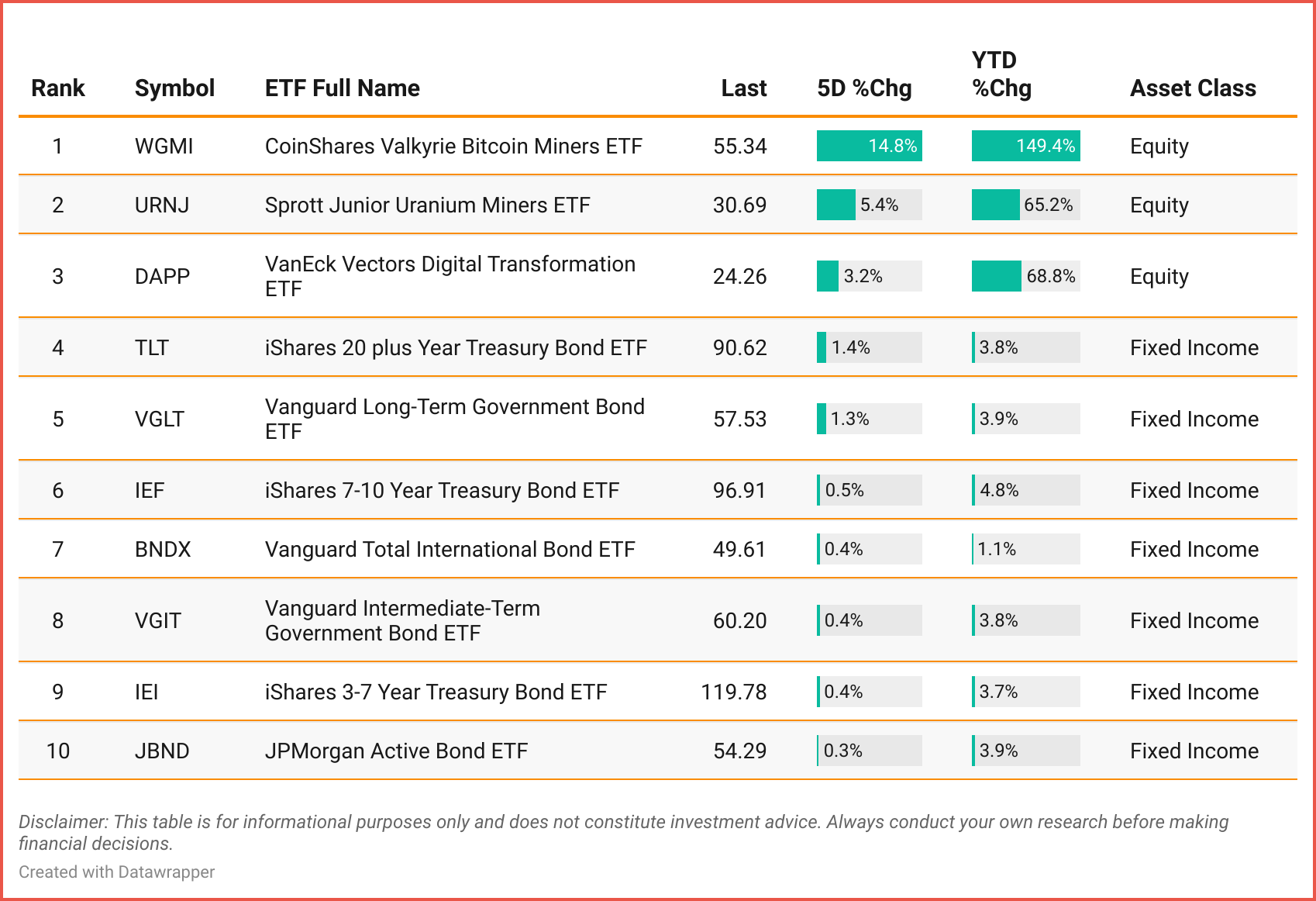

The Hot 10 ETFs 📈

A data-driven look at the 10 best-performing ETFs, all above $20 in price, with over 300K in average volume and $ 250 M+ in assets.

Tickers: WGMI | URNJ | DAPP | TLT | VGLT | IEF | BNDX | VGIT | IEI | JBND

📈 ETF to Watch: WGMI

The CoinShares Valkyrie Bitcoin Miners ETF seeks to provide investors with total return by investing in public companies in the bitcoin mining industry.

Market round-up in 5 minutes. We bring you up to speed. Subscribe to TIPP Insights for $99/year.

📅 Key Events This Week

🟠 Monday, October 13

No major economic releases scheduled.

🔵 Tuesday, October 14

12:20 – Fed Chair Powell Speaks

Remarks from the Fed Chair will be closely watched for policy signals and the economic outlook.

🟢 Wednesday, October 15

08:30 – Core CPI (MoM) (Sep)

Monthly inflation excluding food and energy.

08:30 – CPI (MoM) (Sep)

Headline consumer inflation.

08:30 – CPI (YoY) (Sep)

Annual inflation rate.

🟡 Thursday, October 16

08:30 – Core Retail Sales (MoM) (Sep)

Consumer spending excluding autos.

08:30 – Initial Jobless Claims

Weekly new unemployment filings.

08:30 – Philadelphia Fed Manufacturing Index (Oct)

Regional manufacturing activity.

08:30 – PPI (MoM) (Sep)

Producer price inflation.

08:30 – Retail Sales (MoM) (Sep)

Overall retail spending.

12:00 – Crude Oil Inventories

Weekly change in U.S. crude stockpiles.

🟠 Friday, October 17

08:30 – Average Hourly Earnings (MoM) (Sep)

Wage growth indicator.

08:30 – Nonfarm Payrolls (Sep)

U.S. job creation.

08:30 – Unemployment Rate (Sep)

Labor market health.