China believes that time heals everything. Five years have passed since COVID-19 erupted and convulsed the planet. Millions lost loved ones. Borders snapped shut. Economies buckled. And through it all, Xi Jinping remained behind the high walls of Zhongnanhai and rarely ventured beyond China’s borders.

Beijing has a reputation for bullying its neighbors and browbeating its critics. Over the years, its ambitions have continued to grow. The Chinese Communist Party aspires to one day shape the world beyond its shores, just as it now governs a nation of 1.4 billion. It seeks to shape the global order to its advantage and is steadily building the means to make that happen.

But time has not healed China’s image. If anything, the wounds have deepened. Around the world, trust in Beijing has eroded. The pandemic left scars that have not faded, and China’s behavior since has only reinforced suspicions.

Its threats against Taiwan, its punishment of trading partners, and its combative “wolf warrior” diplomacy have turned even former admirers into skeptics.

The dragon’s rise is real, but so is the resentment it now provokes.

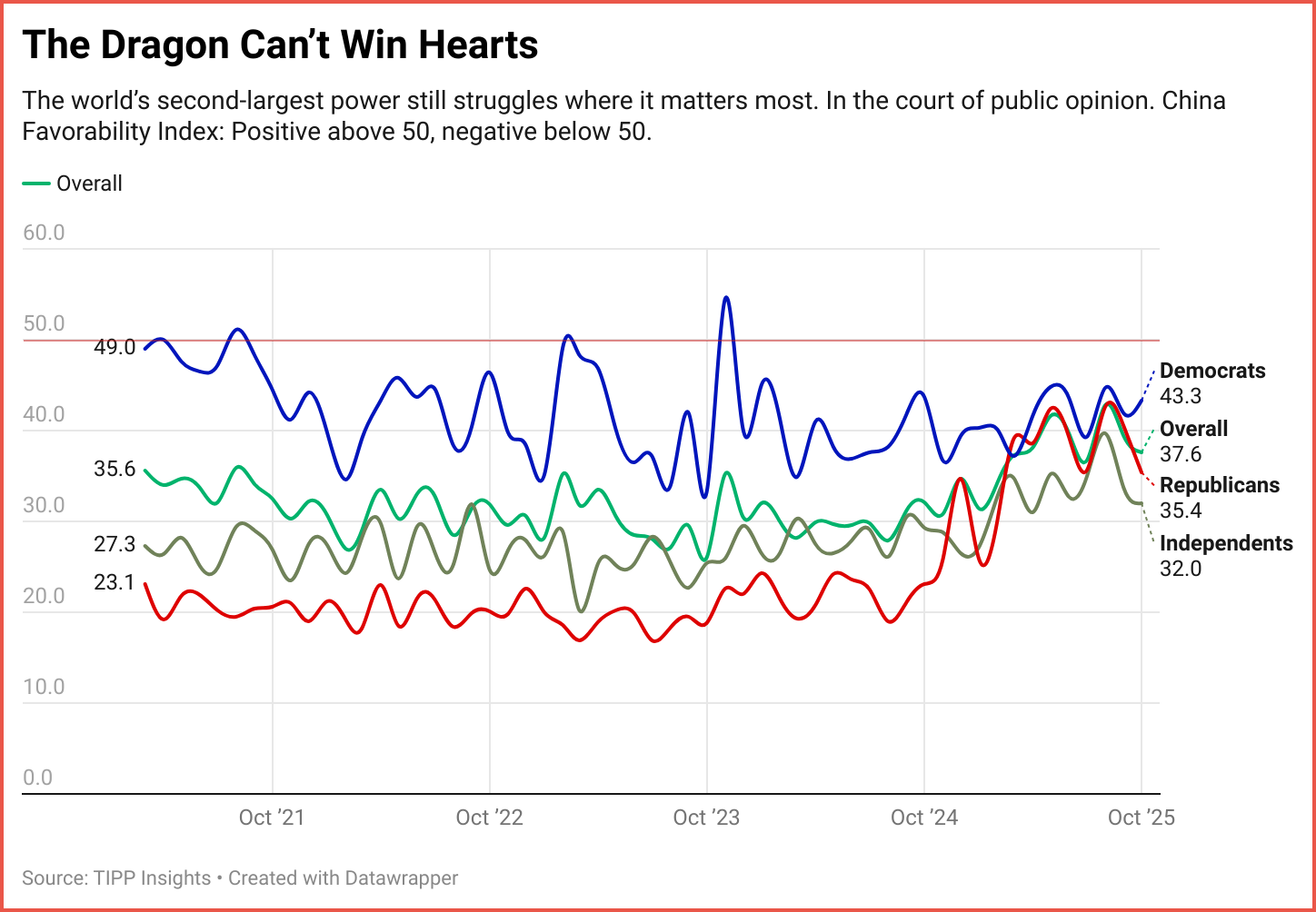

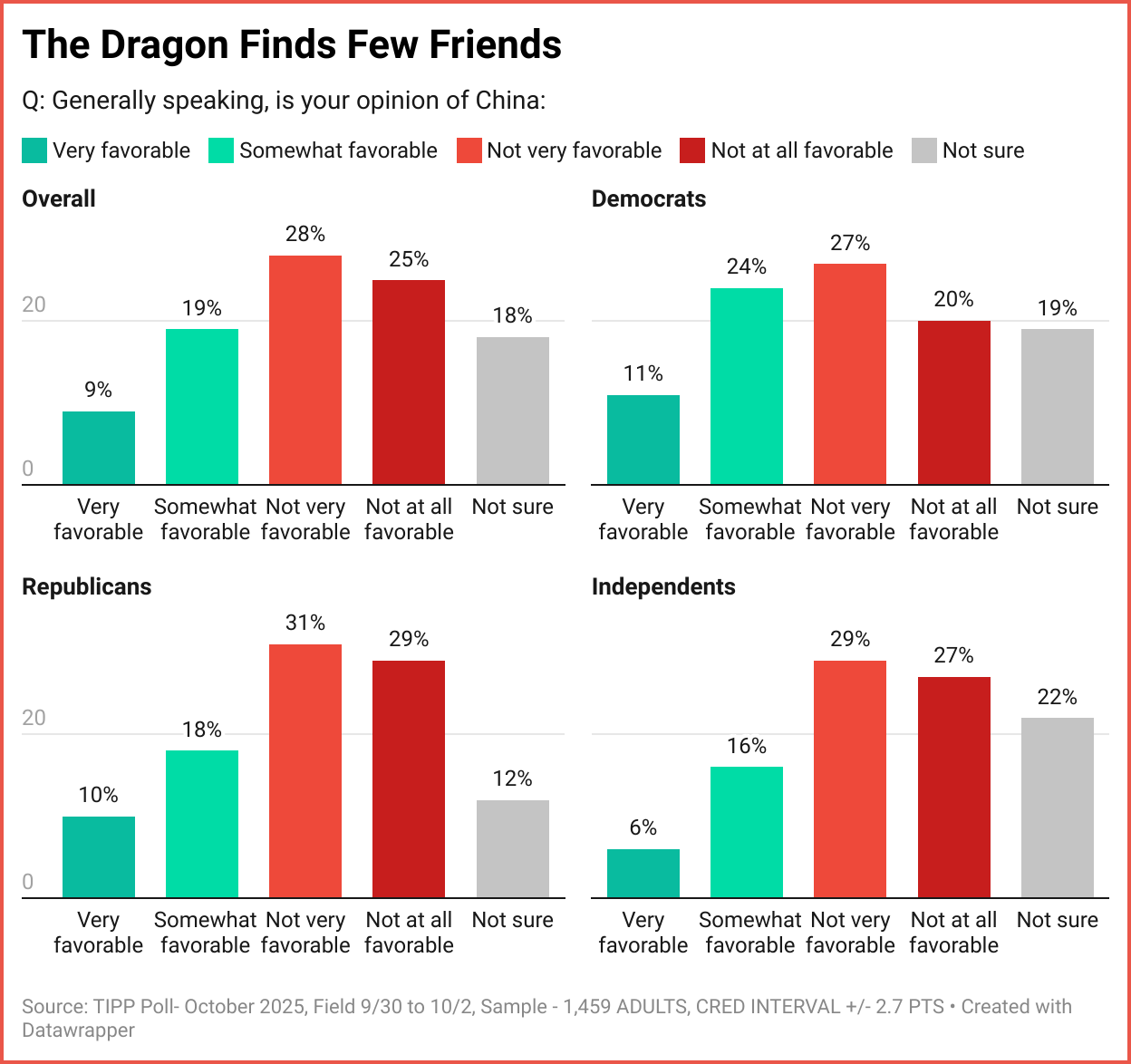

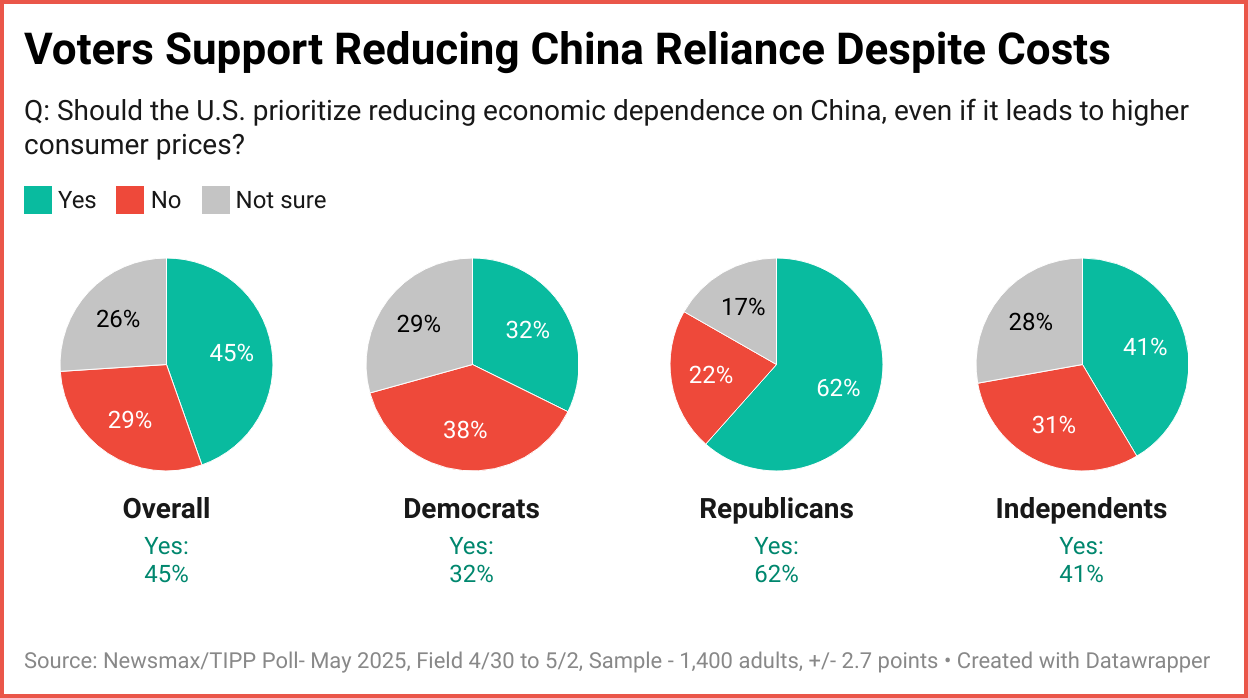

The survey numbers tell the story. Across party lines, Americans no longer view China as a partner to engage with, but rather as a rival to resist. Favorability ratings remain deeply negative. Most voters view Beijing with suspicion, and the mistrust extends beyond politics. It reflects a broader assessment of China’s intentions, values, and the threat it poses to the international order.

TIPP has been tracking China’s favorability every month since March 2021. The trend is unmistakable and unrelenting. Negative views of China have remained high throughout, and this month, only 27% of Americans report having a favorable opinion of the country. It is not a passing mood or a partisan reflex.

The data reveals how deep and persistent this distrust is. Month after month, Americans have rated China’s favorability negatively, and those numbers have shown little sign of recovery. It is a settled judgment that spans ideology, region, and generation. And it shows no sign of softening.

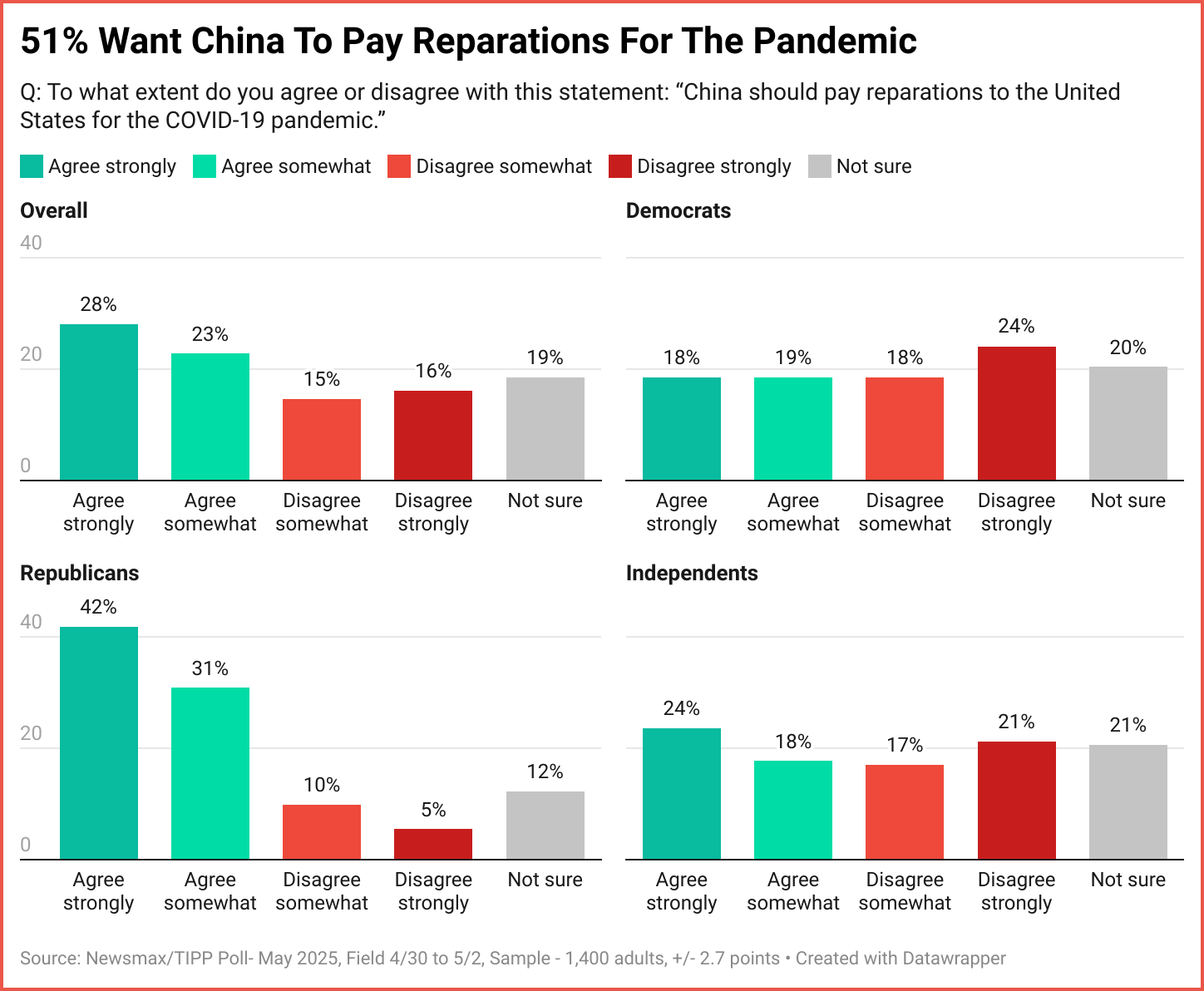

One reason this distrust runs so deep is the pandemic itself. More than five years later, anger over COVID-19 remains. If anything, it has hardened. A majority of Americans still believe China bears responsibility for unleashing the virus on the world, and more than half say Beijing should pay reparations for the damage it caused.

The memory of silenced doctors, vanished data, and stonewalled investigations continues to shape opinion. It is not just history. It is a lingering wound that defines how Americans view China today.

The pandemic was the breaking point, but the reaction has gone far beyond public health. Americans no longer see economic ties with China as benign. They see them as a source of vulnerability. Most now support reducing dependence on Chinese manufacturing, even if it means higher prices or disruptions at home.

📘 TIPP’s Dragon Series

Explore China’s expanding reach and rising power through our exclusive editorial series:

- 🐉 The Dragon’s Chokehold

- 🐉 The Dragon Learns To Fly

- 🐉 The Dragon’s Quest

- 🐉 Bear, Dragon, Eagle

- 🐉 Highway To The Danger Zone: The Dragon’s Gambit In The South China Sea

👉 Subscribe for $99/year to unlock the full Dragon Series and future deep-dive briefings from TIPP Insights.

That is a profound shift for a nation that once regarded global trade as an unquestioned good. It reflects a new consensus that strategic independence matters more than cheap imports, and that safeguarding national security is worth the economic cost.

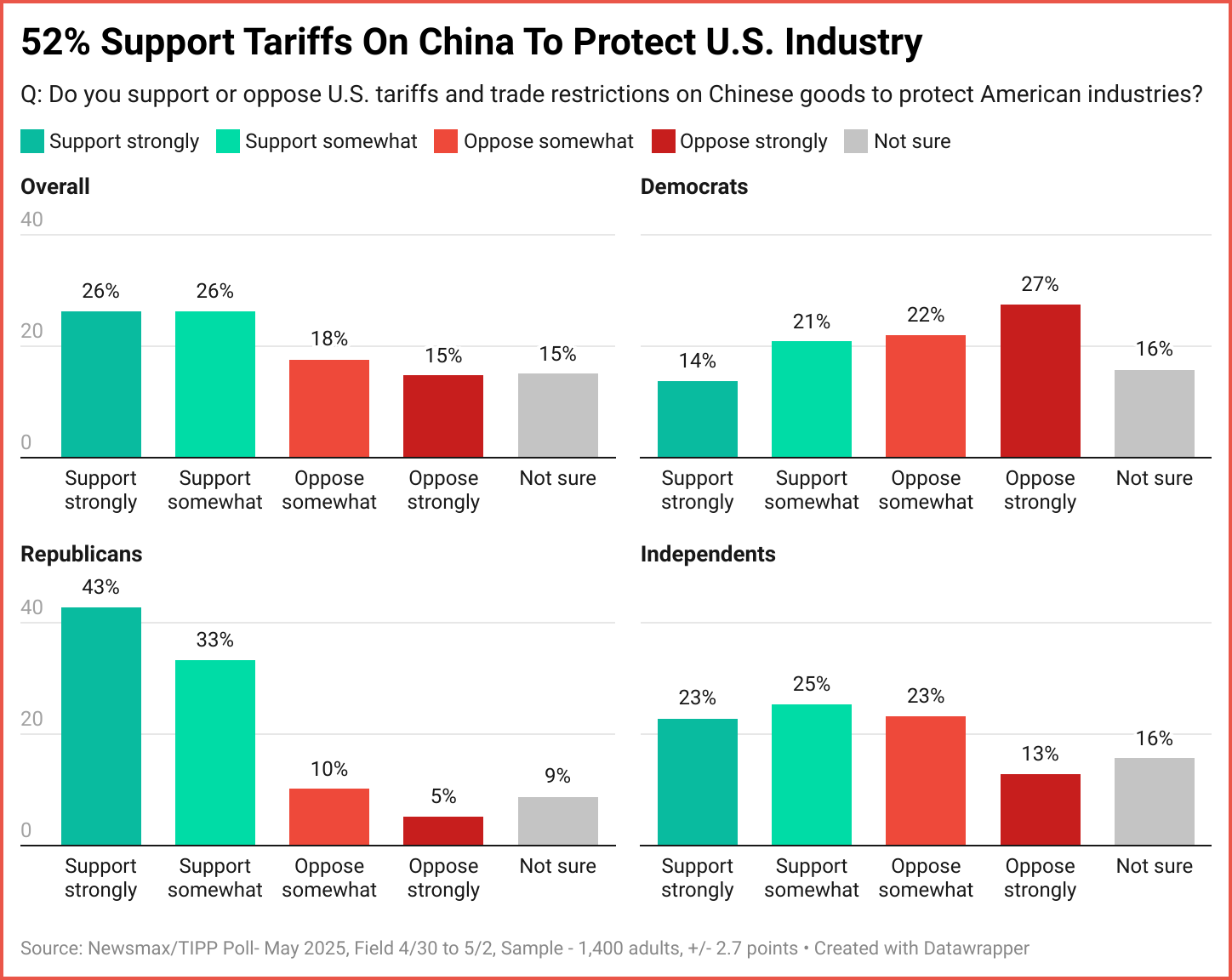

That sentiment now shapes policy. A majority of Americans support imposing tariffs on Chinese goods to protect U.S. industry, even as those tariffs raise costs for consumers. It is a remarkable reversal from the era of unfettered globalization, when low prices were the highest priority and economic interdependence was seen as a path to peace.

Today, voters are willing to pay more for products made in the United States or sourced from trusted partners. They see it as a price worth paying to reduce Beijing’s leverage.

China’s leaders still believe that time is on their side. They assume the world will forget the early lies about the pandemic, overlook the bullying of neighbors, and accept economic coercion as the price of prosperity. But the evidence tells a different story. The scars of COVID remain raw. The appetite for dependency has evaporated. The free world is more united than ever in its determination to limit China’s reach.

This is more than a shift in policy. It is a shift in mindset. Americans no longer view China as a misunderstood partner, but rather as a strategic rival that must be contained. They are prepared to pay higher prices, rebuild supply chains, and endure short-term costs to avoid long-term submission.

That leaves Beijing facing a challenge it cannot solve with propaganda or promises. Its factories may power the global economy, but they cannot manufacture trust. The dragon’s rise is real, but so is the backlash. And that backlash is reshaping the world order; this time, there may be no going back.

You can’t be a menace in your backyard and aspire to become a superpower. A nation distrusted by the world can never lead it.

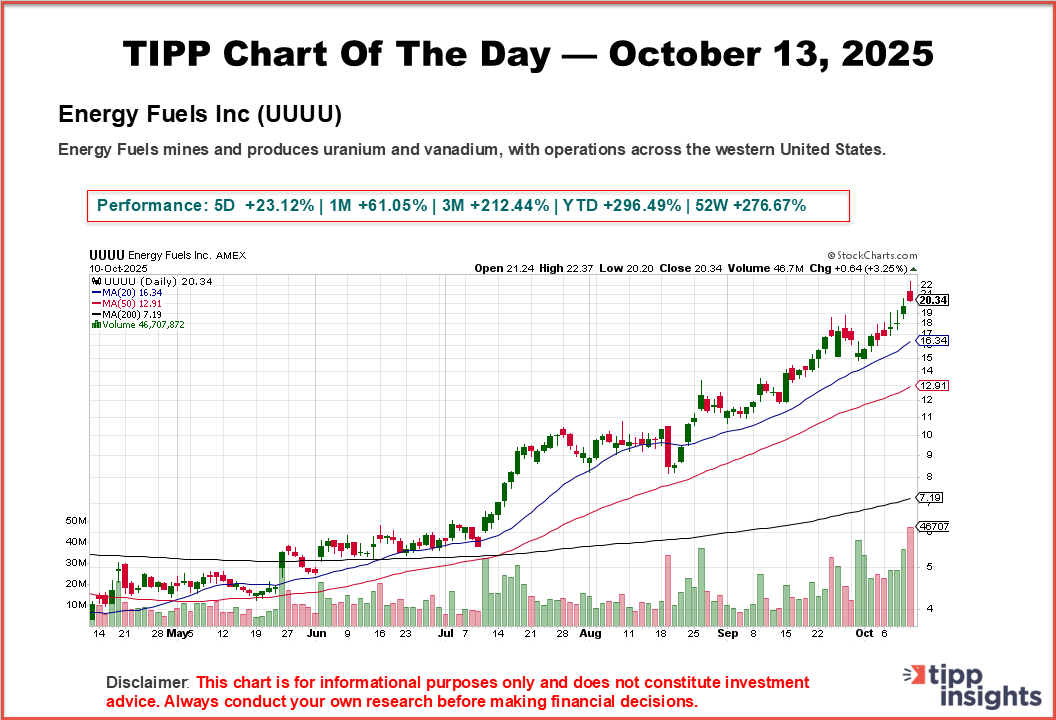

📊 Market Mood — Monday, October 13, 2025

🟢 Futures Surge on Softer Trade Tone

U.S. stock futures rallied as President Trump struck a more conciliatory note on China, saying Washington was not seeking to “hurt” Beijing. The shift eased fears of a tariff escalation and revived hopes that a planned Trump-Xi summit could offer a diplomatic off-ramp.

🟡 Trade Tensions Still Simmer

China’s exports rose 8.3% in September, beating expectations and showcasing resilience amid U.S. pressure. Still, new export curbs and Beijing’s refusal of a U.S. call highlight the risk of a deeper rift between the two largest economies.

🟣 Safe Havens Shine

Gold surged to a record near $4,100 an ounce as investors piled into safe-haven assets amid policy uncertainty. Despite Trump’s softer rhetoric, traders remain wary of sudden shifts in trade policy.

🔵 Oil Rebounds From Lows

Oil prices climbed after sliding to five-month lows last week, supported by optimism that trade tensions could cool and supply risks might ease. Signs of de-escalation in Gaza also lifted sentiment in energy markets.

Market round-up in 5 minutes. We bring you up to speed. Subscribe to TIPP Insights for $99/year.

📅 Key Events Today

🟧 Monday, October 13

No major economic releases scheduled.

Access our Featured Stocks and TIPP Top-20 archives — exclusive to paid subscribers. Subscribe now → $99/year.