If you thought the $61 billion in Ukraine funding that Washington approved over objections of the average American voter was helping the beleaguered country, think again.

Russia is steadily making advances in Ukraine's northeast, within striking distance of Kharkiv, Ukraine's second-most populated region. Speaking to ABC News, President Zelenskyy said that it was very clear that the delay in U.S. aid has had a direct impact on the war.

So, as we had predicted, Speaker Johnson got nothing for caving in. Not only did he lose support from within the GOP, but unbelievably, he and the rest of Washington are being blamed by the very beneficiaries of his decision. When one has friends like Zelenskyy, who needs enemies?

Meanwhile, with Putin's state visit to Beijing, Russia and China continue to strengthen their "no-limits" partnership, thumbing their noses at Secretary of State Blinken's and Treasury Secretary Janet Yellen's warnings about China's support for Russia.

If you thought that the West's failure at managing the war would have given it food for pause, think again. France is now openly talking about sending troops to Ukraine. And geniuses in America's financial industry are proposing even more creative ways of exacerbating the divide and helping Ukraine widen the conflict.

Ever since Russia attacked Ukraine in February 2022, America and the West have helped Kyiv counter the aggression across four fronts: Military and logistical aid, diplomatic support, a brutal sanctions regime, and currency weaponization.

The most potent tactic - and least understood - has been weaponizing the dollar and Euro against Russia. Last week, the New York Times released a trial balloon with a long article: Ukraine Needs Money to Fight. Can Seized Russian Assets Help? The piece discussed how Kyiv's supporters are contemplating using the interest earned by frozen Russian assets to help pay for weapons and postwar reconstruction.

The discussion focused on two aspects of the nearly $300 billion in Russian assets that the West has seized since the onset of the war. The first approach is relatively straightforward: use the assets—or rather take them—to pay Ukraine's expenses directly.

Seizing Russian assets carries various risks and potential consequences. It could further deteriorate relations between Russia and the Western countries, potentially escalating into a full-blown conflict that may prompt retaliatory actions from Russia, impacting global financial markets and creating instability. Furthermore, it may set a precedent that could be used against Western assets in the future. In our editorial last month, we pointed out the risks that such a move would trigger and how it would directly imperil America's global standing.

The second idea was to use the interest generated by the assets—about $3.5 billion a year— and transfer the funds directly to Ukraine.

The article also introduced a third idea through a novel financial engineering concept - the kind that brought America to its knees during the subprime mortgage crisis. The Times reported that Daleep Singh, a U.S. security adviser and a key architect of the Western sanctions on Russia, described the proposal last month in Kyiv. The report did not state how Western sanctions thus far have been a dismal failure if one considers how Russia's economy has continued to grow, Germany and the U.K. are in a recession, and countries of the Global South have revolted at the West's weaponization of their currencies.

Rather than take the interest from Russian assets and immediately consume it - a measly $3.5 billion each year - why not calculate the Net Present Value (NPV) of an asset that generates the same $3.5 billion in guaranteed cash flows and use that to finance Ukraine? The idea is similar to taking out a loan, where you receive a lump sum upfront and then pay it back with regular payments over time.

If it sounds like a head-scratching proposal that only a Wall Street financier can come up with, it is. So, let's explain.

The basic idea behind Net Present Value (NPV) is that a dollar earned in the future is worth less than a dollar earned today due to factors such as inflation and the opportunity cost of using the money elsewhere. NPV calculates the present value of all future cash flows generated by an investment, taking into account the time value of money.

NPV is widely used in capital budgeting and investment decision-making to assess the value of potential projects or investments and compare them to alternative options. It provides a method for businesses and investors to analyze the financial implications of an investment over time and make informed decisions based on the expected returns and risks involved.

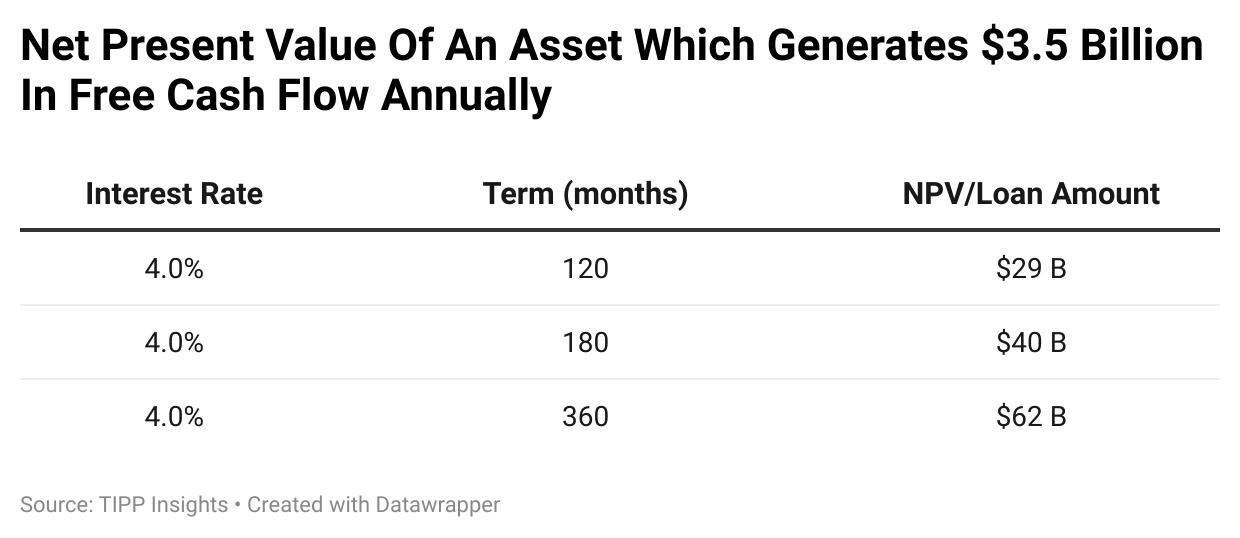

We ran three scenarios, each with a fixed interest rate of 4%, yielding about $3.5 billion in annual interest. We assumed that the term during which the West would continue to seize Russian interest earned would be ten years, 15 years, or 30 years. We calculated the equivalent asset amounts to be $29 billion, $40 billion, or $62 billion, respectively (see table below).

So, in the corridors of major banks and government agencies in Western capitals, our leaders are now talking about borrowing $62 billion more and sending to Ukraine's bottomless pot - money financed by seizing interest payments on Russian assets seized for the next thirty years - without thinking about how the world of geopolitics could forever change as a result.

If you are shaking your head in bewilderment at our leaders' lack of vision and inanity, you are not alone.