Despite being deeply polarized on most issues, Americans are united on the most important issue: the economy. They feel it sucks. Americans expect inflation to stay or worsen, interest rates to increase further, unemployment to rise, and taxes to increase over the next 12 months. That’s the key finding of a recent Golden/TIPP Poll of 1,370 Americans completed in early March, before the recent bank failures.

Bidenflation

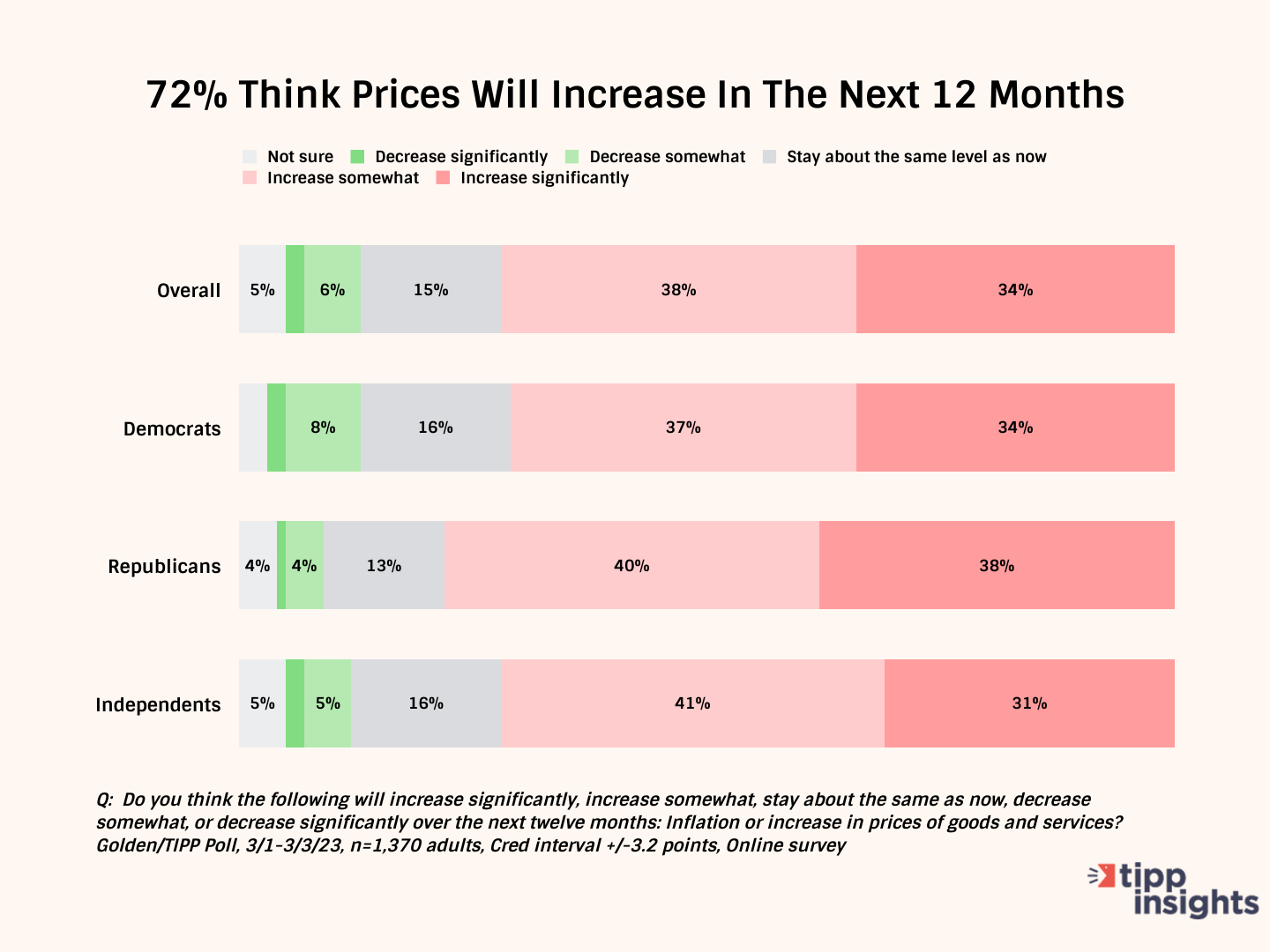

Seventy-two percent of those who participated in the survey think prices will increase in the next 12 months. While 34% believe prices will increase significantly, a similar share of 38% say it will increase somewhat. 71% of Democrats, 78% of Republicans, and 72% of independents expect to pay more.

Biden’s excessive spending and energy policies are the root causes of inflation, driving America’s economic malaise. The Fed's action to combat inflation has raised interest rates, resulting in bank failures.

Bidenflation, the rise in prices since Biden took office, measured by the TIPP CPI, is 14.4%. Even though Consumer Price Index (CPI) inflation measured year-over-year is much lower at 6.0%, Americans struggle to cope with price increases.

The CPI inflation rate mutes the real pain as it is on the heels of another 6.0% real increase between 2021-2022. The velocity of a 14% rise in 24 months is a fact that the administration conveniently ignores. One can’t say you can forget about 2021-2022 since the increase was digested already by the economy, and we look back only on the past 12 months. We are yet to see an economist address this issue.

Interest Rates

The Fed is mandated to keep inflation close to 2% while also managing to nudge America as close to full employment as possible. To slow down inflation, the Fed has a limited, blunt toolset designed to siphon money from the economy.

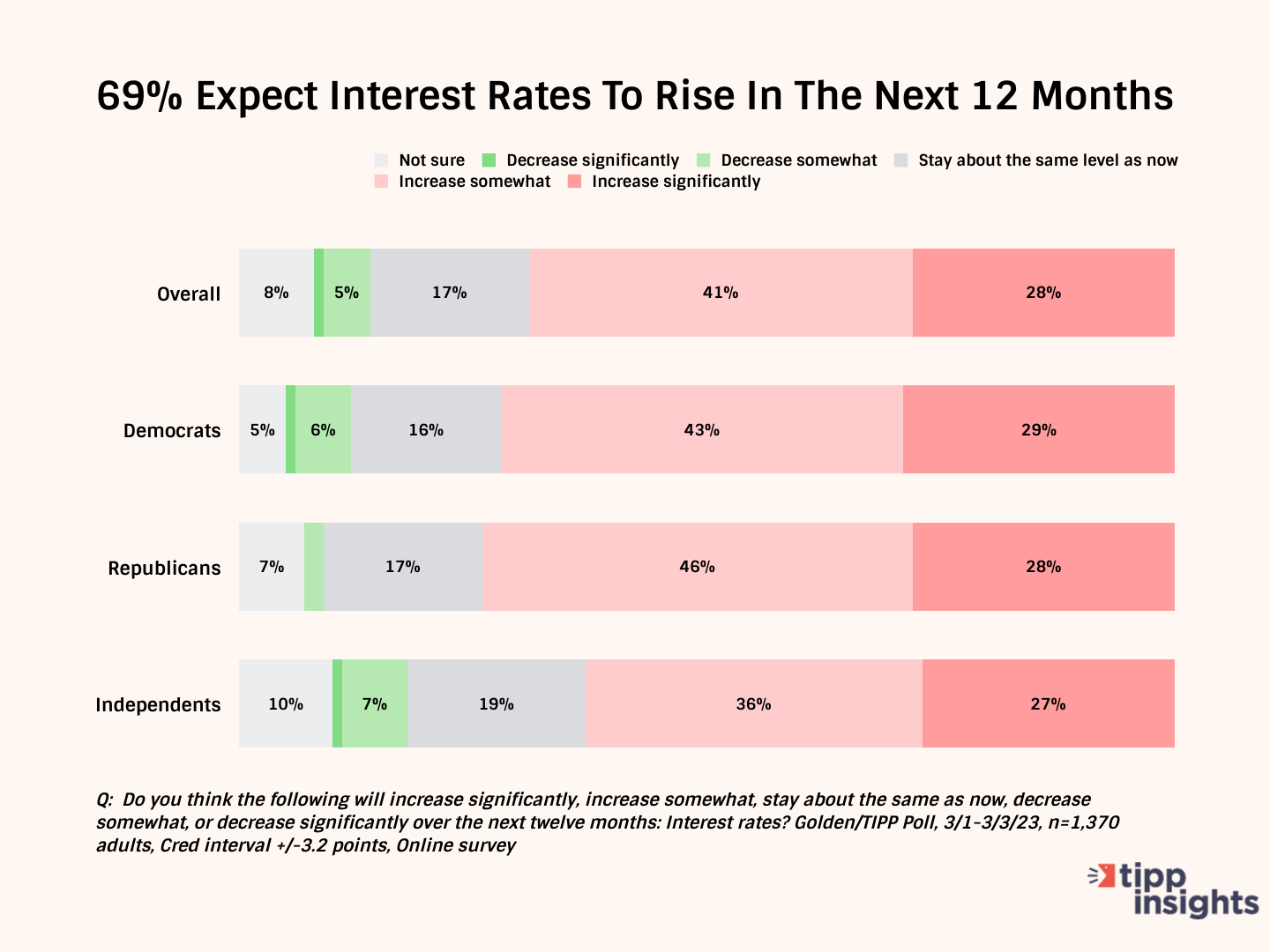

Over two-thirds expect interest rates to rise in the next 12 months. While 28% expect interest rates to increase significantly, 41% think they will increase somewhat. 72% of Democrats, 74% of Republicans, and 63% of independents share the opinion.

Unemployment

The biggest conundrum for the Fed is that the employment market has been surprisingly strong despite rapid increases in interest rates, confounding economic experts. As the Fed further ratchets up interest rates, the economy will likely plunge into a recession as banks restrict lending to shore up reserves. This would result in unemployment beginning to increase.

The Tech Sector is laying off workers daily.

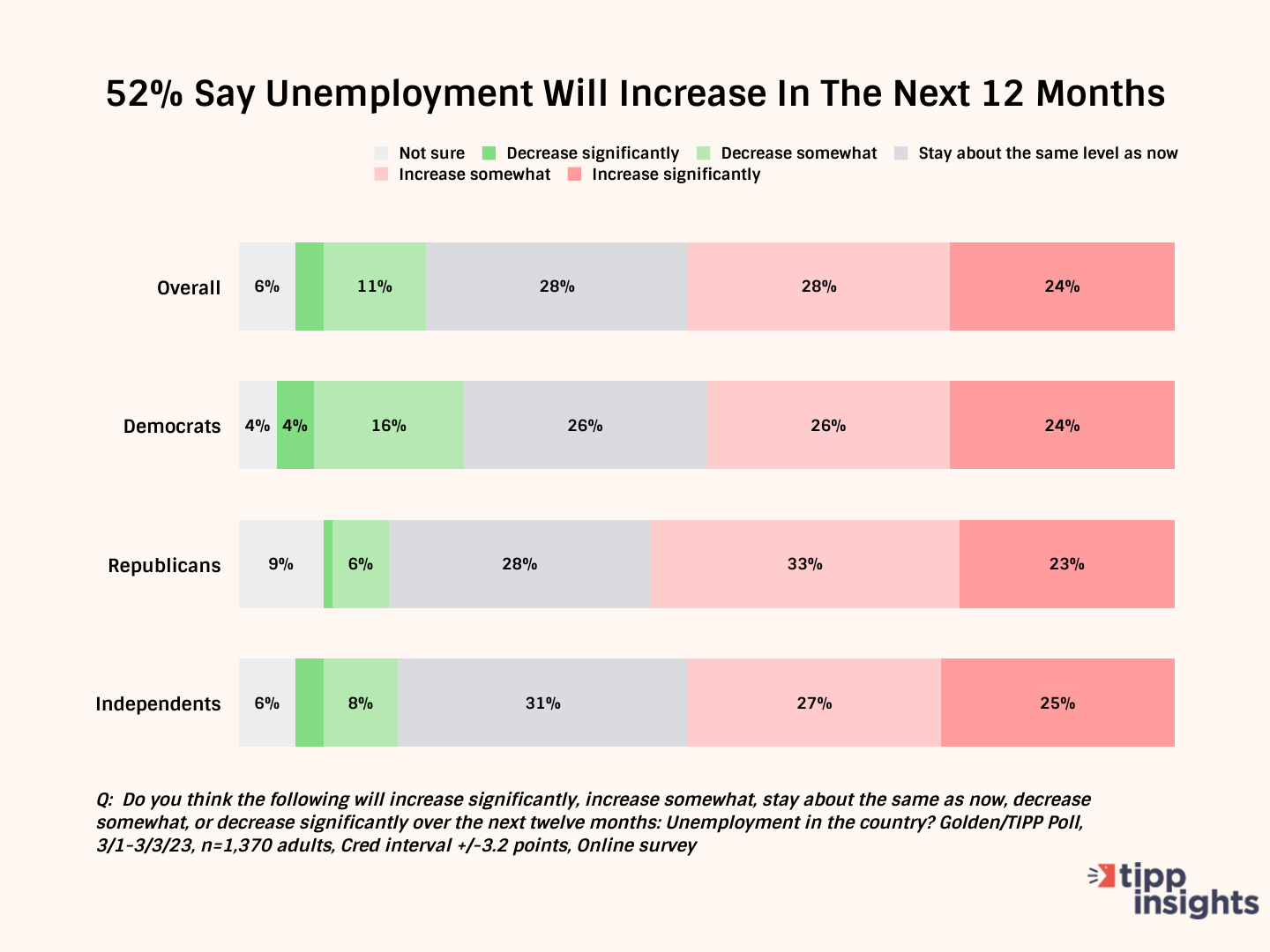

Over one in two (52%) believe unemployment will increase in the next 12 months, including 50% of Democrats, 56% of Republicans, and 52% of independents.

Taxes

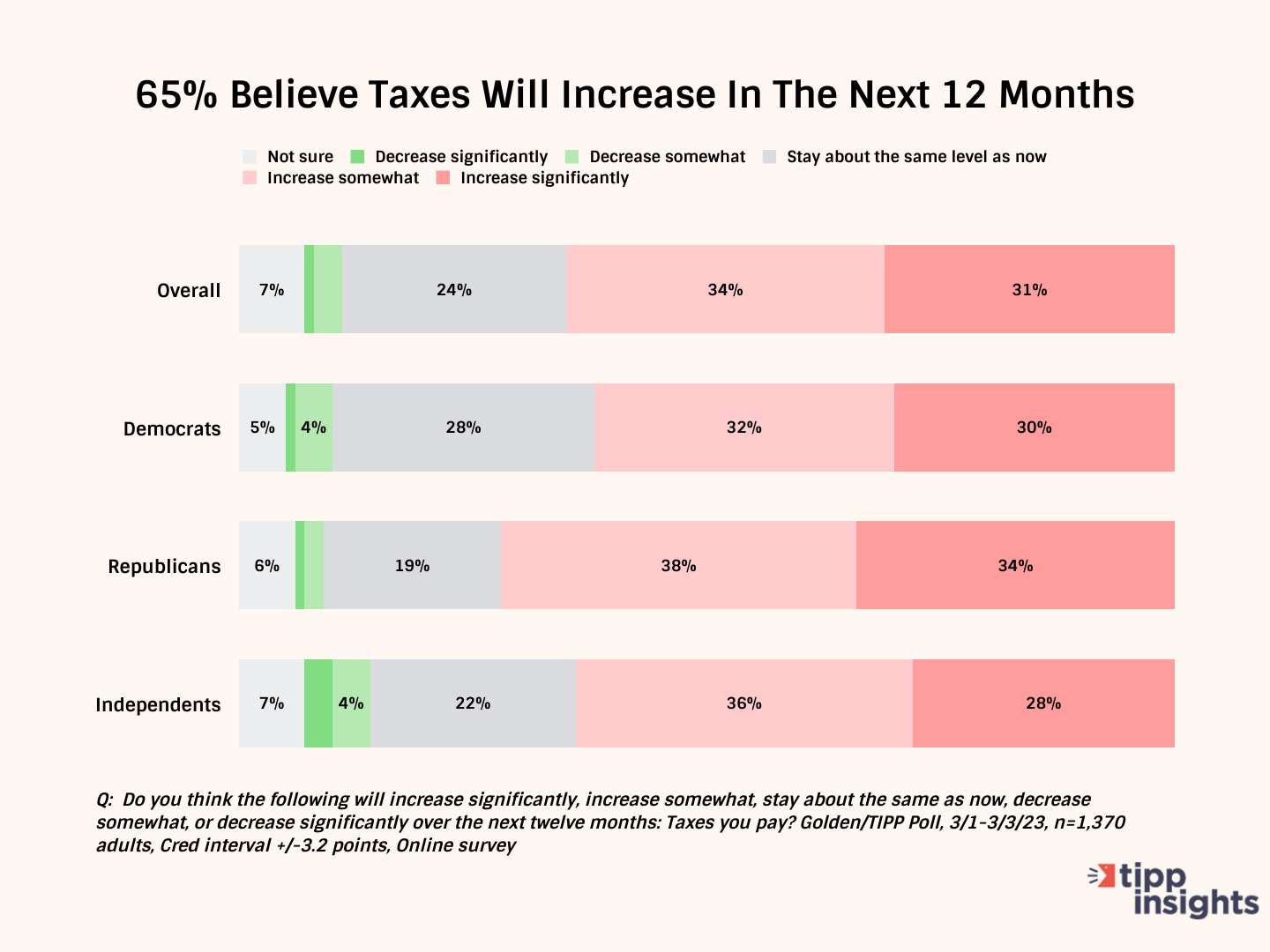

Taxes are mother’s milk for Washington. Nearly two-thirds (65%) expect taxes to increase in the next 12 months. A majority from all political stripes: 62% of Democrats, 72% of Republicans, and 64% of independents anticipate tax hikes.

We are all guinea pigs in the economic lab of the Fed and politicians.

The nation’s debt is skyrocketing, hovering at $31.5 trillion; each household owes $238K. The debt is 123% of the GDP of $25.5 trillion and increasing steadily even without new spending programs because the cost to service the debt is rising with higher interest rates.

Washington is addicted to debt and cannot wean itself from it. Janet Yellen, the treasury secretary, won’t say when the debt will become unsustainable. The revered economist, who promoted transitory inflation theory in 2021, wants to paint a rosy picture and considers 1% of GDP for interest payments reasonable. No politician, be it Republican or Democrat, has a plan for how to cut the nation’s debt.

We recently learned that 200 banks might be on shaky foundations because of the $620 billion hole in the banking sector due to bond investment losses. The government’s main goal is to limit bank runs on customer deposits. The FDIC does not grow money on trees; to stem the banking contagion and bail out the banking sector, ultimately, taxpayers may have to pony up money – an extremely unpopular political move.

We blew a trillion in the Iraq war; we are now on tap for another $700 billion for Ukraine reconstruction. The mighty Petrodollar is giving way to Petroyuan.

America’s fiscal profligacy comes with a price: weakening national security with the China-Russia-Iran-North Korea axis challenging America daily.

In the meantime, we continue to slog to put food on the table and feed the beast - Washington. May God Bless America!

Want to dig deeper? Download data from our store for a small fee!

Like our insights? Show your support by becoming a paid subscriber!

Can't resist showing your appreciation? Donate

Related Video

Please email editor-tippinsights@technometrica.com