Three weeks into her premiership, British Prime Minister Liz Truss finds herself scrambling to stay ahead of events as market reaction to her plan to increase government borrowing to pay for tax cuts slashes the pound to an all-time low.

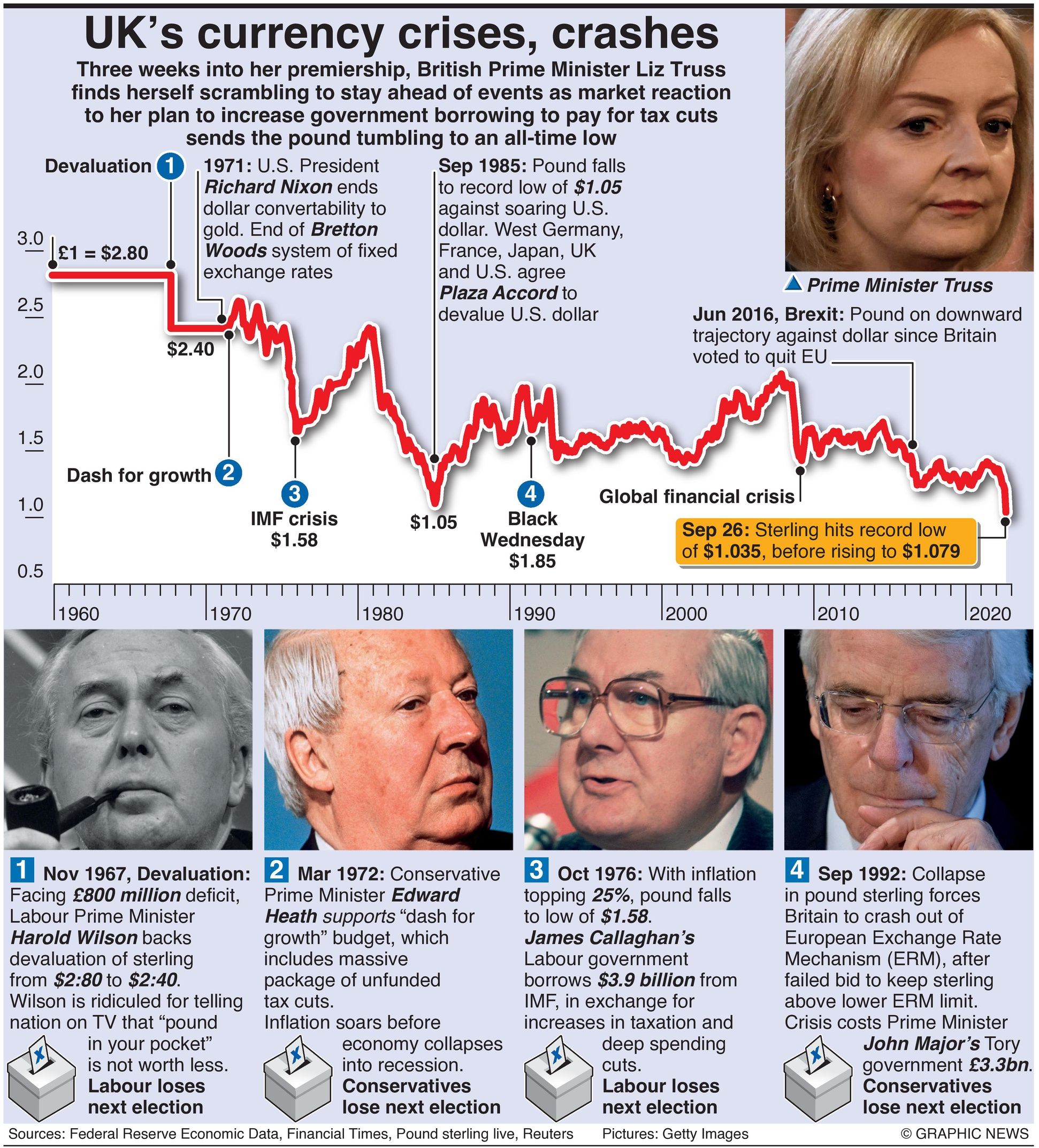

On Monday (September 26, 2022), the pound plummeted to $1.035 to the dollar but rallied slightly later.

Chancellor Kwasi Kwarteng issued an emergency statement late Monday promising a fresh package of supply-side reforms over the coming weeks and a fully costed “fiscal plan” on November 23 to get UK debt levels falling.

The economic turmoil set Conservative MPs’ nerves jangling, fearing their party’s reputation for sound financial management is now at serious risk.

“Very worried,” said one of the many Tory MPs who backed Truss’ opponent, Rishi Sunak, in the leadership contest. “It’s the effect on interest rates that scares the bejeezus out of me. If you think things are bad now, just wait till we see home repossessions.”

“It’s worse than Black Wednesday,” said another Sunak-backing Tory MP, referring to the sterling crisis of September 1992. “This is self-inflicted and without a mandate, whereas at least [Black Wednesday] was perceived as a bid to manage a crisis.”

One former minister who backed Truss in her leadership bid said the decision not to publish official economic forecasts alongside last week’s tax cuts was “a bit of an own goal.”

“The Chancellor should have set out the fiscal position last week,” the MP said. “Markets hate uncertainty.”

“You can’t just borrow your way to a low-tax economy,” former Tory Chancellor George Osborne told Channel 4 News. “Fundamentally, the schizophrenia has to be resolved -- you can’t have small-state taxes and big-state spending.”