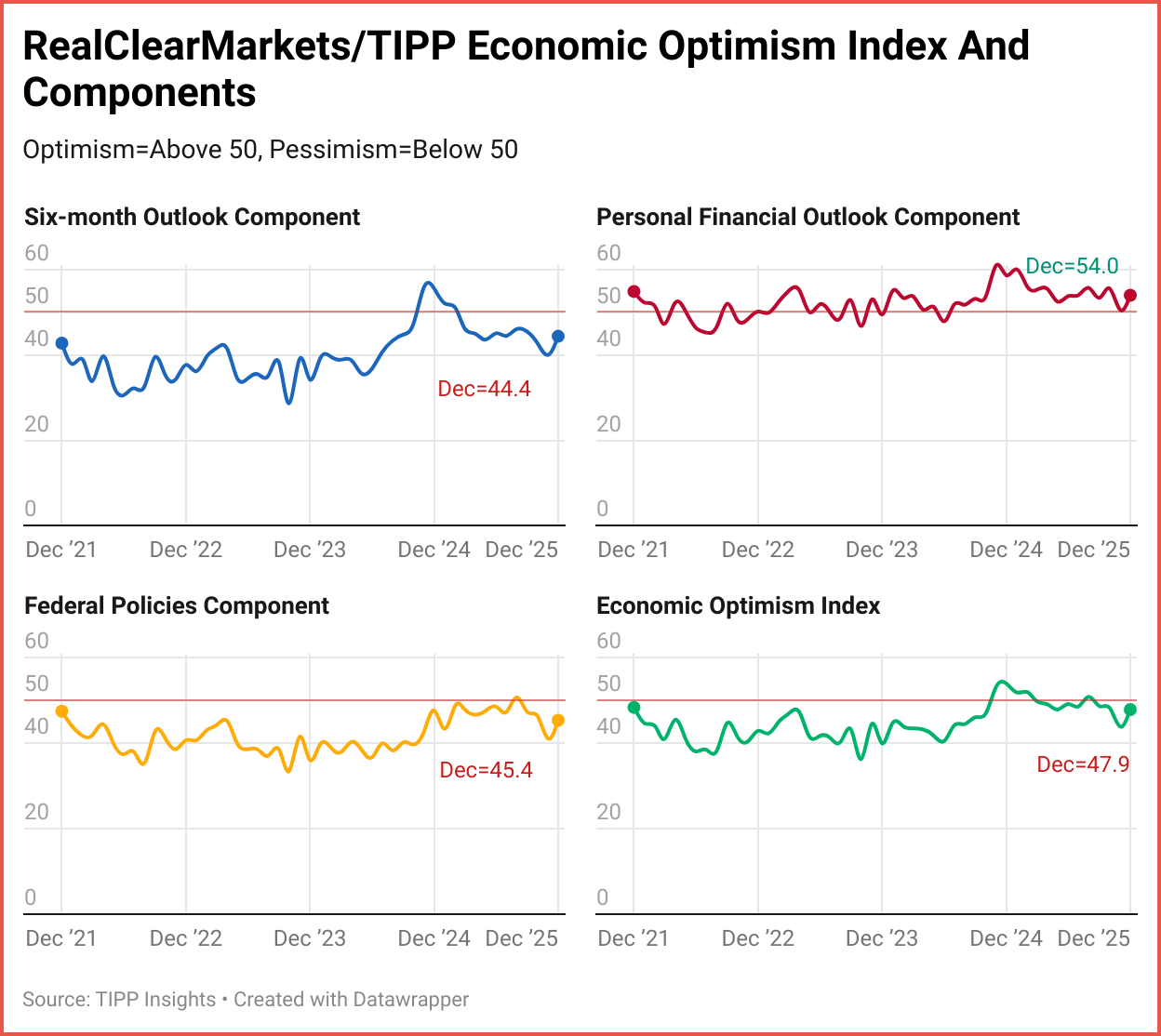

Consumer sentiment improved in December, as the RealClearMarkets/TIPP Economic Optimism Index, the first monthly read on U.S. consumer confidence, rose from 43.9 in November to 47.9, a robust 4.0 points or 9.1 percent gain. Still, the index stayed below the neutral 50 level for the fourth straight month, keeping the nation in what we classify as the pessimistic zone.

December’s reading of 47.9 is 2.5 percent below the 299-month historical average of 49.1, which shows that confidence is strengthening but not fully restored.

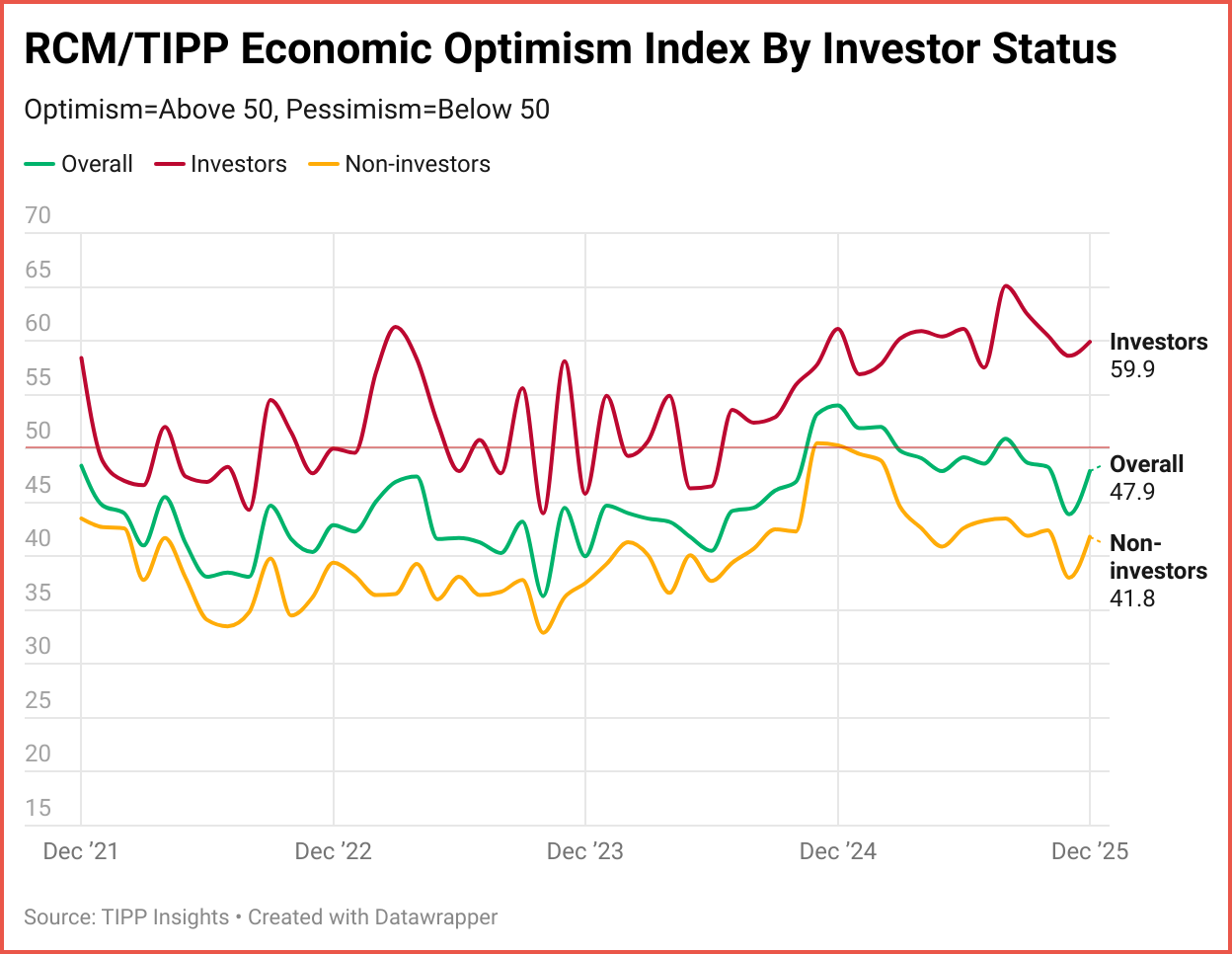

Investor confidence gained 2.2% (1.3 points) to 59.9 in December, while non-investor confidence improved 9.1% (3.8 points) to 41.8.

Explore the data in real time: Track the RCM/TIPP Economic Optimism Index on RealClearMarkets. View monthly trends, compare components, and analyze shifts in sentiment across demographics.

The RCM/TIPP Economic Optimism Index is the first monthly measure of consumer confidence. It has established a strong track record of foreshadowing the confidence indicators issued later each month by the University of Michigan and The Conference Board. (From February 2001 to October 2023, TIPP released this Index monthly in collaboration with its former sponsor and media partner, Investor's Business Daily.)

RCM/TIPP surveyed 1,483 adults from November 25 to 29 for the December Index, using TIPP’s panel network; results have a range of 0–100, with readings above 50 indicating optimism, below 50 signaling pessimism, and 50 considered neutral. A more detailed methodology is available here.

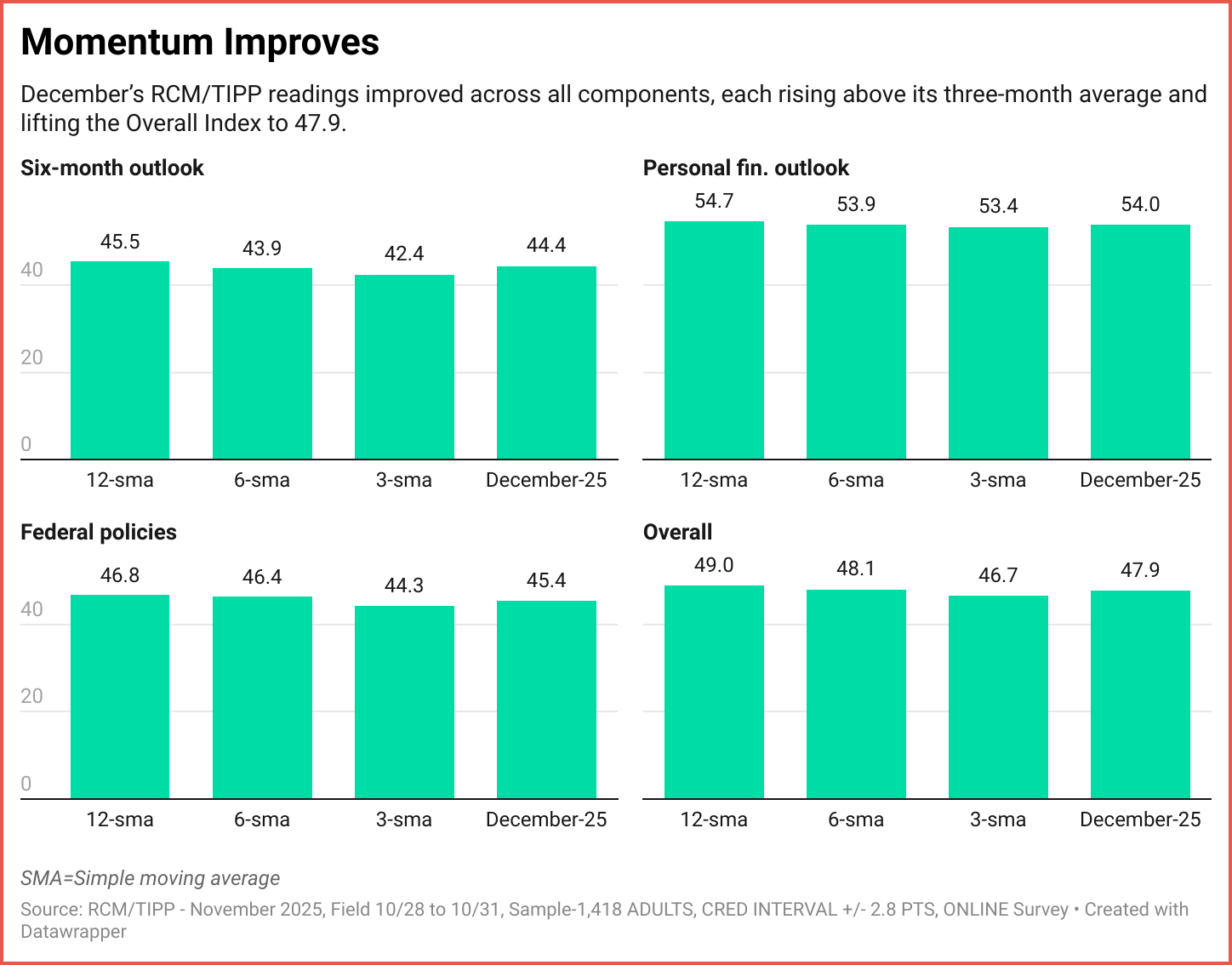

The RCM/TIPP Economic Optimism Index has three key components. In December, all of them improved.

- The Six-Month Economic Outlook, which measures how consumers perceive the economy's prospects in the next six months, gained 11.0%, from 40.0 in November to 44.4 in December.

- The Personal Financial Outlook, a measure of how Americans feel about their own finances in the next six months, rose 6.7% from its previous reading of 50.6 in November to 54.0 this month.

- Confidence in Federal Economic Policies, a proprietary RCM/TIPP measure of views on the effectiveness of government economic policies, increased to 45.4 in December from 41.1 in November, a 10.5% gain.

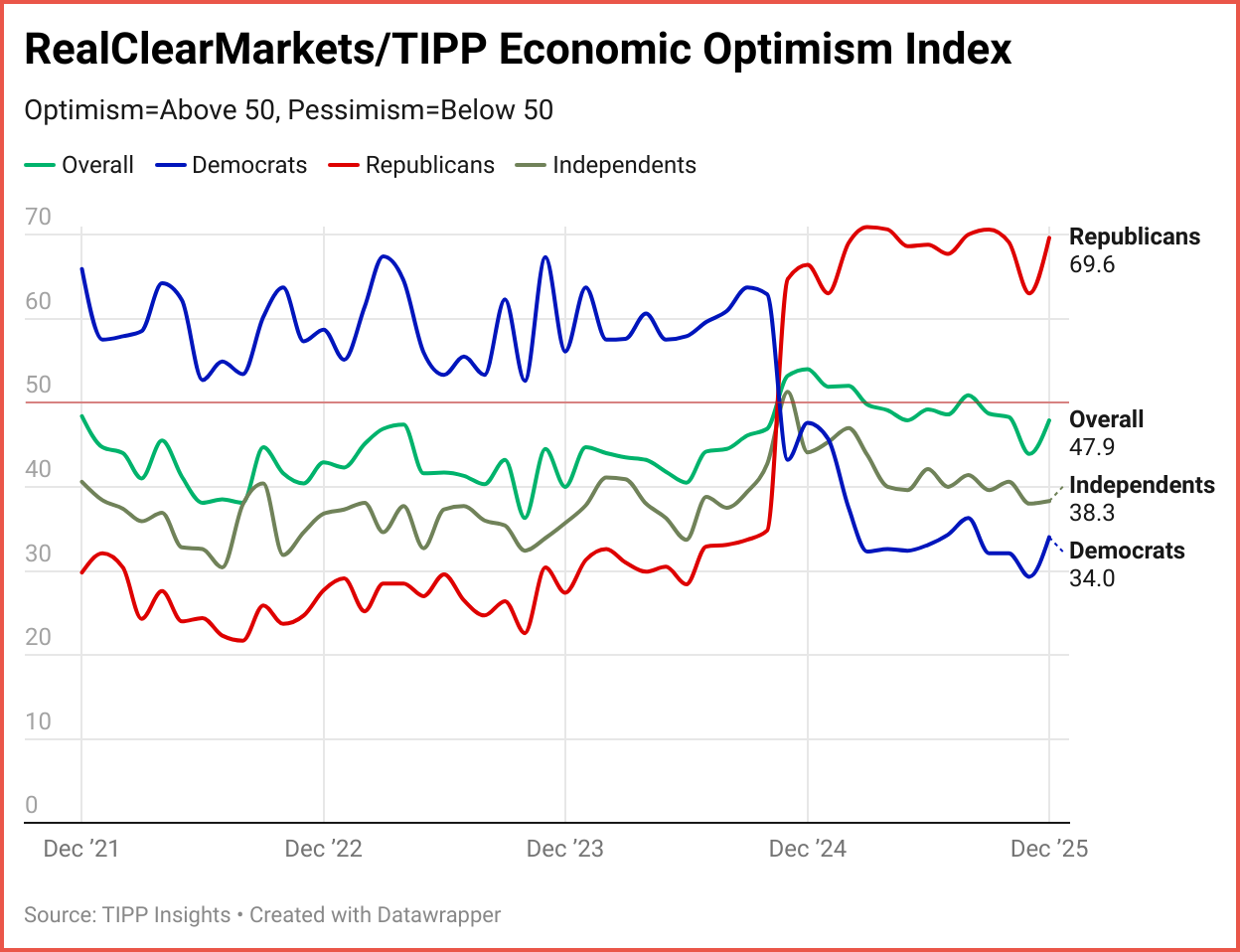

Party Dynamics

Since President Trump’s election as the 47th President, Democrats’ confidence has plunged to 34.0, Republicans’ confidence has soared to 69.6, and independents, after briefly turning optimistic for the first time in nearly five years, have slipped back to 38.3.

Investor Confidence

Respondents are considered "investors" if they currently have at least $10,000 invested in the stock market, either personally or jointly with a spouse, directly or through a retirement plan. One-third (32%) of respondents met this criterion, and 63% were classified as non-investors. We were unable to determine the status of five percent of respondents.

Investor confidence improved 2.2% (1.3 points) to 59.9 in December, while non-investor confidence gained 9.1% (3.8 points) to 41.8. The confidence gap between investors and non-investors widened from 20.6 to 18.1 points.

Momentum

The Optimism Index rose to 47.9 in December, above its three-month average of 46.7. The Six-Month Outlook improved to 44.4, surpassing both its three- and six-month benchmarks. The Personal Financial Outlook strengthened to 54.0, also running ahead of its short-term averages, while confidence in federal policies increased to 45.4, moving back above recent trend levels. Taken together, the data point to a broad pickup in momentum across key indicators.

Get sharp, original analysis on investor confidence and market trends. Full access → $99/year.

Demographic Analysis

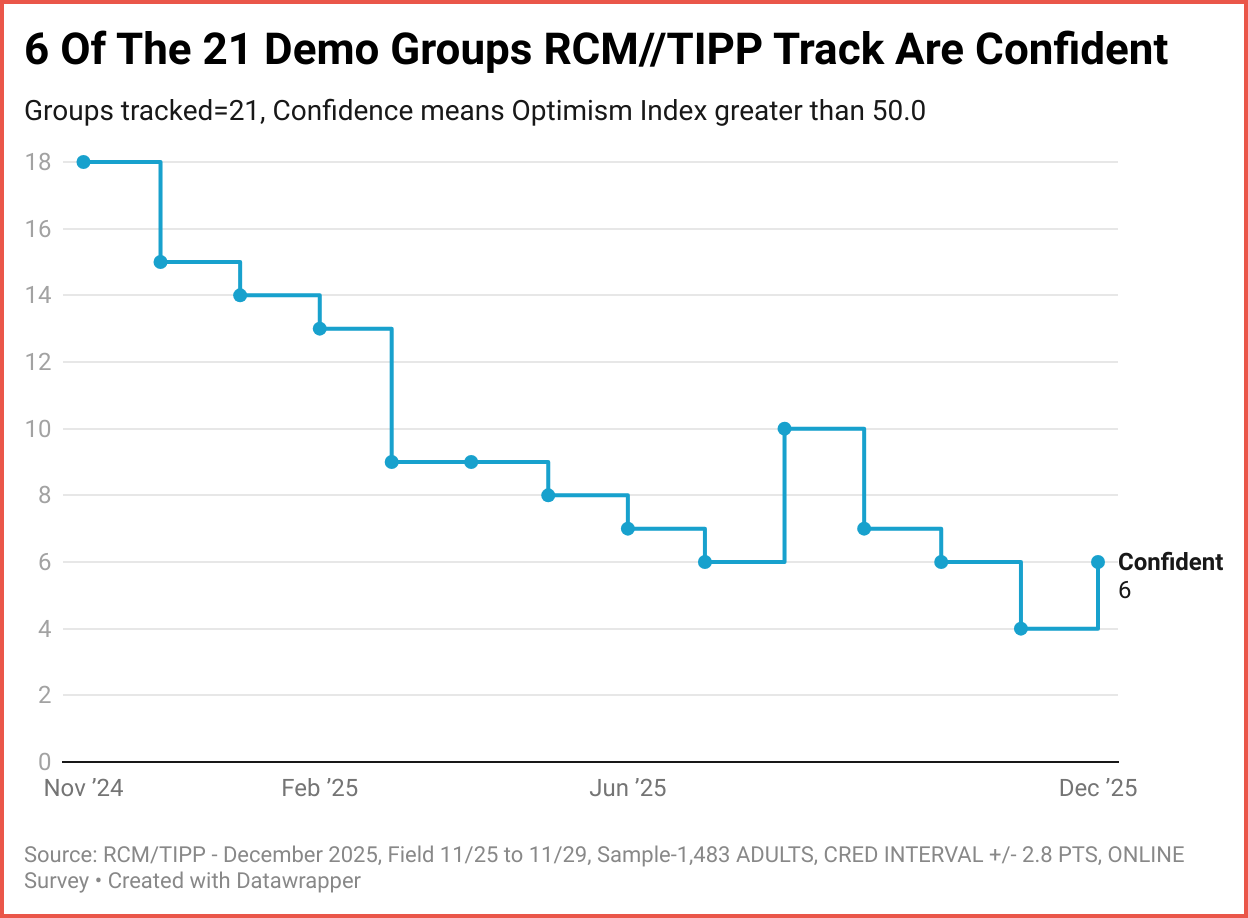

The number of groups in the positive zone indicates the breadth of optimism in American society.

This month, only six of the 21 demographic groups we track are in positive territory, with scores above 50 on the Economic Optimism Index. For comparison, there were six in October, seven in September, and 10 in August.

In the immediate aftermath of the election, the number of groups in the optimistic zone had jumped from eight in October 2024 to 18 in November, indicating widespread optimism.

All 21 groups improved on the index, compared to none in November, nine in October, and three in September.

Economic optimism levels for 15 of 21 demographic groups are lower in December 2025 than the historical average over the 299 months since we began tracking in February 2001.

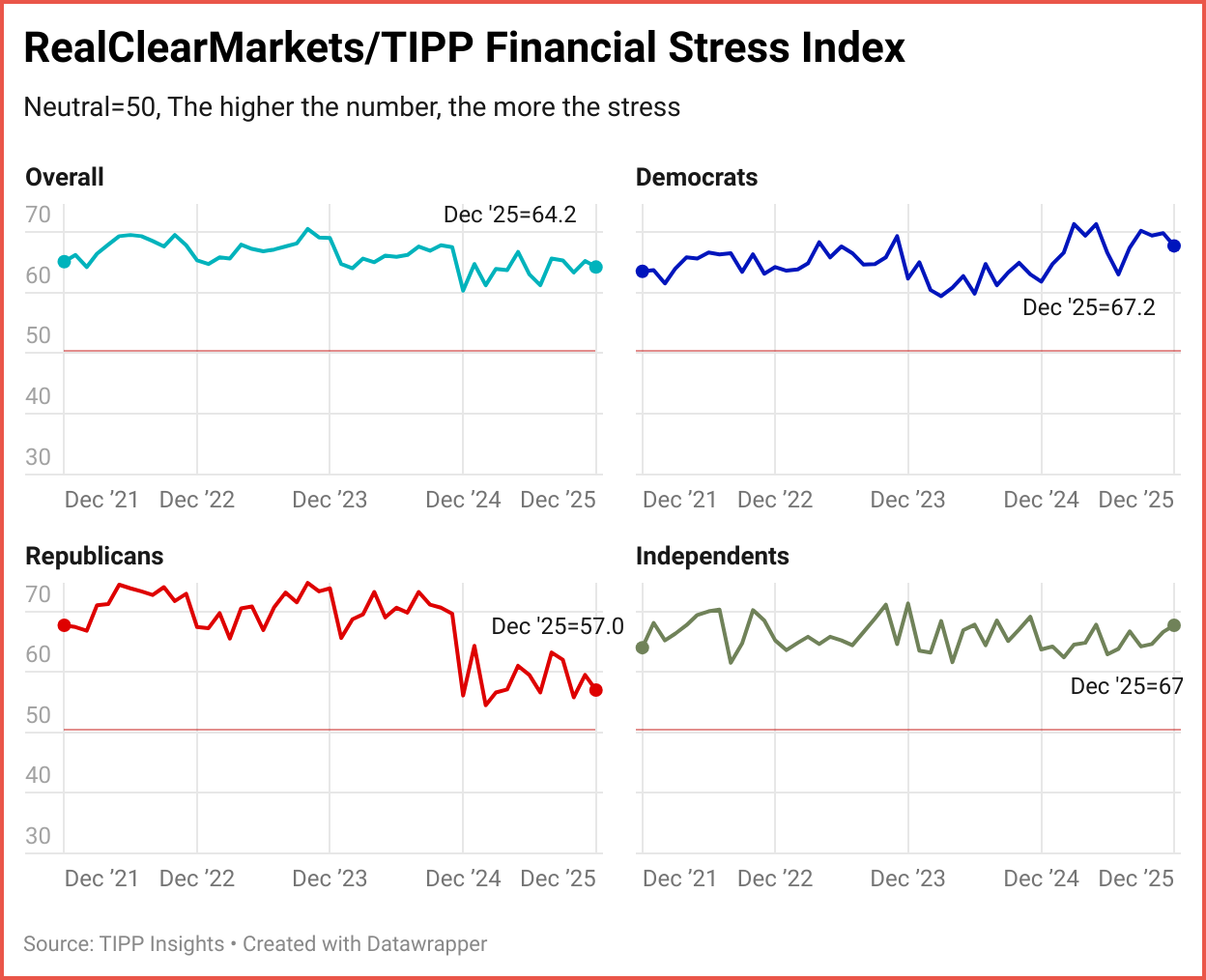

RCM/TIPP also releases our companion index, known as the RCM/TIPP Financial-Related Stress Index, the only metric that tracks the financial stress felt by Americans on a monthly basis.

The higher the number, the more the stress. Readings above 50 signal increased stress, while those below 50 indicate lower stress, with 50 considered neutral.

The RCM/TIPP Financial-Related Stress Index dropped 1.0 points (1.5%) from 65.2 in November to 64.2 in December, reflecting a drop in financial stress among Americans. This reading remains 6.2% above the long-term average of 60.5, underscoring elevated financial strain. The last time the Index posted below 50.0 was before the onset of the pandemic in February 2020, when it stood at 48.1.

RealClearMarkets website will release the next report at 10 a.m. EST on Tuesday, January 13.

TIPP Curated

Handpicked articles from TIPP Insights & beyond

1. Democrats Want To Distract You From This Before Midterms—Victor Davis Hanson, The Daily Signal

2. NATO Thinks Of ‘Pre-emptive Strikes’ Against Russia To ‘Defend’ Against Something That Did Not Happen—Moon of Alabama, Ron Paul Institute for Peace and Prosperity

3. Negotiating In Moscow On The Negotiations—Larry C. Johnson, Ron Paul Institute for Peace and Prosperity

4. Trump ‘Seriously’ Considering Implementing Australian Retirement Program—Elizabeth Troutman Mitchell, The Daily Signal

5. ‘Iryna’s Law’ And The Bad Judges Who Make It Necessary—Daniel McCarthy, The Daily Signal

6. House GOP Pushing Affordability Heading Into Election Year—Jacob Adams, The Daily Signal

7. Rep. Harris Introduces Bill To Stop Discrimination Against Homeschoolers—Elizabeth Troutman Mitchell, The Daily Signal

8. Democrats Want It Both Ways On Debt—And Working Americans Will Pay The Price—Andrew Langer, The Daily Signal

9. SEC Chairman Says At NYSE That Top-down ‘Communism’ Is A Proven Failure—Jarrett Stepman, The Daily Signal

10. RETALIATION? Minnesota Whistleblowers Who Blamed Tim Walz For Enabling Fraud Get Suspended On X—Tyler O'Neil, The Daily Signal

11. Virginia GOP Chairman Announces He Will Step Down—Joe Thomas, The Daily Signal

12. ‘HOAX’?: Trump Changes Tune On Affordability—Elizabeth Troutman Mitchell & Virginia Allen, The Daily Signal

13. ‘Fog Of War’: Hegseth Tells Press What They ‘Don’t Understand’ About Strikes On Narco-Terrorists—Elizabeth Troutman Mitchell, The Daily Signal

14. Congress Could Slip A Major AI Regulation Change Into The NDAA—Jacob Adams, The Daily Signal

15. 4 Takeaways From Supreme Court First Amendment Case On Pro-Life Pregnancy Centers—Fred Lucas, The Daily Signal

16. More Good News Comes For Ohio’s Efforts To Protect Elections—Rebecca Downs, The Daily Signal

17. UNCOVERED: Hamas Strategy To Infiltrate, Control NGOs In Gaza—Virginia Allen, The Daily Signal

18. Hegseth, Boat Strikes, And The False Target Of Establishment Hypocrisy—Connor O'Keeffe, Mises Wire

19. House Republicans Seek Answers On Biden-Era Data Breach Of 256,000 Consumers—Fred Lucas, The Daily Signal

20. When A Crime Burns Up The Narrative—Victor Joecks, The Daily Signal

21. Republican Triumphs In Tennessee Special House Election—George Caldwell, The Daily Signal

22. Polis Silent On Colorado County Clerks’ Demand He Reject Feds’ Ploy To Free Tina Peters—Mark Naughton, The Daily Signal

From TIPP Insights News Editor

23. Ukraine Preps New Talks After Trump Envoys Meet Putin

24. EU Unveils Plan To Cut China Dependence And Boost Economic Security

25. China Builds Port AI Using ‘World’s Largest’ Operations Data Set

26. First Israel-Lebanon Civilian Talks In Decades Boost Peace Hopes

27. India Backs Down After Uproar Over Mandatory Phone-Tracking App

28. Airbus Hit With Fresh A320 Issue As Inspections Widen

29. ADP Reports Job Losses Ahead Of Crucial Fed Meeting

30. After Brief Decline, Trump Leadership Gauges Regain Lost Ground In December: I&I/TIPP Poll

31. Pentagon Watchdog Report: Hegseth Put Troops At Risk With Yemen Signal Messages

32. Trump Targets Biden-Era Fuel Economy Mandate In Major Policy Reversal

33. Commerce Chief Blames Shutdown, Deportations For Job Drop

34. Trump Wipes Away Charges Against Texas Democrat, Citing Biden ‘Abuse’

35. Close Tennessee Race Signals Trouble For GOP Despite Van Epps Win

36. AI Data Center Boom Risks Sticking Families With Soaring Power Bills

37. Microsoft Stock Drops As AI Sales Miss Targets

38. House Democrats Release New Photos, Video From Epstein’s Island

📊 Market Mood — Thursday, December 4, 2025 (Pre-Market)

🟩 Futures Waver as Markets Await Jobs Data

U.S. futures hovered near flat early Thursday as traders waited for fresh jobless-claims data that could influence expectations for a Fed rate cut next week. A softening labor market and steady-but-sticky inflation have markets pricing in a high probability of a December rate cut.

🟨 Initial Jobless Claims on Deck

Investors will parse today’s weekly jobless-claims report for clearer signs of labor-market cooling. Claims remain low but hiring demand has eased. With limited official data during the recent shutdown, each weekly release carries extra weight for shaping expectations around Fed policy.

🟧 Salesforce Lifts Forecast on AI Strength

Salesforce raised its revenue and profit outlook, citing surging enterprise demand for its AI-driven agent platform. Shares rose after hours as the company highlighted rapid ARR growth from Agentforce and Data 360, underscoring strong corporate adoption of automation tools.

🟨 Gold Dips Slightly

Gold edged lower on profit-taking, though expectations for a rate cut next week continue to provide underlying support for bullion. Markets also await Friday’s delayed PCE inflation print, a key input for the Fed.

🟧 Oil Ticks Higher After New Strikes in Russia

Oil prices inched higher as Ukrainian strikes on Russian oil infrastructure renewed supply concerns. Peace talks between U.S. and Russian officials ended without progress, keeping geopolitical risk elevated and supporting crude.

📅 Key Economic Events — Thursday, December 4, 2025

🟦 08:30 AM — Initial Jobless Claims

Weekly tally of first-time unemployment benefit applications — an important g

editor-tippinsights@technometrica.com