The RealClearMarkets/TIPP Economic Optimism Index, a leading gauge of consumer sentiment, rose slightly, by 0.2%, in February to 52.0. The Index posted its 40-month high in December (54.0) and pulled back to 51.9 in January. Since President Trump's re-election in November 2024, the Index has posted readings in the optimistic territory.

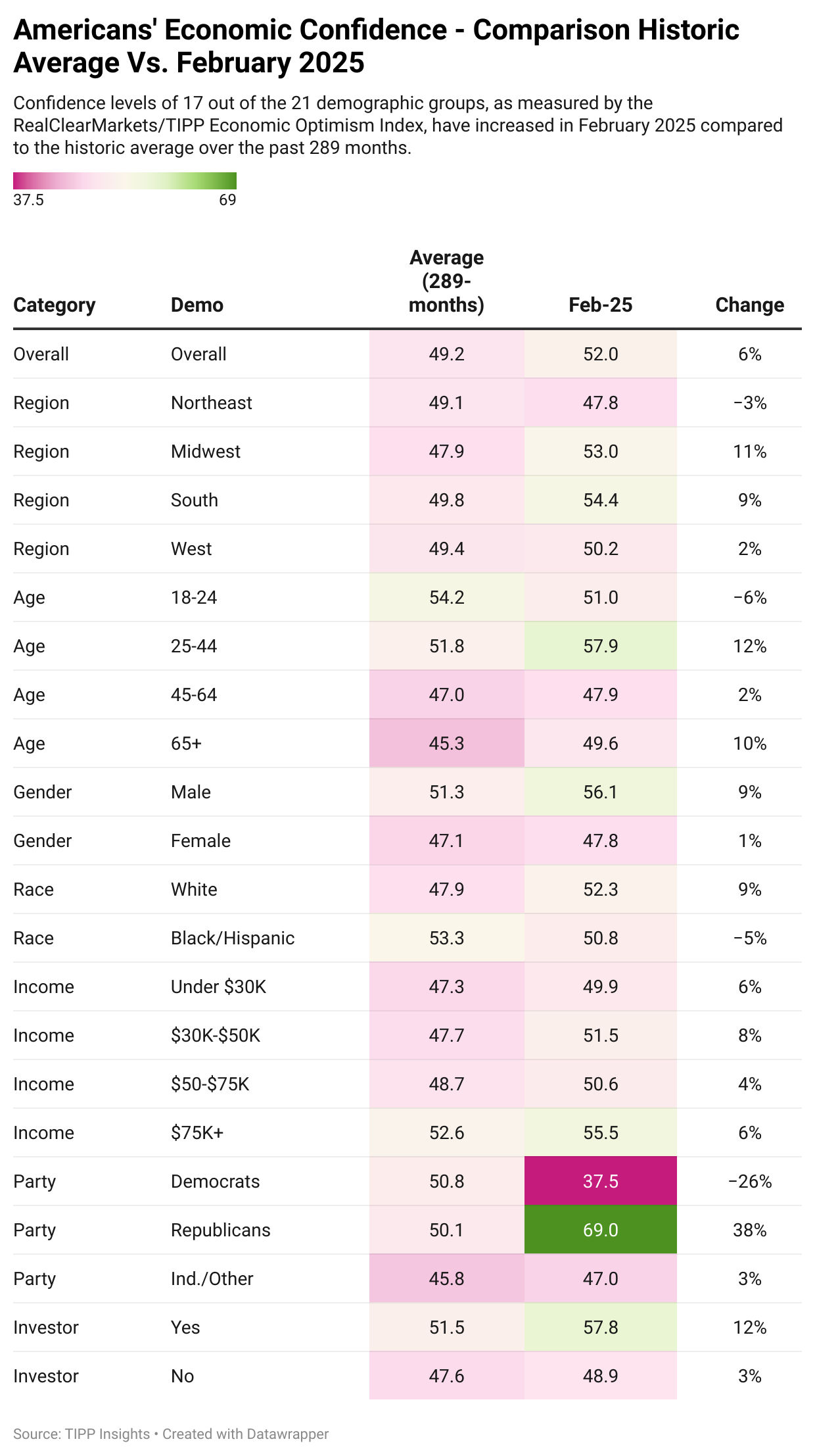

February’s reading of 52.0 is 5.8% higher than its historical average of 49.2

The RCM/TIPP Economic Optimism Index is the first monthly measure of consumer confidence. It has established a strong track record of foreshadowing the confidence indicators issued later each month by the University of Michigan and The Conference Board. (From February 2001 to October 2023, TIPP released this Index monthly in collaboration with its former sponsor and media partner, Investor's Business Daily.)

RCM/TIPP surveyed 1,478 adults from January 29 to 31 for the February index. The online survey utilized TIPP's network of panels to obtain the sample. A more detailed methodology is available here.

The Index and its components range from 0 to 100. A reading above 50.0 signals optimism, and below 50.0 indicates pessimism. 50 is neutral.

RCM/TIPP Economic Optimism Index

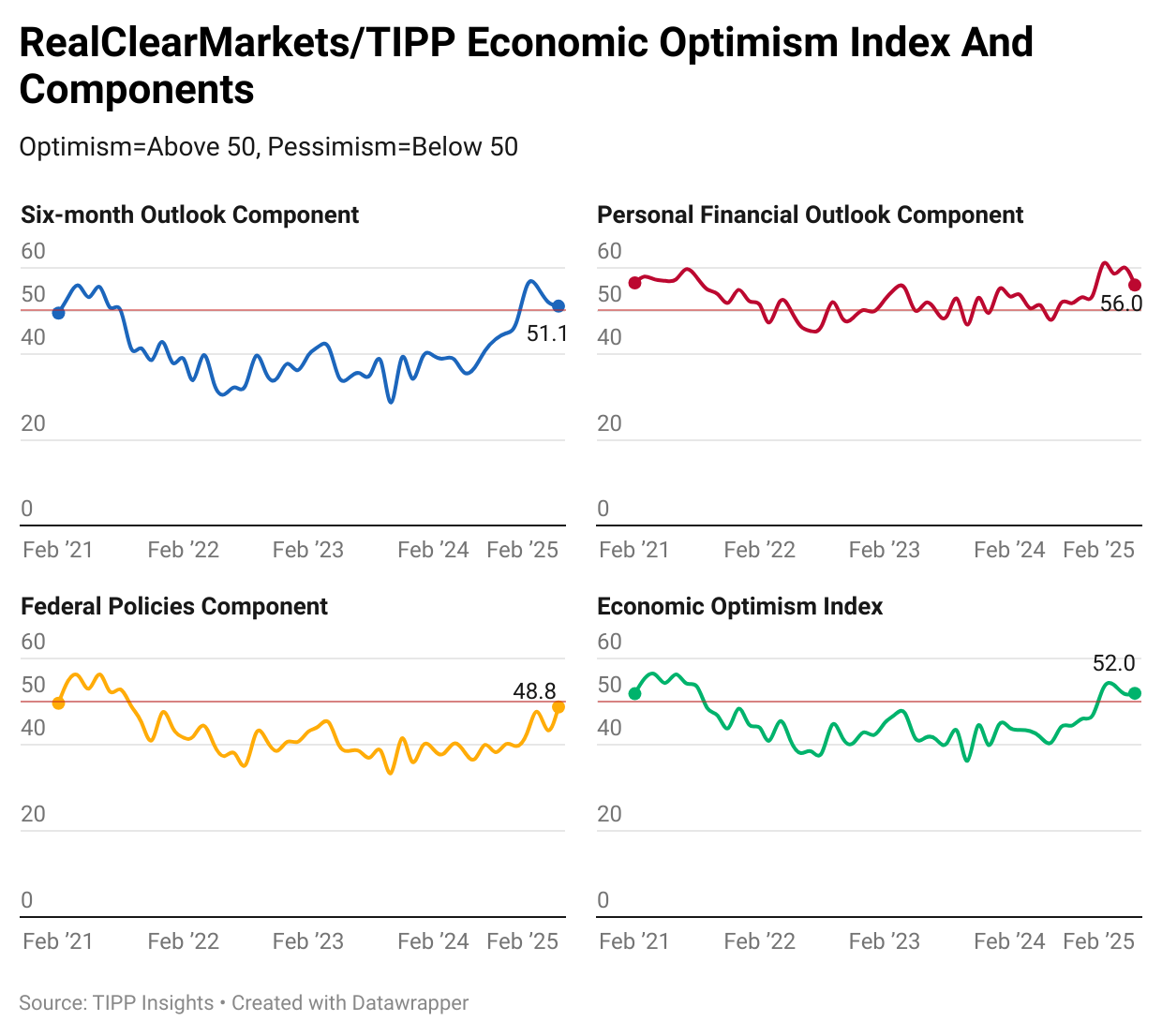

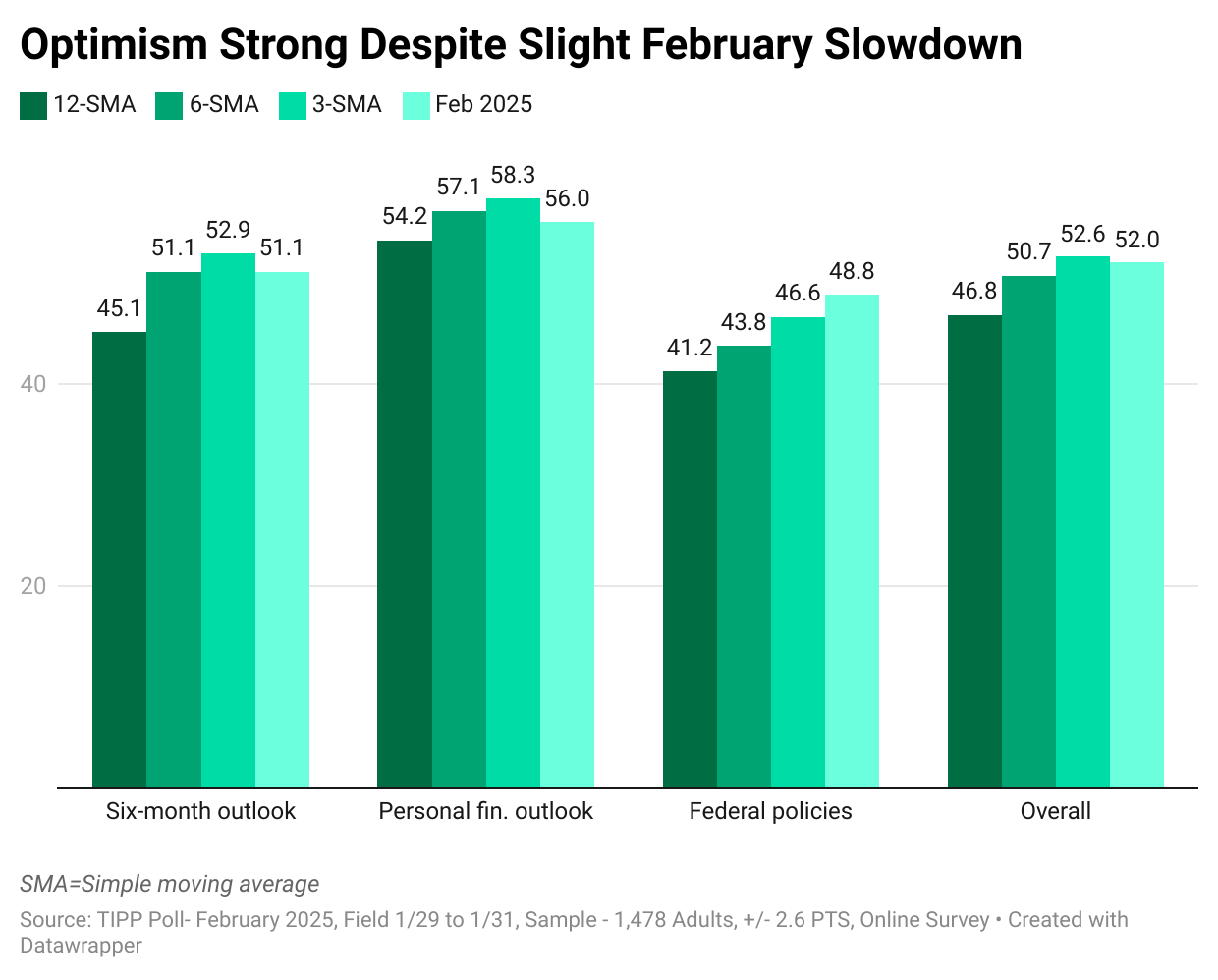

The RCM/TIPP Economic Optimism Index has three key components. In February, two of the three components declined, and one advanced.

- The Six-Month Economic Outlook, which measures how consumers perceive the economy's prospects in the next six months, declined by 1.9%, from 52.1 in January to 51.1 in February.

- The Personal Financial Outlook, a measure of how Americans feel about their own finances in the next six months, dropped by 6.8% from its previous reading of 60.1 in January to 56.0 this month.

- Confidence in Federal Economic Policies, a proprietary RCM/TIPP measure of views on the effectiveness of government economic policies, improved from 43.4 in January to 48.8 this month, reflecting a 12.4% gain. This component has been below 50.0 in the pessimistic territory for 42 consecutive months since September 2021.

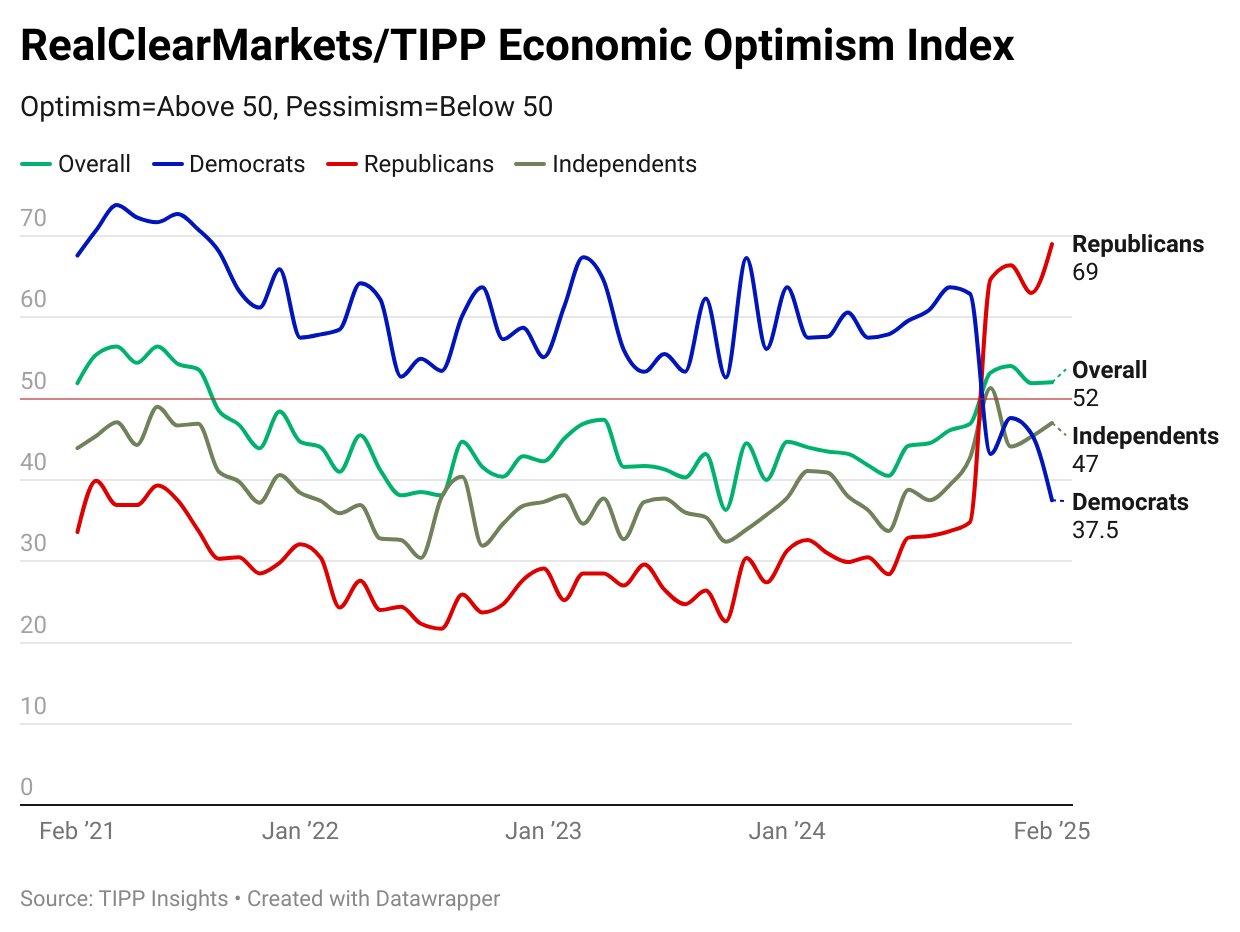

Party Dynamics

With Donald Trump's election as the 47th President, Democrats' confidence tumbled from 62.9 in October to 43.2 in November. However, it increased to December to 47.6. It dropped again in January to 45.7 and further to 37.5 in February.

Meanwhile, Republicans' confidence skyrocketed from 34.8 in October to 64.7 in November. It stands at 69.0 in February.

In November, independent voters' confidence rose by 8.6 points, or 20%, to 51.3—the Index posted its first positive reading in nearly five years––after remaining in pessimistic territory for 56 months, beginning in April 2020, shortly after the onset of the pandemic. It stands at 47.0 in February.

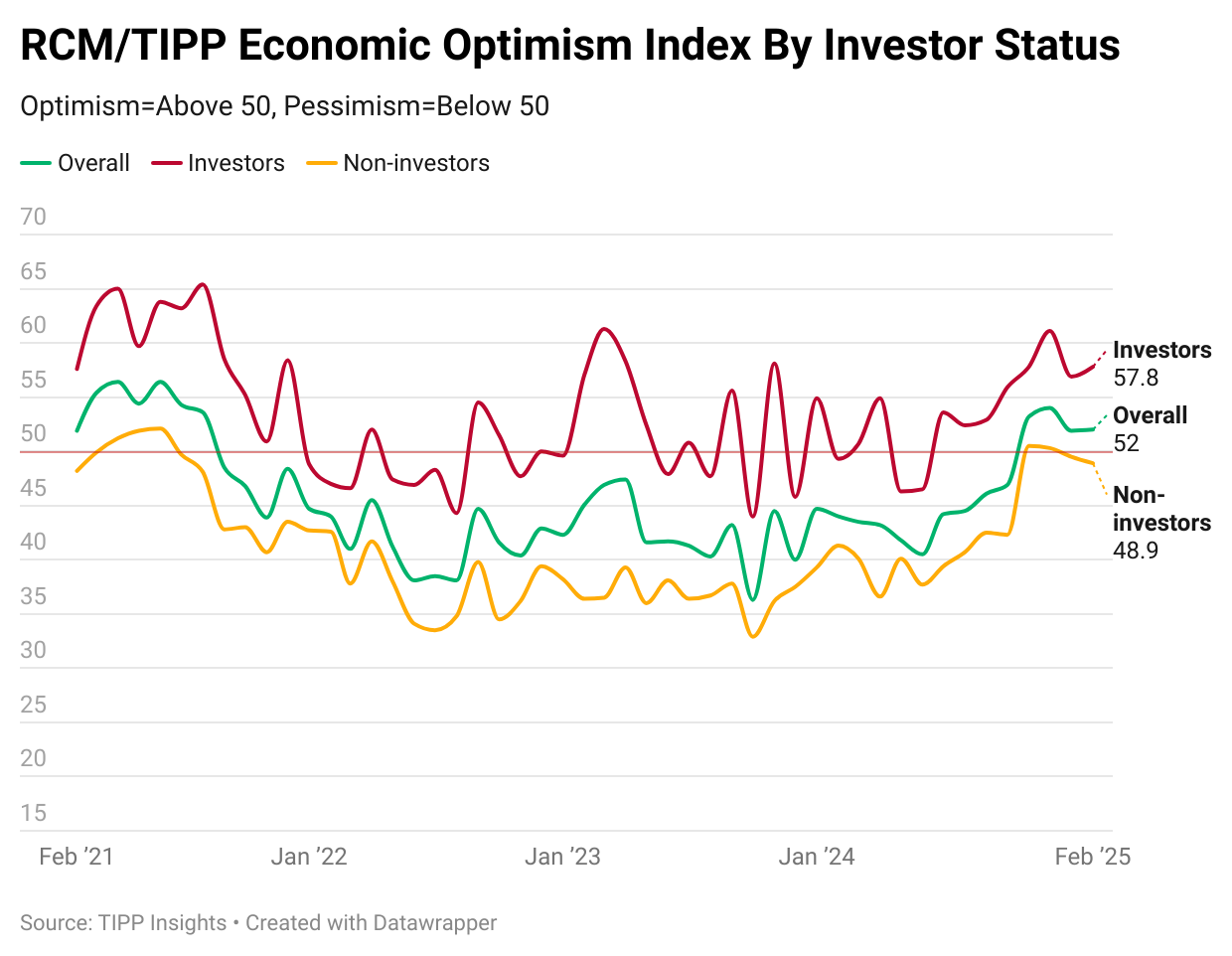

Investor Confidence

Respondents are considered "investors" if they currently have at least $10,000 invested in the stock market, either personally or jointly with a spouse, either directly or through a retirement plan. One-third (31%) of respondents met this criterion, and 62% were classified as non-investors. We could not ascertain the status of seven percent of respondents.

Investor confidence improved by 1.6% (0.9 points) to 57.8, while non-investor confidence declined marginally by 0.6 points (1.2%) to 48.9.

Momentum

Comparing a measure's short-term average to its long-term average is one way to detect its underlying momentum. For example, if the 3-month average is higher than the 6-month average, the indicator is bullish; similarly, if the 6-month average exceeds the 12-month average, the same holds.

In February, the Economic Optimism Index, along with the Six-Month Outlook and Personal Financial Outlook, dipped slightly below their three-month moving averages, suggesting a modest slowdown in sentiment. Despite the mixed trends, all three indicators remain firmly in positive territory—above the 50.0 benchmark—reflecting continued optimism in the broader economic outlook.

The Federal Policies component, however, continued to rise, signaling growing confidence in government actions.

Demographic Analysis

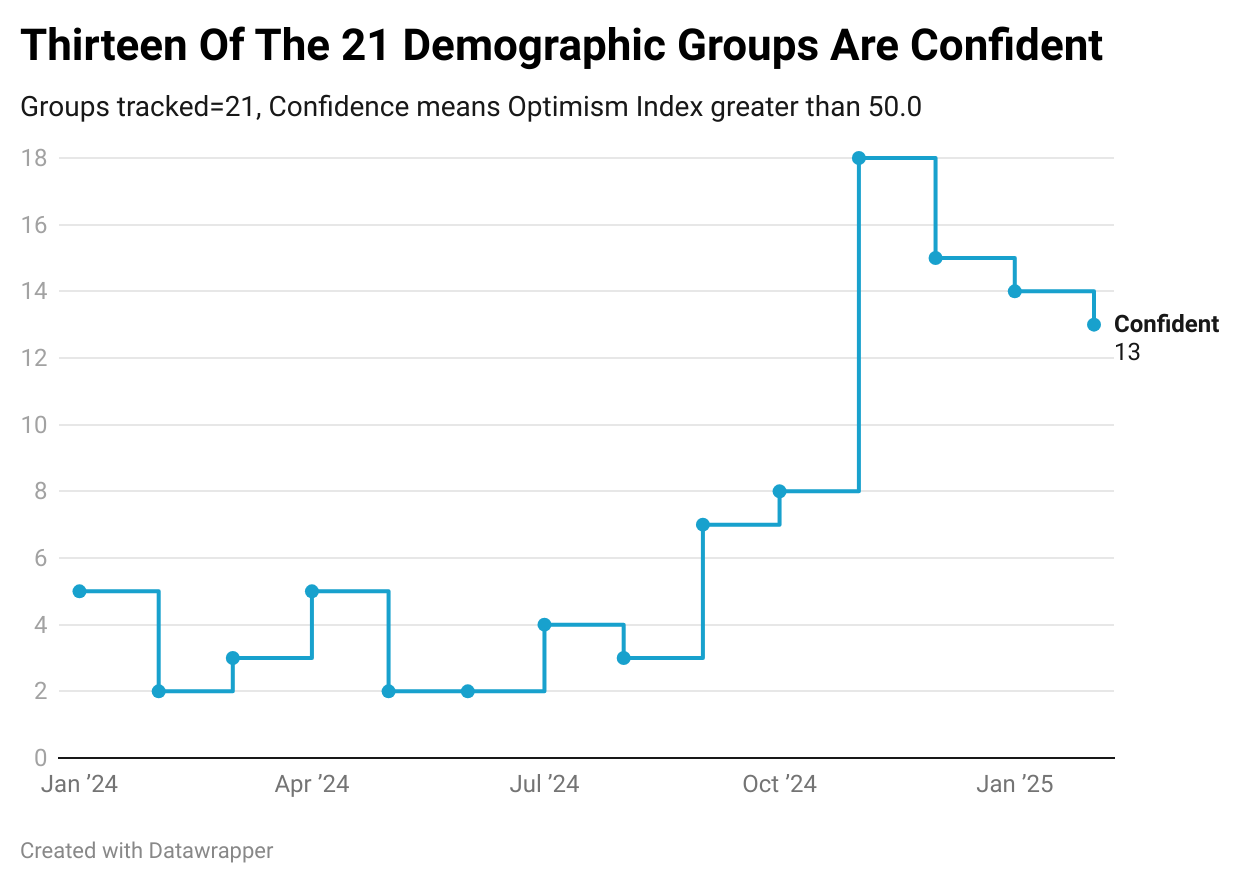

The number of groups in the positive zone indicates the breadth of optimism in American society. This month, demographic groups in the optimism zone fell from 14 in January to 13. In the immediate aftermath of the election, it had jumped from eight in October to 18 in November, indicating widespread optimism.

Eleven groups improved on the index, compared to five in January, 10 in December, and 18 in November.

Economic optimism levels for 17 of 21 demographic groups are higher in February 2025 than the historical average of the past 289 months.

RCM/TIPP Financial-Related Stress Index

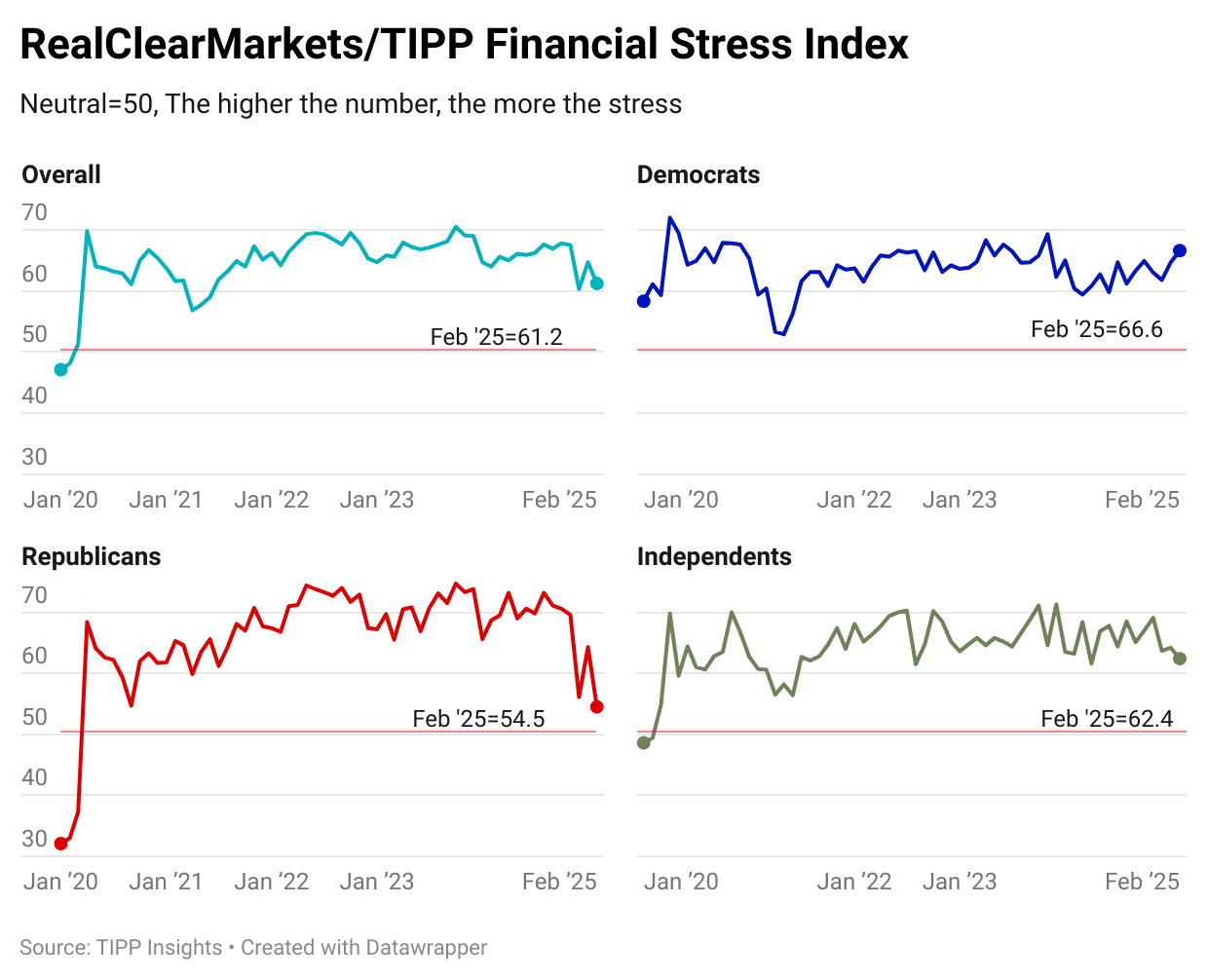

RCM/TIPP also releases our companion index, the RCM/TIPP Financial-Related Stress Index, the only metric to track the financial stress felt by Americans each month.

The Index declined by 3.5 points, or 5.4%, from 64.7 in January to 61.2 in February. The decline indicates an easing of stress, a welcome change.

Readings above 50 signal increased stress, while those below 50 indicate lower stress, with 50 considered neutral. The higher the number, the more stress.

For context, the last time the Index posted below 50.0 was before the onset of the pandemic in February 2020, when it stood at 48.1. The Index’s historical average since December 2007 stands at 60.3. February's reading of 61.2 surpasses this historical average by 1.5%, indicating that Americans are experiencing slightly elevated stress levels. Notably, the Index peaked at 70.5 in October 2023, marking its highest reading since December 2008 (71.0). Since then, it has declined for the better, reaching 61.2 in February 2025.

Inflation

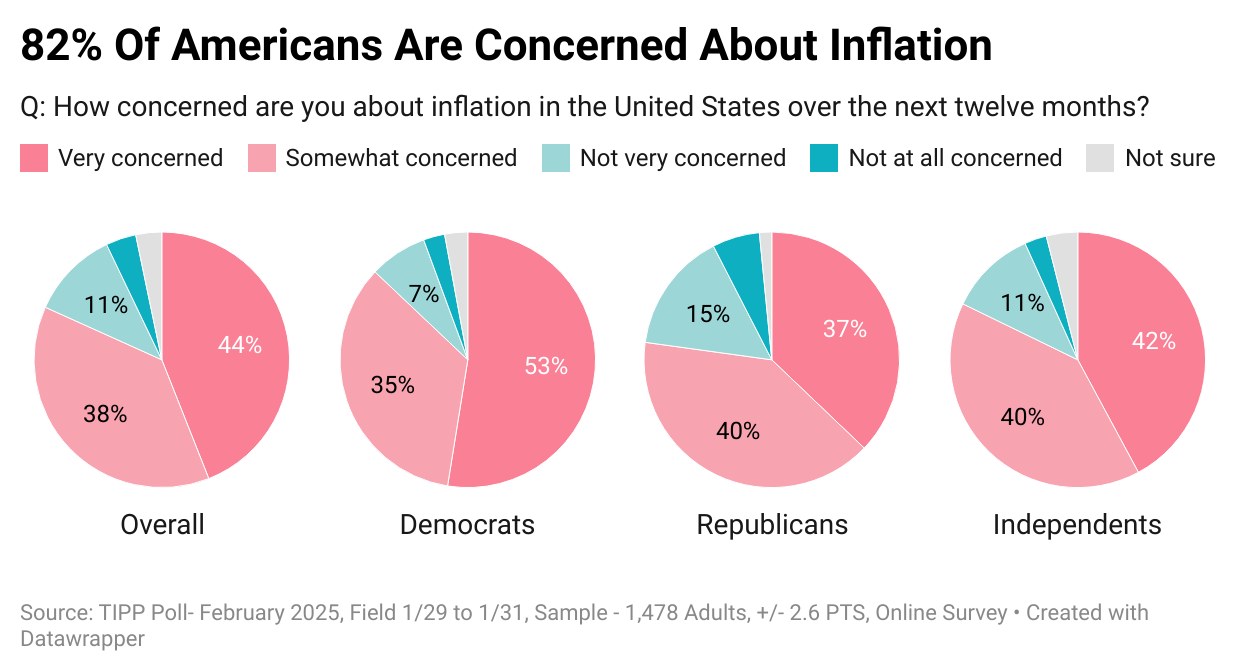

The survey showed that 82% are worried about inflation—44% are very concerned, and another 38% are somewhat concerned.

Americans continue to suffer because real wages have not increased, despite the CPI rate falling from a 40-year high of 9.1% in June 2022 to 2.9% in December 2024.

The Federal Reserve believes that long-run inflation of 2%, measured by the annual change in the price index for personal consumption expenditures, is most consistent with its maximum employment and price stability mandate.

Recession

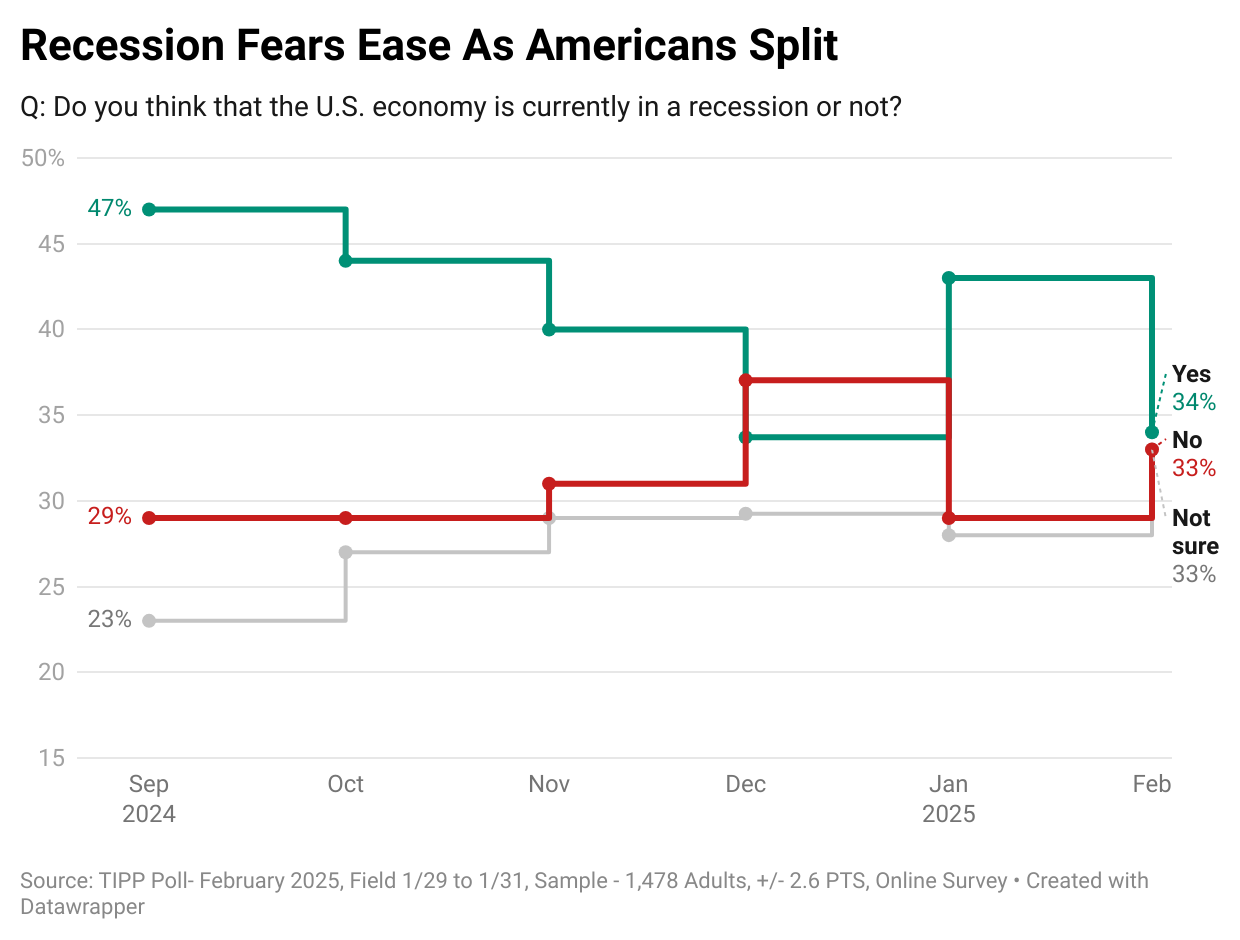

One-third (34%) believe America is in a recession, while 33% think we are not. Another third (33%) are not sure. The share of Americans who think we're in a recession has dropped from 47% in September to 34% in February.

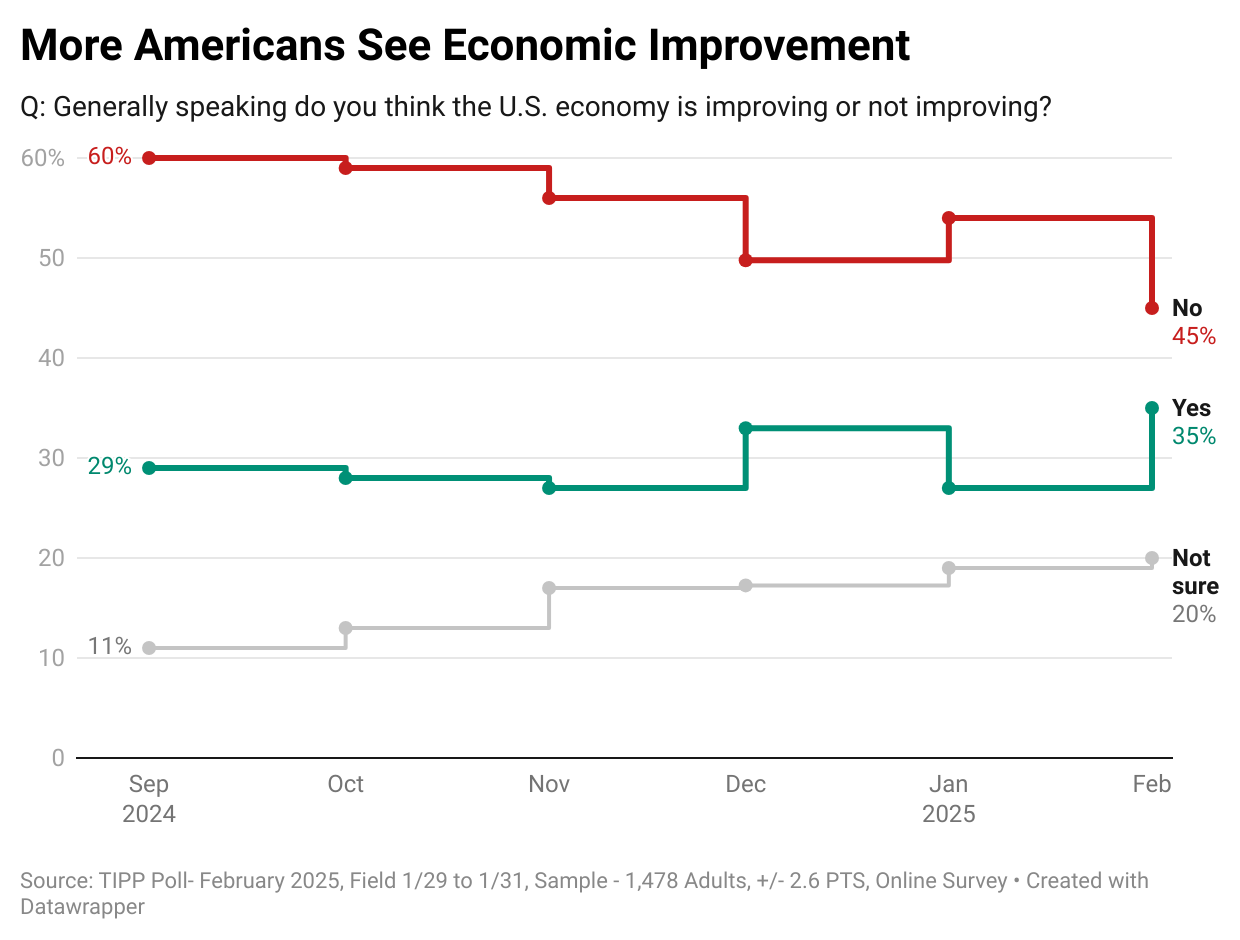

Meanwhile, 45% think the U.S. economy is not improving, while 35% believe it is improving. The share of Americans having a positive view increased from 27% in November to 35% in February.

John Tamny, the editor of RealClearMarkets, observed:

While change is a brilliant constant of dynamic economies, sometimes the ideal scenario for dynamism is a lack of volatility when it comes to economic factors that power dynamism. Perhaps that's what we're seeing in this month's number.

Since President Trump’s re-election, economic optimism has stayed in positive territory, reflecting renewed confidence in his leadership. While Democrats’ sentiment has plummeted, Republicans’ confidence has surged, reaching 69.0 in February. Independent voters, too, saw a post-election boost, signaling broader economic hope. Confidence in federal policies is climbing after years of pessimism, and financial stress is easing. Inflation worries linger, but recession fears are fading, and investor confidence is on the rise. With Trump at the helm, Americans are cautiously optimistic about the path ahead, as momentum builds across key demographics.

Release Schedule Of RCM/TIPP Indexes For 2025

The RealClearMarkets website releases the report at 10 a.m. EST on the release days.

- Mar 25: Tuesday, March 4

- Apr 25: Tuesday, April 1

- May 25: Tuesday, May 6

- Jun 25: Tuesday, June 3

- Jul 25: Tuesday, July 1

- Aug 25: Tuesday, August 5

- Sep 25: Tuesday, September 2

- Oct 25: Tuesday, October 7

- Nov 25: Tuesday, November 4

- Dec 25: Tuesday, December 2

TIPP Picks

Selected articles from tippinsights.com And More

1. The Art Of The Comeback: TIPP Poll Shows Trump’s Strong Start Energizes Core Voters—Editorial Board, TIPP Insights

2. Trump’s Executive Orders Have Solid Voter Backing: I&I/TIPP Poll—Terry Jones, TIPP Insights

3. How The Trump Administration Can Hit Its Growth Target—Glenn Hubbard, Project Syndicate

4. Ship Of Fools: Washington Ran Amok For Decades—Now Comes The Fall—Editorial Board, TIPP Insights

5. Trump Has Become 21st-Century George Patton—Victor Davis Hanson, The Daily Signal

6. Meet Norm Eisen, The Man Leading The Charge To Evict Trump—TIPP Staff, TIPP Insights

7. Trump's Team Used Decoy Plane To Thwart Serious Iran Assassination Threat—Alex Isenstadt, Axios

8. RIP USAID—Editorial Board, TIPP Insights

9. Here’s How Trump’s Move On USAID Will Impact George Soros’ Funding Empire—Tyler O'Neil, The Daily Signal

10. Donald Trump’s Gaza Mirage—Larry C. Johnson, The Ron Paul Institute for Peace and Prosperity

11. Trump Pentagon Reportedly Preparing To Close Curtain On America’s Syria Excursion—Wallace White, DCNF

12. Memo To Trump: FAA’s Failings Are Much Deeper Than DEI—Editorial Board, Issues & Insights

13. Biden’s Dismal Economic Handoff…And Trump’s Charge—Steve Cortes, TIPP Insights

14. Trump Struck A Killing Blow To Heart Of Democrat Deep State Machine—Mary Rooke, DCNF

15. Foreign Flags, Foreign Protestors—Steve Cortes, TIPP Insights

16. Immigration Surge Pushes Top Public Colleges To The Breaking Point—RajKamal Rao, TIPP Insights

17. How USAID Damages US Relations With Foreign Countries—Jarrett Stepman, The Daily Signal

18. The Great COVID Cover-Up? Public Doubt Over Lab Leak Persists—Editorial Board, TIPP Insights

19. ‘This is NPR’: America’s Public Media Faces Reckoning On What It Is—Jonathan Turley, The Ron Paul Institute for Peace and Prosperity

20. Europe Found Its Values and Lost Its Way—Jean-Pierre Landau, Project Syndicate

21. The Case For Abolishing Nuclear Weapons—Melissa Parke, Project Syndicate

22. What Does Trump 2.0 Mean For Venezuela?—Moisés Naím, Project Syndicate