The bond market just sent Washington a warning shot. Yields spiked. Investors flinched. The White House scrambled. Behind all the headlines, one thing became clear: when confidence shakes, borrowing costs surge—and the bond market doesn’t just move money, it can move governments.

The U.S. debt is now $36.2 trillion. A sell-off in bonds doesn’t just rattle markets—it threatens to destabilize the entire economy. That’s why we wrote this explainer to make sense of the bond market in plain English, no jargon, no fluff.

Welcome To The Bond Market

Simply stated, bonds are IOUs from the government or companies. Our focus here is on government bonds, which are sold by the U.S. Treasury Department. Each bond has a face value and a term. The short-term ones are called T-bills and usually come in 1-month, 3-month, and 1-year durations. Then there are the more well-known long-term bonds: the 10-year, 20-year, and 30-year. When you buy one, you’re lending money to the government. In return, you earn interest—also known as the yield.

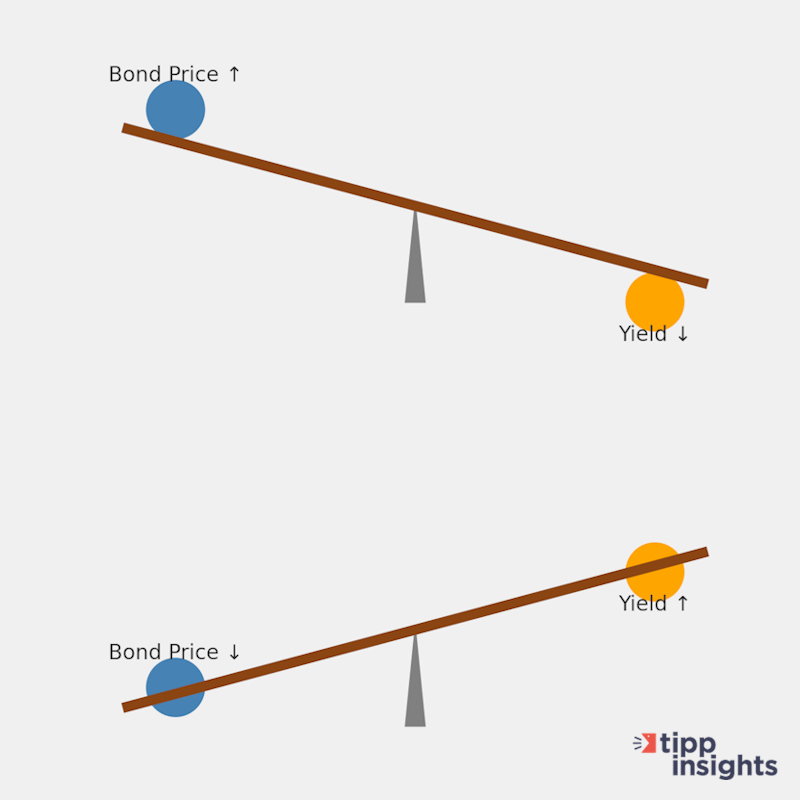

Bonds trade in the bond market just like stocks trade in the stock market. Their prices rise and fall based on demand, inflation expectations, and what investors think the Federal Reserve will do next. One key thing to understand: bond prices and yields move in opposite directions. When prices go up, yields go down. When prices drop, yields rise. That’s the seesaw at the heart of everything. Put simply, when bonds are sold off, prices fall and yields rise. When demand surges, prices rise and yields fall.

Here’s a simple example that brings the concept to life. Say you own a house worth $120,000 and you rent it out for $6,000 a year. Your yield is 5%. Now imagine the housing market dips and the value of your house falls to $100,000—but the rent is still $6,000. Your yield just went up to 6%. On the other hand, if the house price climbs to $150,000, that same rent now gives you a yield of just 4%. The rent didn’t change, but your return did. That’s exactly how it works with bonds. Same interest payment—different yield depending on what people are willing to pay for the bond today.

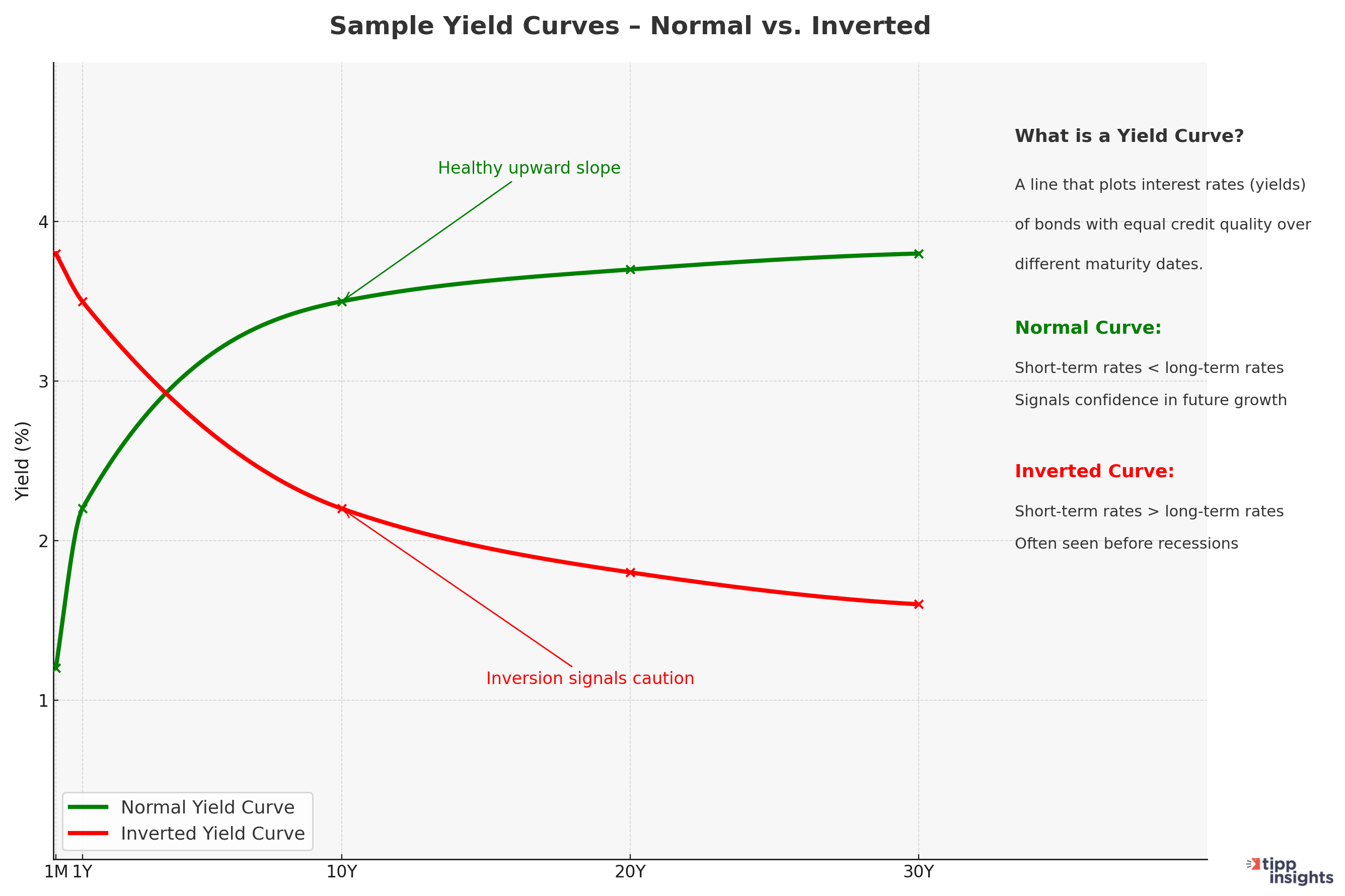

One last thing worth understanding is something called the yield curve. Normally, you expect short-term bonds to have lower yields than long-term ones. That makes sense: lending money for 30 years should carry more risk than lending it for 1 year, so the return should be higher. That’s a healthy, upward-sloping yield curve.

But sometimes, the curve flips. That’s called an inverted yield curve. It happens when investors see more risk in the near term—say, the next 12 months—than in the long run. When short-term yields move higher than long-term ones, it’s often a sign that the market smells trouble ahead. Historically, an inverted yield curve has been one of the most reliable predictors of a recession.

Before we dive into what happened with Britain and Trump, it’s worth understanding who actually holds America’s debt—and why it matters.

Who Owns The U.S. Debt—And Why?

The U.S. national debt stands at around $36.2 trillion today. And surprisingly, foreign countries own a massive chunk of it. When countries like China, Japan, or the United Kingdom buy U.S. Treasury bonds, they’re essentially lending money to the U.S. government—just like American investors do.

As of early February, Japan held the largest amount of U.S. debt, about $1.1 trillion, followed by China at roughly $759 billion. The United Kingdom ranks third, with around $723 billion. Other notable holders include Luxembourg with $424 billion and the Cayman Islands with $397 billion—often acting as financial hubs for investors and institutions.

So why are foreign governments so eager to hold U.S. debt?

First, safety. U.S. Treasuries are widely considered the safest financial assets in the world. The U.S. has never defaulted on its debt, and the Treasury market is deep, liquid, and stable. If you're a foreign central bank managing hundreds of billions in reserves, putting that money into U.S. bonds is like storing it in the safest vault on Earth.

Second, there’s a strategic economic benefit. Countries that run large trade surpluses with the U.S., like Japan and China, receive a flood of U.S. dollars through exports. Instead of letting that cash sit idle, they recycle it into Treasuries. That move does two things: it gives them a steady return, and it helps keep demand for dollars high. That supports the value of the dollar, which in turn helps keep their own currencies relatively weaker—making their exports more attractive to the world. It’s not just investment. It’s part of how they manage their trade and currency strategy.

Foreign purchases of U.S. Treasuries help keep demand for dollars high and interest rates stable. But to critics like J.D. Vance, this reliance is a serious weakness. As he put it bluntly:

We borrow money from Chinese peasants to buy the things those Chinese peasants manufacture. That is not a recipe for economic prosperity. It's not a recipe for low prices, and it's not a recipe for good jobs in the United States of America.

To Vance and others, America’s dependence on foreign debt isn’t just a financial arrangement — it’s a vulnerability that exposes the country to deeper economic and geopolitical risks.

How The Bond Market Affects Each One Of Us

When Treasury yields go up, Uncle Sam has to pay more to borrow money. And if the safest borrower in the world—the U.S. government—has to offer higher rates to attract investors, then everyone else does too.

Think about it: Because U.S. government bonds are considered risk-free, their yield becomes the benchmark — the rate everyone else has to beat. Why would anyone lend at 4% if Uncle Sam is paying 5% with zero risk? They wouldn’t. So banks, lenders, and businesses raise their rates to stay competitive and cover their risk.

That’s how rising bond yields ripple through the economy. Mortgage rates go up. Auto loans get more expensive. Credit card interest climbs. Student debt becomes costlier. Business loans tighten. It all flows from the same source.

And when rates are high, companies become more cautious about borrowing to expand. That hesitation trickles down to hiring decisions—and ultimately affects the number of Americans they employ. The bond market may feel far away, but when it moves, it hits home.

The Liz Truss Bond Market Meltdown—Explained Simply

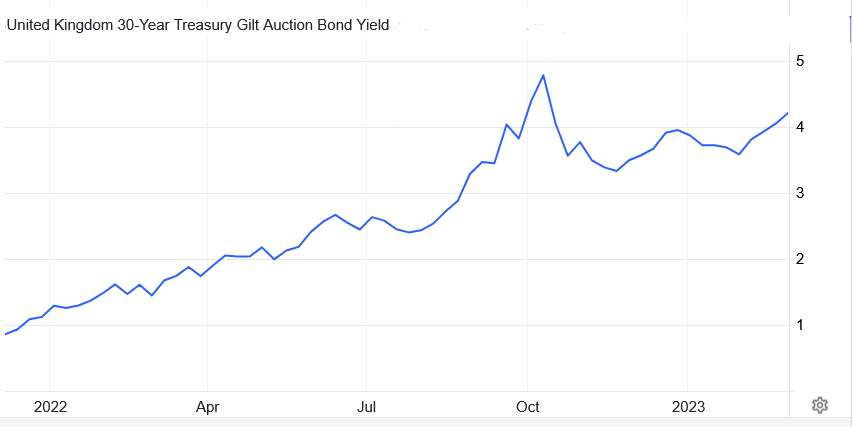

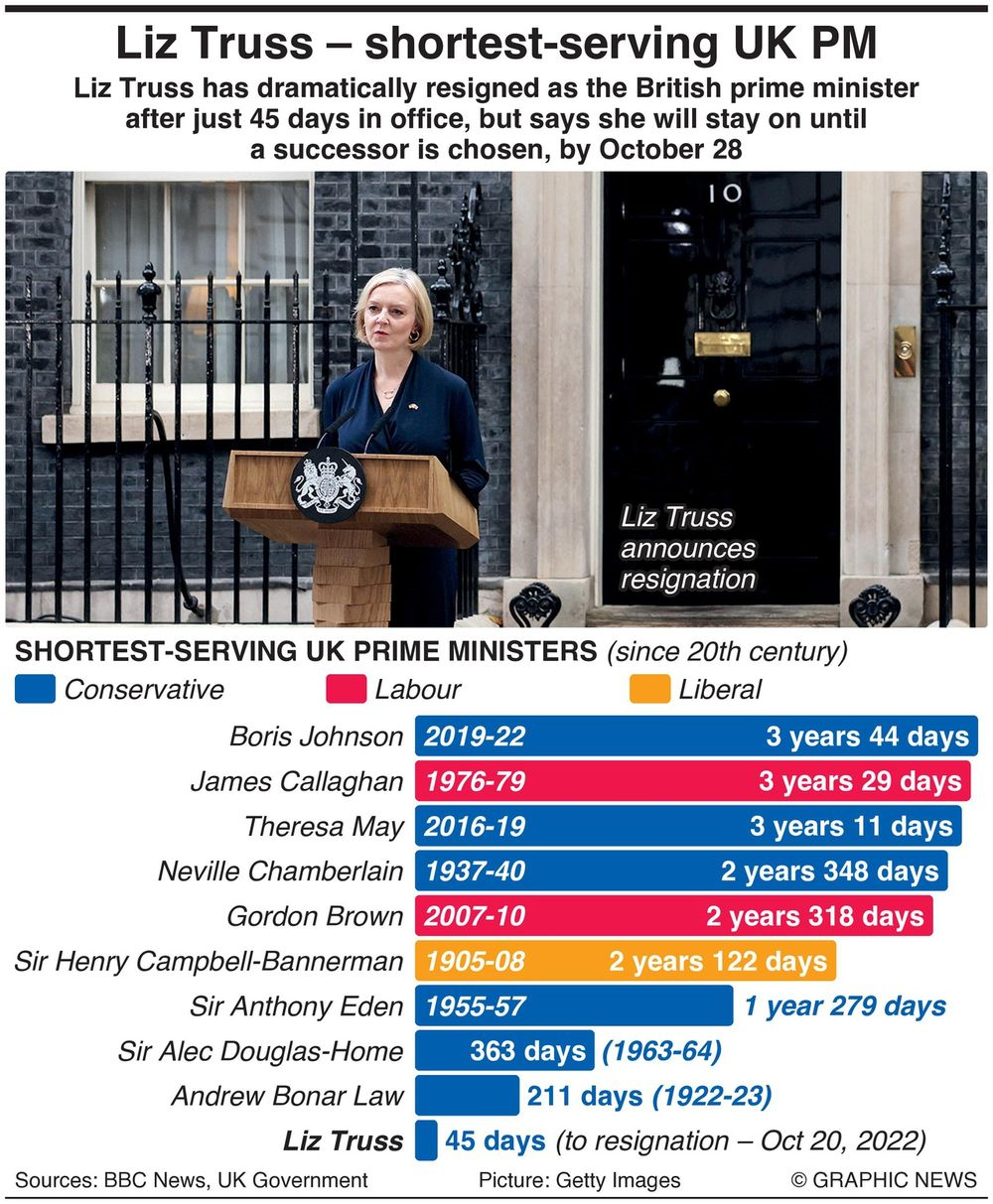

In September 2022, Liz Truss became Prime Minister of the UK and quickly announced a bold plan: major tax cuts with no clear plan to pay for them. That spooked investors. The UK government was already deep in debt, and cutting taxes meant borrowing even more money. Investors began to worry: “If the government is piling on more debt without a plan, can it really pay us back?”

They started dumping UK government bonds (known as gilts), which caused bond prices to fall and yields to spike. That made borrowing more expensive for everyone, including the government itself.

Things got worse fast. Many UK pension funds had built strategies that depended on stable bond prices. When yields surged, those strategies broke. Pension funds suddenly faced huge losses and cash crunches, and the Bank of England had to step in to stop a full-blown collapse.

Just 44 days after taking office, Truss resigned. Her economic plan had triggered a bond market revolt—and in doing so, took down her government. In summary, what happened in Britain wasn’t just about taxes—it was about how quickly a bond market can collapse political power.

Trump and Vance Saw It Coming — And Acted

The White House moved fast to prevent a bond market spiral and stabilize the economy.

Vice President J.D. Vance has long warned about the risk of a “bond market death spiral”—a scenario where investors lose confidence, dump U.S. bonds, and send yields soaring. It’s not just a technical concern. Vance believes such a crisis could be politically devastating for President Trump, especially if it triggers a broader credit crunch or economic slowdown.

As Trump unleashed a new round of tariffs, markets grew jittery. On Wednesday, April 9, 2025, the U.S. bond market experienced significant turmoil. The yield on the 10-year Treasury bond surged to 4.51%, and the 30-year yield reached 5.02%, marking their highest levels since late 2023. This spike was driven by investors offloading government securities amidst escalating trade tensions and concerns over the U.S. fiscal outlook.

Vance saw how fast market confidence can disappear. If it happened in London, it could happen in Washington. He saw shades of 2022, when UK Prime Minister Liz Truss’s government collapsed in a matter of days after markets rebelled against her debt-funded tax plan.

Adding to the drama, Vance suggested that such turmoil might not be accidental. In a September 2024 interview with Tucker Carlson, he raised the possibility that foreign actors or global elites could deliberately try to sink Trump’s presidency by manipulating bond yields. When foreign buyers pull back, bond prices drop, and yields spike even faster. Vance believes the administration must be prepared to fight this form of financial sabotage. As he told Carlson:

I really worry about the bond markets. Do the international investors, the people who are getting rich off globalization, the people who have gotten rich from shipping our manufacturing base to China, the people who have gotten rich from a lot of wars — do they try to take down the Trump presidency by spiking bond rates?

Trump, for his part, stayed publicly calm. He urged Americans to “be cool” as markets wobbled and yields climbed. Then, in a carefully timed move, he paused his tariff plan for 90 days to allow for negotiations. That announcement, made precisely at 1:18 p.m., helped soothe investor nerves. The bond market began to settle, and stocks rebounded.

Former Treasury Secretary Larry Summers didn’t mince words. He called the market pattern “highly unusual” and warned of a possible financial crisis. When both bond yields and stock prices move sharply in opposite directions, he said, it suggests investors are losing confidence in the U.S. altogether—treating it less like the world’s financial anchor and more like a risky emerging market.

Still, the administration insisted everything was under control. Treasury Secretary Scott Bessent told Fox Business there was nothing “systemic” about the bond sell-off and credited the market rebound to “certainty” provided by the president’s tariff pause. Press Secretary Karoline Leavitt brushed off the panic, suggesting it was all part of Trump’s strategy. “Many of you in the media clearly missed The Art of the Deal,” she quipped.

By Thursday, the worst seemed to pass. The 10-year yield came down slightly, though it remained 0.37 percentage points above where it started the week. Foreign investors had returned to bond auctions, and Treasury officials once again called the U.S. “the best place to invest.”

For now, the White House has held the line. But in a bond market this sensitive, confidence remains the currency that matters most. When confidence wobbles, it doesn’t take much for the bond market to send a shockwave through Washington—and the White House knows it. Trump didn’t panic—he paused. And that move may have stopped a full-blown crisis before it started. Chris Ruddy, Newsmax CEO, put it best in a recent tweet: “Trump doesn’t walk on water, but he does turn water into wine.”

TIPP Picks

Selected articles from tippinsights.com and more

Top 10 Most-Read Articles This Week

1. Enough Is Enough! Better Late Than Never. Trump Tariffs Roll Back Decades of Kamikaze Trade Policy—Editorial Board, TIPP Insights

2. Americans Skeptical Of Climate Change Movement, Support ‘Rolling Back’ Green Rules: I&I/TIPP Poll—Terry Jones, TIPP Insights

3. Senate Continues Dismantling Biden’s Green Energy Agenda By Voting To Repeal Gas Water Heater Ban—Adam Pack, DCNF

4. The US And Russia Are Negotiating In Bad Faith—Nina L. Khrushcheva, Project Syndicate

5. Attack Yemen? Yeah, I Warned you, Mr. Trump—Larry C. Johnson, Ron Paul Institute for Peace and Prosperity

6. Texas AG Ken Paxton, Trusted MAGA Ally, Takes On Four-Term Senator John Cornyn—Rajkamal Rao, TIPP Insights

7. Don’t Like Trump’s Plan For The Economy? Let’s Hear Yours—Victor Davis Hanson, The Daily Signal

8. Dream On, Europe: All Hat, No Cattle In Ukraine—Editorial Board, TIPP Insights

9. FEC Opens Probe Of Rep. Jasmine Crockett Donations—Fred Lucas, The Daily Signal

10. Hello Tariffs, My Friend—Trump’s Trade Weapon Delivers Early Results—Editorial Board, TIPP Insights