Editor’s Note: This essay examines how a series of major events in 2025 reshaped global power and weakened Europe’s economic and political standing. It presents the author’s perspective on the war in Ukraine, China’s growing strength, and U.S. trade policy under Donald Trump. In simple terms, the argument is that Europe struggled in the Ukraine war, lost ground as China became more self-reliant, and accepted tougher trade terms from the United States.

By Yanis Varoufakis, Project Syndicate | December 22, 2025

A new, harder, colder world order was erected on the grave of European ambition in 2025. The year’s enduring lesson is that in an age of existential contests, strategic dependency is the prelude to irrelevance.

ATHENS – This was the year that the remaining pillars of the late-20th-century order were shattered, exposing the hollow core of what passed for a global system. Three blows sufficed.

The first was Russia’s impending victory in Ukraine over Europe’s combined leadership. For almost four years, the European Union and NATO engaged in a perilous double game. On one hand, they committed rhetorically to a Ukrainian victory they were unwilling to bankroll. On the other hand, they exploited this never-ending war to advance a new political and economic domestic consensus: military Keynesianism would be their last-ditch stand against Europe’s deindustrialization.

In a continent where debilitating political constraints forbade significant deficit-funded green investments or social policies, the war in Ukraine provided a powerful rationale for funneling public debt into the defense-industrial complex. The unspoken truth was that a forever war served a critical function: it was the perfect engine for Keynesian pump-priming of Europe’s stagnating economy.

The contradiction was fatal: If the Ukraine war ended with a peace deal, it would be hard to sustain this economic pump-priming. Yet to achieve a victory that would justify the spending was deemed too expensive financially and too risky geo-strategically. Thus, Europe settled on the worst possible strategy: sending just enough equipment to Ukraine to prolong the bleeding without altering its course.

Now that Russia is set to prevail (a predictable result that US President Donald Trump merely brought forward), the EU’s best-laid plans lay in ruins. Europe has no Plan B for peace because its entire strategic posture had become dependent on the war’s continuance. Whatever grubby peace deal the Kremlin and Trump’s men ultimately impose on Ukraine will do more than redraw a border. Whether Russia remains a threat to Europe or not, Europe is about to lose the pretext for its nascent military-industrial boom and thus foreshadows a new austerity.

The second shock was that China won the trade war against the United States. The US strategy, initiated under Trump’s first administration and intensified under Joe Biden, was a pincer move: tariff barriers to cripple Chinese access to markets, and embargoes on advanced semiconductors and fabrication tools to cripple its technological ascent. In 2025, this strategy met its Waterloo, and Europe was again the primary collateral damage.

China responded with a masterful two-part response. First, it weaponized its dominance over rare earths and critical minerals, triggering a supply-chain seizure that paralyzed not so much American, but European and East Asian green manufacturing. Second, and most injuriously for America’s standing as the global tech leader, China mobilized its “whole-nation system” toward a single goal: technological autarky. The result was a staggering acceleration in domestic chip production, with SMIC and Huawei achieving breakthroughs that rendered the US-led Western embargo not just obsolete, but counterproductive.

This is probably the shock with the longest-lasting repercussions. In 2025, the US proved incapable of slowing China’s rise and, instead, unwittingly propelled its tech sector toward full independence. And Europe, having dutifully imposed on China the sanctions dictated by the White House, was left with the worst of all worlds: increasingly shut out of the lucrative Chinese market for its high-value goods, yet receiving none of the lavish subsidies and on-shoring benefits of the now rescinded US Inflation Reduction Act. By choosing to act as a strategic subcontractor to the US, the EU accelerated its own deindustrialization. This was not a loss in a trade war; it was a geopolitical checkmate, and Europe featured only as the losing side’s pawn.

The third shock was the ease with which Trump won his tariff war with the EU. At the end of their meeting at one of Trump’s golf clubs in Scotland, choreographed by his men to maximize her humiliation, Ursula von der Leyen, the president of the European Commission, struggled to portray a surrender document as a “landmark agreement.” Tariffs on European exports to the US jumped from around 1.2% to 15% and in some cases to 25% and 50%. Long-standing EU tariffs on US exports were canceled. Last but not least, the Commission committed to $600 billion of European investment in US industry on US soil – money that can come only from diverting mainly German investments to chemical factories in Texas and car plants in Ohio.

This was more than a bad deal. It was an unprecedented capital extraction treaty. It formalizes the EU’s transition from an industrial competitor to a supplicant. Europe is to be a source of capital, a regulated market for US goods, and a technologically dependent junior partner. To add insult to injury, this new reality was codified in a binding commitment, to which all 27 EU member states have now agreed, stripping the bloc of any pretense of sovereignty. Part of the capital Trump needs to consolidate his vision of a G2 world structured around the Washington-Beijing axis is now contractually obligated to flow from Europe westward.

These three shocks form a synergistic trilogy. Europe’s defeat in Ukraine has revealed its strategic blind spots and punctured its military Keynesian project. Trump’s acquiescence to Chinese President Xi Jinping has triggered a flood of Chinese exports to the EU. The shakedown in Scotland has cost Europe its accumulated capital and any lingering hope of parity.

In the G2 world, the imagined global village is a gladiatorial arena where the EU and the United Kingdom now wander aimlessly. A new, harder, colder world order has been erected on the grave of European ambition. The year’s enduring lesson is that in an age of existential contests, strategic dependency is the prelude to irrelevance.

Glossary

(Plain-language explanations of key terms used in this essay)

- Military Keynesianism: Using defense spending to boost the economy when other public investment is politically difficult.

- Strategic Dependency: Relying on other countries for security, technology, or economic stability in ways that limit independence.

- Technological Autarky: A country’s effort to make critical technologies at home rather than depend on foreign suppliers.

- Deindustrialization: The long-term decline of manufacturing jobs and industrial production.

- G2 World: A global system dominated by two major powers, the United States and China.

Yanis Varoufakis, a former finance minister of Greece, is leader of the MERA25 party and Professor of Economics at the University of Athens.

Copyright Project Syndicate

👉 Quick Reads

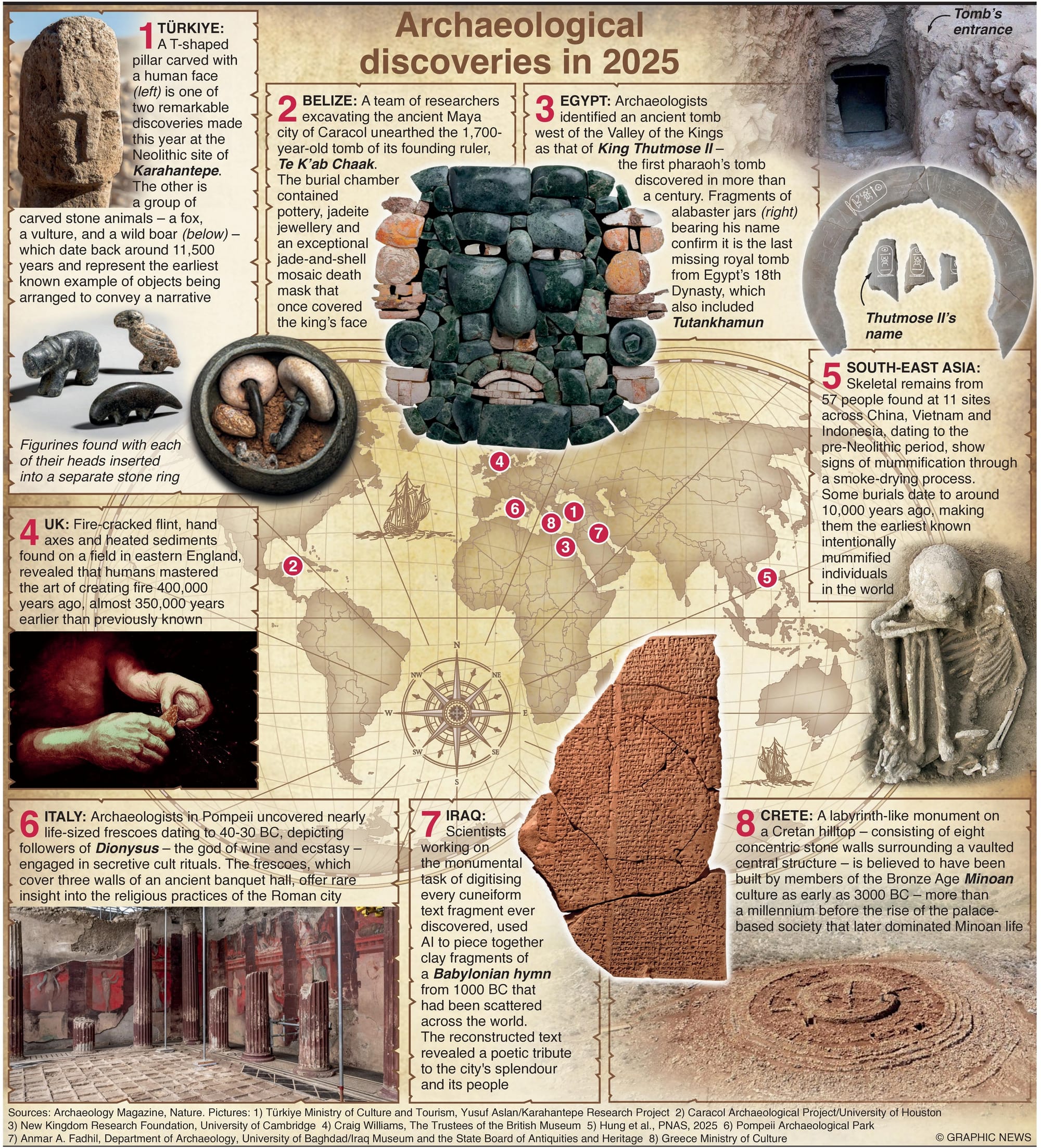

I. The Best Archaeological Discoveries Made In 2025

The world’s most notable archaeological discoveries in 2025 include the first pharaoh’s tomb found in over a century, a Maya ruler’s jade mosaic mask, evidence that humans mastered fire 350,000 years earlier than previously thought, a rare Pompeii fresco, the world’s oldest mummies, and the earliest known objects arranged to tell a story.

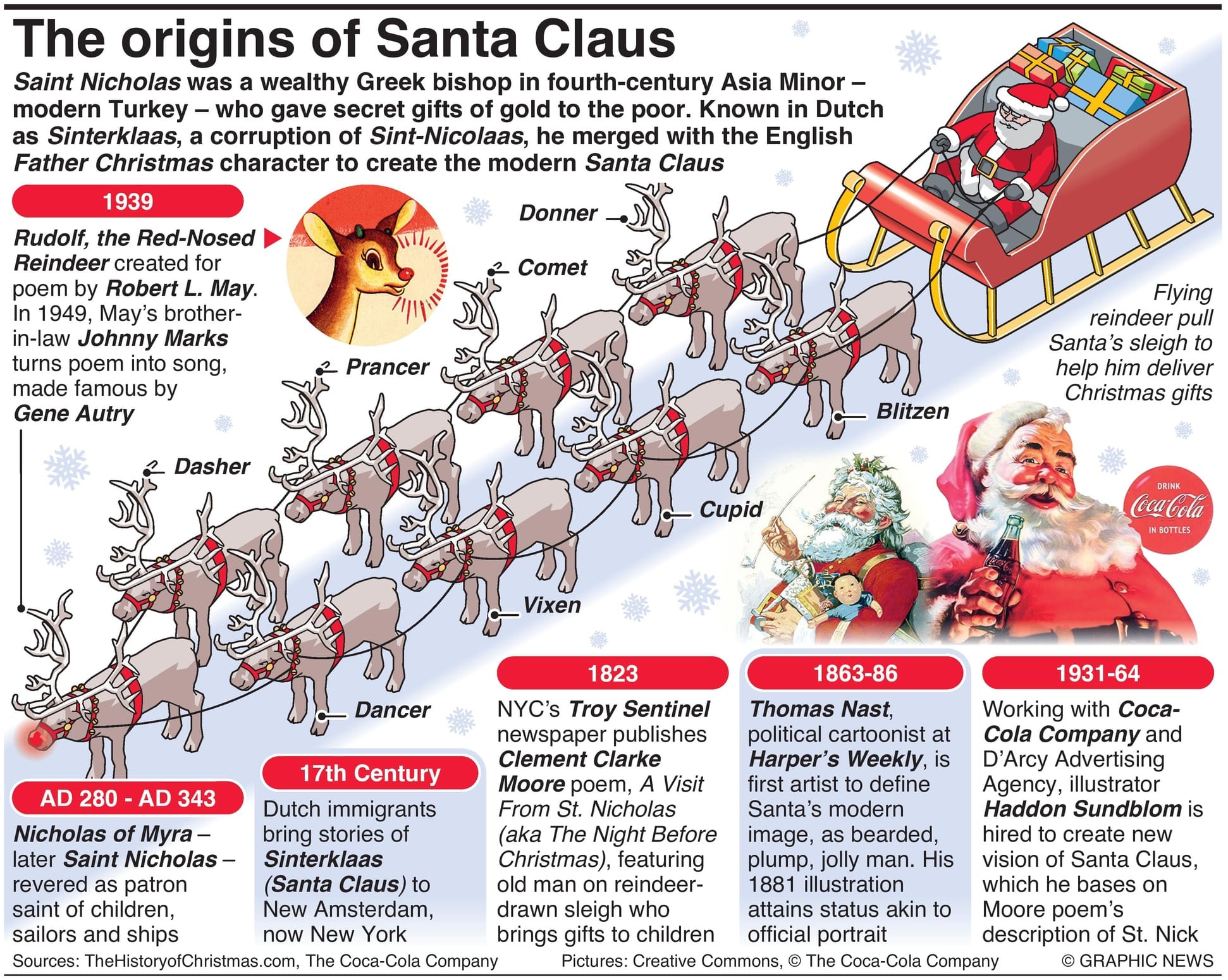

II. The Living Legend That Is Santa Claus!

Saint Nicholas was a wealthy Greek bishop in fourth-century Asia Minor – modern Turkey – who gave secret gifts of gold to the poor. Known in Dutch as Sinterklaas, a corruption of Sint-Nicolaas, he merged with the English Father Christmas character to create the modern Santa Claus.

The TIPP Stack

Handpicked articles from TIPP Insights & beyond

1. CIA Is Broken… Can It Be Fixed?—Larry C. Johnson, Ron Paul Institute for Peace and Prosperity

2. Britain’s Ruling Class Loves To Cosplay As A Titan—Gerry Nolan, Ron Paul Institute for Peace and Prosperity

3. Trump’s Road To Peace Runs Up Against Ukraine Law—William Dunkerley, Ron Paul Institute for Peace and Prosperity

4. Netanyahu Wants To Attack Iran Again, Will Lobby Trump In Mar-a-Lago Visit—Tyler Durden, Ron Paul Institute for Peace and Prosperity

5. The Geopolitical Imperative Behind US Policy Toward Venezuela—Leanna Yavelskaya, Ron Paul Institute for Peace and Prosperity

6. America Is Surviving, Not Living, And It’s Breaking Us—Armstrong Williams, The Daily Signal

7. Government Control In The Digital Age—John Stossel, The Daily Signal

8. Vance Addresses MAGA Infighting At AmericaFest—Elizabeth Troutman Mitchell, The Daily Signal

9. Brown University And MIT Shooter Entered US On Diversity Visa—Virginia Allen, The Daily Signal

10. Taxpayer Cash, Zero Accountability: Minnesota Fraud Proves Welfare Is Broken—Rachel Sheffield, The Daily Signal

11. Why Conservatives Should Oppose The Netflix-Warner Bros. Merger—Joel Thayer, The Daily Signal

12. Trump Overturns Biden-Era ‘Rocks In Shoes’ Regulation—Elizabeth Troutman Mitchell, The Daily Signal

13. California Church Appeals To SCOTUS Over $1.2M In COVID-19 Fines—Dan Hart, The Daily Signal

14. Protecting A Societal Cancer With A Web Of Lies—Patrick Barron, Mises Wire

15. Combating Wokeness: An Interview With Paul Gottfried—Richard McDaniel, Mises Wire

16. The Illusion Of Democracy: The “Iron Law Of Oligarchy”—Thorsten Polleit, Mises Wire

17. A Battered America Awaits Trump’s Next Move—Philip Giraldi, Ron Paul Institute for Peace and Prosperity

18. The Piercing Cold Of Christmas—Andrew Fowler, The Daily Signal

19. This Christmas, Revive The Lost Art Of Matchmaking—Victor Joecks, The Daily Signal

20. It Will Be OK—Erick Erickson, The Daily Signal

From TIPP Insights News Editor

21. Ukraine Expands Deep Strikes On Russian Aircraft And Submarines

22. Russian General Killed In Moscow Car Bomb As Kremlin Points To Ukraine

23. China Protests Japanese Lawmakers’ Taiwan Visits As Ties With Tokyo Sour

24. China Imposes Steep Tariffs On EU Cheese And Cream In Trade Dispute

25. China Rare Earth Magnet Exports To EU Surge As Licensing Rules Ease

26. US Analysts Warn China Trade Surplus Could Invite Tariffs

27. Dozens of US Career Diplomats Ordered Home Under Trump Overhaul

28. US Chases Sanctioned Tanker Near Venezuela As Trump Tightens Oil Blockade

29. Denmark Protests Trump Envoy Pick For Greenland, Summons US Ambassador

30. DHS Raises Self-Deportation Bonus To $3,000 Under Trump Policy

31. Paramount Bolsters Warner Bros.Discovery Offer With $40B Larry Ellison Guarantee

32. AI Use Explodes Among Teens As Safety Rules Lag Behind

33. Trump Administration Freezes East Coast Wind Projects, Dominion Shares Fall

34. Crypto Lags While Gold Soars And US Stocks Climb

35. Lawmakers Slam Justice Department Over Redacted Epstein Records

📊 Market Mood — Tuesday, December 23, 2025

🟩 Gold Steals the Spotlight

Gold tops $4,500 as investors lean into inflation hedges and volatility protection heading into year-end.

🟧 Japan Finds Its Footing

Japanese bonds and the yen stabilize after last week’s BOJ shock, easing fears of runaway tightening.

🟦 U.S. Data Before the Break

Markets brace for the final U.S. data dump of 2025, led by consumer confidence after November’s sharp drop.

🟪 Novo Pops on Wegovy Pill

Novo Nordisk jumps after winning U.S. approval for an oral version of Wegovy, expanding access to obesity treatments.

🟫 Positioning Turns Cautious

Year-end positioning cools as investors trim U.S. equity exposure and hedge risk into the holidays.

🗓️ Key Economic Events — Tuesday, December 23, 2025

🟦 8:30 AM ET — Durable Goods Orders (MoM, Oct)

Tracks business investment and demand for big-ticket items, offering a read on manufacturing momentum.

🟧 8:30 AM ET — GDP (QoQ, Q3 — Preliminary)

A backward-looking update on third-quarter growth, largely predating the government shutdown.

🟩 10:00 AM ET — Consumer Confidence (Dec)

A key sentiment gauge to watch after November’s sharp drop, with implications for holiday spending and 2026 demand.

editor-tippinsights@technometrica.com