In 1994, I entered graduate school at Carnegie Mellon University to pursue an MBA. The annual tuition was $20,000, and because of a generous endowment from the university of about $4,000, my tuition was $16,000 each year. Room and board were extra, of course, and I had decided to fund these privately.

Like millions of students nationwide do to this day, I filed the Free Application for Federal Student Aid (FAFSA) form with the Department of Education to see if I qualified for additional federal money. Because I had already been working for six years, my income and asset levels were too high to qualify me for a grant, which, in the education industry parlance, means a gift that doesn't have to be repaid.

However, the government approved a subsidized Stafford loan of about $6,000 per year. This meant that the government would assume interest payments on the two loan disbursements (my MBA was a two-year program) until six months after I graduated in May 1996. Interest payments kick in as soon as the first tranche of loans is disbursed as a direct deposit to the institution. As of December 1, 1996, I would owe interest and monthly payments to service my loan.

After graduation, I started working full-time at a company that also gave me a signing bonus. In effect, I had saved up the funds to pay off the loan in full as early as July 1996. But why bother paying my loan off when the government was continuing to pay interest?

During Thanksgiving week in November 1996, I FedExed a check for $12,000 to Norwest Bank, my loan servicer, clearing my principal balance. Thanks to the government's subsidized loan, I had not paid a single cent in interest.

Unfortunately, most students who take out loans are not quite as lucky as I was when it comes to paying them off. A 2013 survey by the One Wisconsin Institute, based on responses from 61,000 people, found that the average repayment time for all student loan debt (including graduate degrees) was 21.1 years, while graduate degree holders specifically averaged closer to 23 years.

Old-timers can relate to several parts of my story, including a crucial fact. I paid the loan off to a private financial institution (Norwest Bank, which merged with Wells Fargo in 1998 and was known as a leader in education financing). When the government had initially approved me for the $6,000 subsidized loan, I had shopped around at various banks to find one that would offer me the lowest interest rate and the best customer service for the loan's term. I decided on Norwest, sent the federal paperwork over to Norwest, and began dealing with them directly through their toll-free number. The federal government was never involved in the process, only promising to backstop Norwest if I failed my loan obligations.

Other than this assurance, the student loan business was a 100% private industry in the 1990s. The model was akin to how the Federal Deposit Insurance Corporation (FDIC) insures bank deposits and thrifts up to $250,000 per depositor, encouraging confidence in the banking system. The FDIC backstops losses if a bank fails, but private banks manage deposits and operations. Small Business Administration loans work the same way. Private banks issue loans to borrowers, with the federal government backing up the loans if borrowers fail to repay.

However, credit Congress to bungle things up. In 1993, during President Clinton's first term, Congress passed the Student Loan Reform Act (part of the Omnibus Budget Reconciliation Act of 1993), which established the Direct Loan Program and allowed the Department of Education to begin making loans directly to students starting in 1994. However, the Federal Family Education Loan (FFEL) program, where the government guaranteed loans issued by private lenders, continued to operate alongside the Direct Loan Program until it was fully ended in 2010.

That decisive shift occurred on July 1, 2010, with the enactment of the Health Care and Education Reconciliation Act, this time under another Democratic president, Barack Obama. This legislation terminated the FFEL program, eliminating new guaranteed loans from private lenders and making the Department of Education the sole originator of federal student loans under the Direct Loan Program. From that point forward, the Department directly assumed responsibility for issuing and managing federal student loans rather than just backstopping loans made by private entities, in effect placing the entire burden of student loan debt on the taxpayer.

Today, the Department of Education, carrying liabilities of over $1.6 trillion in student loans, is one of the largest banks in the world. It is the only bank with no assets on its balance sheet—only liabilities. America's debt is $36 trillion. If the shift to government financing had not occurred in 2010, our debt would have been $1.6 trillion less.

The move to direct lending was marketed as one of efficiency and fairness—under FFEL, private lenders issued loans, but the federal government guaranteed them against default, paying lenders subsidies and covering losses if borrowers didn't repay—but the real reason was political. President Obama and, later, President Biden realized that direct lending gave their administrations more power to adjust loan terms, interest rates, and repayment options (like income-driven plans) without negotiating with private lenders, aligning the program more closely with their priorities.

During the 2020 campaign, Biden campaigned to provide student loan relief to attract younger voters. He pledged to forgive $10,000 in federal student loan debt per borrower as part of COVID-19 relief efforts, aligning with proposals from Leftist Democrats like Sen. Elizabeth Warren and Sen. Bernie Sanders, who were also competing for the nomination. Biden also supported $20,000 in forgiveness for Pell Grant recipients earning less than $125,000 annually as part of a broader debt relief plan announced during his presidency. Biden promised that borrowers earning $25,000 or less would owe no payments and accrue no interest. In contrast, others would pay only 5% of discretionary income (down from the existing 10-20%), with forgiveness after 20 years. He also aimed to ensure forgiven amounts wouldn't be taxed.

Once in office, Biden aggressively pursued his campaign plans, even though numerous courts, including the Supreme Court, repeatedly stopped him. By the time he left office, Biden had engineered total relief of $188.8 billion for 5.3 million borrowers but was well short of the broad $400 billion plan he promised during the campaign—every red cent added to our ballooning debt.

With President Trump signing an executive order to dramatically shrink the Department of Education this week, a big administrative headache remains: who would oversee the federal government's student loan administration? The Small Business Administration? The Treasury?

We would never have been in this precarious position if the Democrats had not messed with what was working perfectly well in the 1990s.

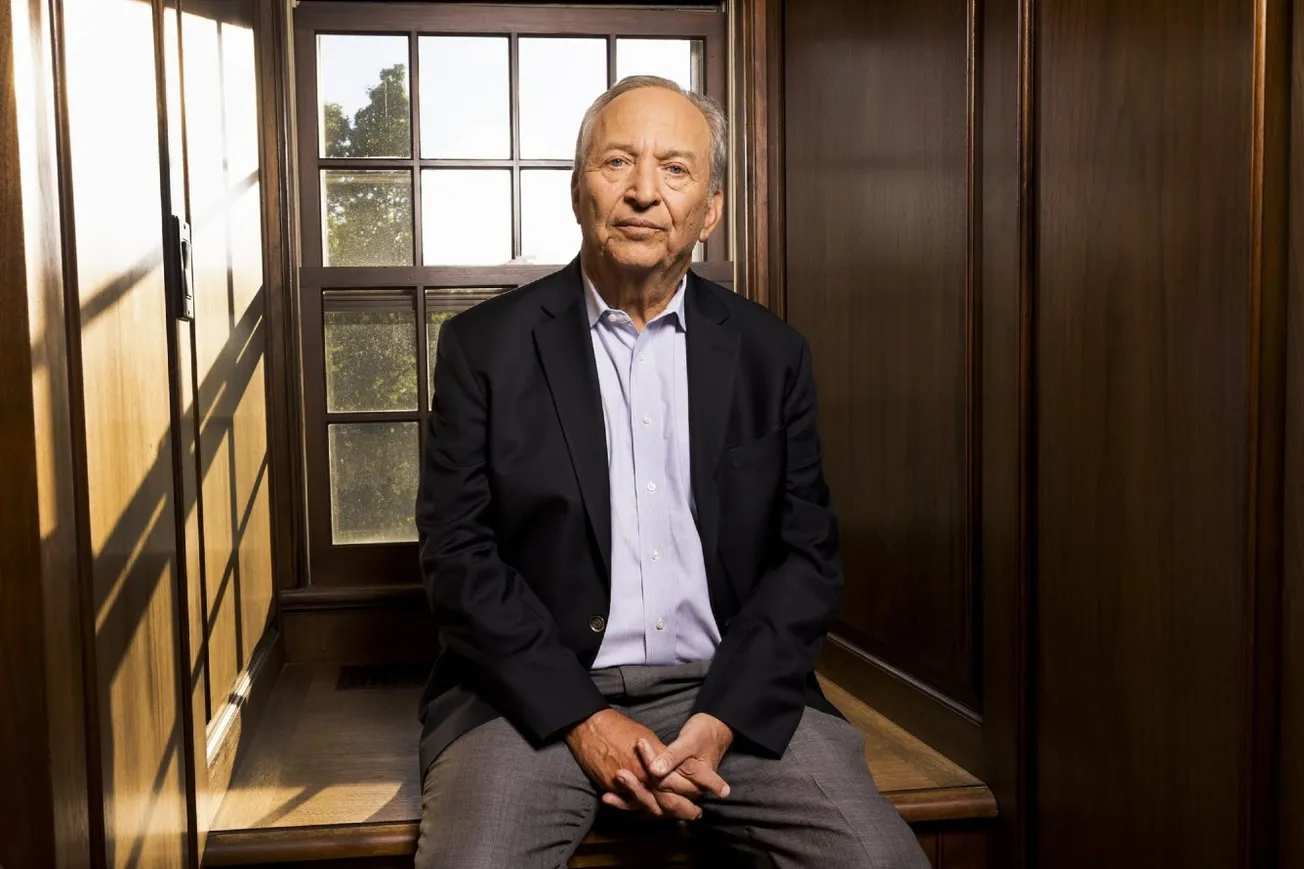

Rajkamal Rao is a columnist and a member of the tippinsights editorial board. He is an American entrepreneur and wrote the WorldView column for the Hindu BusinessLine, India's second-largest financial newspaper, on the economy, politics, immigration, foreign affairs, and sports.

TIPP Picks

Selected articles from tippinsights.com and more

Trump 2.0

1. It Feels Like Christmas Every Day Since Trump Took Office—Editorial Board, Issues & Insights

2. BETRAYAL: Chief Justice John Roberts Takes The Side Of Deep State Swamp Creatures Against Trump—Tyler O'Neil, The Daily Signal

3. Trump Admin Freezes Millions In Federal Funds For Ivy League School Allowing Men In Women’s Sports—Jaryn Crouson, DCNF

4. Trump Admin Gives Hunter Biden IRS Whistleblowers Their Careers Back—Hudson Crozier, DCNF

5. Why Trump Should Ignore The Stock Market—Victor Joecks, The Daily Signal

6. Trump Adopts The Democrats’ Terrible Yemen Policy—Connor O'Keeffe, Mises Wire

7. Zelenskyy Thanks Trump, Who Promises To Look For More Defense Aid In ‘Fantastic’ Phone Call—Reagan Reese, DCNF

8. Here’s What Christians Urged Trump to Prioritize in Talks at White House—Elizabeth Troutman Mitchell, The Daily Signal

World Affairs

9. Putin Gives Trump A Meaningless Concession, But Sticks To June 2024 Position—Larry C. Johnson, The Ron Paul Institute for Peace and Prosperity

10. Ukrainian President Zelensky Says Partial Ceasefire Could Be Established Quickly—TIPP Staff, TIPP Insights

11. Nuclear-Generated Electricity Saves An Electricity-Starved World—Ronald Stein, CFACT

12. Paul Calls For Review Of UK’s Encrypted Data Demands—George Caldwell, The Daily Signal

13. Expert On JFK Assassination: Released Files Reveal How CIA Strived To Conceal Questionable ’60s Operations—Jacob Adams, The Daily Signal

Economy

14. Newsom’s Answer To California’s Business Exodus Is … A Free Burner Phone?—Editorial Board, Issues & Insights

15. Federal Reserve Staying The Course … For Now—Ireland Owens, DCNF

16. Doug Burgum’s ‘4 Babies’ Plan For US Energy Dominance—Rob Bluey, The Daily Signal

17. The Bell “Tolls” For Congestion Taxes—Peter Murphy, CFACT

18. Chatting With A Dead Economist: Charles Rist—C.J. Maloney, Mises Wire

Politics

19. Biden Autopen Actions ‘Non-Delegable’ And ‘Invalid,’ Legal Analysis Finds—Fred Lucas, The Daily Signal

20. Michelle Obama Not Interested In Running For Office—TIPP Staff, TIPP Insights

21. Biden-Appointed Judge Blocking Transgender Military Ban Used To Be Anti-Trump Legal Activist—Hudson Crozier, DCNF

22. CNN Panelist So Demoralized By Trump She Doesn’t Even Care If Dems Win House In 2026—Harold Hutchison, DCNF

23. CNN Host Asks Jim Clyburn If Democrats Not Having Open Primary In 2024 Led To Leadership Struggles—Jason Cohen, DCNF

24. Supreme Court To Decide If States Can Withhold Medicaid Funding From Planned Parenthood—Moira Gleason, The Daily Signal

25. Judge Who Blocked Trump’s Ban On Transgender Troops Faces Misconduct Complaint—Jacob Adams, The Daily Signal

26. PBS And NPR Heads Asked To Testify Before DOGE Committee—Casey Harper, The Daily Signal

General Affairs

27. The Media’s Kamikaze Death Spiral: Lies, Hubris, And A Profession In Ruins—Editorial Board, TIPP Insights

28. The Left’s Lies Did Terrible Damage To America—Victor Davis Hanson, The Daily Signal

29. Gangsters, Terrorists, And Deep State Judicial Tyranny—Thomas J. DiLorenzo, Mises Wire

30. Using Medicalization To Suppress The Exercise Of First Amendment Rights—Adam Dick, The Ron Paul Institute for Peace and Prosperity

31. Inside A Taxpayer-Funded Think Tank’s Aborted Rebellion Against DOGE—Thomas English, DCNF

32. Department of Veterans Affairs To No Longer Provide Gender Transition Procedures—Joshua Arnold, The Daily Signal

33. Federal Government Finds Maine Defying Federal Law For Still Allowing Males In Female Sports—Moira Gleason, The Daily Signal

34. Trump Admin ‘Not Going to Tolerate’ Illinois School Forcing Girls to Change Clothes Alongside Trans Classmate—Elizabeth Troutman Mitchell, The Daily Signal

35. Want to Fix The Birth Dearth? Make Marriage Matter—Melanie Israel, The Daily Signal

36. One Texas Jail Tells The Story Of America’s Illegal Immigration Crisis—R.E. Wermus, The Daily Signal

37. Another Federal Court Determines Parents Had No Right to Know School Was Socially Transitioning Daughter—Sarah Parshall Perry, The Daily Signal

38. 'Barron Trump's Got An Unbelievable Aptitude In Technology': Trump—TIPP Staff, TIPP Insights